Questions To Ask When Choosing A Business Entity

The dream of entrepreneurship pulses strong, but the path to turning vision into reality is paved with crucial decisions, none perhaps more foundational than choosing the right business entity. This decision, often made in the nascent stages of a venture, can have profound implications for liability, taxation, and the long-term growth trajectory of a company. Selecting the appropriate structure is not merely a formality, it's a strategic imperative that demands careful consideration.

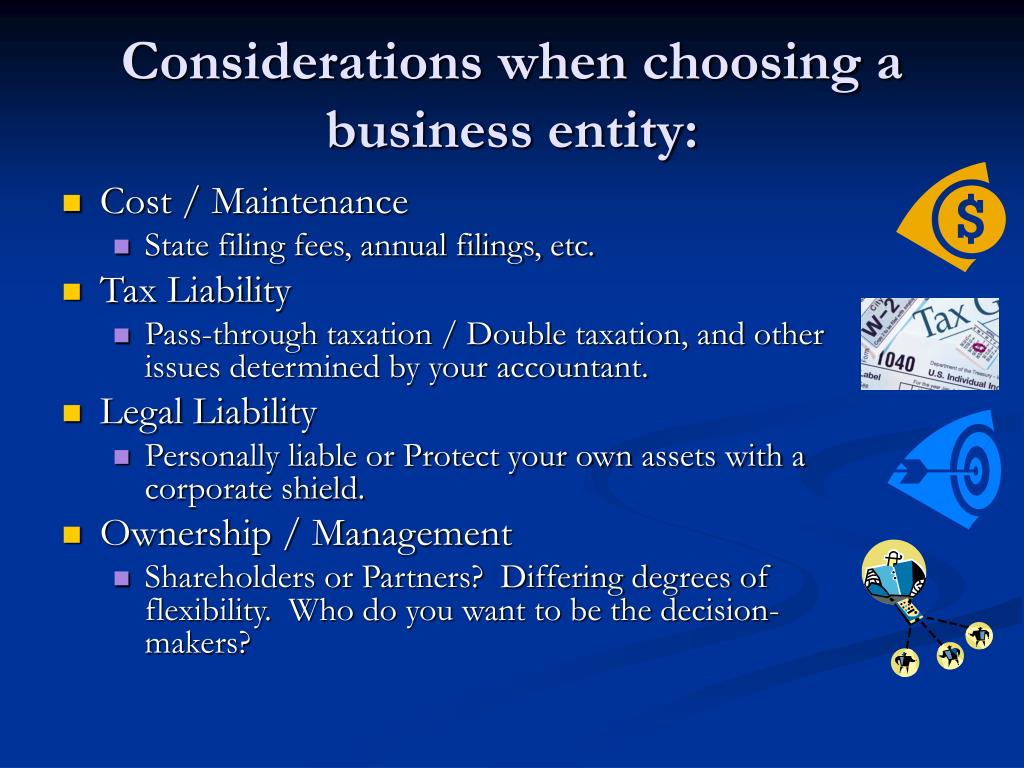

Choosing a business entity is a pivotal decision that impacts a business's legal structure, tax obligations, and operational flexibility. It dictates how profits are distributed, who is liable for debts, and the administrative burdens the business will face. Experts emphasize the importance of seeking professional advice from attorneys and accountants to ensure the chosen entity aligns with the business's specific needs and long-term goals, helping it navigate the complexities of regulations and compliance.

Key Questions to Navigate the Entity Maze

Liability Shield: How Protected Do You Need to Be?

One of the most critical considerations is the level of personal liability protection offered by each entity. Sole proprietorships and partnerships offer no such shield, exposing personal assets to business debts and lawsuits. Corporations and Limited Liability Companies (LLCs), on the other hand, provide a legal separation between the business and its owners, potentially shielding personal assets from business liabilities.

According to the Small Business Administration (SBA), understanding liability is paramount. "Choosing an entity that offers liability protection can be the difference between a business setback and personal financial ruin," the SBA notes on its website.

Taxation: Which Structure Minimizes Your Burden?

Tax implications vary significantly depending on the entity type. Sole proprietorships and partnerships are subject to pass-through taxation, meaning profits are taxed at the individual owner's income tax rate. Corporations, particularly C corporations, face double taxation – once at the corporate level and again when profits are distributed to shareholders as dividends.

LLCs offer flexibility in taxation, allowing them to be taxed as a sole proprietorship, partnership, or corporation. S corporations, a specific type of corporation, also offer pass-through taxation, but with specific requirements and limitations.

Accountants often advise business owners to project their income and expenses to determine which structure will result in the lowest overall tax burden. The IRS provides resources and publications to help businesses understand their tax obligations under different entity structures.

Administrative Burden: How Much Red Tape Can You Handle?

Different entity types come with varying degrees of administrative requirements. Sole proprietorships generally have the fewest formalities, while corporations face the most stringent regulations, including annual reporting and compliance requirements. LLCs offer a middle ground, providing liability protection with a relatively simpler administrative structure.

The Secretary of State in each state oversees business entity filings and regulations. Businesses need to understand the ongoing compliance obligations associated with their chosen entity to avoid penalties.

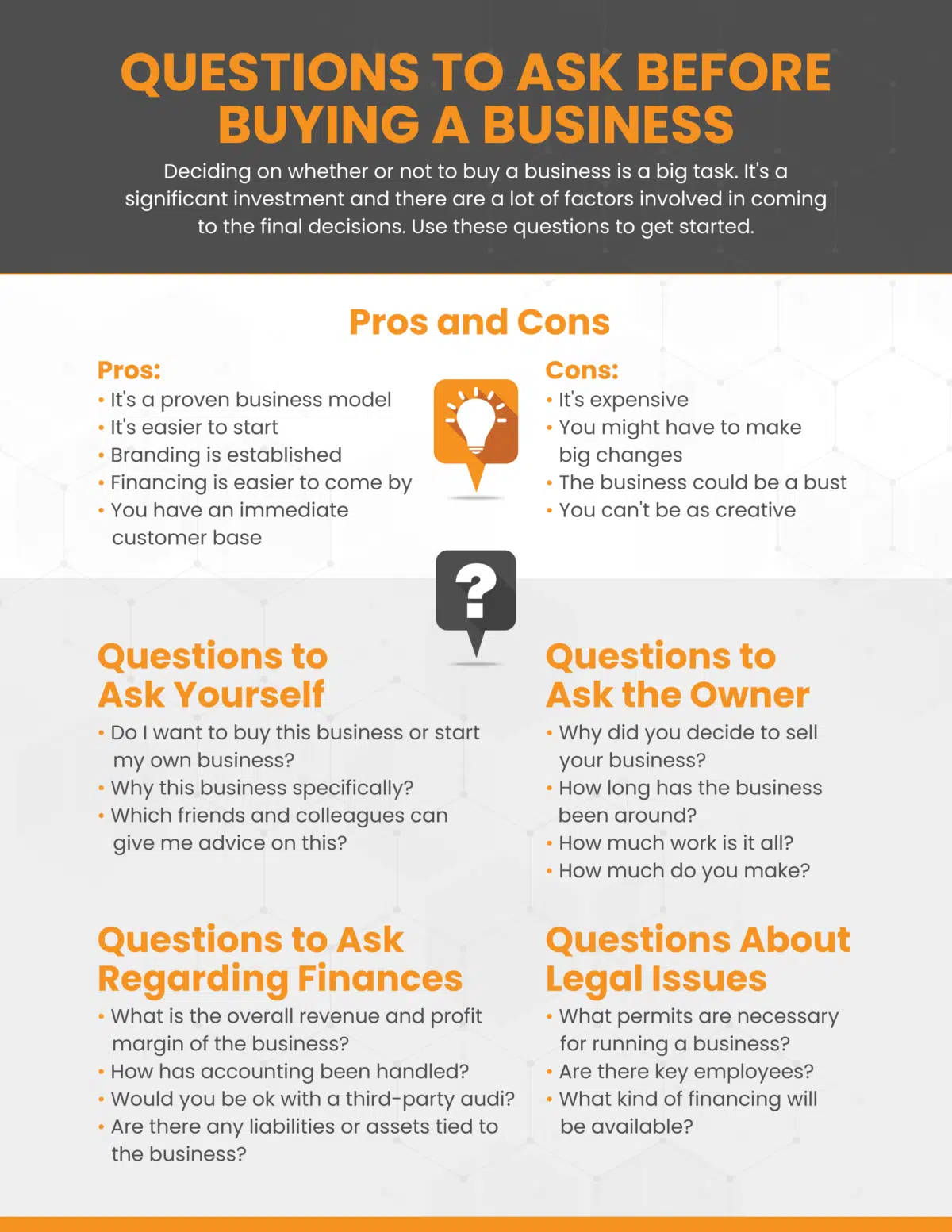

Funding and Investment: How Will You Raise Capital?

The type of entity can significantly impact a business's ability to attract investment. Corporations, with their ability to issue stock, are generally more attractive to investors than sole proprietorships or partnerships. LLCs can also attract investment, but the process may be more complex than with corporations.

"If you anticipate needing significant capital from outside investors, a corporation may be the most suitable structure," advises John Smith, a business attorney with Miller & Zois.

Future Growth and Succession Planning: What's Your Long-Term Vision?

Consider how the business structure will impact future growth and succession planning. Some entities are easier to transfer ownership of than others. Corporations, with their readily transferable shares, offer a relatively simple succession planning process. LLCs and partnerships require more careful planning to ensure a smooth transition of ownership.

"Thinking about the long-term implications of your entity choice is crucial," says Jane Doe, a financial advisor with Accurate Advice. "What might work well in the early stages of your business might not be optimal as you grow and evolve."

The Importance of Expert Consultation

Navigating the complexities of business entity selection is best done with the guidance of qualified professionals. Attorneys can provide legal advice on liability protection and compliance requirements, while accountants can offer expertise on tax implications and financial planning.

Seeking professional advice can help business owners make informed decisions that align with their unique circumstances and long-term goals. It's an investment that can pay dividends in the form of reduced liability, lower taxes, and a more solid foundation for future success.

Looking Ahead: Adapting to Evolving Needs

The initial entity choice isn't necessarily set in stone. As a business grows and evolves, its needs may change, necessitating a restructuring. This might involve converting a sole proprietorship to an LLC or an LLC to a corporation.

The key is to remain proactive and periodically reassess the business's entity structure to ensure it continues to align with its goals and objectives. Regular consultation with legal and financial professionals is essential to navigate these transitions smoothly and effectively.