Rocket Mortgage Affect Credit Score

The dream of homeownership, often fueled by streamlined online mortgage platforms like Rocket Mortgage, can sometimes carry unintended consequences for credit scores. While Rocket Mortgage offers a convenient pathway to securing a loan, understanding its potential impact on your credit is crucial for responsible financial planning.

This article delves into the multifaceted relationship between using Rocket Mortgage and its effect on credit scores. It examines the initial credit checks, the potential for score fluctuations, and the long-term credit implications of managing a mortgage obtained through this popular platform. We'll explore the common concerns, offer insights from financial experts, and provide guidance on navigating the mortgage process while safeguarding your credit health.

Initial Credit Inquiry: The First Dip

Applying for a mortgage, regardless of the lender, almost always triggers a hard credit inquiry. This occurs when lenders pull your credit report to assess your creditworthiness. Rocket Mortgage is no exception, and this inquiry can cause a slight, temporary dip in your credit score.

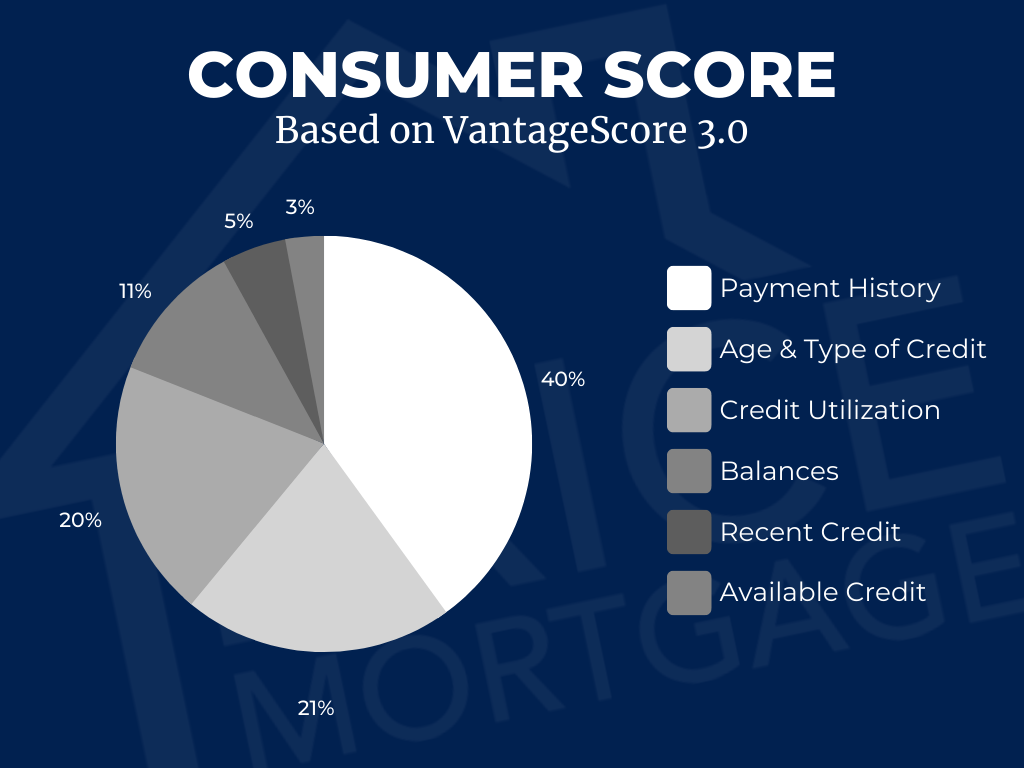

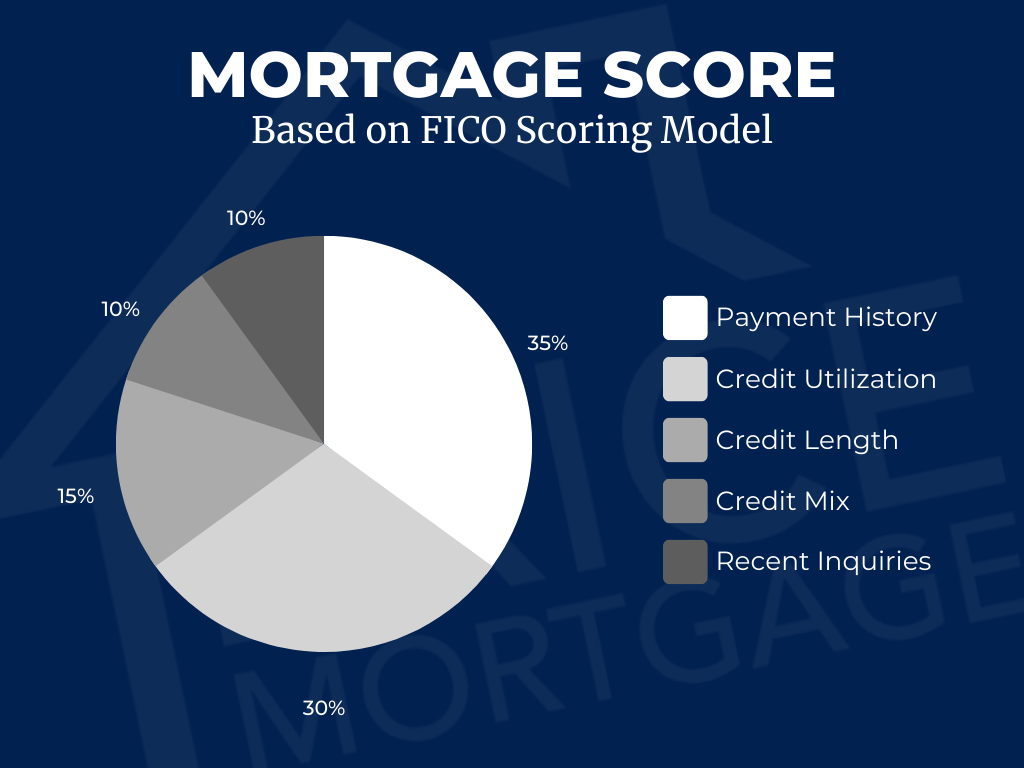

The impact of a hard inquiry is generally minimal, typically knocking off a few points. The exact amount depends on your credit profile and the scoring model used. Multiple hard inquiries within a short period, especially for the same type of loan, are often treated as a single inquiry by credit scoring models, minimizing the overall impact.

Rate Shopping and Credit Impact

Rocket Mortgage, like many online lenders, allows potential borrowers to "shop around" for the best rates. This can involve multiple credit pulls from different lenders.

The good news is that credit bureaus recognize the need for rate shopping and have implemented measures to mitigate the impact of multiple inquiries. As long as the inquiries are made within a specific timeframe (usually 14-45 days), they are often counted as a single inquiry.

"It's important for consumers to understand that shopping around for a mortgage is encouraged, and the credit bureaus have protections in place to prevent excessive damage to their credit scores," says Sarah Johnson, a certified financial planner.

Mortgage Management: The Long-Term View

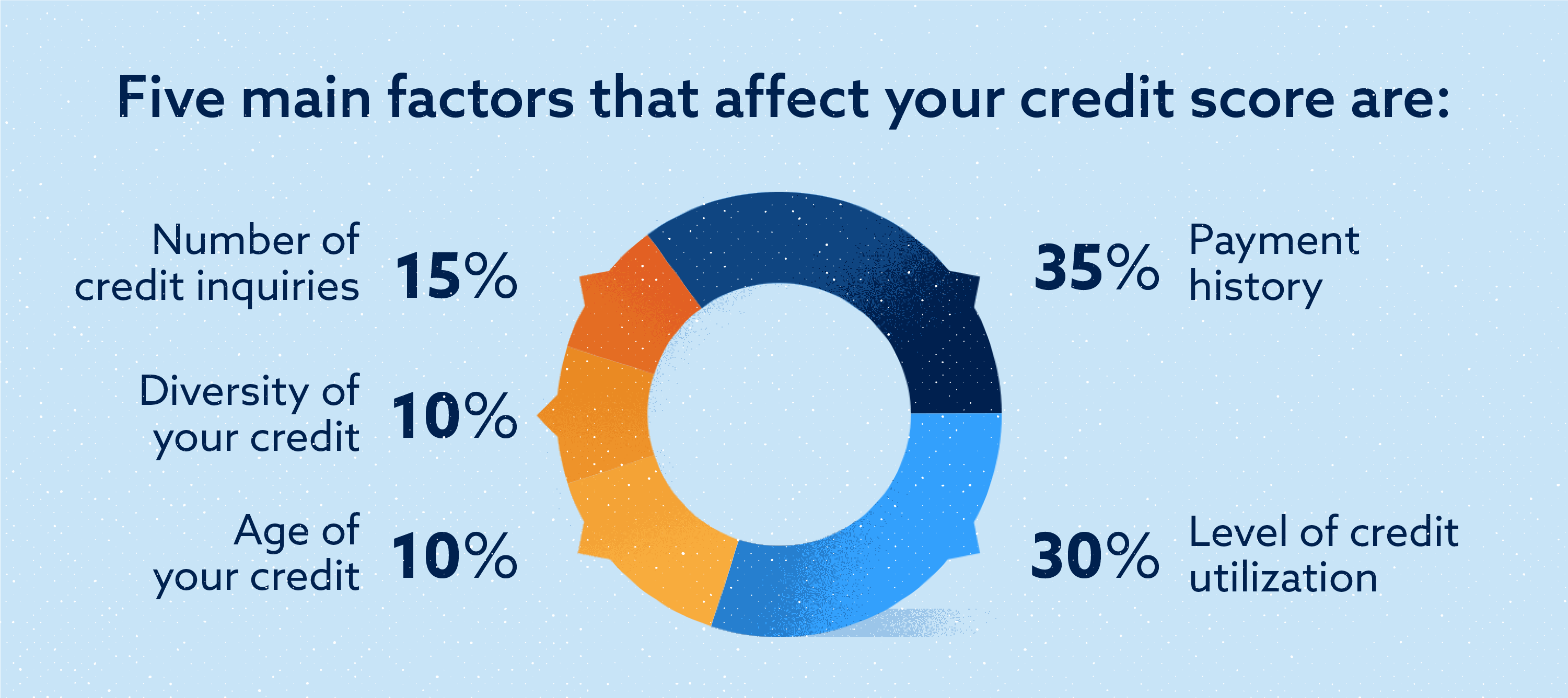

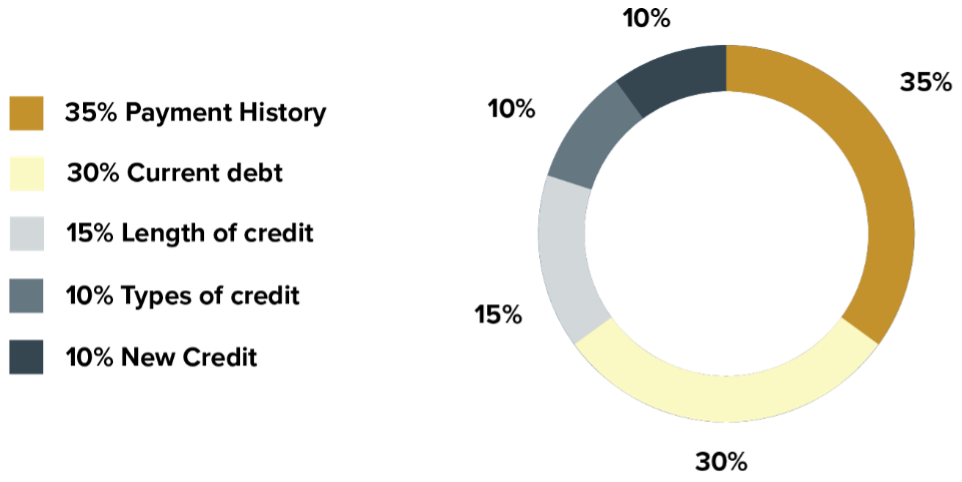

The most significant impact of a Rocket Mortgage loan, or any mortgage for that matter, on your credit score comes from the ongoing management of the loan. Making timely payments is critical for building and maintaining a strong credit history.

Conversely, late payments can severely damage your credit score. Even a single late payment can have a noticeable negative impact, and multiple late payments can lead to a significant decrease in your creditworthiness.

Furthermore, the size of your mortgage relative to your other debts, and your overall debt-to-income ratio, can also influence your credit score. A healthy balance between debt and income is crucial for demonstrating responsible financial management.

Rocket Mortgage's Reporting Practices

Rocket Mortgage, as a responsible lender, reports your payment history to the major credit bureaus. This reporting is essential for building credit history and demonstrating your ability to manage debt responsibly.

It's crucial to ensure that Rocket Mortgage is reporting your payments accurately. Regularly check your credit report to identify and dispute any errors. Errors can negatively impact your credit score, so prompt correction is essential.

Expert Perspectives and Recommendations

Financial experts generally agree that the convenience and streamlined process of online mortgage platforms like Rocket Mortgage can be beneficial, but they also emphasize the importance of understanding the credit implications. It's always a good idea to check your credit report before applying for a mortgage, regardless of the lender.

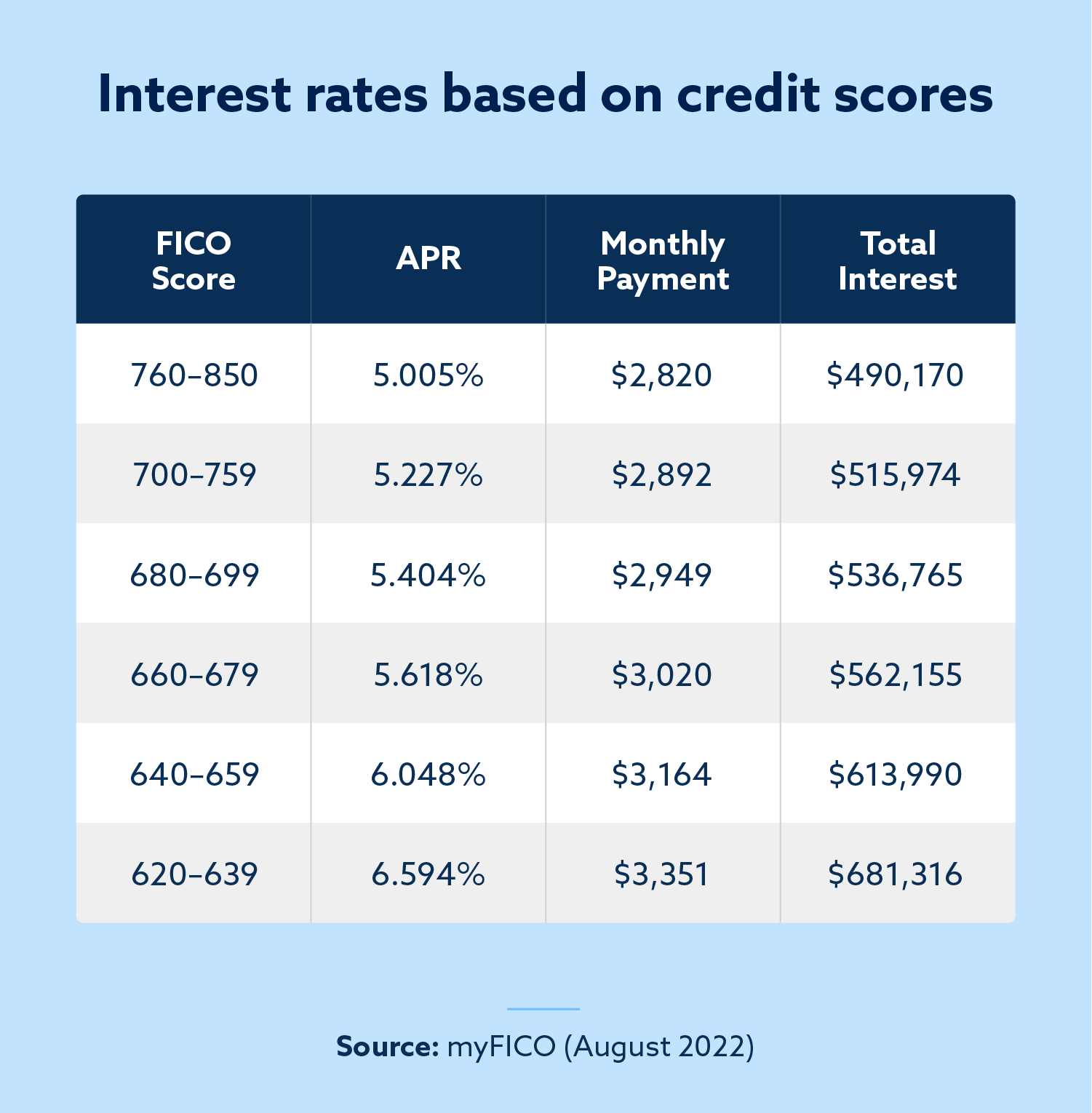

Maintaining a good credit score before applying for a mortgage can help you qualify for better interest rates. A higher credit score can save you thousands of dollars over the life of the loan.

Before settling on Rocket Mortgage, compare rates and terms from multiple lenders. Understanding the total cost of the loan, including fees and interest, is critical for making an informed financial decision.

Looking Ahead: Future of Online Lending and Credit Scores

The landscape of online lending is constantly evolving, with new technologies and innovations emerging regularly. As online platforms continue to gain popularity, it's likely that credit scoring models will adapt to better reflect the unique characteristics of these lenders.

Consumers should stay informed about changes in credit scoring and lending practices. Understanding how these changes may affect their credit scores is crucial for making sound financial decisions.

Ultimately, responsible financial management remains the cornerstone of a healthy credit score. By understanding the impact of mortgage applications and diligently managing their loans, individuals can navigate the mortgage process with Rocket Mortgage and other lenders while safeguarding their credit health for the long term.