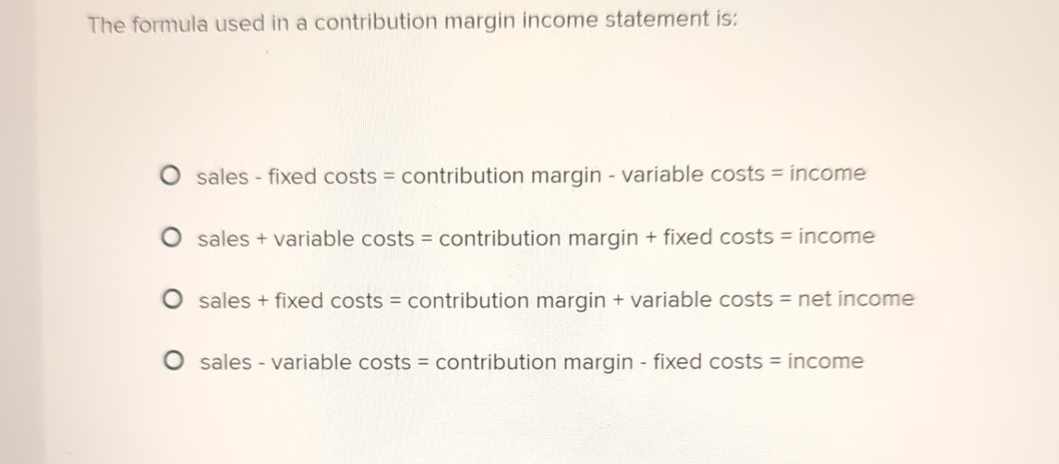

The Formula Used In A Contribution Margin Income Statement Is:

Imagine a small bakery, "Sweet Surrender," bustling with activity on a Saturday morning. The aroma of freshly baked bread and delicate pastries fills the air, drawing customers in with promises of delightful treats. But behind the scenes, beyond the sweet smell of success, lies a crucial calculation that determines whether "Sweet Surrender" is truly thriving: the contribution margin income statement.

This article delves into the heart of financial analysis, exploring the fundamental formula used in a contribution margin income statement. Understanding this formula is paramount for businesses of all sizes, as it provides a clear picture of profitability and aids in making informed decisions about pricing, production, and overall financial health.

Unveiling the Contribution Margin Income Statement

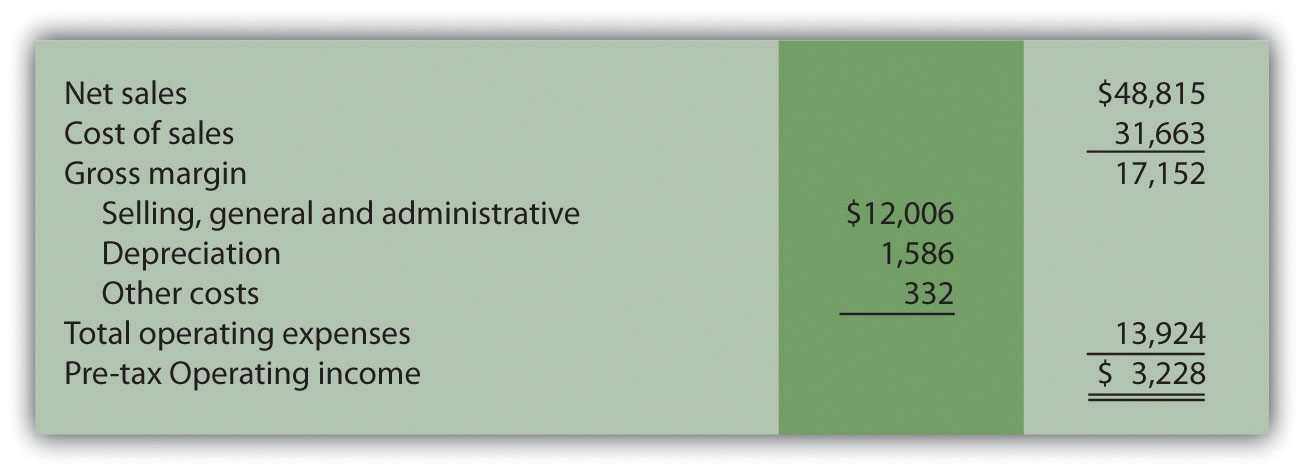

The traditional income statement focuses on gross profit and net income, which are certainly important. However, the contribution margin income statement offers a different perspective, highlighting the relationship between variable costs and revenue. This alternative format is particularly useful for internal decision-making, offering insights that the traditional format might obscure.

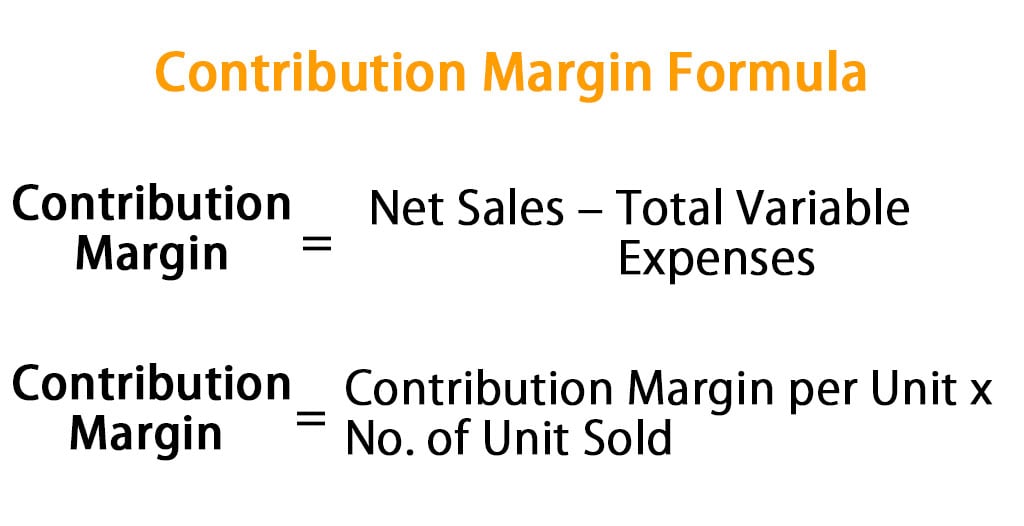

The core formula at the heart of this statement is remarkably simple, yet incredibly powerful: Sales Revenue - Variable Costs = Contribution Margin. This equation forms the bedrock upon which the entire statement is built, providing the foundation for analyzing profitability and making strategic adjustments.

Breaking Down the Formula

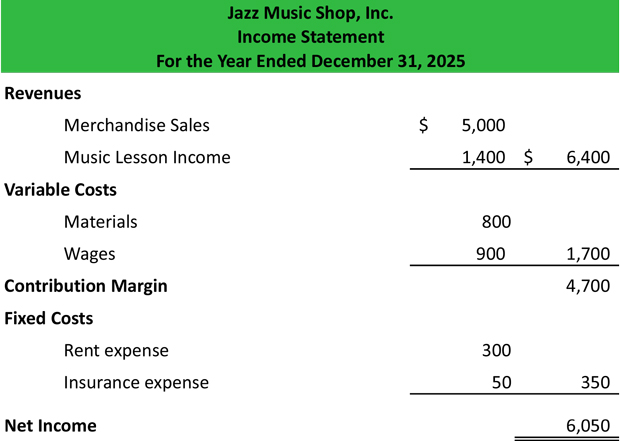

Let's dissect each component of this formula to fully understand its significance. Sales Revenue represents the total income generated from the sale of goods or services. It's the top line, the starting point of any financial analysis.

Variable Costs, on the other hand, are those expenses that fluctuate directly with the level of production or sales. For "Sweet Surrender," this would include the cost of flour, sugar, eggs, and other ingredients, as well as the direct labor involved in baking and decorating.

The Contribution Margin is the crucial result of this calculation. It represents the amount of revenue that contributes towards covering fixed costs and generating profit. It's the money left over after covering those costs that change with the production volume.

The Power of the Contribution Margin

The contribution margin is not just a number; it's a vital indicator of a business's ability to generate profit. A high contribution margin suggests that a significant portion of each sale is available to cover fixed costs and contribute to overall profitability.

A low contribution margin, conversely, raises red flags. It indicates that a large portion of each sale is being consumed by variable costs, leaving less available to cover fixed expenses and potentially impacting the company's bottom line. This allows companies to identify areas to improve.

Using the Statement for Decision-Making

The contribution margin income statement empowers businesses to make more informed decisions. For example, if "Sweet Surrender" wants to introduce a new pastry, they can use this statement to estimate the potential impact on profitability.

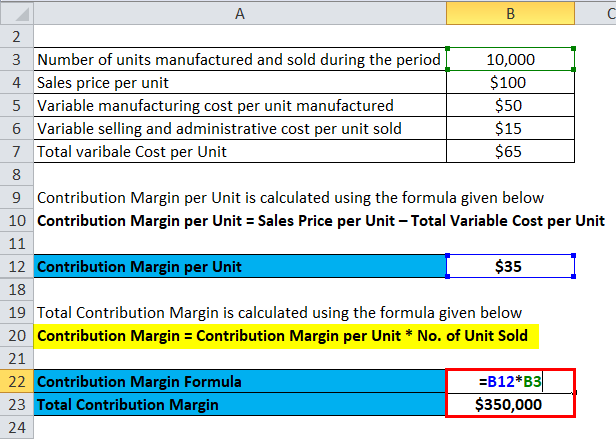

By calculating the variable costs associated with the new pastry and comparing them to the projected sales price, they can determine the contribution margin per unit. This information can then be used to forecast the overall impact on the bakery's profitability.

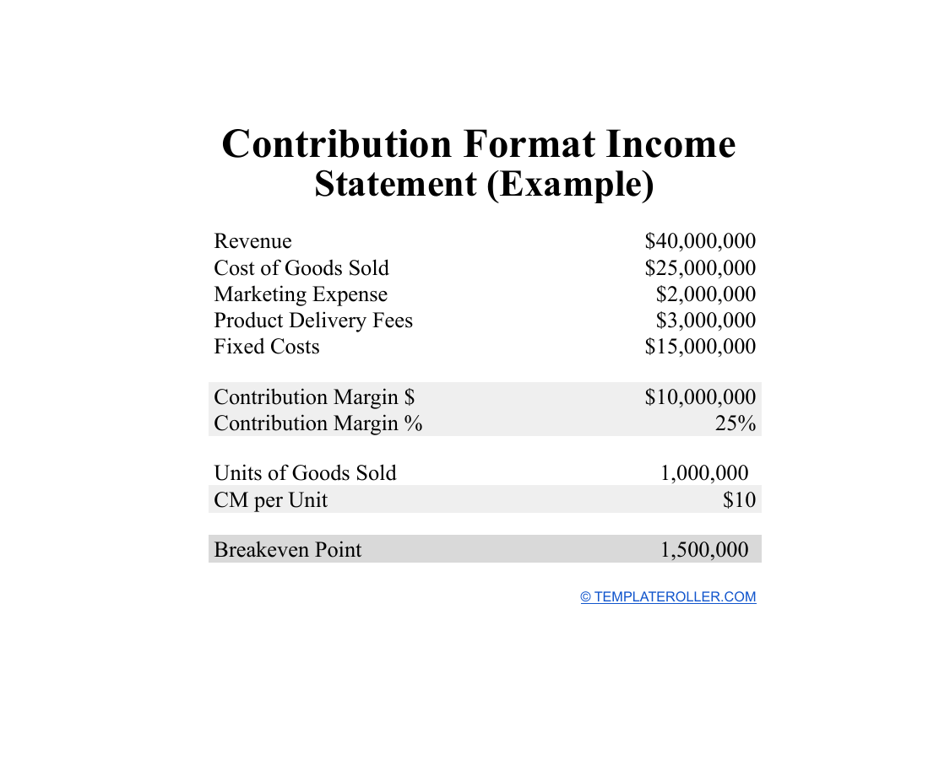

Another key application is break-even analysis. By dividing total fixed costs by the contribution margin per unit, businesses can determine the number of units they need to sell to cover all their costs and reach the break-even point. This helps companies understand how many products they must sell.

Beyond the Basic Formula: A Deeper Dive

While the basic formula (Sales Revenue - Variable Costs = Contribution Margin) is the foundation, the contribution margin income statement typically includes further refinements. This often involves calculating the contribution margin ratio and subtracting fixed costs to arrive at net operating income.

The contribution margin ratio is calculated by dividing the contribution margin by sales revenue. This ratio expresses the contribution margin as a percentage of sales, providing a useful metric for comparing the profitability of different products or services.

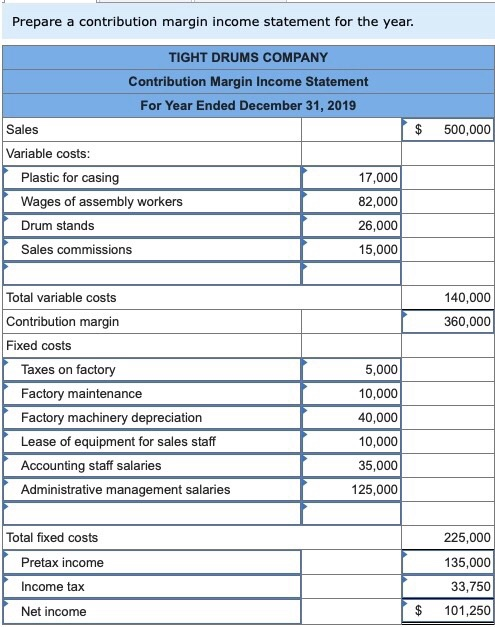

By subtracting total fixed costs from the contribution margin, businesses can arrive at net operating income. This represents the profit earned before interest and taxes, providing a clearer picture of the company's operational performance.

An Example in Action

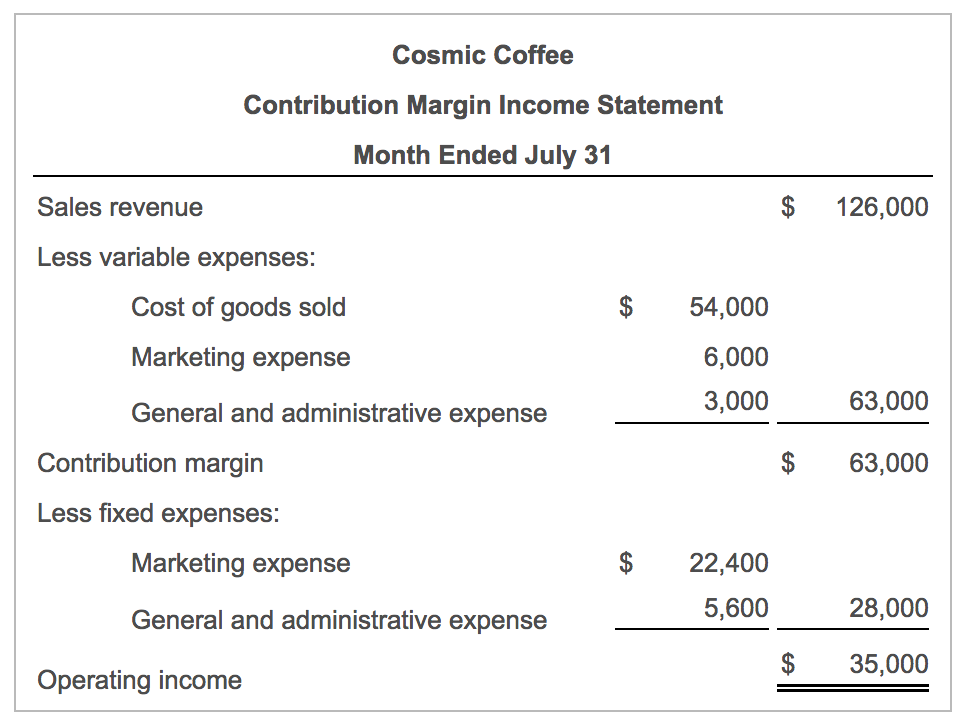

Let’s say "Sweet Surrender" has total sales revenue of $100,000 in a month. Their variable costs, including ingredients and direct labor, amount to $60,000. Applying the formula, we find that their contribution margin is $40,000 ($100,000 - $60,000).

This means that for every dollar of sales, "Sweet Surrender" has 40 cents available to cover fixed costs and contribute to profit. If their fixed costs are $30,000, their net operating income would be $10,000 ($40,000 - $30,000).

This simple example illustrates the power of the contribution margin income statement in revealing the underlying profitability of a business. It's a very useful tool for financial analysis.

The Enduring Significance

In today's dynamic business environment, understanding the contribution margin income statement is more crucial than ever. It provides businesses with the insights they need to make informed decisions, optimize their operations, and achieve sustainable profitability.

Whether it's a small bakery like "Sweet Surrender" or a large multinational corporation, the principles remain the same. By focusing on the relationship between variable costs and revenue, businesses can gain a clearer understanding of their financial performance and chart a course towards success.

The formula Sales Revenue - Variable Costs = Contribution Margin is a cornerstone of managerial accounting. It empowers businesses to navigate the complexities of the modern marketplace with confidence and clarity. It is a simple yet powerful tool.