Questions To Ask Before Purchasing A Business

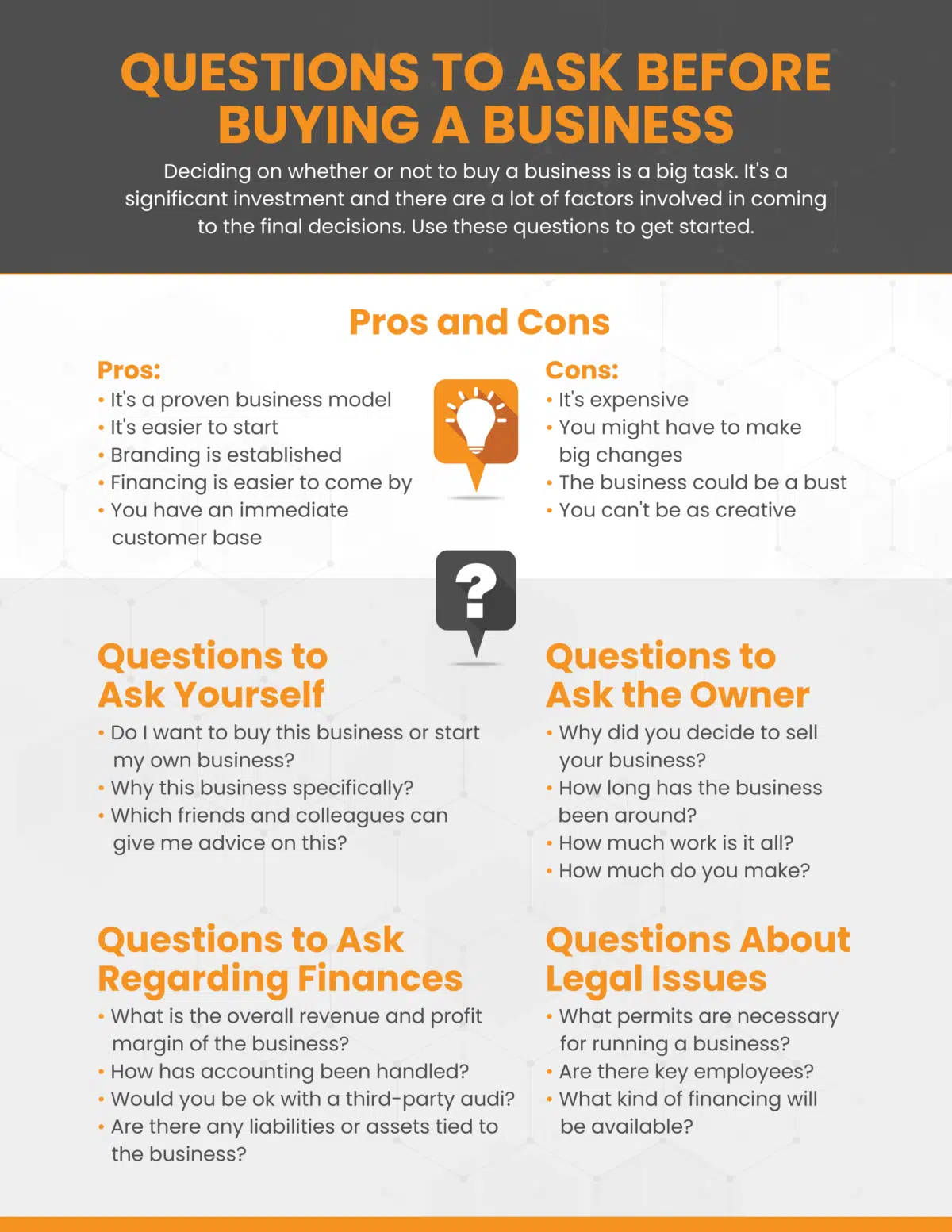

The dream of owning a business is a powerful one, drawing countless individuals to take the entrepreneurial leap. However, beneath the surface of that dream lies a complex reality, fraught with potential pitfalls that can turn aspirations into financial nightmares. Before signing on the dotted line, prospective buyers must engage in rigorous due diligence, asking the right questions to ensure they are making a sound investment.

Acquiring a business is a significant financial commitment, often representing a life's savings or a substantial loan. Therefore, this article aims to provide a roadmap of crucial questions to ask before purchasing a business, covering financial health, legal compliance, operational efficiency, and market position. Ignoring these considerations can lead to unexpected expenses, operational challenges, and ultimately, business failure.

Financial Due Diligence: Unveiling the Truth

Understanding the financial health of a business is paramount. Start by requesting at least three to five years of financial statements, including profit and loss statements, balance sheets, and cash flow statements.

Question the accuracy and completeness of these documents. Seek clarification on any inconsistencies or unusual trends. Independent verification of these records by a qualified accountant is highly recommended.

Specifically, inquire about the business's debt obligations, including loans, leases, and outstanding invoices. Furthermore, ask about the business's profitability and cash flow trends.

Key Financial Questions:

- What are the historical revenue and profit margins?

- What are the current assets and liabilities?

- What is the business's cash flow situation?

- Are there any outstanding debts or liens?

- What are the terms of any existing leases?

Legal and Regulatory Compliance: Avoiding Future Headaches

Businesses operate within a complex web of laws and regulations. Ensuring compliance is crucial to avoid costly fines, legal battles, and reputational damage.

Investigate the business's compliance with all applicable federal, state, and local laws. Request copies of all permits, licenses, and certifications.

Review any existing contracts, including supplier agreements, customer contracts, and employee agreements. Seek legal counsel to assess the terms and potential liabilities associated with these agreements.

According to the Small Business Administration (SBA), lack of legal due diligence is a common reason for business acquisition failures.

Legal Questions to Consider:

- Is the business in compliance with all applicable laws and regulations?

- Are all permits, licenses, and certifications up to date?

- What are the terms of any existing contracts?

- Are there any pending lawsuits or legal claims?

- What are the intellectual property rights of the business?

Operational Efficiency and Market Position: Assessing Value

Beyond financials and legalities, understanding the business's operations and market position is essential. Evaluate the efficiency of the business's operations, including its supply chain, production processes, and distribution channels.

Ask about the business's key performance indicators (KPIs), such as customer acquisition cost, customer retention rate, and employee productivity. Analyze the business's market share and competitive landscape.

Also assess the strength of the business's brand and reputation. Consider the impact of technology and innovation on the business's future prospects.

Evaluate the business’s customer base and its satisfaction levels. Also, scrutinize employee turnover rates and the existing skillsets.

Operational and Market Questions:

- What are the business's key performance indicators (KPIs)?

- What is the business's market share and competitive landscape?

- What is the strength of the business's brand and reputation?

- How efficient are the business's operations?

- What is the business's customer acquisition and retention strategy?

Looking Ahead: The Importance of Continued Vigilance

Purchasing a business is not a one-time event but the start of a new chapter. After the acquisition, continue to monitor the business's financial performance, legal compliance, and operational efficiency.

Regularly review financial statements, contracts, and legal documents. Stay informed about changes in regulations and industry trends. Build strong relationships with employees, customers, and suppliers.

By asking the right questions upfront and maintaining ongoing vigilance, aspiring business owners can increase their chances of success and avoid the pitfalls that can derail their entrepreneurial dreams. Remember that thorough due diligence is not an expense; it's an investment in the future of the business and the buyer's financial well-being.

![Questions To Ask Before Purchasing A Business 3 questions to ask before buying a business [infographic]](https://blog.jpabusiness.com.au/hs-fs/hubfs/3. Infographics and cheat sheets/3 questions to ask yourself before buying a business.png?width=300&name=3 questions to ask yourself before buying a business.png)

+(1).png?format=1500w)