Sales Tax Rate In Philadelphia Pa

Philadelphia residents and visitors alike are well-acquainted with the city's sales tax, a key component of the local economy. The current sales tax rate in Philadelphia stands at 8%, a figure that significantly impacts purchasing decisions and revenue generation for the city.

Understanding the intricacies of this tax, its implications, and how it compares to rates in neighboring areas is crucial for consumers and businesses operating within the city. This article provides a comprehensive overview of Philadelphia's sales tax rate, its composition, and its potential effects on the local economy.

The Makeup of Philadelphia's Sales Tax

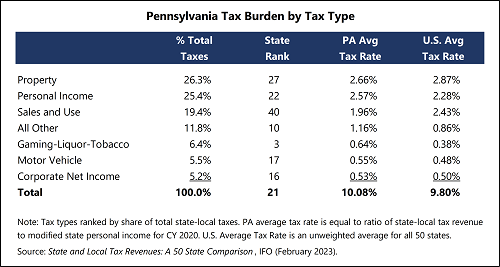

The 8% sales tax in Philadelphia isn't solely allocated to the city's coffers. It's actually a combination of different tax levies, each contributing to various governmental functions.

Of the 8%, 6% goes to the Commonwealth of Pennsylvania. The remaining 2% is specifically designated for Philadelphia's city revenue.

This breakdown is vital in understanding how sales tax dollars are distributed and used to fund state and local services.

What's Taxable?

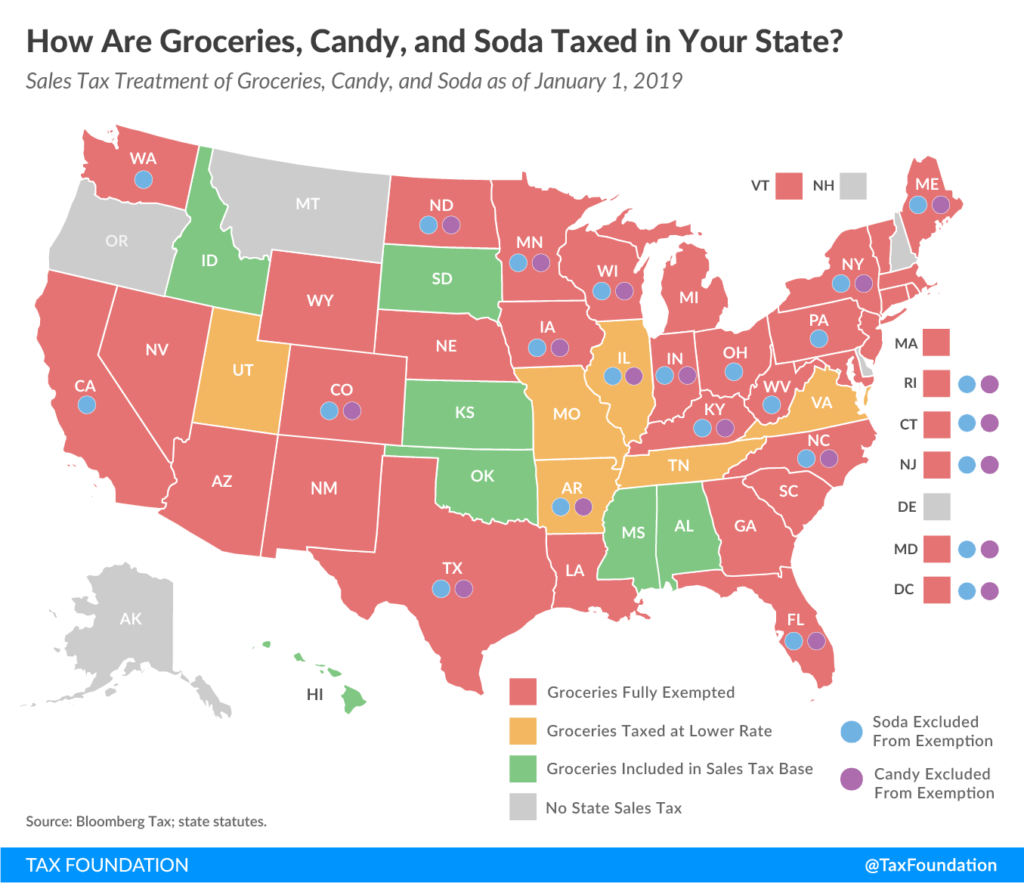

Not all purchases are subject to the 8% sales tax in Philadelphia. Pennsylvania law dictates what goods and services are taxable.

Tangible personal property is generally taxable. This includes items like clothing, electronics, furniture, and most retail goods.

However, there are several exemptions. Unprepared food, prescription drugs, and clothing are generally exempt from sales tax in Pennsylvania.

Services are a bit more nuanced. Some services are taxable, while others are not. For example, dry cleaning services are taxable, but medical services are not.

Navigating the Tax Code

Understanding the nuances of what is and isn't taxable can be complex. The Pennsylvania Department of Revenue provides detailed guidance on its website.

Businesses are responsible for collecting and remitting sales tax, so they need a thorough understanding of these regulations. Consumers can also benefit from knowing their rights and responsibilities regarding sales tax.

Consulting the Department of Revenue's website or seeking professional tax advice is recommended for clarification on specific situations.

Comparing Philadelphia's Rate

Philadelphia's 8% sales tax rate is notably higher than the standard Pennsylvania sales tax rate of 6%. This difference is due to the additional 2% levied by the city.

The higher rate is often a point of discussion, particularly when compared to neighboring counties and states with lower rates. For example, counties surrounding Philadelphia typically only have the 6% PA sales tax.

This can influence consumer behavior, as some residents may choose to make larger purchases outside of Philadelphia to avoid the higher tax burden.

Impact on Consumers and Businesses

The sales tax has a direct impact on both consumers and businesses operating in Philadelphia. For consumers, it increases the cost of goods and services, potentially affecting their purchasing power.

For businesses, the sales tax adds administrative burdens related to collection, reporting, and remittance. Some businesses, particularly those located close to county lines, may experience competitive disadvantages due to the higher tax rate.

The impact is felt differently across various income levels. Lower-income households may be disproportionately affected by sales taxes, as they spend a larger portion of their income on taxable goods.

How the Revenue is Used

The revenue generated from Philadelphia's sales tax plays a vital role in funding essential city services. This includes public safety, infrastructure, and education.

The city's budget relies heavily on sales tax revenue to maintain these services. The Philadelphia City Council is responsible for allocating these funds.

Transparency in how sales tax revenue is used is crucial for maintaining public trust and ensuring accountability.

Recent Developments and Future Outlook

There are always discussions and debates surrounding sales tax policies. Proposals to modify the rate, expand exemptions, or change the allocation of revenue are common.

The Philadelphia Inquirer and other local news outlets often report on these discussions, providing insights into potential changes.

Keeping informed about these developments is essential for understanding the future trajectory of sales tax in Philadelphia and its impact on the community.

A Human Perspective

For Maria Sanchez, a single mother raising two children in North Philadelphia, every penny counts. The 8% sales tax adds a noticeable burden to her already stretched budget.

"It's hard enough to afford groceries and clothes for my kids," she says. "The sales tax just makes everything that much more difficult."

Maria's story highlights the real-world impact of sales tax on individuals and families, particularly those with limited financial resources.

.png)