Questions To Ask When Looking For An Accountant

Are you ready to take control of your finances? Don't make a mistake – choosing the right accountant is critical for success.

Selecting an accountant isn't just about crunching numbers; it’s about securing your financial future. This guide provides essential questions to ensure you choose a qualified professional to navigate the complexities of tax season and beyond.

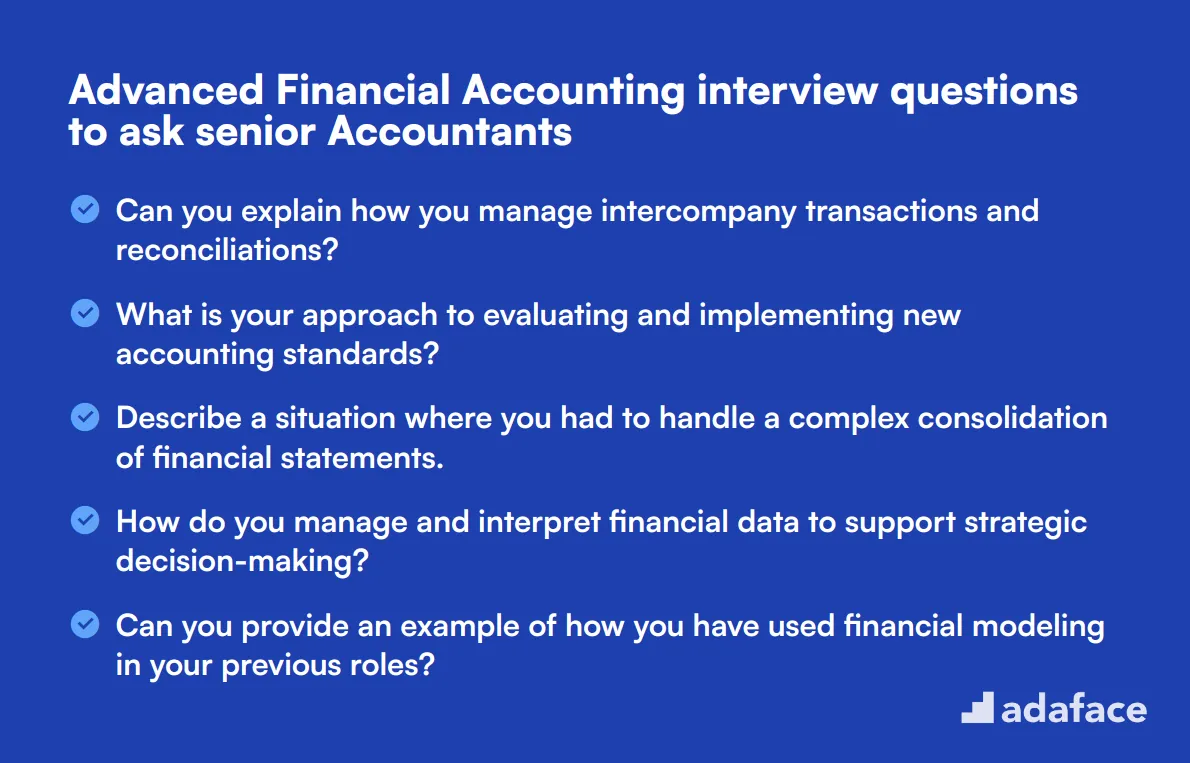

Essential Questions to Ask Potential Accountants

Before entrusting your finances, delve into these critical areas during your initial consultations.

Qualifications and Experience

What certifications do you hold? Understanding credentials is vital. Look for designations like Certified Public Accountant (CPA) or Enrolled Agent (EA).

How many years have you been practicing? More experience often translates to a deeper understanding of complex financial scenarios. Inquire about their specific industry experience.

What industries or types of businesses do you specialize in? Matching their experience to your needs is crucial. A small business has different needs than a large corporation.

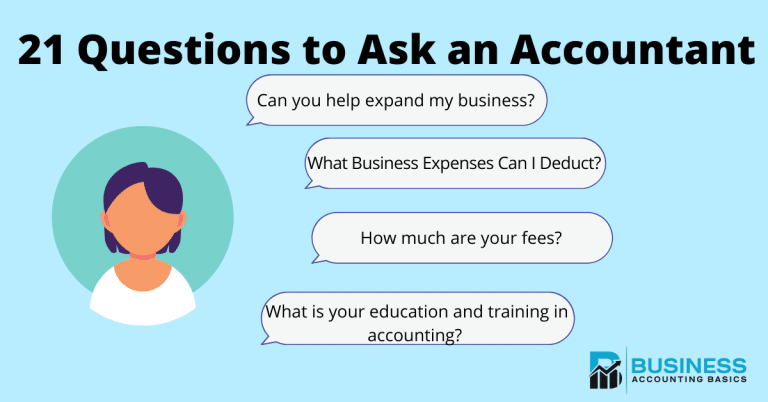

Services Offered

What services do you provide besides tax preparation? Many accountants offer bookkeeping, financial planning, and business consulting.

Do you offer payroll services? For businesses with employees, this is a vital service to ask about. How do they handle it?

What accounting software do you use? Ensure compatibility with your existing systems. Familiarity with software like QuickBooks or Xero can streamline processes.

Fees and Payment Structure

How do you charge for your services? Hourly rates, flat fees, or value-based pricing are common models. A transparent fee structure is vital.

What are your payment terms? Understand when and how payments are expected. Avoid surprises by clarifying payment schedules upfront.

Are there any additional fees I should be aware of? Some services might incur extra charges. Get everything in writing.

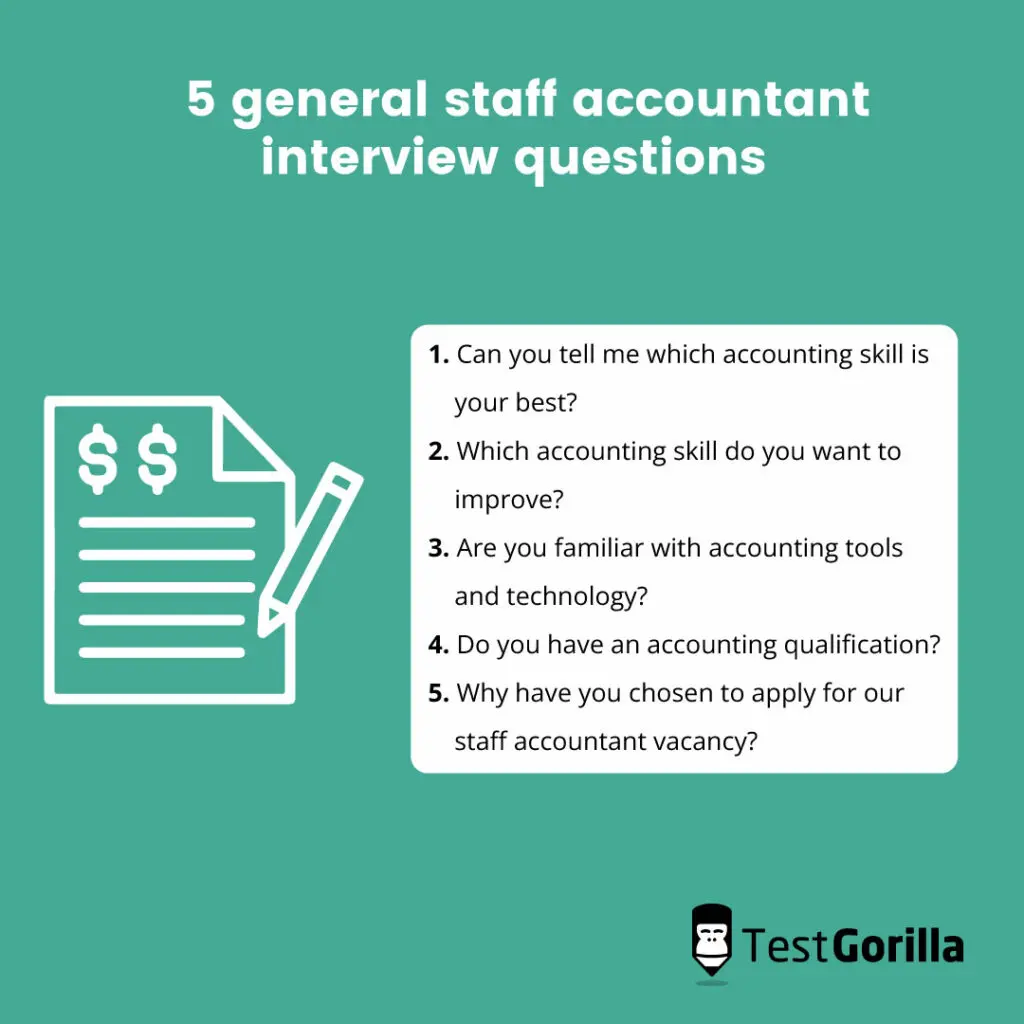

Communication and Availability

How often will we communicate? Regular updates and accessibility are key. Ask about their preferred communication method (email, phone, meetings).

What is your typical response time to inquiries? Timely responses are crucial, especially during critical financial periods. Establish clear expectations.

Who will be my primary point of contact? Knowing who to contact directly ensures efficient communication. Will it always be the same person?

Compliance and Ethics

Are you up-to-date on the latest tax laws and regulations? Staying compliant is their responsibility. Do they invest in continuing education?

Have you ever been audited or faced any disciplinary actions? This is a crucial question to understand their professional standing. Ask for references.

What are your ethical standards? Ensure they align with your values and prioritize integrity.

"Integrity is the foundation of trust," emphasizes the American Institute of Certified Public Accountants.

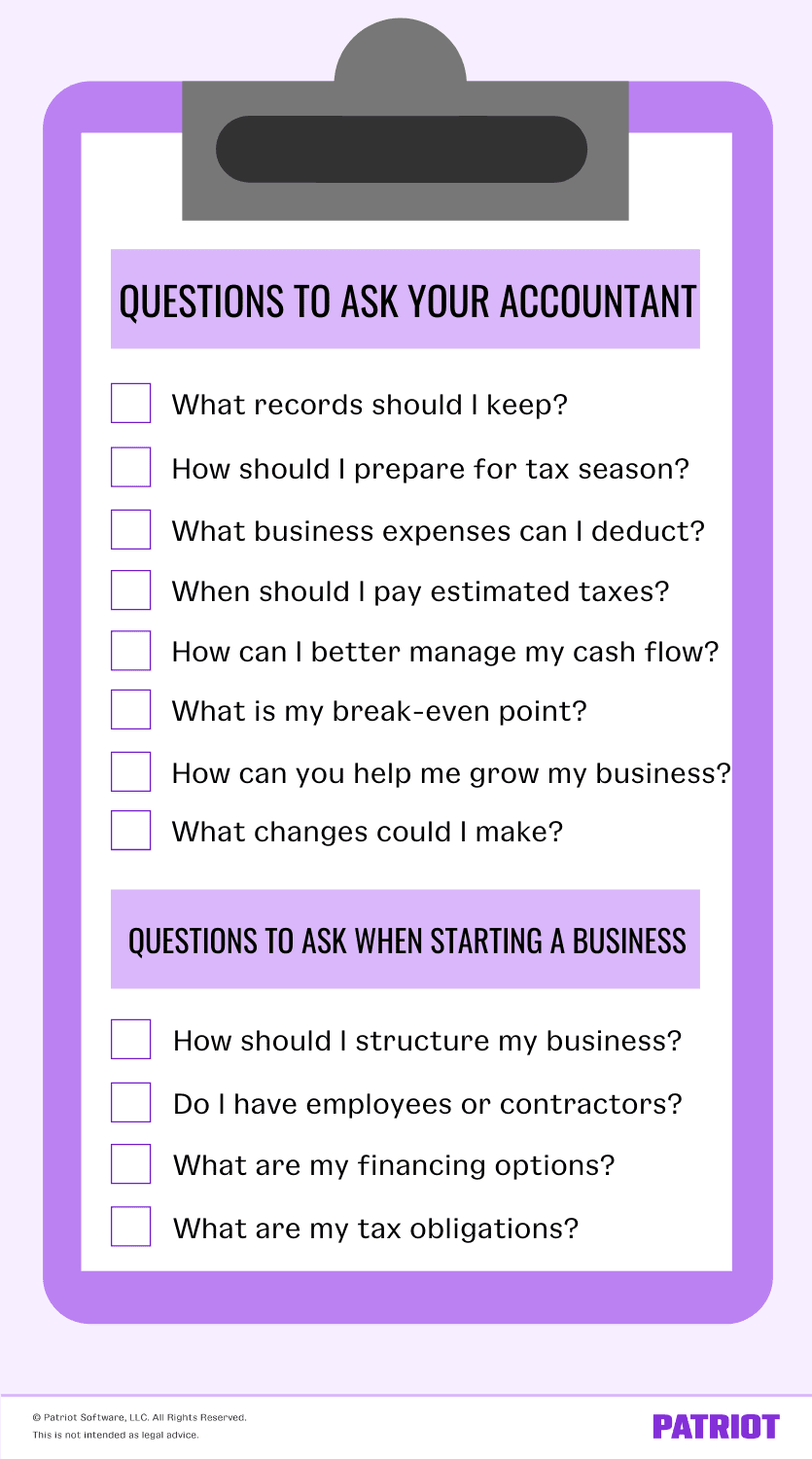

References and Reviews

Can you provide references from current or past clients? Hearing firsthand accounts can offer valuable insights. Check online reviews as well.

What do your clients say about your services? Look for recurring themes in testimonials. Do they emphasize reliability, expertise, or communication?

Researching reviews online can show a bigger picture. Third party reviews can show areas of strength and weaknesses.

Securing the right accountant is a crucial investment in your financial well-being. Now, it's time to begin your search and conduct thorough interviews, empowering you to navigate the financial landscape with confidence.