Turbo Tax Business Vs Home And Business

Imagine you're sitting at your kitchen table, surrounded by a sea of receipts, a half-empty mug of coffee, and the daunting prospect of filing your business taxes. The sun streams in, highlighting the complexity of the forms. You're trying to decide which tax software is the right fit: TurboTax Business or TurboTax Home & Business? It’s a common dilemma faced by countless small business owners every year.

Choosing between TurboTax Business and TurboTax Home & Business hinges on understanding the structure of your business. This decision can significantly impact your tax preparation experience, ensuring accuracy and potentially maximizing deductions. Knowing the nuances of each platform is key to a smooth and efficient filing process.

Understanding the Core Differences

TurboTax Home & Business is designed for sole proprietors, freelancers, and single-member LLCs who report business income and expenses on Schedule C of their personal income tax return. It combines personal and business tax filing into one convenient platform.

TurboTax Business, on the other hand, caters to corporations (C-corps and S-corps), partnerships, and multi-member LLCs. It handles the complexities of filing business tax returns separately from personal returns.

Who Should Use TurboTax Home & Business?

This version is ideal for those whose business is closely tied to their personal finances. If you operate as a freelancer, consultant, or independent contractor and report your income on Schedule C, Home & Business provides the tools and guidance you need. It simplifies the process of integrating business income and deductions with your personal tax situation.

The software walks you through common self-employment tax scenarios. This helps you identify deductible expenses like home office deductions, business travel, and supplies.

Who Needs TurboTax Business?

If your business operates as a corporation or partnership, TurboTax Business is the appropriate choice. These business structures require filing separate tax returns (Form 1120 for C-corps, Form 1120-S for S-corps, and Form 1065 for partnerships).

TurboTax Business provides specialized features for these complex tax filings. It helps navigate corporate tax laws, partnership allocations, and shareholder distributions.

Key Features and Benefits

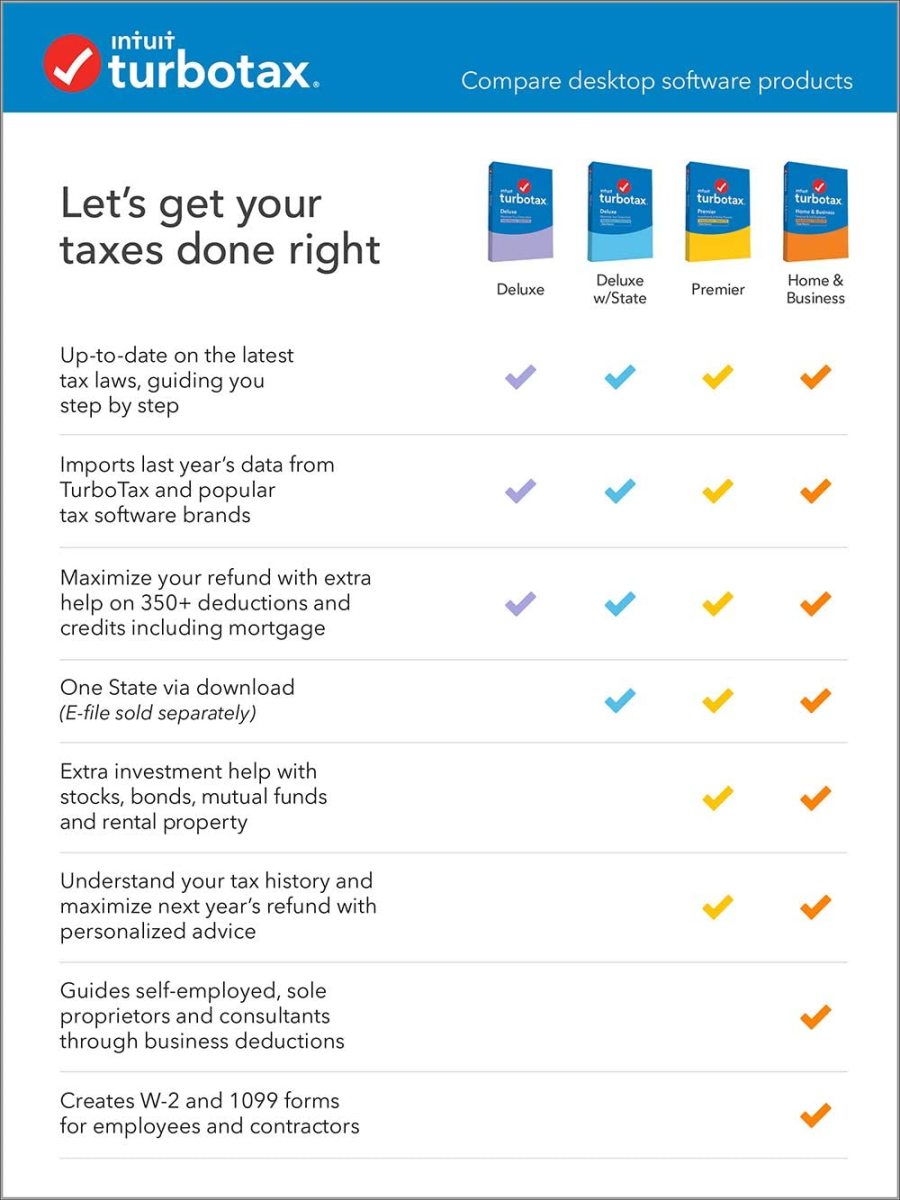

Both versions offer features like expense tracking, deduction finders, and audit support. Intuit, the maker of TurboTax, provides regular updates to reflect the latest tax laws and regulations.

TurboTax Home & Business excels at simplifying self-employment taxes. It provides a user-friendly interface for entering income and expenses, along with helpful tips and explanations.

TurboTax Business offers robust tools for managing more complex business tax situations. These include features for calculating depreciation, handling inventory, and reporting various types of business income and expenses.

Making the Right Choice

Ultimately, the best choice depends on your specific business structure and tax filing requirements. Consider the complexity of your business finances and whether you need to file a separate business tax return.

If you're a sole proprietor or single-member LLC, TurboTax Home & Business is likely the right fit. For corporations or partnerships, TurboTax Business is the better option.

According to the IRS, choosing the correct tax software is crucial for accurate filing and avoiding potential penalties. Take the time to assess your business needs and select the software that best aligns with your situation.

Beyond the Software: Seeking Professional Advice

While tax software can simplify the filing process, it's not a substitute for professional advice. If you have complex tax situations or are unsure about certain deductions or credits, consult a tax professional.

A certified public accountant (CPA) or enrolled agent can provide personalized guidance. They can help you navigate intricate tax laws and ensure you're taking advantage of all available deductions.

The Small Business Administration (SBA) offers resources for finding local tax advisors. They can help you make informed decisions about your business taxes.

Choosing between TurboTax Business and Home & Business is a critical first step toward tax compliance. By understanding the distinct capabilities of each platform and seeking professional guidance when needed, you can confidently navigate the tax season and focus on growing your business. Remember, accurate filing is not just about avoiding penalties, it's about laying a solid foundation for your business's financial future.

![Turbo Tax Business Vs Home And Business Turbotax Home Business State 2022 [PC/Mac Download] –, 51% OFF](https://m.media-amazon.com/images/I/71iVlwKXaEL._AC_UF1000,1000_QL80_.jpg)