Quick Loan No Credit Check Instant Approval

A surge in advertisements promising "Quick Loan No Credit Check Instant Approval" is raising alarms among consumer advocacy groups and financial regulators. These readily available loans often come with hidden fees and exorbitant interest rates, trapping vulnerable individuals in cycles of debt.

This article dissects the rising trend of these predatory lending practices, examining their potential dangers and offering guidance to consumers.

The Allure of Instant Approval

The appeal is undeniable: immediate access to cash without the hassle of credit checks. These loans, often marketed online and through social media, target individuals with poor credit histories or urgent financial needs.

"The speed and convenience are what make these loans attractive," explains Sarah Johnson, a financial advisor at Consumer Credit Counseling Services. "But that convenience comes at a very steep price."

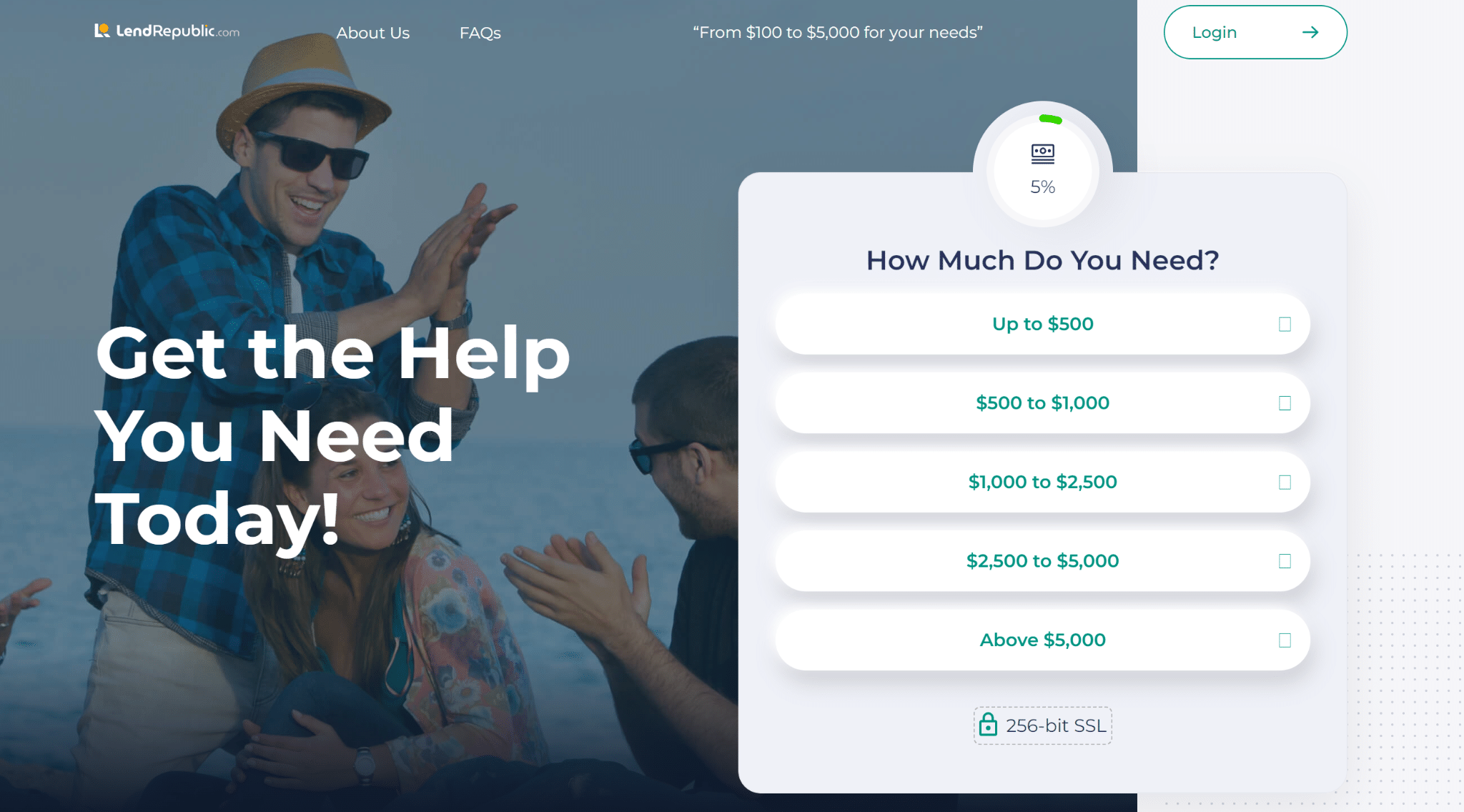

Companies like SpeedyCashNow and EZMoneyLoans are prominent players in this market, aggressively advertising their services to a wide audience. They frequently target areas with lower average incomes and higher rates of financial insecurity.

The Hidden Costs

While the "no credit check" aspect is heavily promoted, the fine print often reveals shocking terms. Annual Percentage Rates (APRs) can soar into the triple digits, far exceeding those of traditional loans or credit cards.

Fees are another major concern. Late payment fees, origination fees, and even prepayment penalties can quickly add up, making it difficult to repay the loan.

According to a recent report by the Consumer Financial Protection Bureau (CFPB), these types of loans have an average APR of 391%. This means that a borrower taking out a $500 loan could end up paying back over $1955 in a year.

Who is Most Vulnerable?

These loans disproportionately impact low-income individuals, minorities, and those struggling with unemployment or medical debt. These groups are often excluded from traditional financial services and are more likely to be targeted by predatory lenders.

"These companies prey on people's desperation," says Robert Miller, a lawyer specializing in consumer protection. "They know that their customers have limited options and are willing to accept unfavorable terms."

Data from the National Consumer Law Center (NCLC) shows a strong correlation between the prevalence of these loans and areas with high poverty rates. They emphasize the need for increased financial literacy and alternative lending options.

Red Flags to Watch Out For

Be wary of any loan that promises guaranteed approval, requires upfront fees, or lacks transparency about its terms. Always read the fine print carefully before signing anything.

Check for a physical address and contact information for the lender. Avoid companies that operate solely online or use generic email addresses.

If a lender pressures you to borrow more than you need, or discourages you from seeking advice from a financial expert, proceed with extreme caution.

Seeking Help and Alternatives

If you are struggling to repay a "Quick Loan No Credit Check Instant Approval," contact a credit counseling agency or legal aid organization immediately.

Explore alternative borrowing options, such as credit union loans, payday alternative loans (PALs) from federal credit unions, or borrowing from friends and family.

Consider seeking help from local charities or government assistance programs that can provide financial support during emergencies.

Regulatory Scrutiny

The CFPB and other regulatory agencies are actively investigating these lending practices. They are working to enforce existing consumer protection laws and implement new regulations to curb predatory lending.

Several states have already enacted laws capping interest rates and restricting the terms of these loans. More states are considering similar legislation.

The Federal Trade Commission (FTC) also plays a role in combating deceptive advertising and fraudulent practices in the lending industry. Consumers are encouraged to report any suspicious activity to the FTC.

Next Steps

Consumers are urged to exercise extreme caution when considering "Quick Loan No Credit Check Instant Approval" offers. Educate yourself about the risks and explore all available options before borrowing.

The CFPB provides a wealth of information on responsible borrowing and financial planning on its website. Resources from non-profit organizations like the NCLC and Consumer Credit Counseling Services can also offer invaluable guidance.

The ongoing debate surrounding these lending practices highlights the need for stronger consumer protections and increased financial literacy initiatives to protect vulnerable individuals from predatory lenders. Monitoring of these companies and awareness are keys.