Which Of These Factors Would An Insurer Consider

The sting of a denied insurance claim. It's a scenario dreaded by homeowners, drivers, and anyone relying on the safety net promised by their insurance policies. But behind the seemingly simple transaction of paying premiums and expecting coverage lies a complex web of considerations that determine whether an insurer approves or rejects a claim.

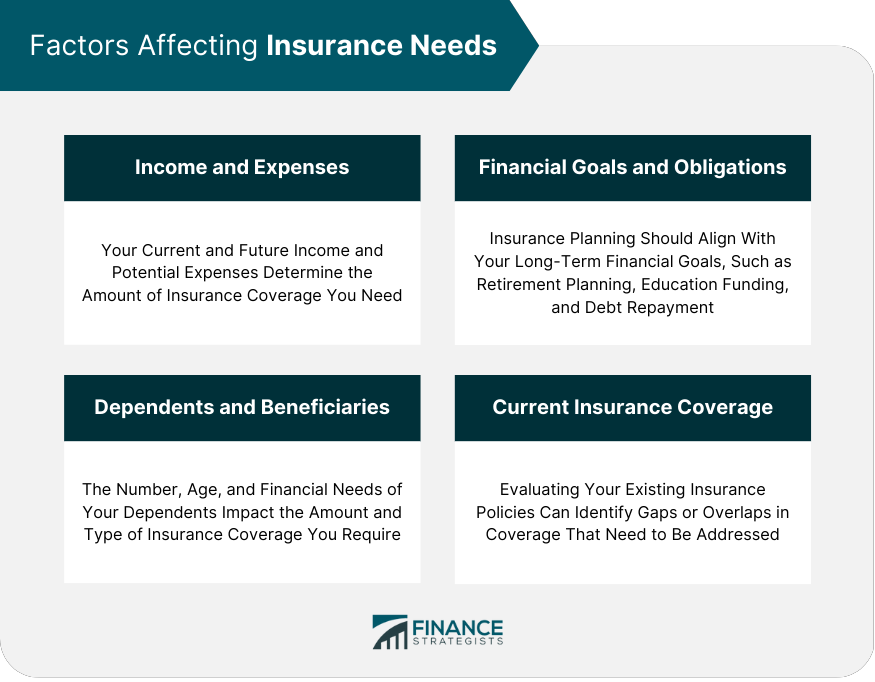

Understanding these factors is crucial. It empowers consumers to make informed decisions about their insurance needs and navigate the claims process effectively, avoiding potential pitfalls. What are the key determinants that shape an insurer's decision-making process? This article delves into the myriad factors insurers weigh, examining how they assess risk, evaluate claims, and ultimately decide whether to provide coverage.

Risk Assessment: The Foundation of Insurance Decisions

At the heart of every insurance decision lies risk assessment. Insurers are in the business of managing risk, and they meticulously evaluate the likelihood and potential cost of a claim before offering coverage and setting premiums.

Several factors contribute to this assessment, varying depending on the type of insurance. For instance, in auto insurance, a driver's history is paramount.

Driving Record and Demographics

A clean driving record with no accidents or traffic violations is a major plus. Insurers statistically correlate past driving behavior with future risk.

Younger drivers, particularly males, often face higher premiums due to statistically higher accident rates, although this practice is increasingly scrutinized for potential bias.

Location also plays a role. Insurers consider factors like population density, traffic patterns, and crime rates in a given area to estimate the likelihood of accidents or theft.

Property Characteristics and Location (Homeowners Insurance)

For homeowners insurance, the characteristics of the property itself are crucial. The age and condition of the home, the type of construction materials used, and the presence of safety features like smoke detectors and alarm systems all influence the perceived risk.

Location is equally important. Homes in areas prone to natural disasters like hurricanes, floods, or wildfires will face higher premiums or even difficulty obtaining coverage.

Insurers utilize sophisticated mapping technologies and historical data to assess the risk associated with specific locations.

Claims Evaluation: Scrutinizing the Incident

Once a claim is filed, the insurer initiates a thorough evaluation process. This involves gathering information, investigating the incident, and determining whether the claim is valid and covered under the policy terms.

The policy language is paramount in this stage. Insurers will meticulously examine the policy's definitions, exclusions, and conditions to determine whether the claimed event falls within the scope of coverage.

Policy Coverage and Exclusions

Understanding your policy's coverage is crucial. Policies specify covered perils (e.g., fire, theft, windstorm) and often include specific exclusions.

For example, flood damage is typically excluded from standard homeowners insurance policies and requires separate flood insurance.

Similarly, wear and tear or gradual deterioration are often excluded, emphasizing the importance of regular maintenance.

The Claims Investigation Process

Insurers typically conduct a thorough investigation to verify the details of the claim. This may involve gathering police reports, interviewing witnesses, and inspecting the damaged property.

For larger claims, insurers often hire independent adjusters to assess the damages and provide an objective estimate of the loss.

The claimant's cooperation and provision of accurate information are essential throughout this process. Any inconsistencies or misrepresentations can raise red flags and potentially lead to claim denial.

Pre-existing Conditions and Fraud

Insurers are vigilant about detecting pre-existing conditions that were not disclosed during the application process. Failure to disclose material facts can invalidate the policy.

Furthermore, insurers actively investigate suspected cases of insurance fraud. False claims or inflated damages can result in legal consequences.

Sophisticated data analytics and fraud detection technologies are increasingly used to identify suspicious patterns and potential fraudulent activity.

Other Influential Factors

Beyond risk assessment and claims evaluation, other factors can influence insurance decisions. These include the insurer's financial stability, regulatory requirements, and the overall economic climate.

An insurer's financial strength is a crucial indicator of its ability to pay out claims. Reputable insurers maintain adequate reserves to cover potential losses. Consumers can check an insurer's financial rating with independent rating agencies like A.M. Best or Standard & Poor's.

Government regulations play a significant role in shaping insurance practices. State insurance departments oversee the industry and enforce consumer protection laws, ensuring fair treatment of policyholders.

Looking Ahead: The Future of Insurance Decisions

The insurance industry is constantly evolving, driven by technological advancements and changing societal needs. The increasing availability of data and the rise of artificial intelligence are transforming risk assessment and claims processing.

Insurers are leveraging data analytics to gain deeper insights into risk factors and personalize insurance offerings. Telematics devices in vehicles, for example, can track driving behavior in real-time, allowing insurers to offer discounts to safe drivers.

The future of insurance will likely involve more personalized and data-driven risk assessments, faster and more efficient claims processing, and a greater emphasis on preventative measures to mitigate risks. By understanding the factors that influence insurance decisions, consumers can better navigate this complex landscape and secure the coverage they need.

:max_bytes(150000):strip_icc()/7-factors-affect-your-life-insurance-quote.asp_V2-ba373e2794d94d97abd3e15cc60bed4e.png)