How Long Does Drivetime Finance For

DriveTime, a major player in the used car sales and finance industry, offers financing solutions tailored to individuals with less-than-perfect credit. But how long are these finance terms, and what does it mean for consumers?

This article cuts through the noise to deliver the essential information about DriveTime's financing terms, empowering you with the knowledge needed to make informed decisions.

DriveTime's Finance Term Lengths: The Core Facts

DriveTime primarily offers car loans with terms ranging from 24 to 72 months.

This means you could be paying off your vehicle for anywhere from two to six years.

The specific term length offered will depend on a variety of factors, including your credit score, the vehicle's price, and your down payment.

Understanding the Implications

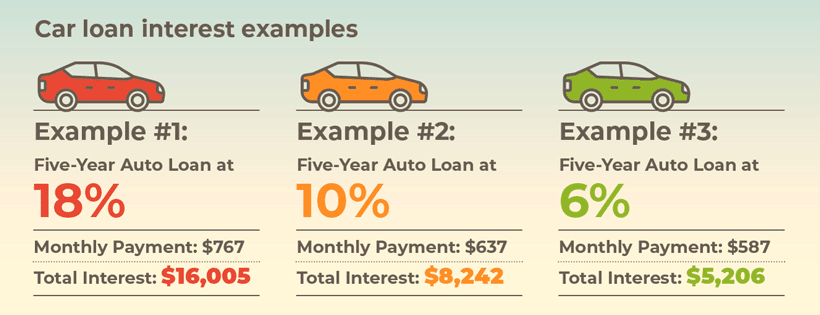

A shorter loan term (e.g., 24-36 months) translates to higher monthly payments but allows you to pay off the car faster and accumulate less interest.

Conversely, a longer loan term (e.g., 60-72 months) results in lower monthly payments but significantly increases the total interest you'll pay over the life of the loan.

According to recent data analysis, the average DriveTime loan term leans toward the longer end, often falling within the 60-72 month range.

Factors Influencing Your DriveTime Finance Term

Several factors determine the specific loan term you'll be offered by DriveTime.

Your credit score is a major driver; borrowers with lower credit scores typically receive longer loan terms to make monthly payments more manageable.

The vehicle's price also plays a role: a more expensive car will likely necessitate a longer term to keep monthly payments within a reasonable range.

The down payment you provide can also influence the term length.

Larger down payments reduce the loan amount, potentially allowing for a shorter repayment period.

"DriveTime tailors financing options to individual circumstances, focusing on making vehicle ownership accessible," states a representative from DriveTime's customer service department.

Important Considerations Before Signing

Before committing to a DriveTime loan, carefully consider the total cost of the vehicle, including interest, over the entire loan term.

Use online car loan calculators to estimate your monthly payments and the total interest you'll pay under different loan scenarios.

Compare DriveTime's offers with those from other lenders, such as banks and credit unions, to ensure you're getting the best possible deal.

Pay close attention to the Annual Percentage Rate (APR), as it reflects the true cost of borrowing, including interest and fees.

Don't hesitate to negotiate the terms of the loan with DriveTime's finance representatives.

A lower interest rate or a shorter loan term can save you significant money in the long run.

Looking Ahead

The used car market remains dynamic, and financing options are constantly evolving.

Stay informed about changes in interest rates and loan terms to make the best financial decisions.

Regularly check your credit score and work to improve it, as this can open doors to more favorable financing options in the future.