Questions To Ask When Opening A Business Account

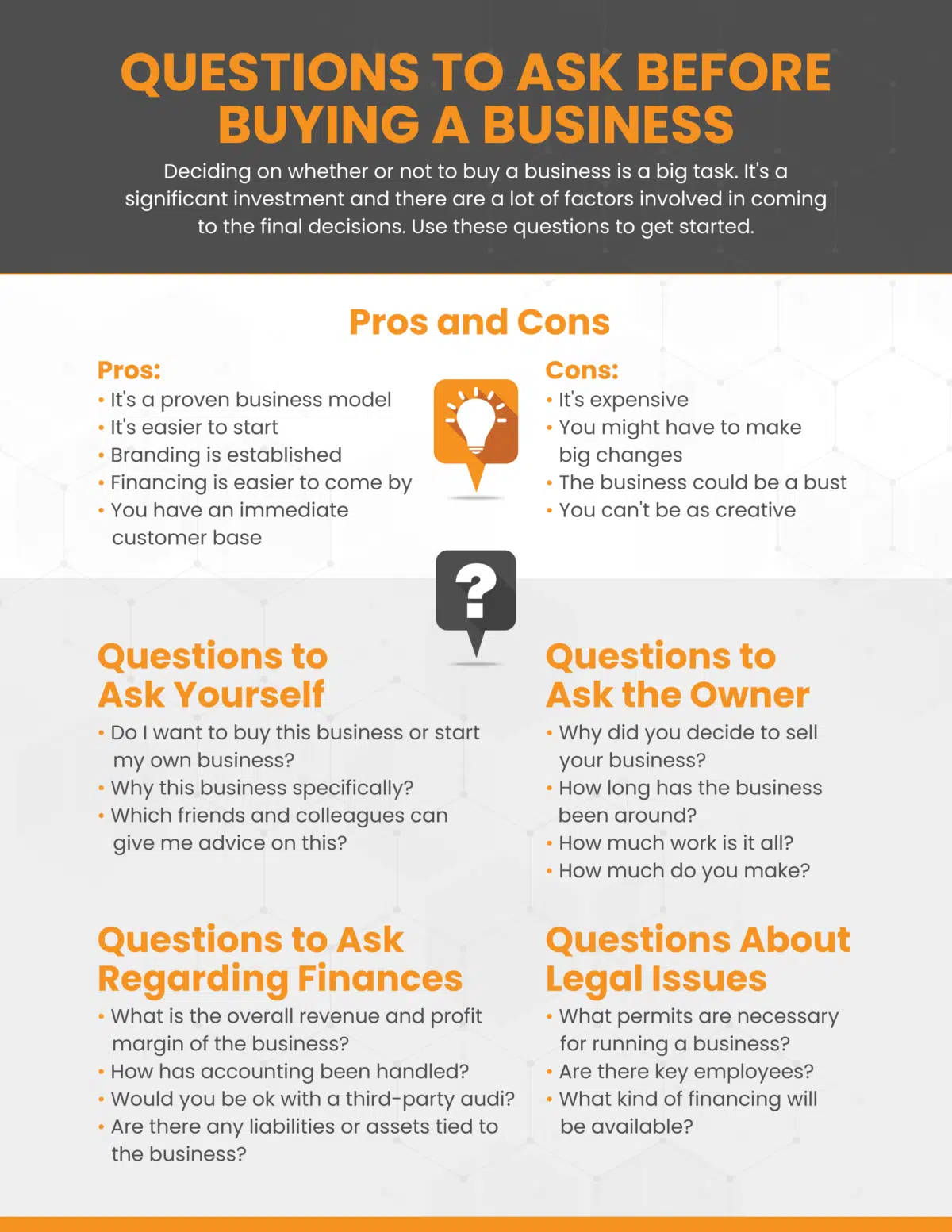

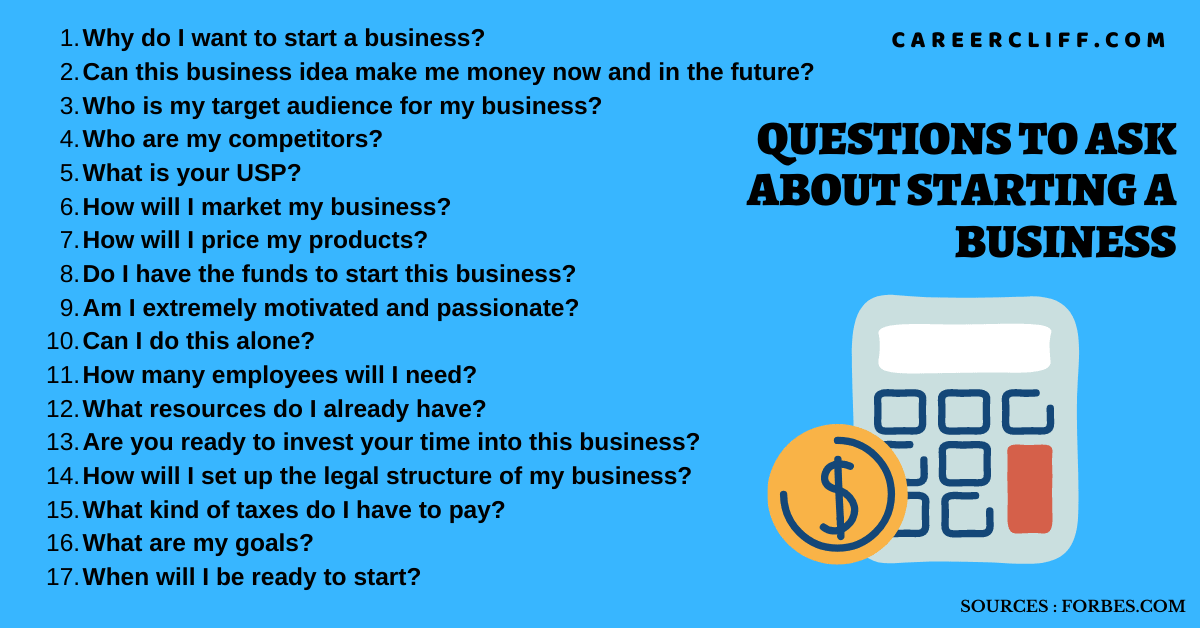

Opening a business bank account is a crucial step for any entrepreneur. It establishes financial credibility, simplifies accounting, and separates personal and business finances. However, navigating the banking landscape can be daunting.

Choosing the right bank and account requires careful consideration. Knowing the right questions to ask can save business owners time, money, and potential headaches down the road. It helps them make informed decisions that align with their specific business needs and growth plans.

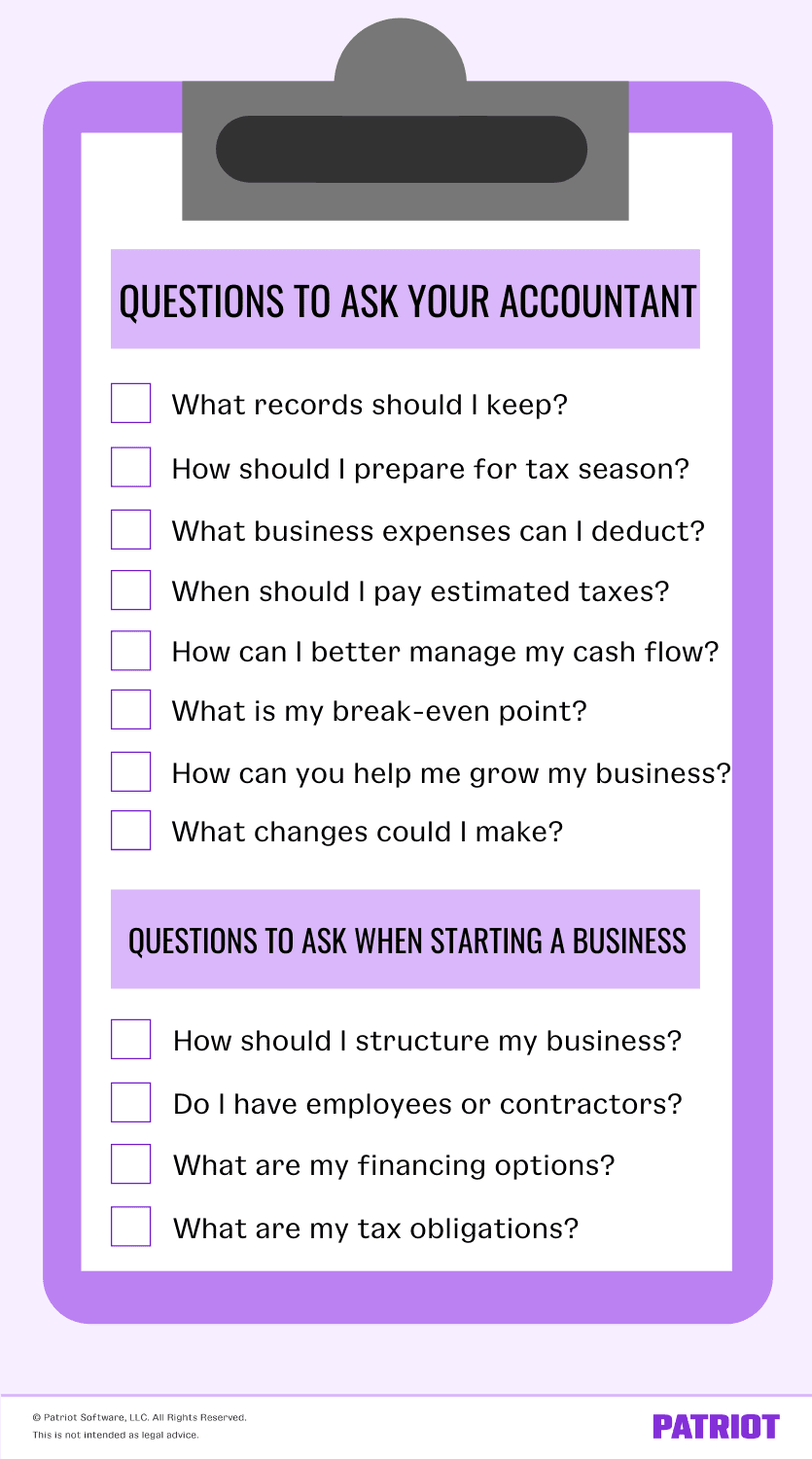

Key Questions to Ask When Opening a Business Account

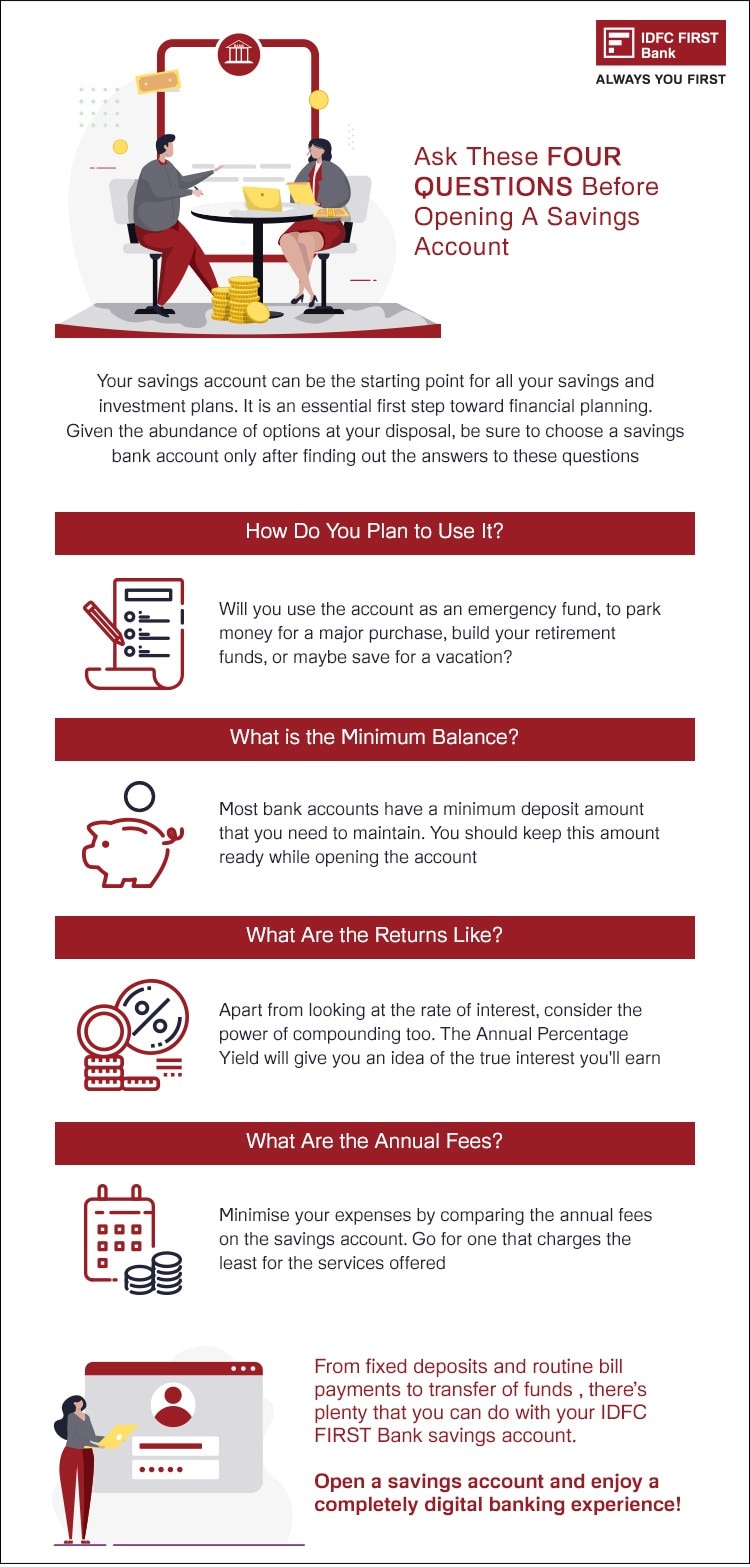

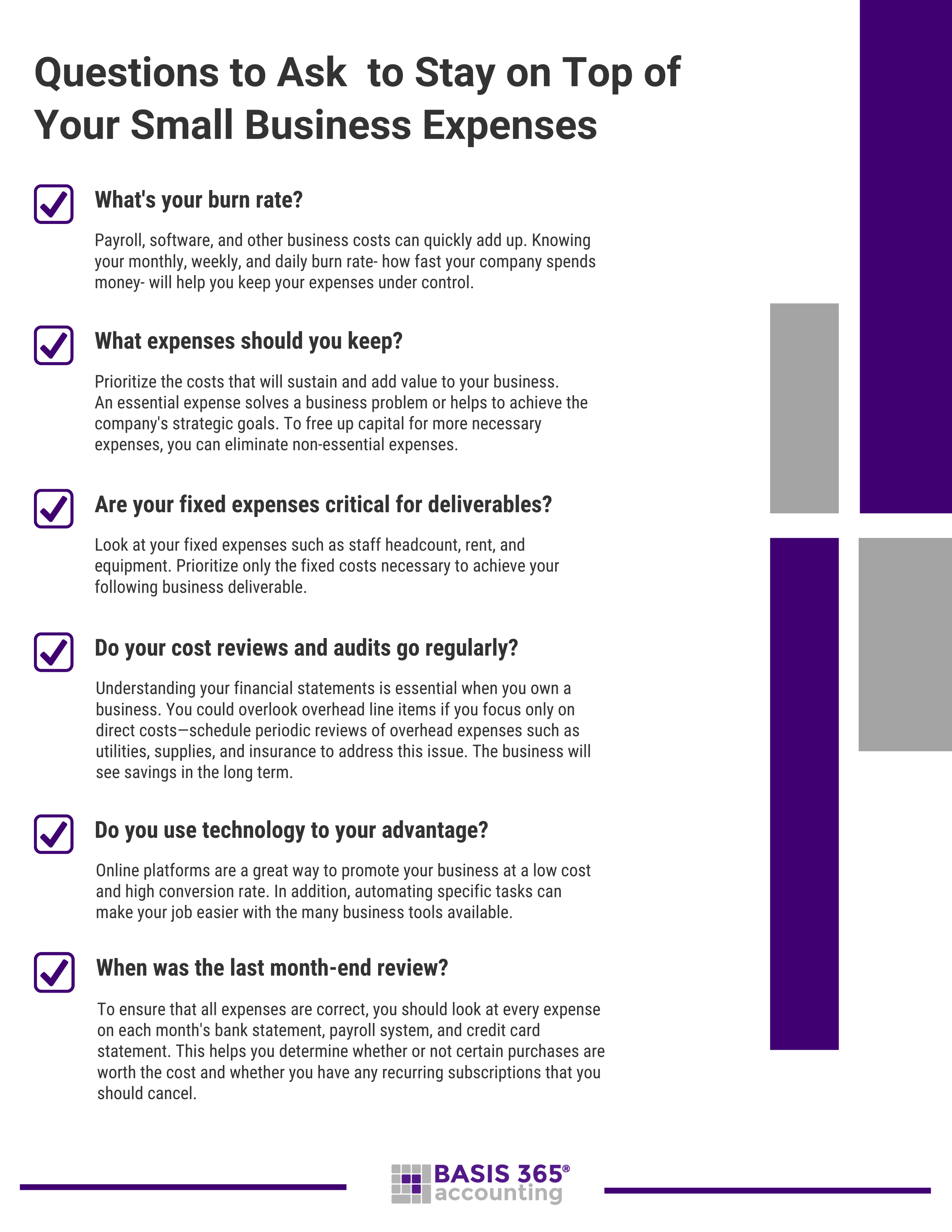

Before signing on the dotted line, business owners should delve into the specifics of each account. According to the Small Business Administration (SBA), understanding fees, transaction limits, and available services is paramount.

Fees and Charges: What are the actual costs?

Inquire about all potential fees. This includes monthly maintenance fees, transaction fees (both for deposits and withdrawals), overdraft fees, and wire transfer fees. Hidden fees can quickly erode profits.

Also, clarify if there are ways to waive or reduce these fees. Banks sometimes offer waivers for maintaining a certain balance or using other bank services.

Transaction Limits: Are there restrictions on activity?

Understanding transaction limits is critical, especially for businesses with high volumes of sales or payments. Are there limits on the number of transactions allowed per month?

Are there limits on the amount of cash deposits or withdrawals? Exceeding these limits can trigger hefty fees.

Interest Rates: Is the account interest-bearing?

While most business checking accounts don't offer high interest rates, it's worth exploring options. Ask about the interest rate offered, if any.

Consider if a business savings account or certificate of deposit (CD) might be a better option for excess cash. Researching options is crucial in maximizing financial gain.

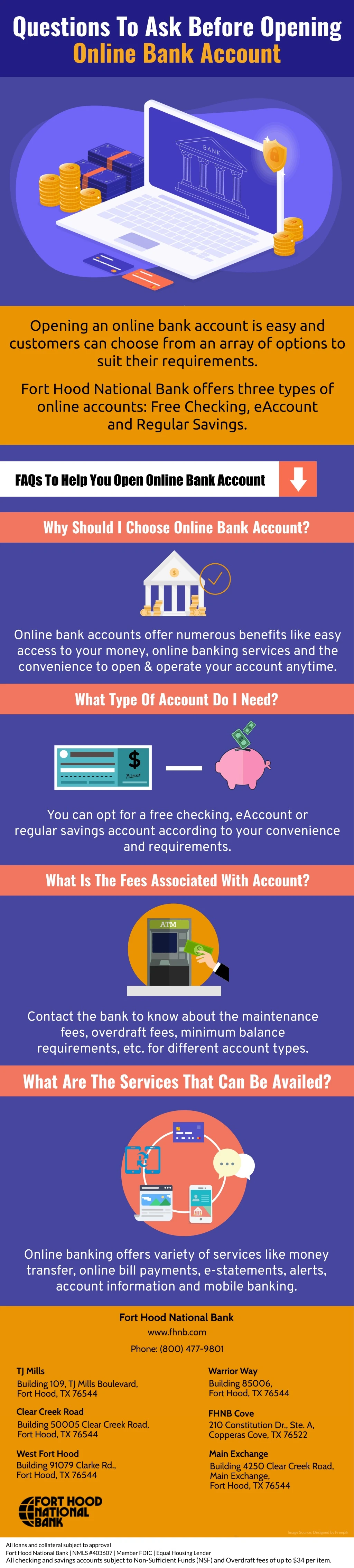

Online Banking and Mobile Access: How accessible is the account?

In today's digital age, robust online and mobile banking capabilities are essential. Can you easily monitor transactions, transfer funds, and pay bills online?

Does the bank offer a mobile app with features like remote deposit capture and account alerts? Ensure the online platform is secure and user-friendly.

ATM Access: What are the options for cash withdrawals?

Determine the bank's ATM network and fees for using ATMs outside of that network. Access to fee-free ATMs can save money, especially for businesses that frequently need cash.

Are there any daily withdrawal limits? Consider what options are available if a business has to access cash that is over the daily limit.

Customer Service: How responsive and helpful is the bank?

Evaluate the bank's customer service reputation and available support channels. Is phone support readily available?

Does the bank offer in-person support at local branches? A responsive and helpful bank can be invaluable, especially when dealing with complex financial issues.

Credit Card Processing: What options are available for accepting payments?

If the business accepts credit or debit card payments, inquire about the bank's credit card processing services. Are their partnerships that could be beneficial?

Understand the fees associated with credit card processing and explore different processing options. This could include mobile payment systems or point-of-sale (POS) integrations.

Account Security: What measures are in place to protect my funds?

Ask about the bank's security measures to protect against fraud and cybercrime. Confirm that the account is FDIC-insured.

What steps does the bank take to prevent unauthorized access to your account? Understanding security protocols can provide peace of mind.

Choosing the Right Bank

Selecting the right bank involves more than just comparing interest rates. It requires understanding the bank's culture, values, and commitment to supporting small businesses.

Consider local community banks, as they often provide personalized service and a deeper understanding of the local business environment. The Federal Deposit Insurance Corporation (FDIC) provides resources on bank safety and soundness.

Conclusion

Opening a business bank account is a significant decision that requires careful research and consideration. Asking the right questions upfront can prevent misunderstandings, minimize fees, and ensure that the chosen bank aligns with the business's financial needs.

By taking the time to thoroughly evaluate different banking options, entrepreneurs can set themselves up for financial success. Remember that a strong banking relationship is a valuable asset for any growing business.