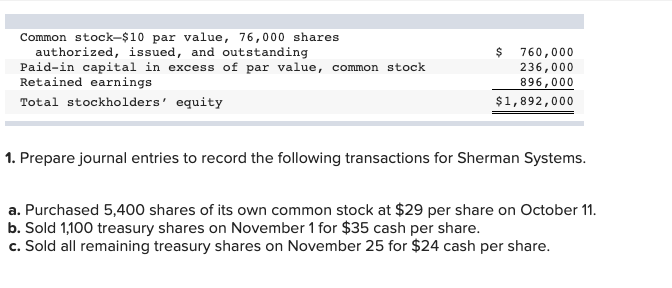

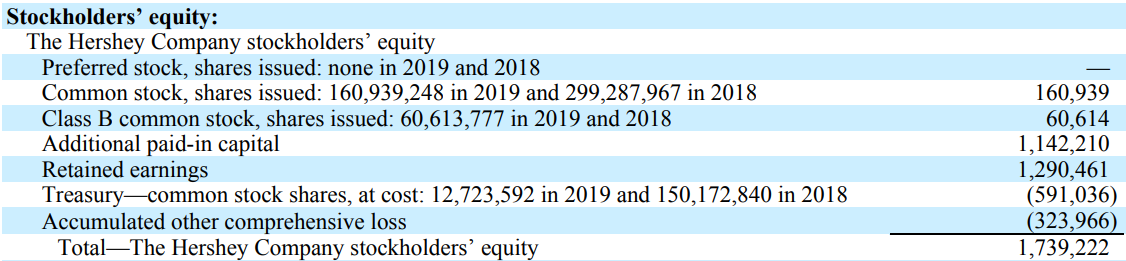

Represents The Shares Issued At Par Value

Breaking: Shares of Apex Innovations were today represented at par value on the Nasdaq, triggering immediate trading halts and widespread investor concern. This unprecedented event signals a potential crisis in confidence for the technology firm.

The representation at par value, effectively wiping out market capitalization above the nominal issuance price, raises serious questions about the company's financial stability and future prospects.

Trading Halts and Market Reaction

Trading of Apex Innovations (APXI) was halted at 9:35 AM EST following the initial indication of shares trading at their $0.01 par value. The halt, initiated by Nasdaq, aimed to prevent further volatility and allow for dissemination of information.

A second halt occurred at 10:15 AM EST after a brief resumption of trading, indicating persistent downward pressure. The exchange cited "order imbalance" as the reason for the second suspension.

Market analysts are stunned by the rapid and severe devaluation. "This is unheard of for a company of Apex's scale," commented John Carter, Senior Analyst at MarketWatch.

Understanding Par Value

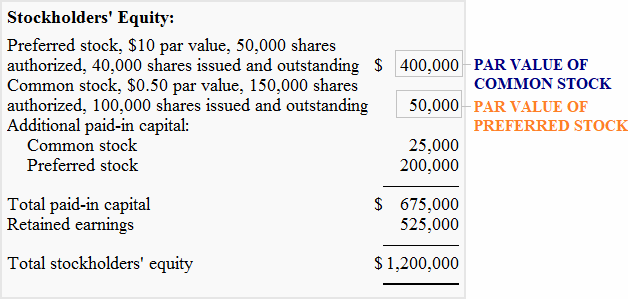

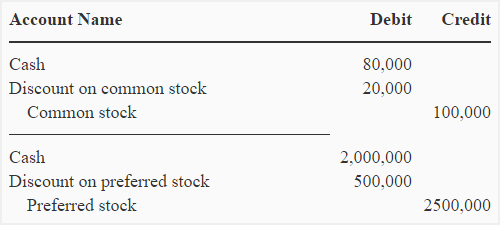

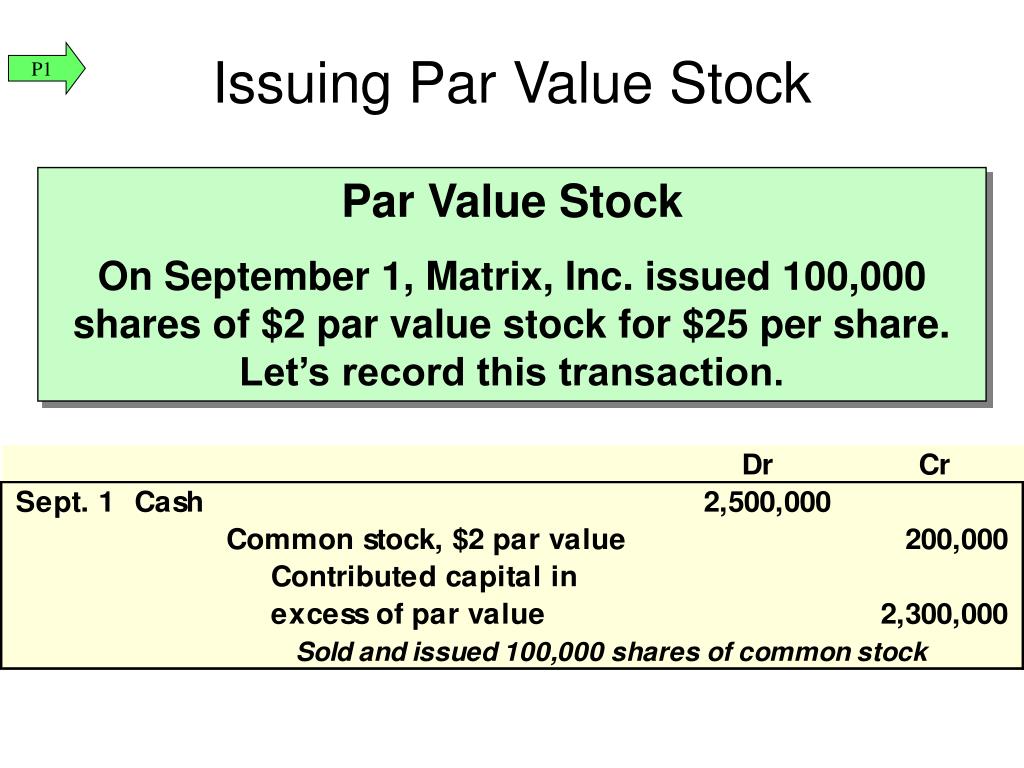

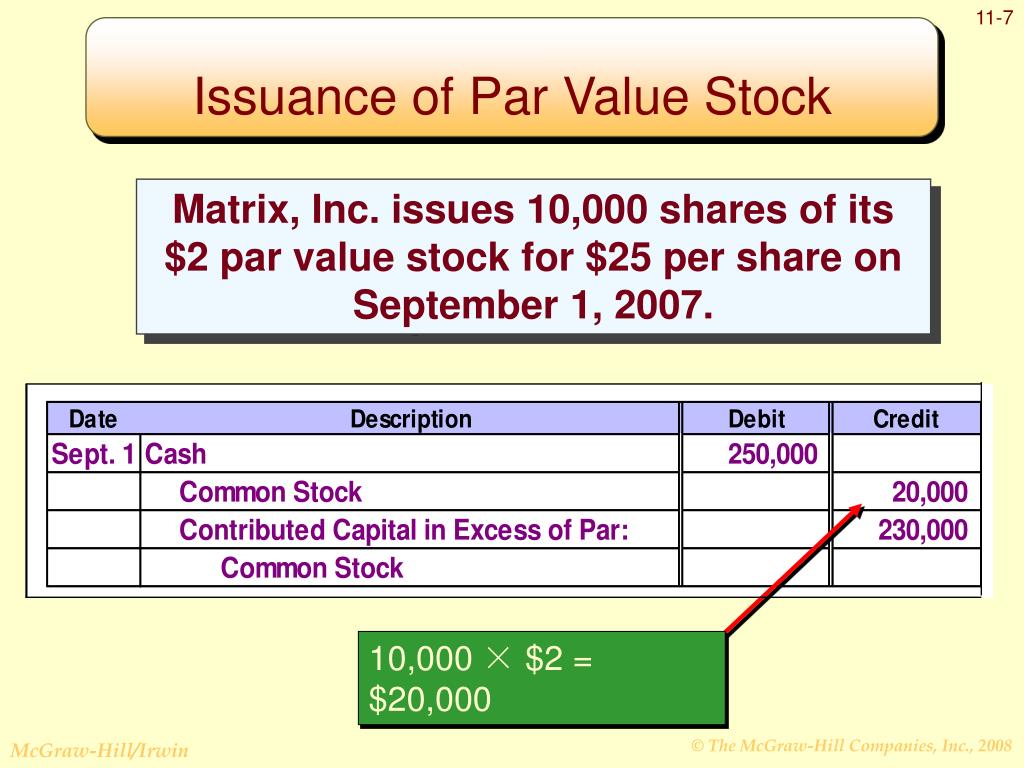

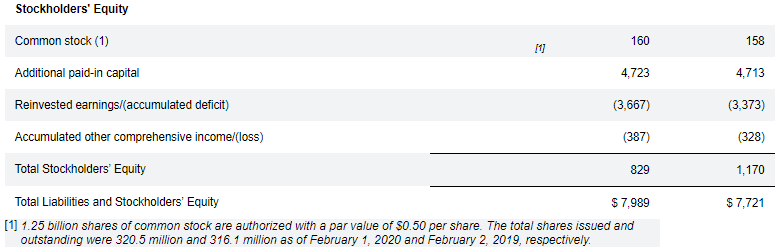

Par value is the nominal value assigned to a share of stock when it is first issued by a company. It is generally a very small amount and bears little relation to the actual market value of the share.

Representation at par value means the market perceives the company's equity to be worth essentially nothing beyond its initial issuance price. This often indicates a severe financial distress or imminent bankruptcy.

Companies like Apex Innovations, previously trading at multiples of their par value, are expected to generate profits and increase shareholder value over time. This drastic shift suggests a fundamental flaw in the company's perceived performance.

Apex Innovations' Response

Apex Innovations released a brief statement acknowledging the situation. The statement, posted on their investor relations website, stated they are "aware of the market activity" and "exploring all available options."

No further details were provided regarding the cause of the market collapse. CEO Sarah Chen has remained silent, fueling speculation among investors and analysts.

The company has scheduled an emergency board meeting for tomorrow morning. The agenda has not been disclosed, but it is widely expected that the board will discuss the company's financial position and potential restructuring options.

Possible Causes and Implications

Several factors could be contributing to Apex Innovations' predicament. These include a recent failed product launch, a significant debt burden, and allegations of accounting irregularities.

Rumors of an SEC investigation are circulating in financial circles, though unconfirmed.

"If true, this could explain the market's swift and brutal reaction,"said financial analyst Michael Davis.

The implications of Apex Innovations' decline extend beyond the company itself. It raises broader concerns about the stability of the technology sector and the potential for similar collapses among other high-growth companies.

Investor Impact

Investors in Apex Innovations are facing substantial losses. Many individual investors, who bought shares at inflated prices, are now seeing their investments effectively wiped out.

Large institutional investors are also feeling the pain. Pension funds and mutual funds holding Apex Innovations shares will likely need to write down the value of their holdings, potentially impacting their overall performance.

Several law firms have announced investigations into potential securities fraud. They are seeking to represent investors who suffered losses as a result of Apex Innovations' alleged misconduct.

Next Steps and Ongoing Developments

The situation surrounding Apex Innovations remains fluid and uncertain. The company's board meeting tomorrow will be a critical moment.

Investors should closely monitor news and regulatory filings for updates. The SEC is likely to take a closer look at the company's financial disclosures and trading activity.

The future of Apex Innovations hangs in the balance. Whether the company can recover from this crisis remains to be seen, but the road ahead is undoubtedly challenging.

:max_bytes(150000):strip_icc()/Parvalue-Final-1a535f4a987248bd8c09f75551c7a011.jpg)