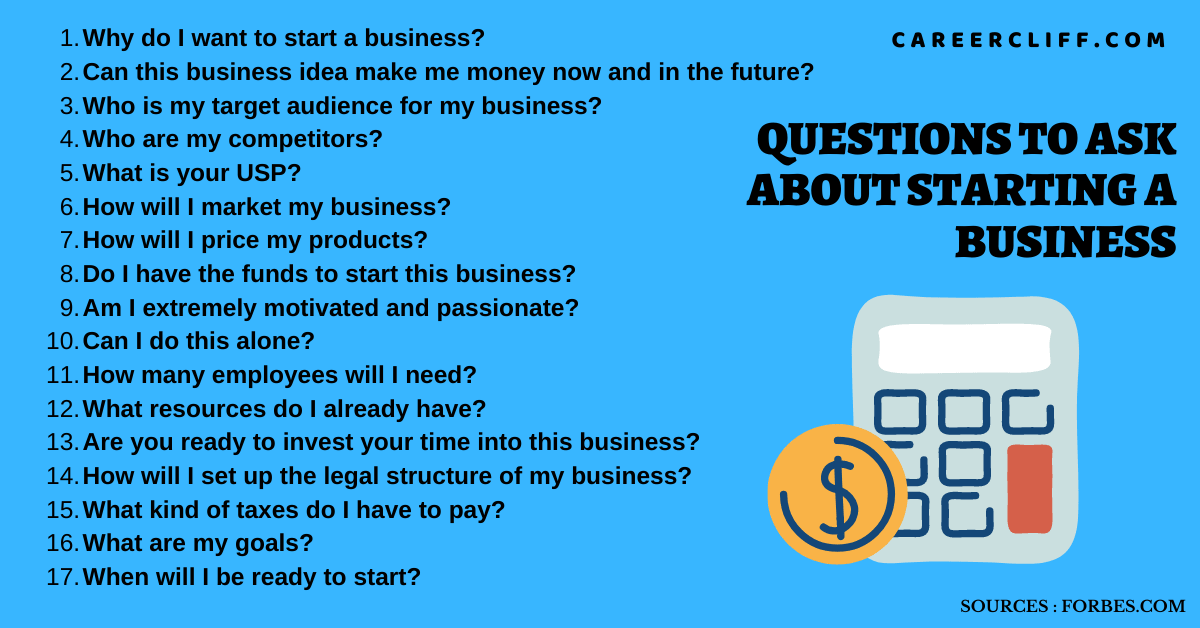

Questions To Ask Your Accountant When Starting A Small Business

Starting a small business is exhilarating, but financial missteps can cripple your dreams before they take flight. Avoid costly errors by grilling your accountant with these critical questions before you launch.

This article provides a crucial checklist of questions every new business owner must ask their accountant to ensure financial stability and legal compliance from day one.

Understanding Your Accountant's Expertise

"What experience do you have with businesses similar to mine?" This is your opening gambit.

You need an accountant who understands the specific challenges and opportunities within your industry.

Industry-specific experience is gold.

"Are you a Certified Public Accountant (CPA)?" A CPA designation signifies rigorous training and adherence to ethical standards.

Verify their credentials with your state's board of accountancy. Don't skip this vital step.

"What accounting software do you recommend, and why?" Software proficiency is key to efficient bookkeeping.

Your accountant should suggest options that suit your business size and needs, such as QuickBooks, Xero, or others.

Navigating Financial and Legal Structures

"Which business structure is best for my company (sole proprietorship, LLC, S-corp, etc.)?" Your accountant can analyze your situation and recommend the most advantageous legal structure for tax and liability purposes.

This decision has significant long-term implications. Choose wisely, with expert guidance.

"How can I set up a system for tracking income and expenses?" Proper record-keeping is the bedrock of sound financial management.

Your accountant should advise on best practices for tracking every penny.

Tax Implications and Compliance

"What taxes do I need to pay, and when are they due?" Missing tax deadlines can result in hefty penalties.

Understand your obligations for federal, state, and local taxes.

"How can I minimize my tax liability legally?" Tax planning is crucial for maximizing your profits.

Your accountant should identify deductions and credits applicable to your business.

"Can you help me prepare and file my taxes?" Tax preparation can be complex and time-consuming.

Ensure your accountant is equipped to handle your tax filings accurately and efficiently.

Budgeting, Forecasting, and Financial Planning

"How can I create a realistic budget for my business?" A budget is your roadmap to financial success.

Your accountant can help you develop a budget that aligns with your business goals. Don’t leave this to chance.

"Can you assist with financial forecasting and projections?" Projecting future performance is essential for strategic decision-making.

Forecasting can help you secure funding and anticipate challenges. Don't ignore this area.

"What key performance indicators (KPIs) should I track to monitor my business's financial health?" KPIs provide valuable insights into your business's performance.

Your accountant can identify the most relevant KPIs for your industry and business model.

Fees, Communication, and Ongoing Support

"How do you charge for your services (hourly, fixed fee, etc.)?" Transparency in pricing is essential for avoiding surprises.

Get a clear understanding of the fee structure upfront. No hidden costs!

"How often will we communicate, and what is your preferred method of communication?" Open communication is crucial for a successful accountant-client relationship.

Establish clear expectations for communication frequency and responsiveness.

"What ongoing support do you provide beyond tax preparation?" Look for an accountant who offers comprehensive support throughout the year.

This could include business advisory services, financial planning, and more.

Next Steps

Schedule consultations with several accountants before making a decision. Don't settle for the first option.

Compare their expertise, fees, and communication styles. Choose an accountant who is the right fit for your business.