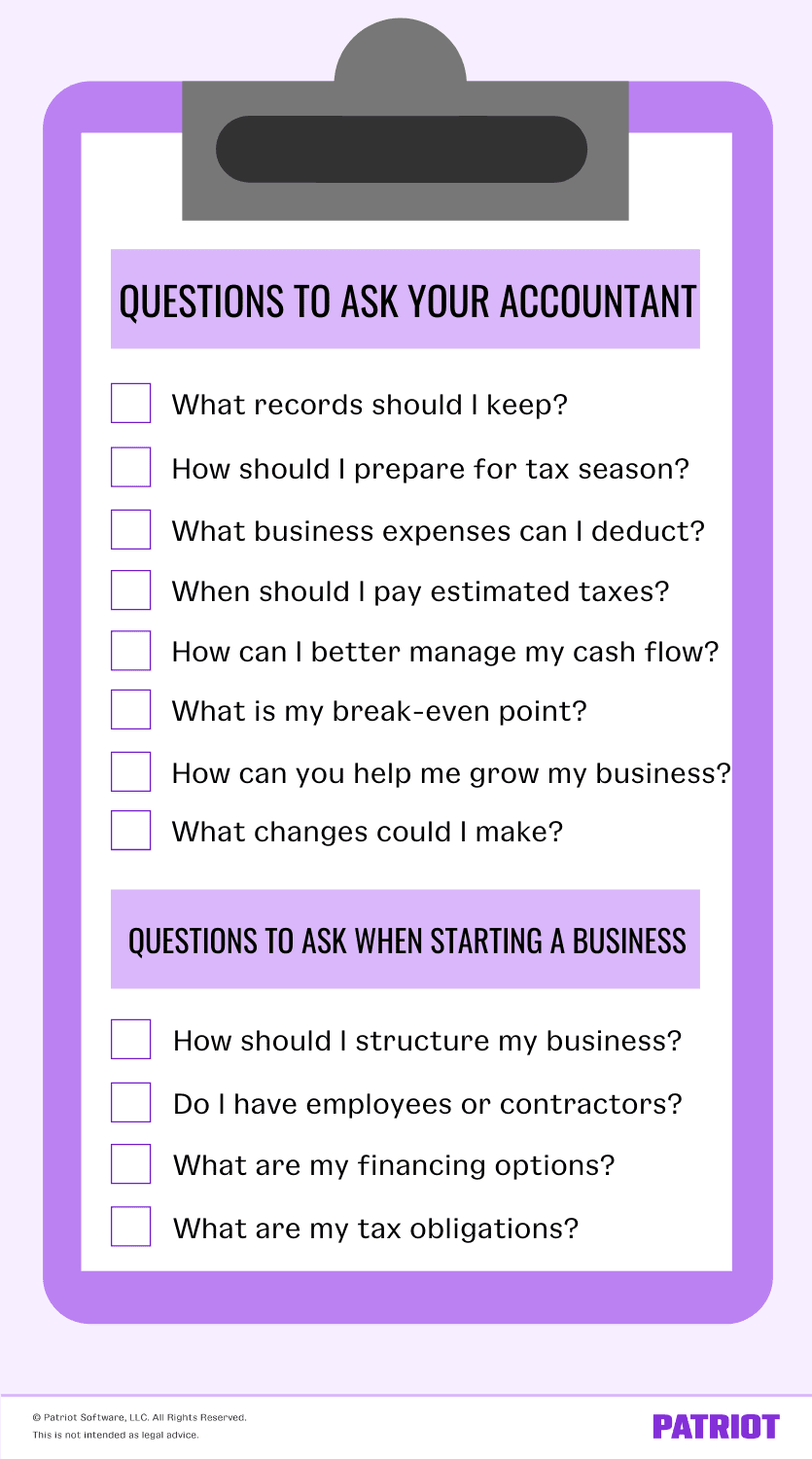

Questions To Ask Your Personal Accountant

Tax season looms, and with it, a tidal wave of forms, deadlines, and deductions. Navigating this complex landscape often requires professional guidance. But how do you ensure your personal accountant is truly working in your best interest, maximizing your returns, and minimizing your stress?

This article provides a crucial guide to the essential questions you should be asking your accountant. Getting the right answers can save you money, avoid potential legal pitfalls, and provide invaluable peace of mind.

Understanding Your Accountant's Credentials and Expertise

Before diving into the specifics of your finances, it’s critical to understand your accountant’s background. Confirming their qualifications and areas of expertise is paramount.

Are you a Certified Public Accountant (CPA)?

This seemingly simple question is foundational. A CPA designation signifies rigorous training, examination, and adherence to ethical standards.

It also requires ongoing professional development, ensuring they stay up-to-date with the ever-changing tax laws.

What are your areas of expertise?

Not all accountants are created equal. Some specialize in individual tax returns, while others focus on small business accounting or estate planning.

It’s crucial to find an accountant whose expertise aligns with your specific needs. According to the AICPA (American Institute of Certified Public Accountants), understanding your accountant's niche can significantly improve your tax outcomes.

How long have you been practicing?

Experience matters, especially when dealing with intricate tax situations. A seasoned accountant has likely encountered a wide range of scenarios and can offer valuable insights.

Discussing Your Financial Situation and Tax Strategy

Transparency is key to a successful accountant-client relationship. Be prepared to discuss your finances openly and honestly, and don't hesitate to ask clarifying questions.

What information do you need from me?

A good accountant will provide a comprehensive list of required documents and information. This includes W-2s, 1099s, investment statements, and records of deductible expenses.

They should also explain why each piece of information is necessary, fostering a better understanding of the tax process.

What deductions and credits am I eligible for?

This is where a skilled accountant can truly shine. They should be able to identify all eligible deductions and credits, potentially saving you significant money.

Don’t be afraid to ask for clarification on unfamiliar terms or deductions you’re unsure about.

What is your tax planning strategy for me?

Tax planning goes beyond simply filing your return. It involves developing a proactive strategy to minimize your tax liability throughout the year.

A proactive approach can involve adjusting withholdings, making estimated tax payments, or utilizing tax-advantaged investment accounts.

Understanding Fees and Communication

Clarity regarding fees and communication is essential to avoid misunderstandings and build trust.

How do you charge for your services?

Accountants typically charge by the hour, by the form, or a flat fee. Understand the pricing structure upfront to avoid surprises.

Also, inquire about potential additional fees for complex situations or amended returns.

How often will we communicate, and what is your preferred method?

Establish clear communication expectations from the outset. Discuss how often you’ll receive updates and the preferred method of communication (e.g., email, phone, video calls).

What happens if I receive a notice from the IRS?

It's crucial to know how your accountant will handle potential audits or notices from the IRS. Will they represent you before the IRS? What are their fees for this service?

Looking Ahead: Long-Term Financial Goals

A good accountant can be a valuable partner in achieving your long-term financial goals. They can provide guidance on investments, retirement planning, and estate planning.

Can you help me with retirement planning?

Understanding the tax implications of different retirement accounts (e.g., 401(k), IRA) is critical. Your accountant can help you optimize your retirement savings strategy.

Do you offer financial planning services beyond tax preparation?

Some accountants offer comprehensive financial planning services, including investment advice and budgeting. Determine if they offer these services and if they align with your needs.

Asking these questions to your personal accountant is an important first step in building a strong and productive professional relationship. By understanding their credentials, discussing your financial situation openly, and clarifying fees and communication, you can ensure they are working in your best interest and helping you achieve your financial goals. Remember that finding a trustworthy financial advisor can provide invaluable peace of mind and ensure your financial future is in good hands.