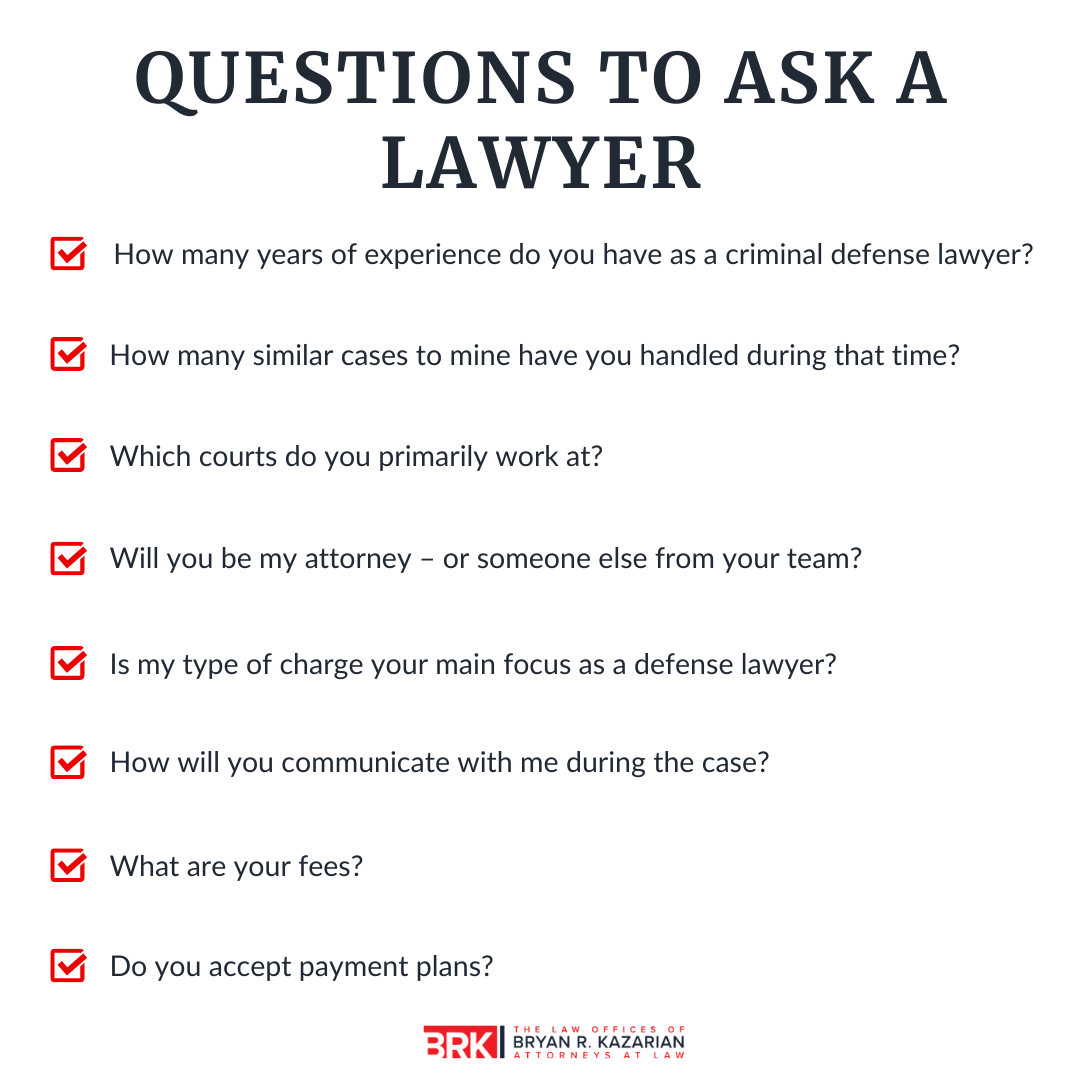

Questions To Ask Your Attorney Before Starting A Business

Starting a business is a thrilling leap into the unknown, filled with potential rewards but also considerable risks. The legal landscape surrounding business formation is complex, and navigating it without expert guidance can lead to costly mistakes and unforeseen liabilities. Before you even draft a business plan, engaging with an attorney is a crucial first step that can safeguard your future entrepreneurial endeavors.

A consultation with a business attorney isn't just about ticking boxes; it's about building a solid legal foundation for your company. This article delves into the essential questions you should ask your attorney to ensure you're making informed decisions from the outset. These questions cover entity selection, intellectual property protection, contract law, regulatory compliance, and dispute resolution, providing a comprehensive framework for your initial legal consultation.

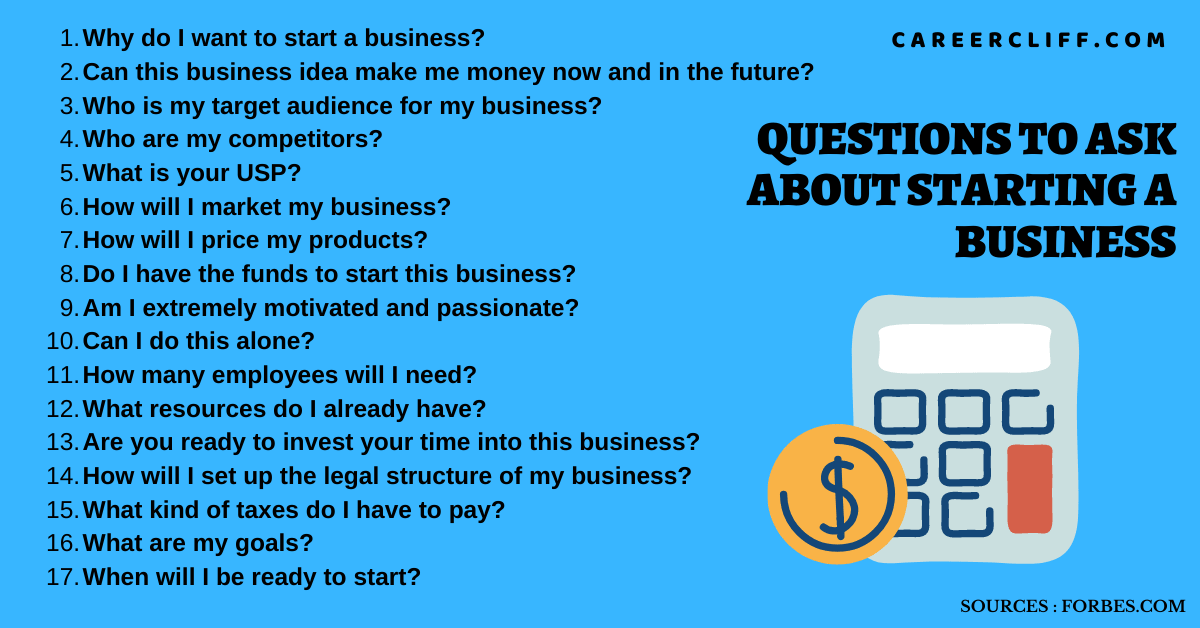

Choosing the Right Business Entity

The structure of your business impacts everything from taxation to liability. Understanding the nuances of each entity type is paramount.

What are the advantages and disadvantages of each entity type (sole proprietorship, partnership, LLC, S-corp, C-corp) for my specific business?

Each structure has different implications for personal liability, taxation, and administrative burden. A sole proprietorship, for example, is simple to set up but offers no liability protection. A corporation, while offering liability protection, involves more complex compliance requirements, according to the Small Business Administration (SBA).

What are the tax implications of each entity type, and which one is most beneficial for my financial situation?

The IRS treats different entities differently. S-corps and LLCs can offer pass-through taxation, potentially reducing your tax burden. However, the best option depends on your individual circumstances and projected profitability.

What are the requirements for setting up and maintaining each entity type in my state?

State laws vary significantly. Requirements for registration, reporting, and ongoing compliance differ. Failing to comply can result in penalties and legal issues.

Protecting Your Intellectual Property

Intellectual property (IP) is often a company’s most valuable asset. Safeguarding it is crucial from day one.

What steps should I take to protect my brand, logo, and other intellectual property?

This could involve trademarks, copyrights, and patents. A trademark protects your brand name and logo, while a copyright protects original artistic or literary works. A patent protects inventions.

How can I conduct a thorough trademark search to ensure my brand name is available?

A comprehensive search can prevent future legal battles. The United States Patent and Trademark Office (USPTO) offers resources for conducting trademark searches.

What are the key provisions I should include in contracts with employees, contractors, and partners regarding intellectual property ownership?

Clear agreements are essential to avoid disputes over ownership. Include clauses that explicitly assign ownership of IP created during the course of employment or partnership to the company.

Navigating Contract Law

Contracts are the backbone of any business. Understanding your contractual obligations is vital.

What are the essential elements of a legally binding contract?

A valid contract typically requires an offer, acceptance, consideration, and mutual intent to be bound. These elements must be present for a contract to be enforceable.

What are some common pitfalls to avoid when drafting or reviewing contracts?

Vague language, ambiguous terms, and failure to address potential contingencies are common pitfalls. Ensure every term is clear and understandable.

What are the best practices for negotiating contracts to protect my interests?

Preparation, clear communication, and a willingness to compromise are key. Understand your priorities and be prepared to walk away if necessary.

Ensuring Regulatory Compliance

Businesses must adhere to a myriad of regulations. Failure to comply can lead to fines and legal action.

What licenses and permits do I need to operate my business legally in my industry and location?

Requirements vary depending on the nature of your business and where you operate. Research federal, state, and local regulations thoroughly.

What are the key regulatory requirements related to data privacy, consumer protection, and environmental compliance that apply to my business?

Laws like the California Consumer Privacy Act (CCPA) and the General Data Protection Regulation (GDPR) impose strict requirements on data handling. Businesses must comply with these laws to avoid penalties.

How can I stay up-to-date on changes in regulations that may affect my business?

Subscribe to industry newsletters, attend relevant conferences, and maintain a relationship with your attorney to stay informed. Regularly reviewing relevant government websites like the Federal Trade Commission (FTC) is also important.

Planning for Dispute Resolution

Disputes are inevitable in business. Having a plan for resolving them is crucial.

What are the common types of business disputes, and how can I proactively minimize the risk of them occurring?

Contract disputes, partnership disagreements, and employment disputes are common. Clear agreements, open communication, and robust internal policies can help minimize risk.

What are the different methods of dispute resolution, such as mediation, arbitration, and litigation?

Mediation involves a neutral third party facilitating negotiation. Arbitration involves a neutral third party making a binding decision. Litigation involves resolving the dispute in court.

What are the pros and cons of each method, and which one is most appropriate for my business?

Mediation is often faster and less expensive than litigation. Arbitration can be more binding than mediation but less formal than litigation. The best option depends on the specific circumstances.

Starting a business is a marathon, not a sprint. Investing in legal advice early on is an investment in your long-term success. By asking the right questions and building a strong relationship with your attorney, you can navigate the legal complexities with confidence and focus on building a thriving enterprise. Remember, seeking proactive legal guidance is not an expense, but a strategic investment in the future of your business.