Sandia Laboratory Federal Credit Union Locations

Imagine stepping into a place where the atmosphere is less about sterile transactions and more about genuine connection. The tellers know your name, the financial advisors understand your goals, and the entire space hums with a feeling of community. This isn't a scene from a bygone era of small-town banking; it's a snapshot of Sandia Laboratory Federal Credit Union (SLFCU) in action.

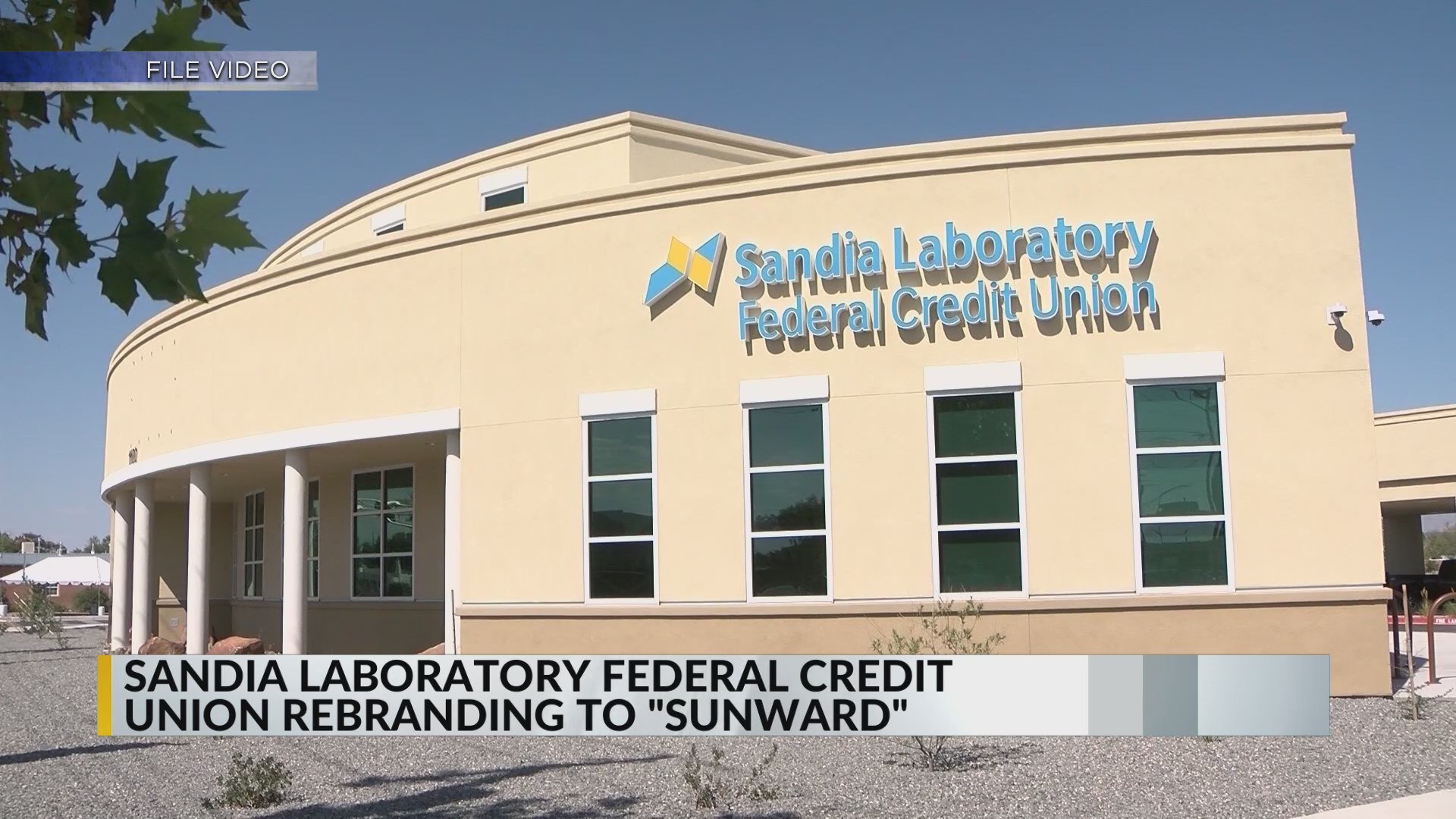

SLFCU's branch locations are more than just brick-and-mortar buildings. They represent a commitment to accessibility and personalized service for their members across New Mexico and beyond.

This article explores the story behind SLFCU's branch network, examining its growth, its role in the community, and its ongoing efforts to meet the evolving needs of its members.

A History Rooted in Service

Founded in 1948, SLFCU began as a resource for employees of Sandia National Laboratories. It was created to provide affordable financial services to a group who might otherwise struggle to find them.

Over the decades, SLFCU has expanded its reach, welcoming members from various fields and communities. But its core values remain unchanged.

That commitment to service continues to drive the credit union's decisions, including where and how to establish its physical presence.

Strategic Expansion: Meeting Members Where They Are

SLFCU's branch locations aren't scattered haphazardly. Each is carefully chosen to serve a specific segment of its membership.

Albuquerque, being the home of Sandia National Laboratories, naturally houses a significant number of branches. This ensures easy access for lab employees and their families.

Beyond Albuquerque, branches can be found in other key New Mexico cities like Rio Rancho and Los Alamos, reflecting the credit union's statewide presence.

Beyond New Mexico

Recognizing the increasingly mobile nature of its membership, SLFCU has also expanded beyond New Mexico. This expansion ensures members can access services even when they are not in their home state.

The location of these out-of-state branches is typically determined by the concentration of members who have relocated or travel frequently.

This strategic approach to expansion demonstrates SLFCU's dedication to serving its members regardless of their geographic location.

More Than Just Transactions: Community Hubs

SLFCU branches are designed to be more than just places to deposit a check or apply for a loan. They are intended to be welcoming community hubs.

Many branches offer educational workshops and seminars on various financial topics, from budgeting and saving to retirement planning.

These events are often free and open to both members and the general public, reinforcing SLFCU's commitment to financial literacy.

Investing in the Community

SLFCU actively participates in local events and initiatives, further solidifying its role as a community partner.

The credit union supports local charities and organizations through sponsorships and volunteer efforts.

This investment in the community reflects SLFCU's belief in giving back and supporting the well-being of the areas it serves.

The Digital Age and the Enduring Value of Physical Branches

In an increasingly digital world, the role of physical bank branches is often questioned. However, SLFCU recognizes the enduring value of having a physical presence.

While online and mobile banking options provide convenience, many members still value the personal interaction and expert advice they can receive at a branch.

Complex financial matters, such as mortgages or retirement planning, often require a face-to-face conversation with a knowledgeable advisor.

Adapting to Changing Needs

SLFCU is constantly adapting its branch locations to meet the evolving needs of its members. This includes incorporating technology to enhance the member experience.

Some branches feature self-service kiosks for quick transactions, while others offer private consultation rooms for more in-depth discussions.

This blend of technology and personal service ensures that SLFCU remains relevant and responsive to the needs of its diverse membership.

A Look Inside: What to Expect at an SLFCU Branch

Walking into an SLFCU branch, you're immediately greeted with a sense of warmth and professionalism. The atmosphere is designed to be inviting and comfortable.

Friendly tellers are ready to assist with routine transactions, while experienced financial advisors are available to provide personalized guidance.

The branches are equipped with the latest technology to ensure efficient and secure transactions.

Accessibility for All

SLFCU is committed to making its branches accessible to all members, regardless of their physical abilities. This includes ensuring that branches are wheelchair-accessible and equipped with assistive listening devices.

The credit union also provides alternative formats for documents and communications, such as large print and Braille.

This commitment to accessibility reflects SLFCU's dedication to serving all members with dignity and respect.

The Future of SLFCU's Branch Network

Looking ahead, SLFCU remains committed to maintaining a strong branch network while continuing to invest in digital channels. This hybrid approach ensures that members have access to the services they need, whenever and wherever they need them.

The credit union will continue to evaluate its branch locations and make adjustments as needed to optimize its network and better serve its membership.

This includes exploring new branch formats and technologies to enhance the member experience.

A Continued Focus on Service

Ultimately, SLFCU's branch network is a reflection of its unwavering commitment to service. The credit union understands that its members are its greatest asset, and it is dedicated to providing them with the best possible financial services.

By maintaining a strong physical presence and investing in its branches, SLFCU is ensuring that it remains a trusted and valued partner for its members for years to come.

SLFCU's story is one of growth, adaptation, and unwavering commitment to its members. Its branch locations stand as tangible symbols of this dedication, offering a blend of personalized service and cutting-edge technology. They are not just buildings; they are community hubs, financial resource centers, and a testament to the enduring power of the credit union philosophy.