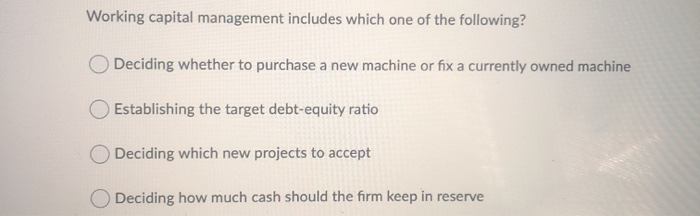

Working Capital Management Includes Which One Of The Following

Navigating the financial landscape of any organization, whether a small business or a multinational corporation, requires a keen understanding of working capital management. Often framed as a vital sign of a company's financial health, efficient working capital management can be the difference between thriving and merely surviving.

This article delves into the core components of working capital management, elucidating its role and examining which elements are definitively included. We will explore the key aspects that businesses consider when optimizing their short-term assets and liabilities.

Defining Working Capital Management

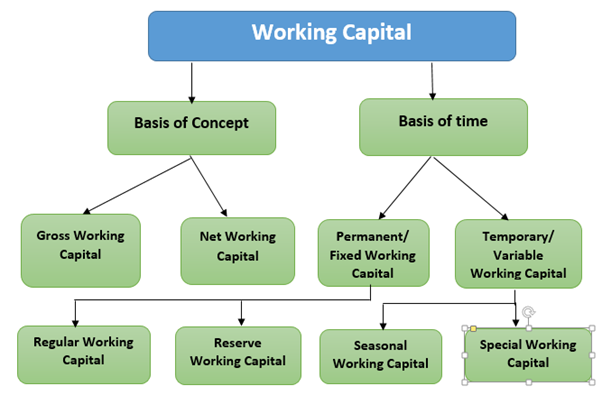

Working capital management encompasses the strategies and processes involved in managing a company's current assets and current liabilities. The central goal is to ensure a company has sufficient liquidity to meet its short-term obligations and operate smoothly.

Effective working capital management involves optimizing the levels of cash, accounts receivable, inventory, and accounts payable. The objective is to find the right balance that maximizes profitability while minimizing the risk of financial distress.

Key Components: What's In and What's Out

The core equation for working capital is: Working Capital = Current Assets - Current Liabilities. Current assets are those assets that can be converted into cash within one year, while current liabilities are obligations due within one year.

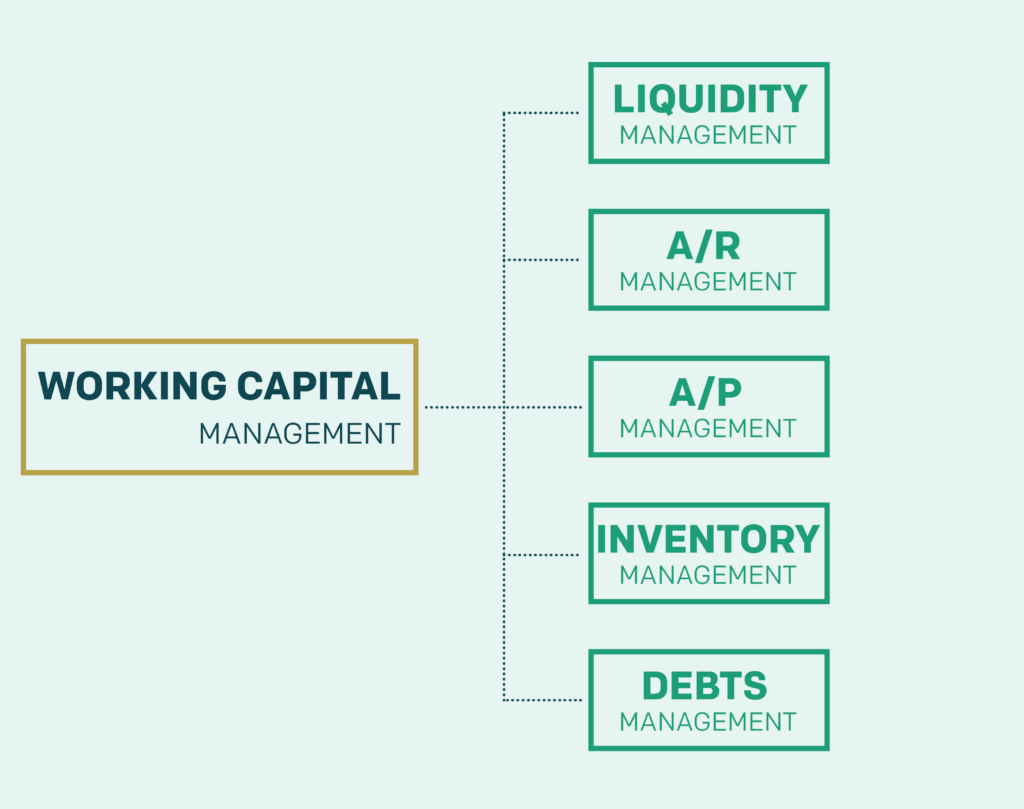

The primary components consistently included in working capital management are:

Cash Management

Cash management focuses on optimizing the amount of cash a company holds. This includes strategies for accelerating cash inflows and delaying cash outflows.

Companies utilize various techniques like efficient invoicing processes and negotiating favorable payment terms with suppliers to improve their cash position. Short-term investments are another important aspect.

Accounts Receivable Management

Accounts receivable management involves establishing credit policies, sending invoices promptly, and actively collecting outstanding payments. Efficient management minimizes the risk of bad debts and ensures timely cash inflows.

Companies use strategies like offering early payment discounts and implementing robust collection procedures. Analyzing customer creditworthiness is also crucial.

Inventory Management

Inventory management aims to maintain optimal inventory levels to meet customer demand without tying up excessive capital. Techniques like Just-in-Time (JIT) inventory systems and demand forecasting are commonly used.

Efficient inventory control reduces storage costs, minimizes the risk of obsolescence, and ensures products are available when needed. Effective demand planning is an essential component.

Accounts Payable Management

Accounts payable management focuses on optimizing payment terms with suppliers to maximize the use of available cash. This involves negotiating extended payment deadlines and taking advantage of early payment discounts when beneficial.

Effective management of payables allows companies to conserve cash and improve their liquidity. Building strong relationships with suppliers is also important.

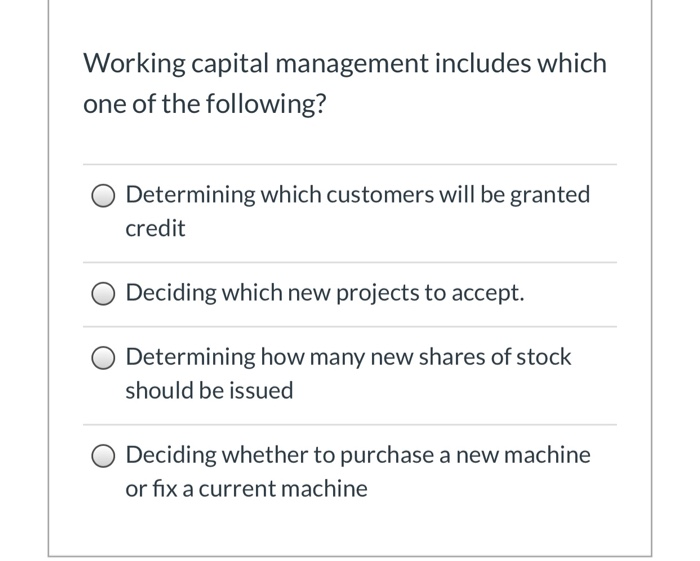

What is NOT Typically Included

While working capital management is comprehensive, it's important to note what it typically *doesn't* include. For instance, management of long-term assets like property, plant, and equipment (PP&E) falls outside its scope.

Similarly, long-term liabilities such as bonds payable or deferred tax liabilities are not considered part of working capital management. These items are addressed within broader financial management strategies.

The Significance of Effective Management

Effective working capital management has a profound impact on a company's profitability and stability. By optimizing cash flow and minimizing the risk of financial distress, businesses can invest in growth opportunities and create shareholder value.

Poor working capital management can lead to cash shortages, missed opportunities, and even bankruptcy. A healthy working capital position allows a company to navigate economic downturns and capitalize on emerging trends.

According to a report by Deloitte, companies with strong working capital management practices consistently outperform their peers. This highlights the strategic importance of prioritizing this area of financial management.

Conclusion

In conclusion, working capital management primarily includes the management of cash, accounts receivable, inventory, and accounts payable. These components are essential for maintaining liquidity and ensuring the smooth operation of a business.

By focusing on these core elements, companies can optimize their short-term assets and liabilities, thereby enhancing their financial performance and resilience. Ultimately, effective working capital management is a cornerstone of sustainable business success.

:max_bytes(150000):strip_icc()/workingcapital.asp-Final-7145e98d92d446938fa2123de0f36220.png)

:max_bytes(150000):strip_icc()/workingcapitalmanagement_definition_0914-38bc0aea642a4a589c26fbc69ea16564.jpg)

:max_bytes(150000):strip_icc()/WORKING-CAPITAL-FINAL-a6e7622f373e4210bd6d9eace32bdc82.png)