How To Manage Your Business Finances

Navigating the financial landscape of a business can feel like traversing a complex maze. Solid financial management isn't just about tracking income and expenses; it's the bedrock upon which sustainable growth and profitability are built. For entrepreneurs and business owners alike, mastering these principles is crucial for long-term success.

This article delves into practical strategies for effectively managing business finances. We will explore key areas like budgeting, cash flow management, accounting practices, and long-term financial planning. Understanding these concepts is essential for any business, regardless of size or industry.

Budgeting: Charting Your Financial Course

A well-structured budget serves as a roadmap for your business's financial journey. It outlines projected income and expenses over a specific period, allowing you to anticipate potential challenges and opportunities.

Creating a budget involves several steps. First, estimate your revenue streams based on historical data and market trends. Then, identify and categorize all expenses, from fixed costs like rent and salaries to variable costs like marketing and supplies.

Regularly compare your actual performance against your budget. This practice, known as variance analysis, helps you identify areas where you're overspending or underspending. Adjustments can then be made to keep your business on track.

Cash Flow Management: Keeping the Lifeblood Flowing

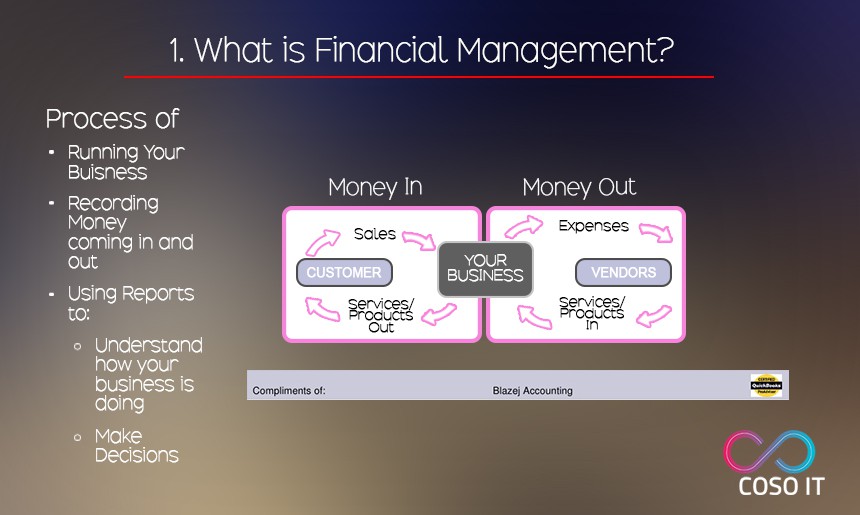

Cash flow, the movement of money in and out of your business, is the lifeblood of any organization. Effectively managing cash flow ensures you have enough funds to meet your obligations and invest in growth.

Monitoring your accounts receivable and accounts payable is crucial. Invoice clients promptly and efficiently to expedite payments. Negotiate favorable payment terms with suppliers to extend your payment cycles.

Consider implementing cash flow forecasting. Projecting your inflows and outflows over the short and long term helps you anticipate potential cash shortages and take proactive measures.

Accounting Practices: The Foundation of Financial Transparency

Sound accounting practices are essential for maintaining accurate financial records and making informed decisions. Implementing a robust accounting system ensures transparency and compliance.

Choose an accounting method that suits your business needs. The accrual method recognizes revenue and expenses when they are earned or incurred, while the cash method recognizes them when cash changes hands. Many businesses find that the accrual method offers a clearer picture of their long-term financial health.

Consider using accounting software to streamline your processes. These tools automate tasks like invoicing, bank reconciliation, and financial reporting. Popular options include QuickBooks, Xero, and Sage.

Long-Term Financial Planning: Building a Sustainable Future

Beyond day-to-day operations, long-term financial planning is crucial for securing your business's future. This involves setting financial goals, developing strategies to achieve them, and regularly monitoring your progress.

Evaluate your capital structure. Determine the appropriate mix of debt and equity financing for your business. A healthy balance can provide the resources needed for growth while minimizing financial risk. Seek advice from a financial advisor.

Plan for capital expenditures. Estimate the cost of future investments in equipment, technology, and infrastructure. Creating a sinking fund or securing financing in advance can help you manage these expenses effectively.

Seeking Professional Advice

Managing business finances can be complex, especially for those without a financial background. Consider seeking guidance from qualified professionals.

Accountants can provide expertise in bookkeeping, tax preparation, and financial reporting. Financial advisors can help you develop long-term financial plans and investment strategies. Business consultants can offer insights into industry best practices and operational efficiencies.

By implementing these strategies and seeking professional advice when needed, you can navigate the financial complexities of running a business. Solid financial management is the key to building a sustainable and profitable enterprise. Good financial decisions today will lead to greater prosperity tomorrow.