Fully Diluted Shares Vs Outstanding Shares

For investors navigating the complexities of the stock market, understanding the difference between outstanding shares and fully diluted shares is crucial for making informed decisions. These figures, both representing ownership in a company, paint different pictures of the company's equity structure and potential future dilution.

The discrepancy between these two numbers can significantly impact a stock's per-share value and an investor's stake in the company. Ignoring this difference can lead to misinterpretations of financial statements and potentially poor investment choices. This article breaks down these two key metrics, explaining what they represent, how they differ, and why they matter to you.

Outstanding Shares: A Snapshot of Current Ownership

Outstanding shares represent the total number of shares of a company's stock that are currently held by investors. This includes shares held by institutional investors, retail investors, and company insiders.

Outstanding shares are readily available and actively traded on the open market. This number is typically found on a company's balance sheet and is updated regularly to reflect stock buybacks or new issuances.

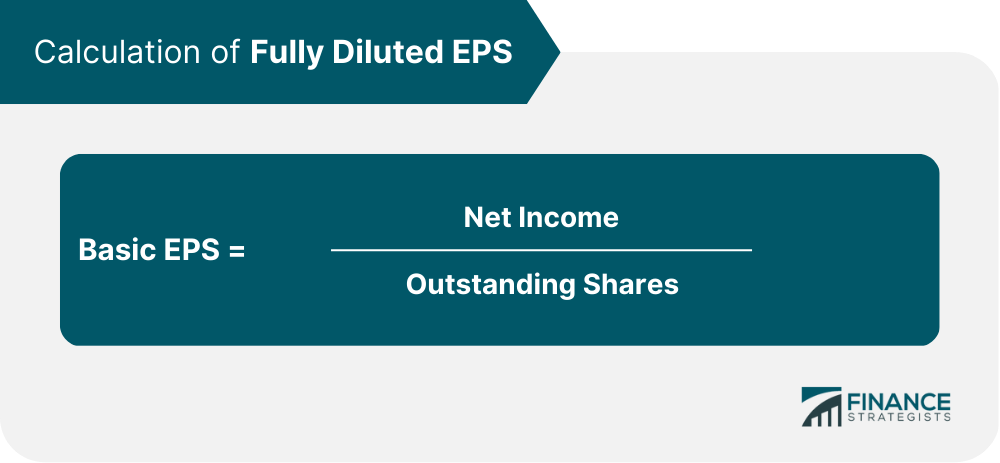

It’s a real-time indicator of the current ownership structure. This number is used to calculate important metrics such as earnings per share (EPS) and market capitalization.

Fully Diluted Shares: A Look into Potential Future Dilution

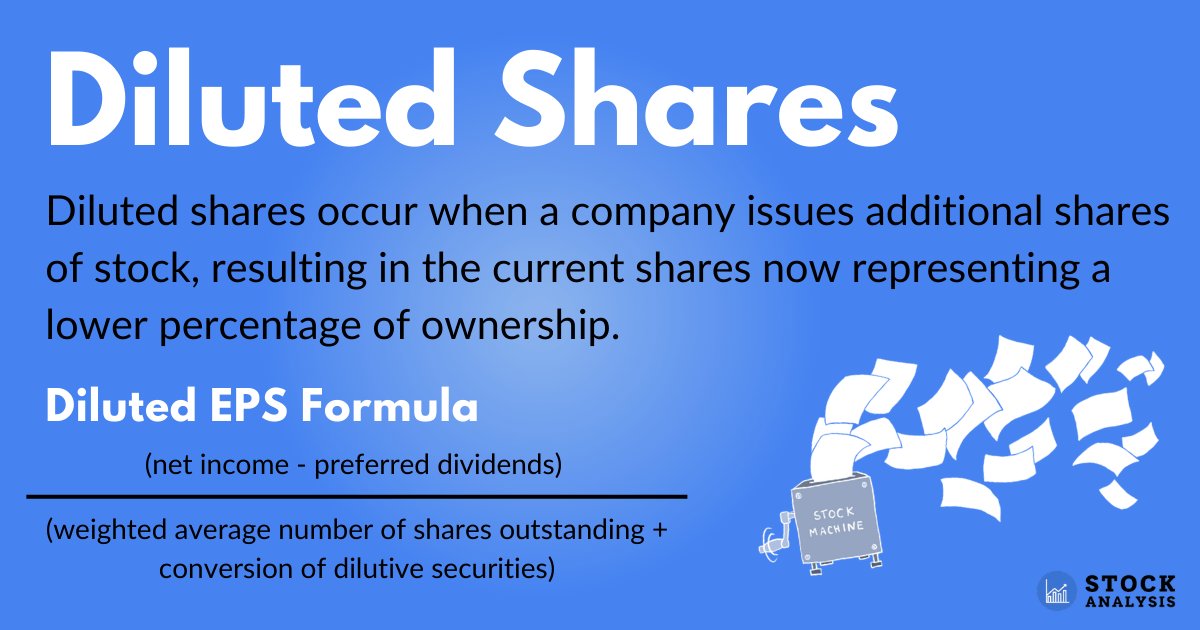

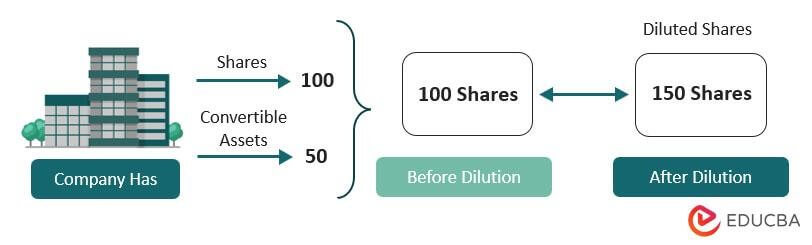

Fully diluted shares represent the total number of shares that would be outstanding if all possible sources of conversion were exercised. This includes stock options, warrants, convertible bonds, and other convertible securities.

It gives a forward-looking perspective on potential changes to a company’s capital structure. It's important to remember that fully diluted shares represent a hypothetical scenario.

The figure isn't the current reality, but a *possibility*. Companies are not obligated to convert these outstanding options or securities.

Key Differences & Calculation

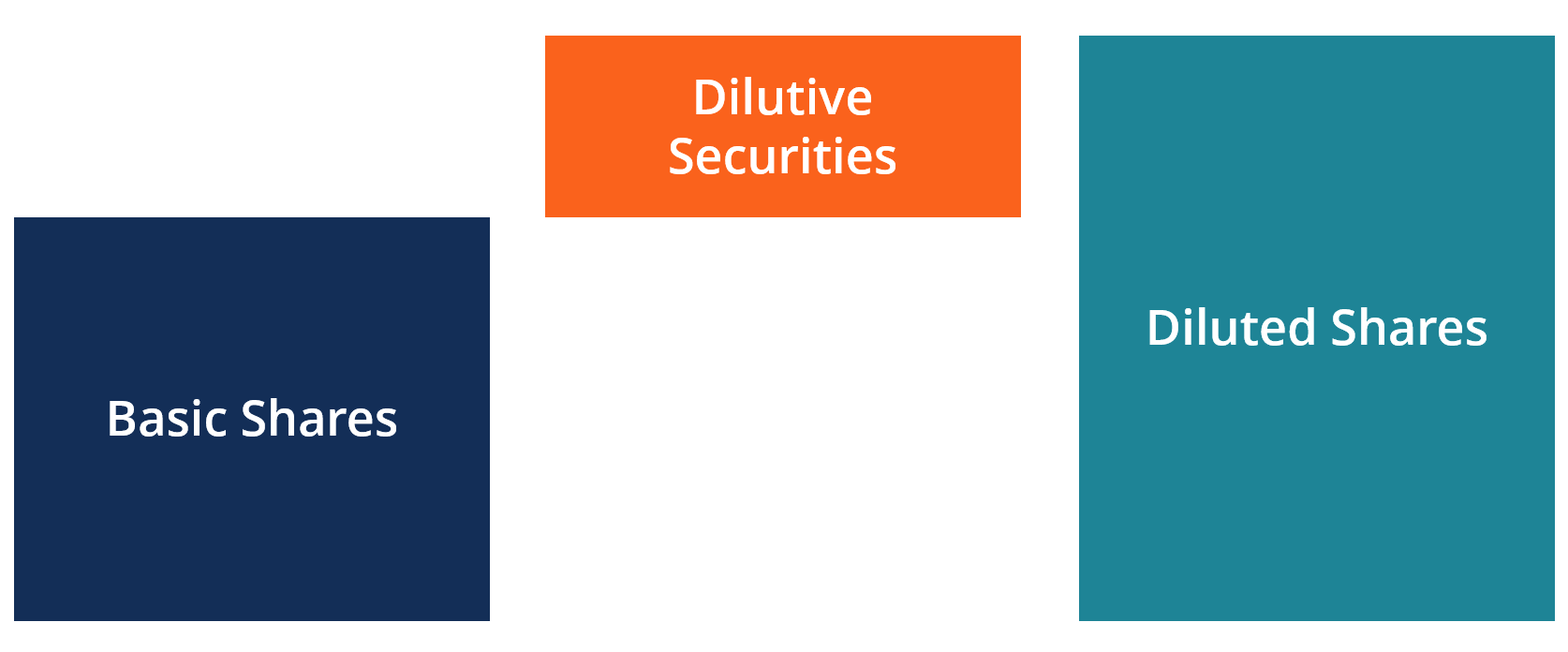

The core difference lies in the "if" – fully diluted shares consider what the total number of shares *would be* if all convertible securities were exercised.

Calculating *fully diluted shares* involves adding the number of outstanding shares to the number of shares issuable upon the conversion of all dilutive securities. Companies typically disclose the potential dilutive impact of these securities in their financial statements.

The calculation can be complex, considering different conversion ratios and exercise prices. However, the underlying principle remains the same: to provide a broader view of potential future dilution.

Why Investors Should Care

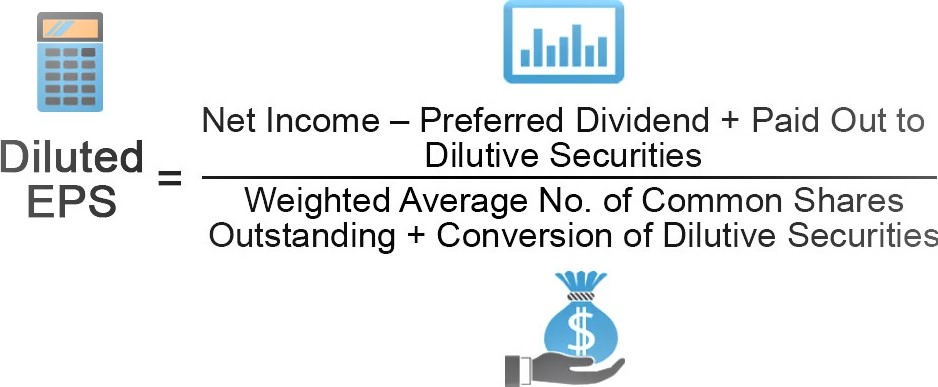

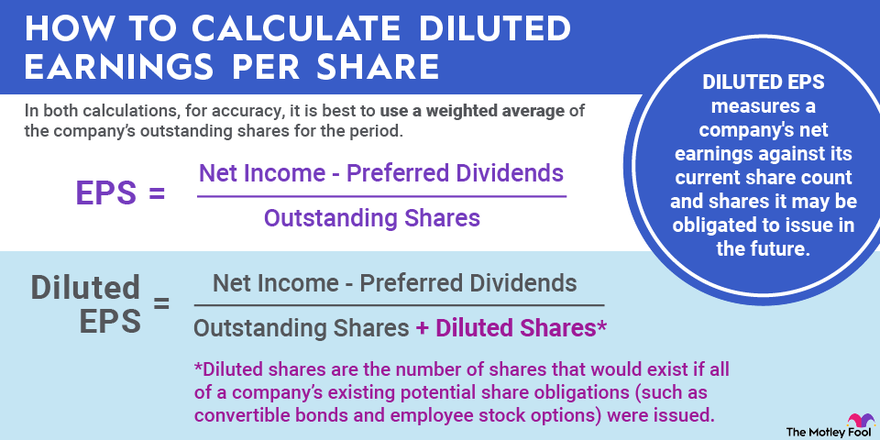

Understanding both outstanding and fully diluted shares is crucial for assessing a company's true value and potential future performance. Ignoring the potential impact of dilution can lead to an overestimation of EPS and other key metrics.

Imagine a company reports impressive earnings based on its outstanding share count. But if the company has a significant number of outstanding stock options, exercising those options would increase the number of shares, diluting the existing shareholders' ownership and potentially lowering the EPS.

Investors should use fully diluted shares to calculate a diluted EPS, providing a more conservative and realistic view of the company's profitability. A *diluted EPS* calculation often provides a more accurate picture of a company's profitability potential.

Impact on Share Price

Increased shares in the market, usually decreases the share price. The reason is that it waters down the ownership stake of existing shareholders.

This dilution effect can affect the stock price when the market acknowledges it. Investors consider future dilution when they make their investment decisions.

Dilution can also influence important valuation multiples, such as the price-to-earnings (P/E) ratio. It changes investor perception of the company's potential value.

Finding the Numbers

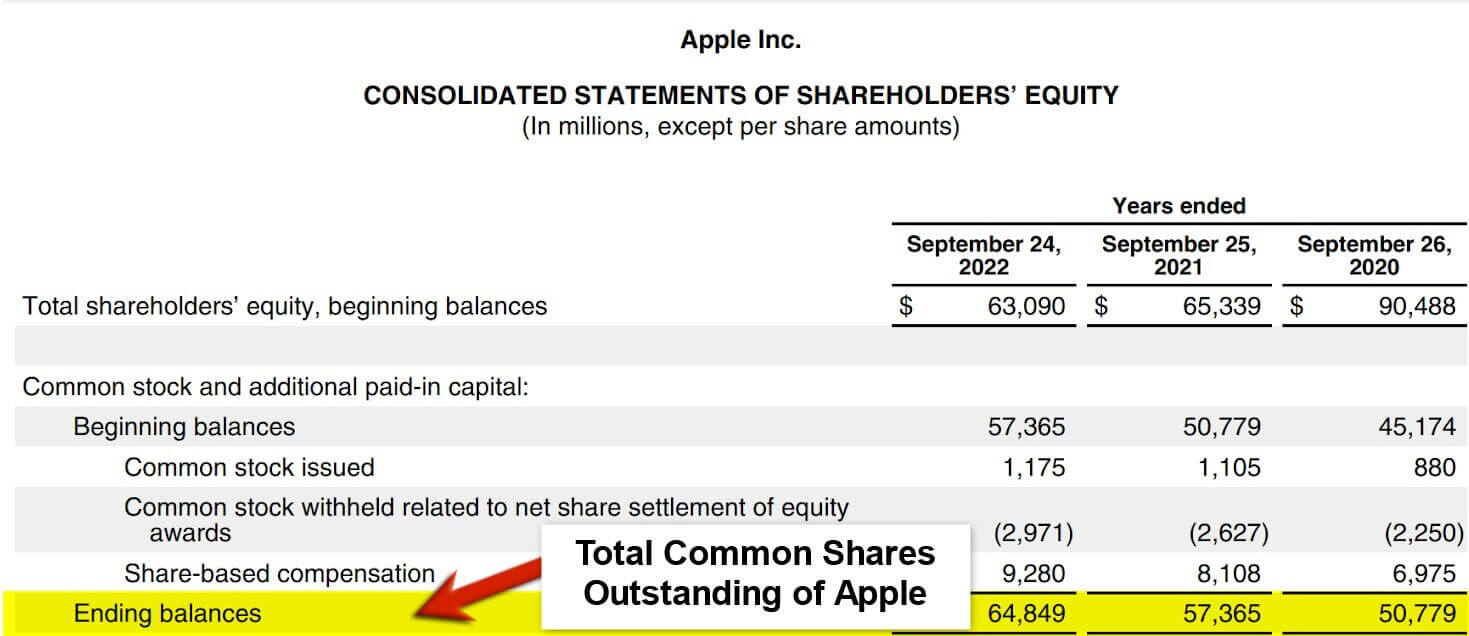

Information about both outstanding and fully diluted shares can be found in a company's financial reports. These are usually made available through the company's investor relations page or via filings with the Securities and Exchange Commission (SEC), such as the 10-K and 10-Q reports.

The balance sheet will list the number of outstanding shares, while the notes to the financial statements often provide details on potential dilution from stock options, warrants, and convertible securities. Looking at both these sections gives an investor the full picture.

Pay close attention to the footnotes and management discussion and analysis (MD&A) sections, as these often contain valuable insights into the company's capital structure and potential dilution risks. Careful analysis is key.

Real-World Example & Context

Consider a hypothetical tech startup, "InnovTech," which has 10 million outstanding shares. However, the company has also issued stock options that, if exercised, would add another 2 million shares to the market. This means "InnovTech" has 12 million fully diluted shares.

If an investor calculates *EPS* based solely on the 10 million outstanding shares, they might overestimate the company's true profitability per share. Investors should consider the fully diluted share count to get a clearer picture.

Understanding this potential dilution is especially critical for companies with significant stock-based compensation programs or those that rely heavily on convertible debt financing.

Conclusion: Due Diligence is Paramount

In conclusion, knowing the difference between outstanding shares and fully diluted shares is more than just a technical detail; it's a critical component of sound investment analysis.

By considering the potential impact of dilution, investors can make more informed decisions and avoid overpaying for a company's stock. Due diligence remains the best approach.

Always remember to consult a financial professional for personalized advice, as this information is for educational purposes only and should not be considered investment advice. Understanding these concepts empowers you to invest more wisely.

:max_bytes(150000):strip_icc()/Fullydilutedshares_final-17d11bef0894485bb4bafe4dcdb0d261.png)