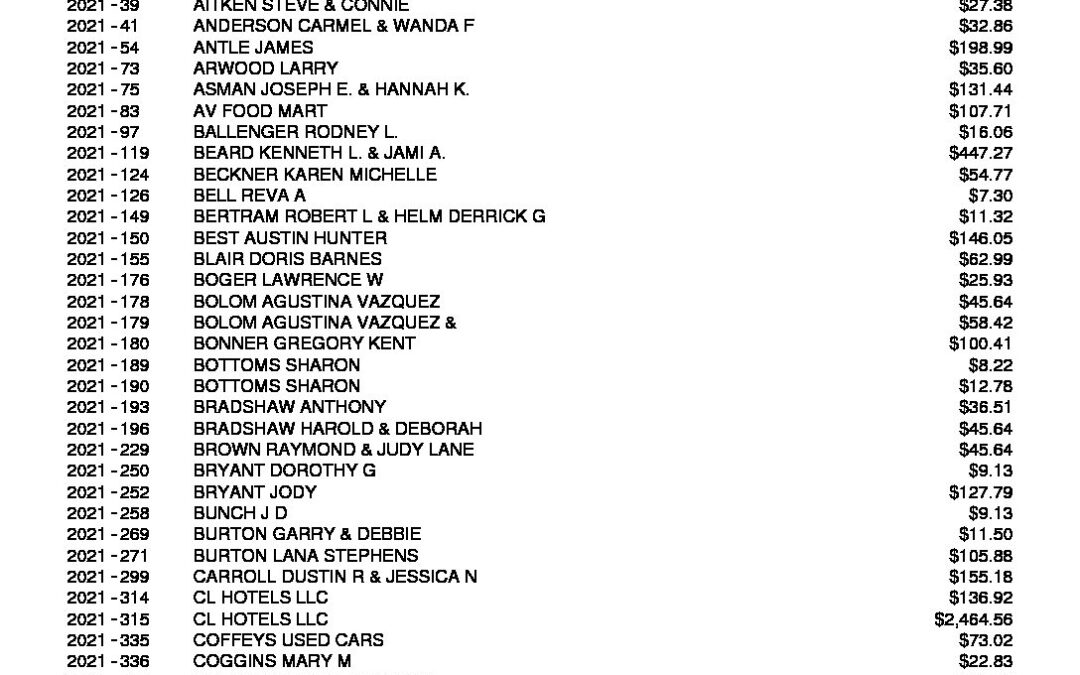

Riverside County Delinquent Property Tax List

Riverside County is grappling with a significant surge in delinquent property taxes, potentially jeopardizing essential public services and impacting property values across the region. Millions of dollars remain unpaid, casting a long shadow over the county's fiscal stability and raising concerns among homeowners and community leaders alike. The growing tax delinquency demands immediate attention and strategic solutions to mitigate its far-reaching consequences.

This article delves into the escalating problem of delinquent property taxes in Riverside County. It will examine the contributing factors, analyze the potential repercussions for county services and property owners, and explore possible remedies to address this pressing financial challenge. Understanding the scope and implications of this issue is crucial for residents, policymakers, and stakeholders to collectively navigate towards a sustainable and equitable solution.

The Rising Tide of Unpaid Taxes

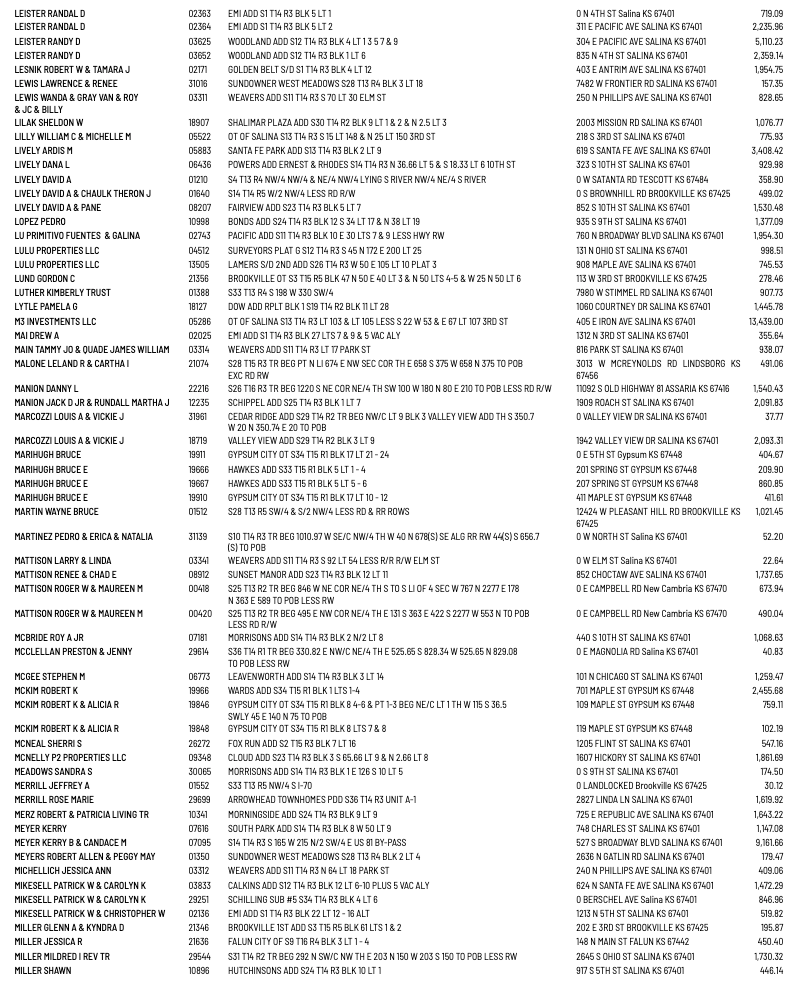

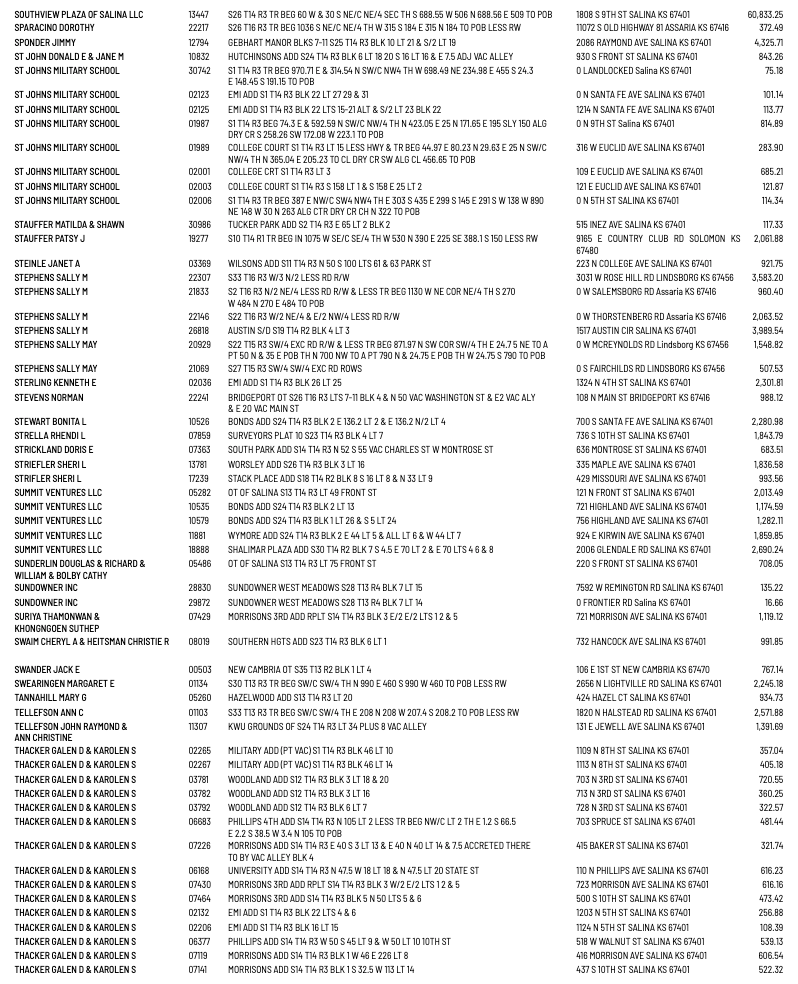

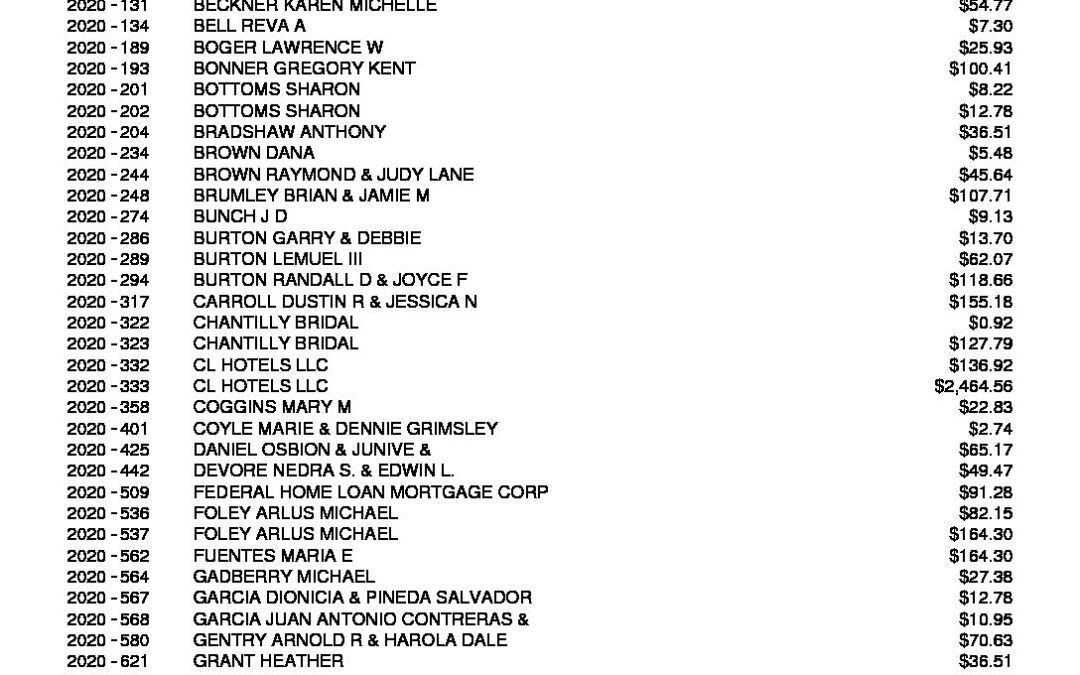

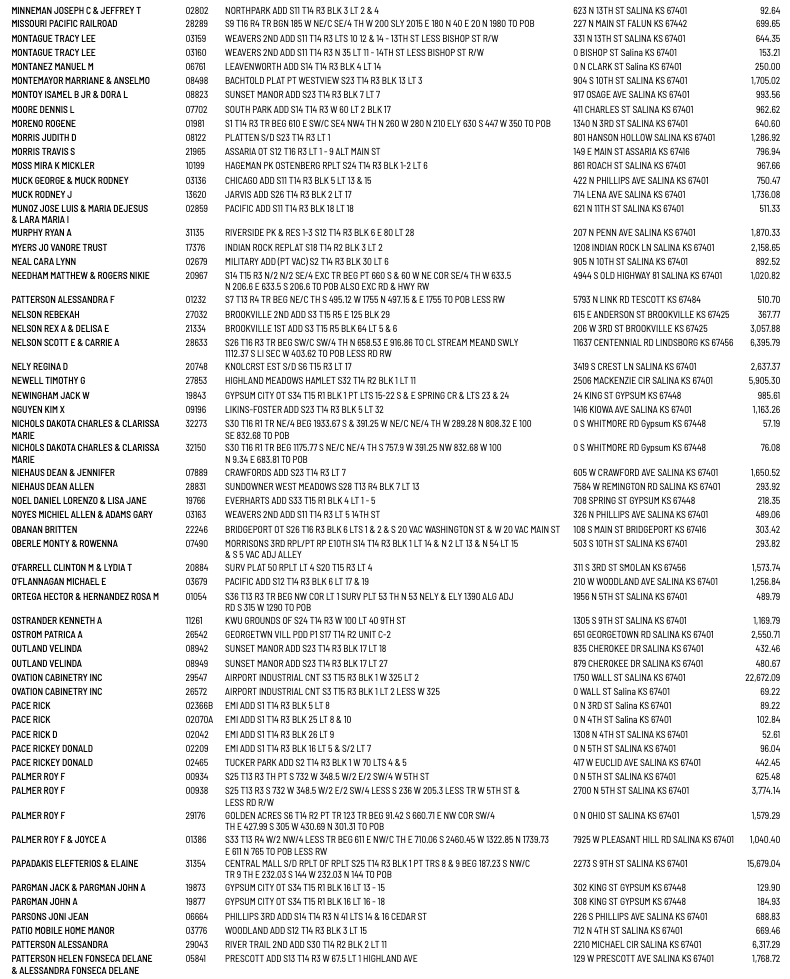

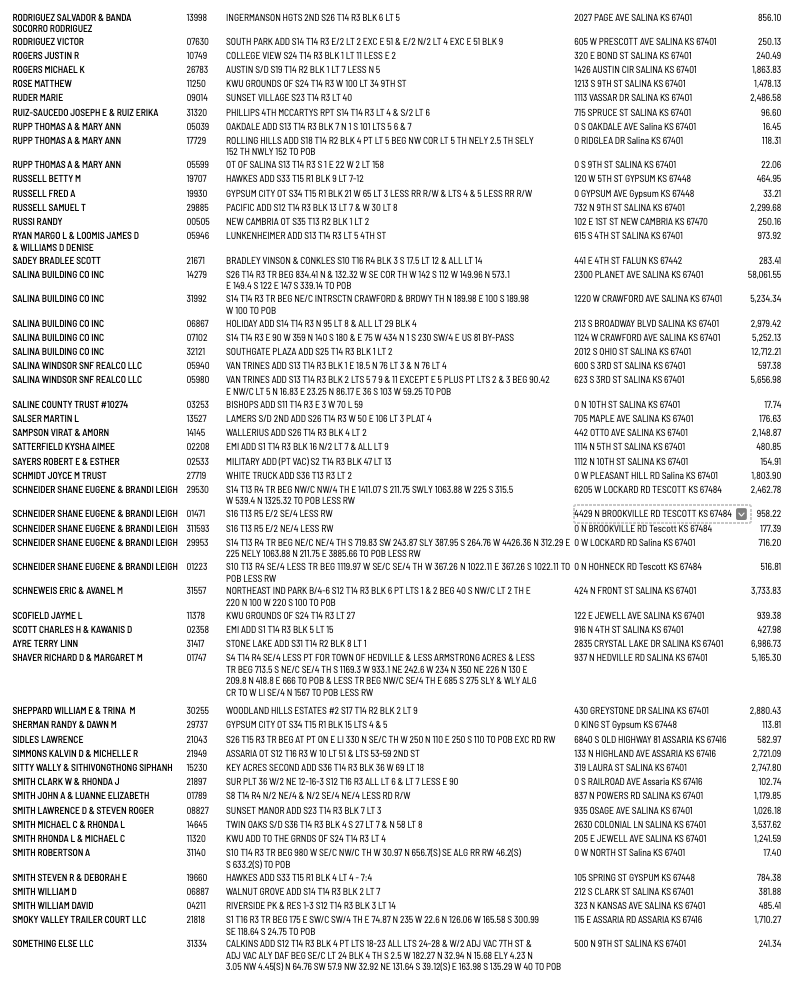

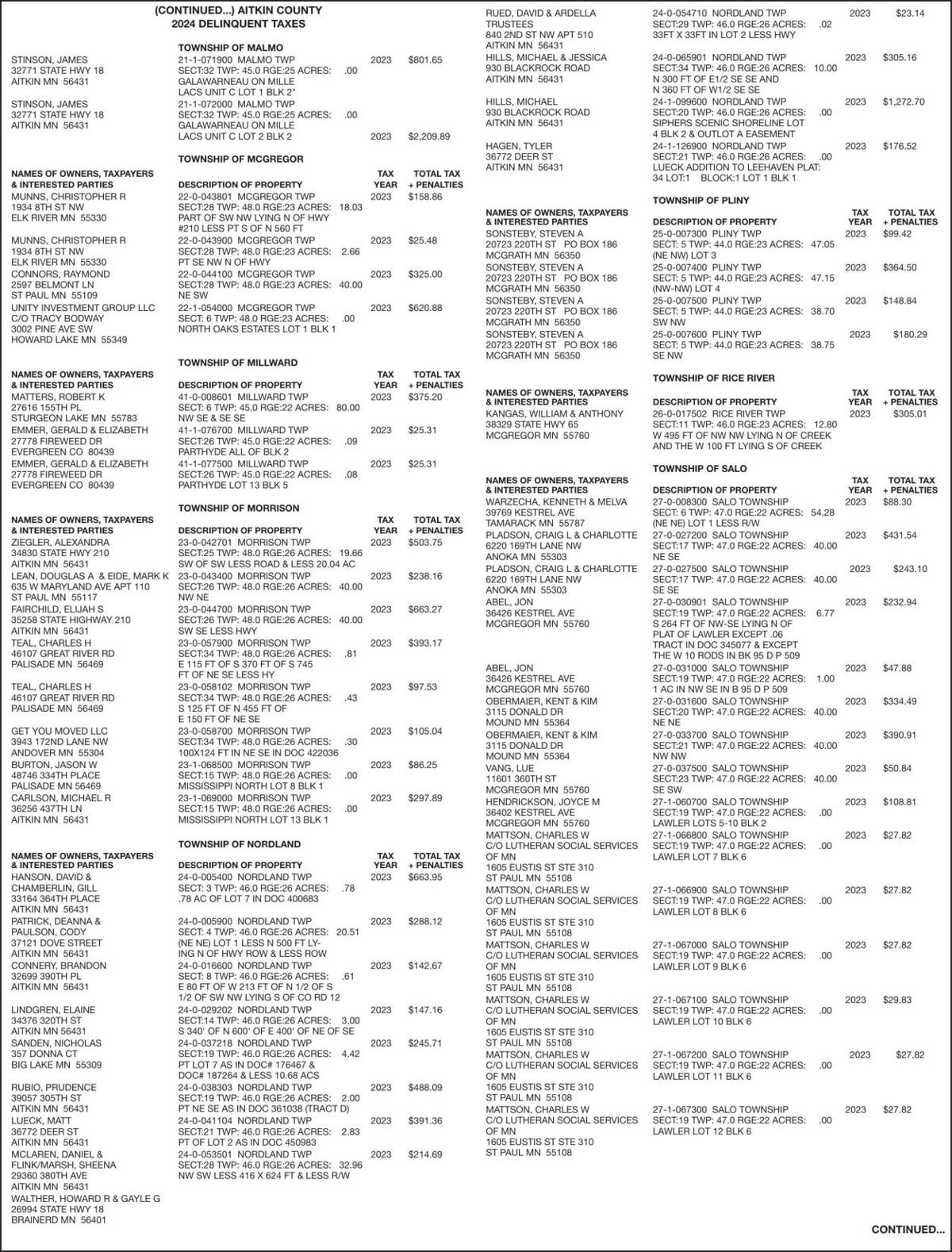

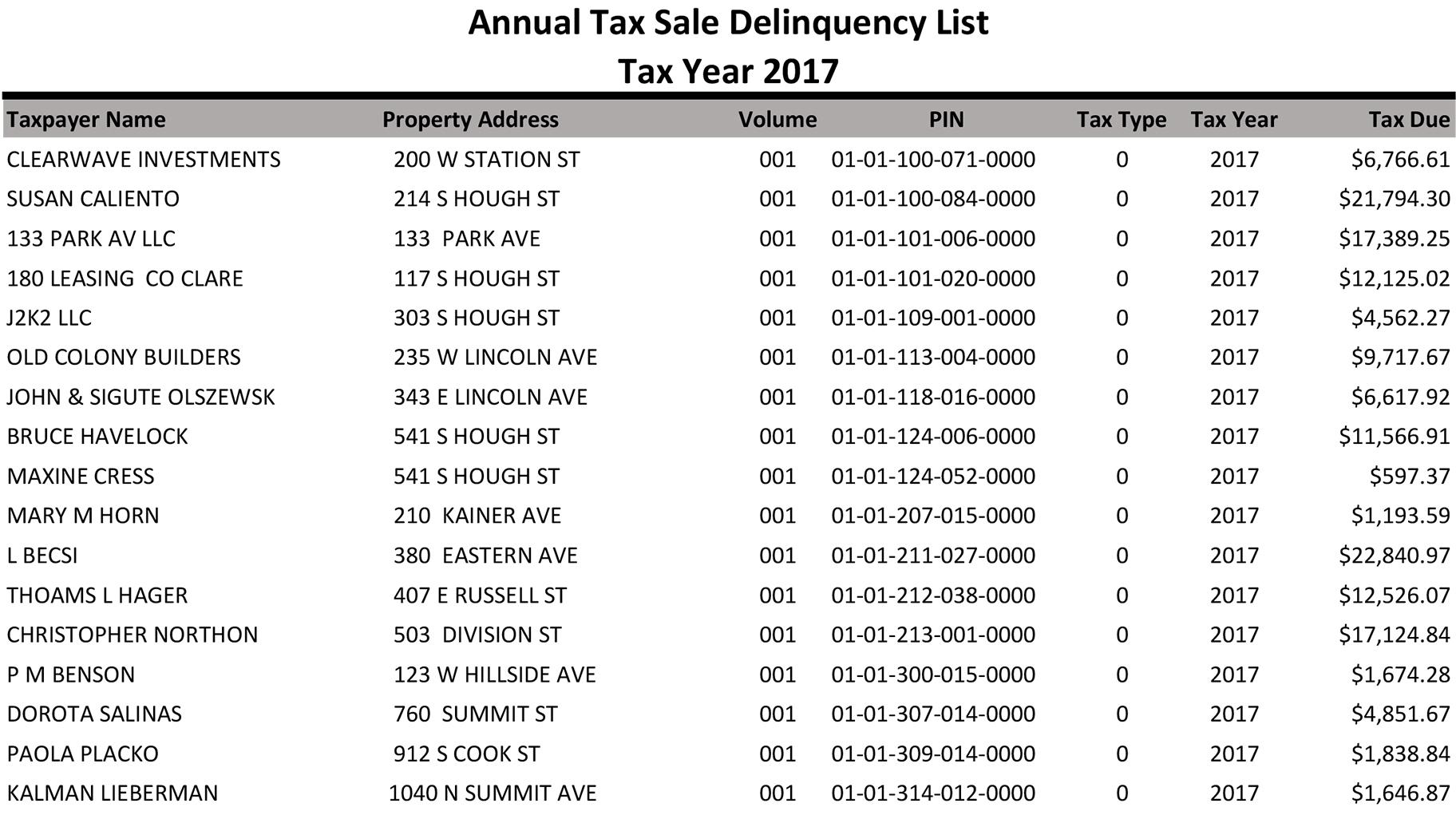

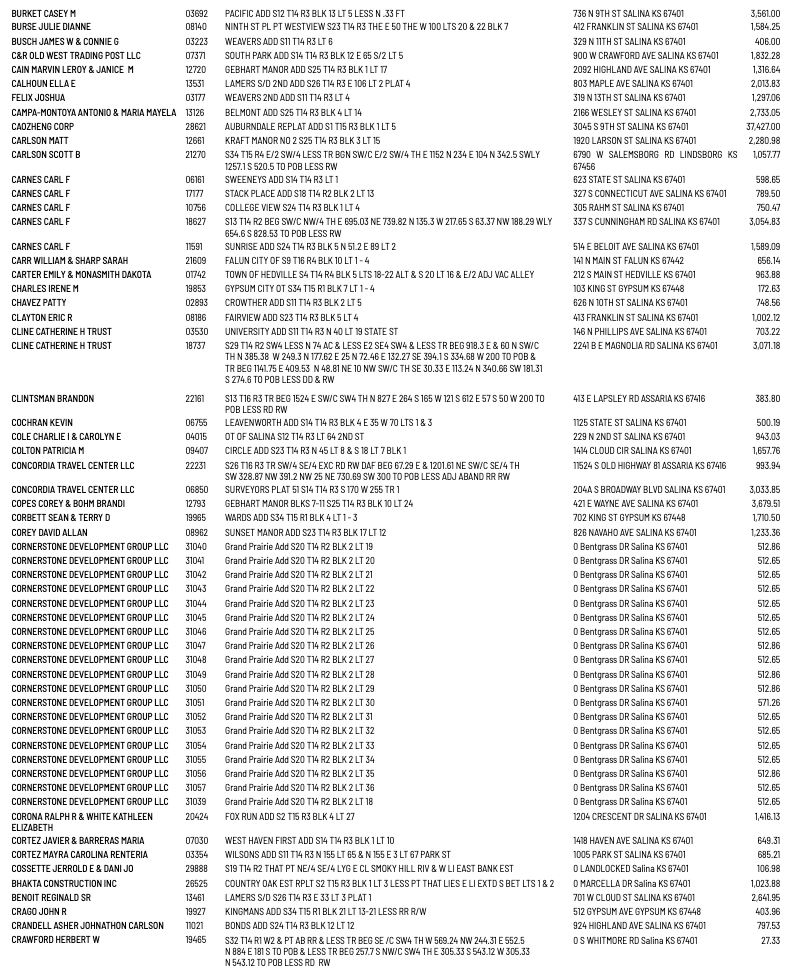

Riverside County's delinquent property tax roll has been steadily increasing in recent years, a trend exacerbated by economic downturns and shifting demographics. The total amount of unpaid taxes has reached a concerning level, prompting urgent action from county officials. Data from the Riverside County Treasurer-Tax Collector's office reveals a substantial rise in delinquency rates compared to previous years.

Barbara Dunmore, the current Treasurer-Tax Collector, recently stated, "We are actively working to address the increasing delinquency rates and exploring all available options to recover these funds for the benefit of our community." This is impacting schools, infrastructure, and public safety initiatives throughout the county. It is a situation that requires collaborative efforts from various agencies and the community.

Factors Contributing to Delinquency

Several factors contribute to the rising tide of delinquent property taxes in Riverside County. Economic hardship, including job losses and business closures, plays a significant role. Foreclosure rates, although lower than in the past, continue to impact property tax revenue.

Furthermore, some homeowners may face difficulties navigating the property tax system, leading to inadvertent delinquencies. "We understand that many factors can contribute to a homeowner's inability to pay their property taxes on time," explained Jane Smith, a local housing advocate. Outreach and education efforts are being increased to mitigate this risk.

Impact on County Services

Delinquent property taxes directly impact the county's ability to fund essential services. These services include schools, law enforcement, fire protection, and infrastructure maintenance. A reduction in property tax revenue can lead to budget cuts and service reductions.

The ripple effect can impact the quality of life for Riverside County residents. Reduced funding for schools, for example, can lead to larger class sizes and fewer resources for students. Similarly, strained law enforcement budgets can affect response times and community policing initiatives.

"The less money available for us to provide service to our people, the more harm it ultimately does to the people of Riverside County," said the Sheriff Chad Bianco of Riverside County during the county’s budget meeting.

Impact on Property Owners

Delinquent property taxes not only affect county services but also have consequences for individual property owners. Properties with unpaid taxes are subject to penalties and interest charges. Continued delinquency can lead to property tax sales and eventual foreclosure.

Homeowners facing financial difficulties are encouraged to contact the Treasurer-Tax Collector's office to explore available payment options and assistance programs. Ignoring the problem can lead to more severe consequences. Michael Brown, a local real estate attorney, advises property owners to seek professional advice if they are struggling to pay their taxes.

County Strategies for Addressing Delinquency

Riverside County is implementing several strategies to address the issue of delinquent property taxes. These strategies include increased outreach and education efforts. More aggressive collections efforts are also being made.

The county is also exploring alternative payment options and assistance programs for property owners facing financial difficulties. Supervisors Karen Spiegel is advocating for a more proactive approach to identifying and assisting struggling homeowners. "We need to be more proactive in reaching out to those who are at risk of falling behind on their property taxes," she stated.

Digital Outreach

The county has also increased its presence online, developing a new online portal. This portal allows users to easily check property tax status. It also provides comprehensive information about payment options.

Community Partnership

The county is partnering with local community organizations to reach at-risk homeowners. This will provide financial counseling and assistance navigating the property tax system. This community focus shows Riverside County’s commitment to supporting those in need.

Looking Ahead

Addressing the issue of delinquent property taxes in Riverside County requires a multifaceted approach. Sustained economic growth, combined with targeted assistance programs and effective communication, is essential. The county must continue to adapt its strategies to meet the evolving needs of its residents.

The long-term success of these efforts depends on collaboration between county officials, community organizations, and individual property owners. By working together, Riverside County can mitigate the negative impacts of delinquent property taxes. It can also ensure the long-term financial stability and prosperity of the region. The situation will require constant awareness and communication within the community.