Sales Tax On Jewelry In Nj

Jewelry buyers in New Jersey, brace yourselves. A significant change to the state's sales tax policy is about to impact your next purchase of diamonds, gold, and other precious items.

This shift could mean higher prices for consumers and potential challenges for jewelry retailers across the state. Here's what you need to know immediately about the new sales tax regulations affecting jewelry in New Jersey.

The New Sales Tax Rule: What Changed?

Effective [Insert Effective Date - Search for Actual Effective Date], New Jersey has eliminated the sales tax exemption on certain types of jewelry. Previously, certain jewelry items, particularly those considered *investment-grade* or exceeding a specific price threshold, were exempt from the state's sales tax.

This exemption has now been rescinded, meaning virtually all jewelry purchases are now subject to New Jersey's standard sales tax rate.

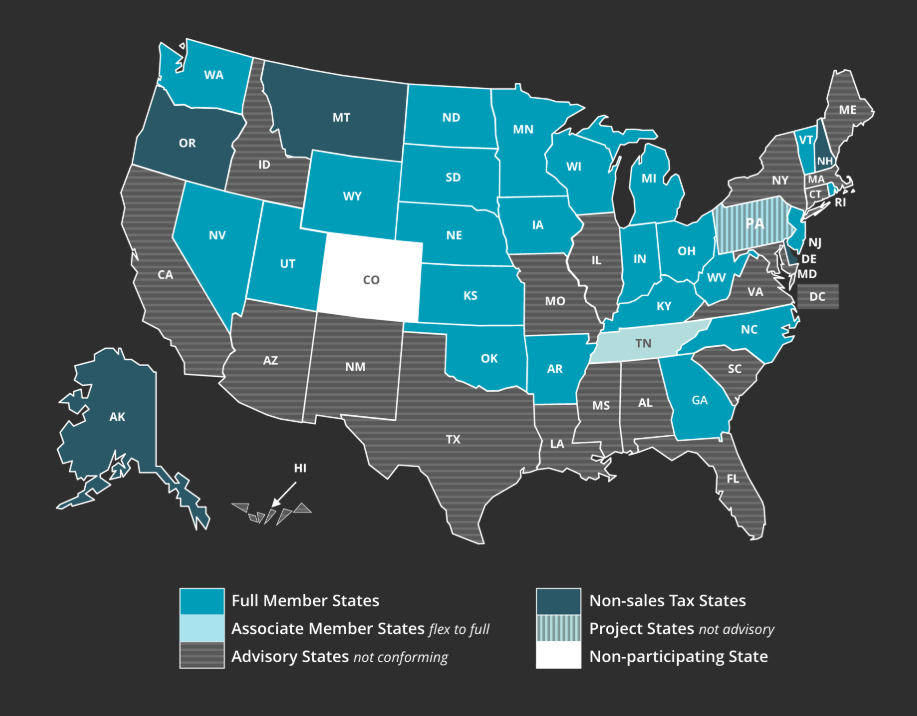

This change impacts both brick-and-mortar stores and online retailers selling jewelry to New Jersey residents.

Who is Affected?

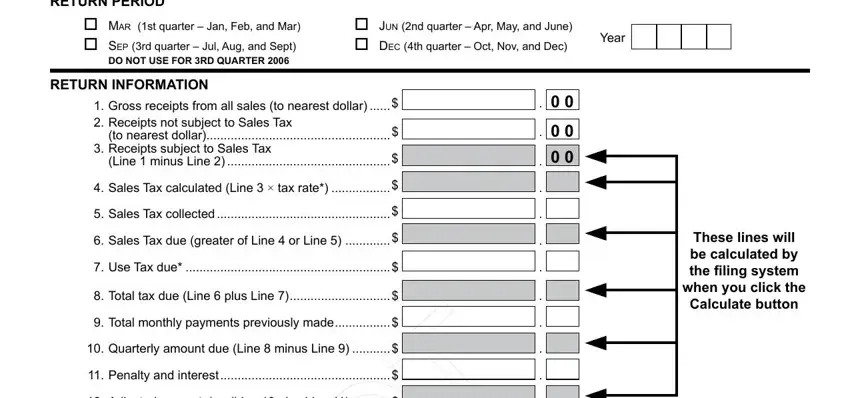

This change directly impacts consumers purchasing jewelry in New Jersey, regardless of the price point. It also affects jewelry retailers operating within the state, who must now collect and remit sales tax on all applicable jewelry sales.

The change will affect both large chain stores and independent jewelers. Online retailers shipping to New Jersey addresses will also be required to comply.

Essentially, if you're buying jewelry in New Jersey, expect to pay sales tax.

Where and When Does This Take Effect?

The new sales tax rule applies to all jewelry sales made in New Jersey. It affects every city and town across the state.

The implementation date is [Insert Effective Date - Search for Actual Effective Date]. Any purchase made on or after this date is subject to the sales tax.

Make sure you are prepared for the extra charge when making your purchase.

How Will This Impact Jewelry Prices?

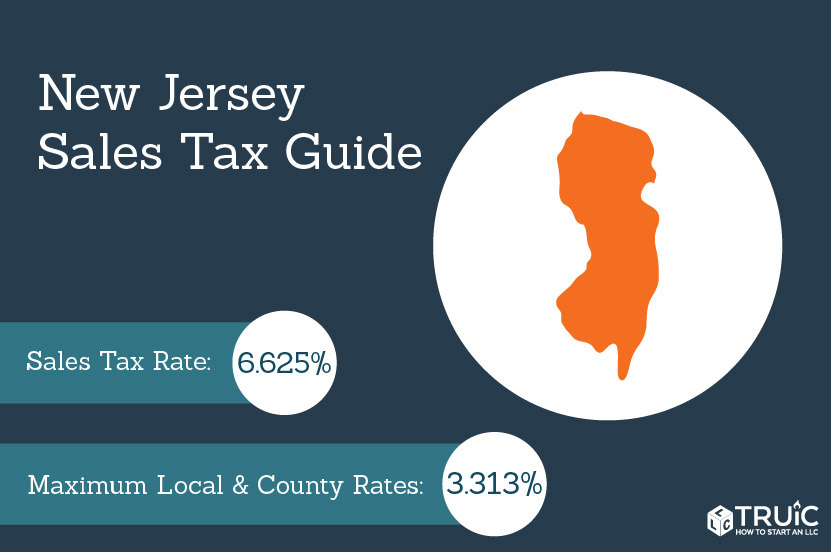

The most immediate impact will be an increase in the final price of jewelry. New Jersey's sales tax rate is [Insert New Jersey Sales Tax Rate - Search for Actual Sales Tax Rate].

This percentage will be added to the price of the jewelry item at the point of sale. For example, a $1,000 ring will now cost $[1000 + (1000 * Sales Tax Rate)] including tax.

Consumers should factor this additional cost into their budget when planning jewelry purchases.

Retailer Concerns and Adaptations

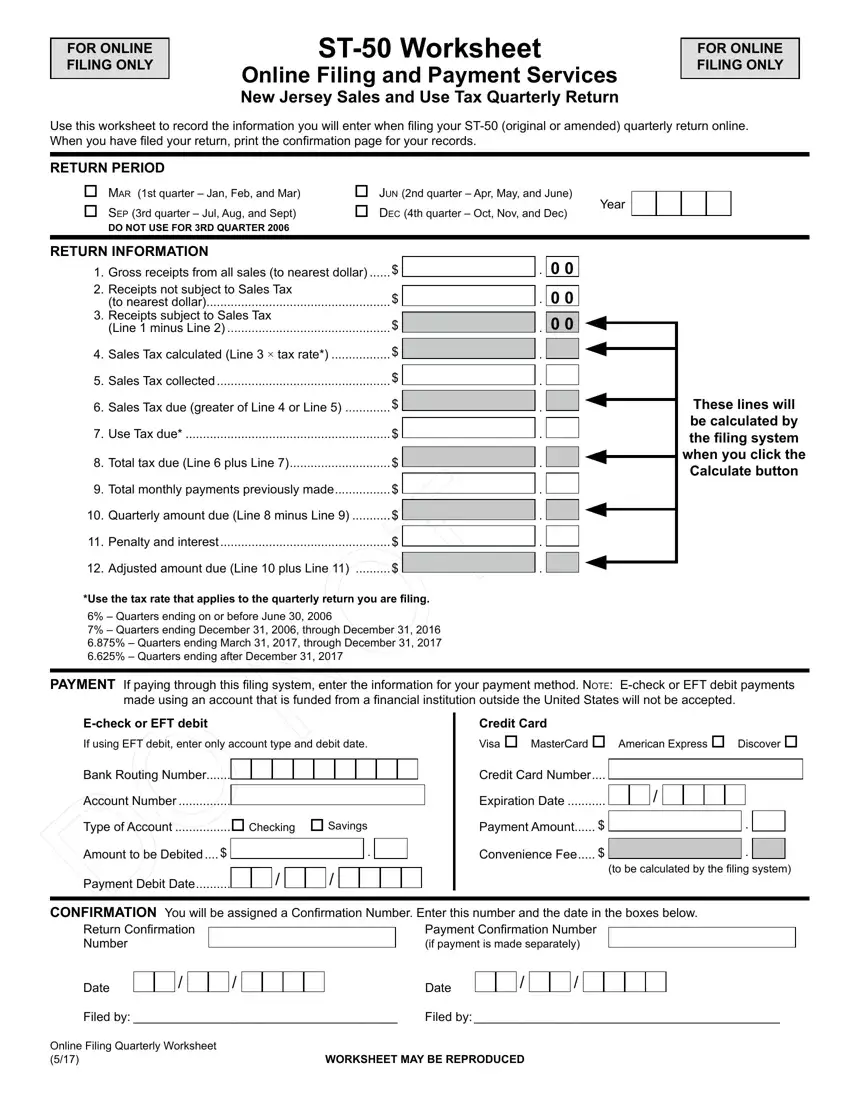

Jewelry retailers are grappling with the operational changes needed to comply with the new regulations. They must update their point-of-sale systems.

They must train employees on the new tax rules, and communicate the changes to their customer base. Some retailers fear a potential decrease in sales.

They worry that consumers may opt to purchase jewelry in neighboring states with different tax policies.

Expert Commentary

"This change will undoubtedly affect consumer behavior," says *[Insert Name of Tax Expert/Financial Analyst - Search for Relevant Expert]* from *[Insert Organization of Expert]*. "Consumers should shop smarter and be prepared for the additional cost. Retailers will have to work hard to retain customers and justify the price increase."

Potential Loopholes and Grey Areas

While the intent of the new rule is to apply sales tax to all jewelry sales, some potential loopholes may exist. For instance, repairs to existing jewelry may still be exempt.

It is also unclear how the rule will be applied to customized jewelry designs where materials are sourced separately. Further clarification from the New Jersey Division of Taxation is anticipated.

Seek professional guidance on specific circumstances to ensure compliance.

What's Next?

The New Jersey Division of Taxation is expected to release updated guidance and FAQs to address concerns and clarify the new regulations. Retailers should actively monitor these updates.

Consumers should stay informed about their rights and responsibilities. Consider consulting with a financial advisor about the impact on their purchasing power.

The impact of this tax change will be closely monitored by the industry in the coming months. Stay tuned for further updates as they develop.