Questions To Ask When Purchasing A Business

Imagine yourself standing on the precipice of a new adventure. Sunlight streams through the windows of a charming bookstore, its shelves overflowing with literary treasures. Or perhaps you're touring a bustling bakery, the air thick with the scent of warm bread and sweet pastries. The possibility of owning your own business, becoming your own boss, is tantalizingly close. But before you sign on the dotted line, a crucial step remains: asking the right questions.

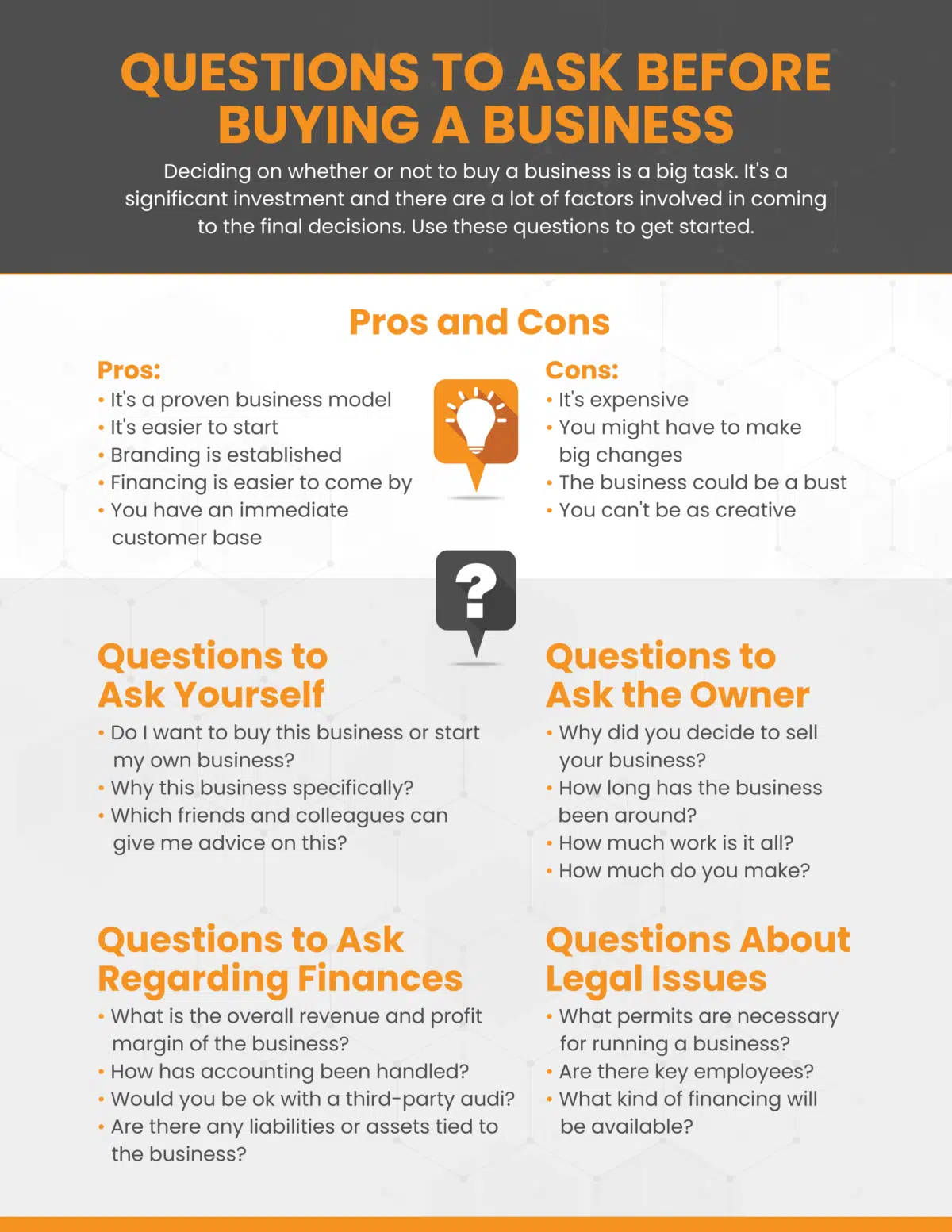

Before diving into the world of entrepreneurship by buying an existing business, it is essential to conduct thorough due diligence. Knowing what to ask will help you gain a clear picture of the business’s true health, potential, and any hidden risks. This article explores the critical questions you should ask before taking the plunge, ensuring you make a sound investment and avoid costly surprises.

Unveiling the Business's Past and Present

First, delve into the history of the business. Why is the current owner selling? Understanding their motivations is key. Is it retirement, a desire to pursue other ventures, or are there underlying issues driving the sale?

Examine the financial records meticulously. Request at least the past three years of profit and loss statements, balance sheets, and tax returns. Verify these documents with a qualified accountant to ensure accuracy and identify any red flags.

Don’t just look at the numbers; understand them. What are the revenue trends? What are the major expenses? How consistent is the profitability? Analyze the cash flow and understand the business's ability to meet its financial obligations. According to the Small Business Administration (SBA), "Understanding the financials is paramount to assess the viability of the business."

Delving into Operations and Customers

Next, explore the operational aspects of the business. How does the business operate on a day-to-day basis? What are the key processes? Understand the supply chain, the inventory management system, and the production process (if applicable).

Who are the business's key employees? What are their roles and responsibilities? What is their tenure? Assess the importance of key employees and develop a plan for retaining them after the acquisition. Often, a business's value is tied to the expertise and relationships of its staff.

Understanding the customer base is also crucial. Who are the primary customers? What is their demographic profile? How loyal are they? Identify the biggest customers and understand their buying patterns. Diversification is key – a business heavily reliant on a few major clients is inherently riskier.

Legal and Regulatory Compliance

Conduct a thorough review of all legal and regulatory aspects. Are there any outstanding lawsuits or legal claims? Are all permits and licenses up to date and transferable? Are there any environmental concerns?

Review all contracts, including leases, supplier agreements, and customer contracts. Understand the terms and conditions and assess their impact on the business. Engage a lawyer to review these documents and advise on any potential liabilities.

Also, investigate the business's compliance with all applicable laws and regulations. This includes labor laws, safety regulations, and environmental regulations. Failure to comply can result in costly fines and legal penalties.

Assessing the Market and Competition

Finally, analyze the market in which the business operates. What are the industry trends? What is the competitive landscape? Understand the size and growth potential of the market.

Who are the major competitors? What are their strengths and weaknesses? How does the business differentiate itself from its competitors? A clear understanding of the competitive landscape is essential for developing a successful business strategy.

Consider the barriers to entry. How difficult is it for new competitors to enter the market? High barriers to entry can provide a competitive advantage. Conduct a SWOT analysis (Strengths, Weaknesses, Opportunities, and Threats) to gain a comprehensive understanding of the business's position in the market.

Key Questions to Ask: A Summary

"Why are you selling the business?" This is paramount. "Can I see your financial records for the past three years?" Transparency is essential. "What are the biggest challenges facing the business?" Understand the potential pitfalls. "Who are your key employees, and what are their roles?" Employee retention is often crucial. "What are your plans for the future, and how will they affect the business?" Understand the seller's intentions and ensure a smooth transition.

Purchasing a business is a significant undertaking. By asking the right questions and conducting thorough due diligence, you can minimize the risks and maximize your chances of success. Remember to consult with trusted advisors, including accountants, lawyers, and business brokers, to guide you through the process.

Stepping into the role of a business owner is a leap of faith, one filled with both challenges and immense rewards. Armed with knowledge and a clear understanding of the business you're acquiring, you can confidently embark on this exciting journey, ready to shape your own destiny and build a thriving enterprise. The right questions are your compass, guiding you toward a successful and fulfilling future.

![Questions To Ask When Purchasing A Business 3 questions to ask before buying a business [infographic]](https://blog.jpabusiness.com.au/hs-fs/hubfs/3. Infographics and cheat sheets/3 questions to ask yourself before buying a business.png?width=300&name=3 questions to ask yourself before buying a business.png)

+(1).png?format=1500w)