1099 Misc Due Date To Recipient

Urgent Reminder: The deadline to furnish 2023 Form 1099-MISC to recipients is rapidly approaching. Businesses and individuals must ensure timely delivery to avoid potential penalties.

This article provides crucial information on the upcoming due date for distributing Form 1099-MISC to recipients, outlining the requirements and emphasizing the importance of compliance.

Key Deadline: January 31st

The IRS mandates that Form 1099-MISC be furnished to recipients by January 31st. This applies to payments made in 2023 for specific types of income.

This deadline is crucial for ensuring recipients can accurately report their income on their tax returns.

Who Needs to File?

Businesses and individuals who made certain types of payments throughout 2023 are required to file Form 1099-MISC. These payments typically include:

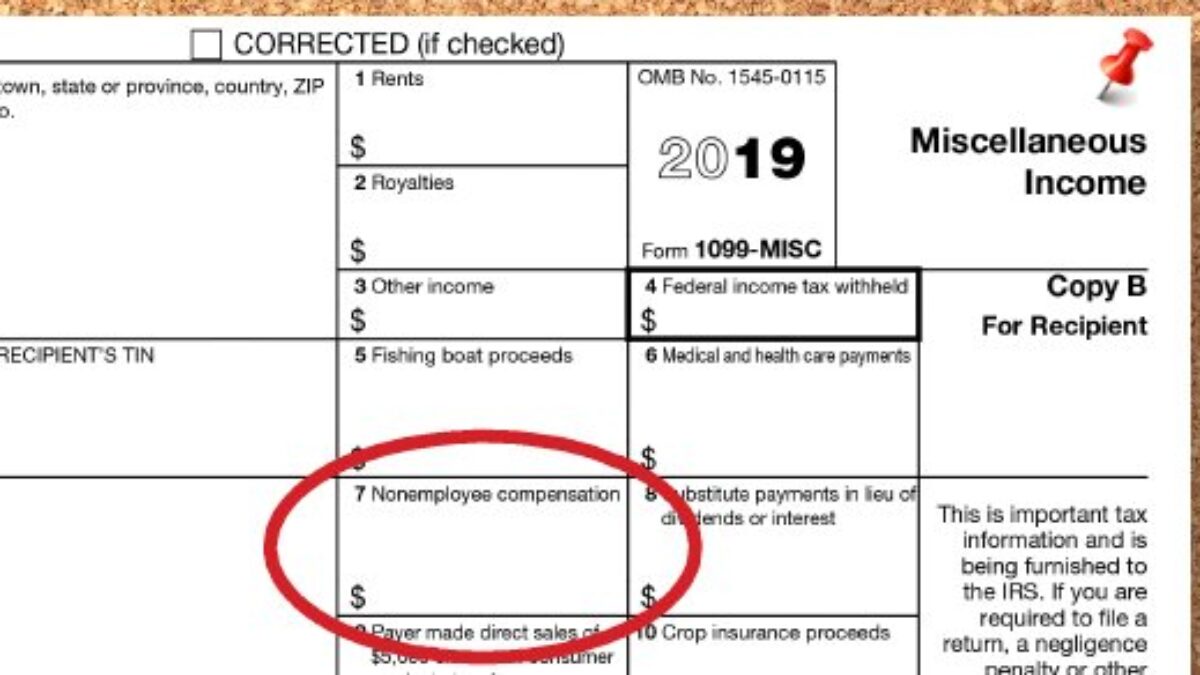

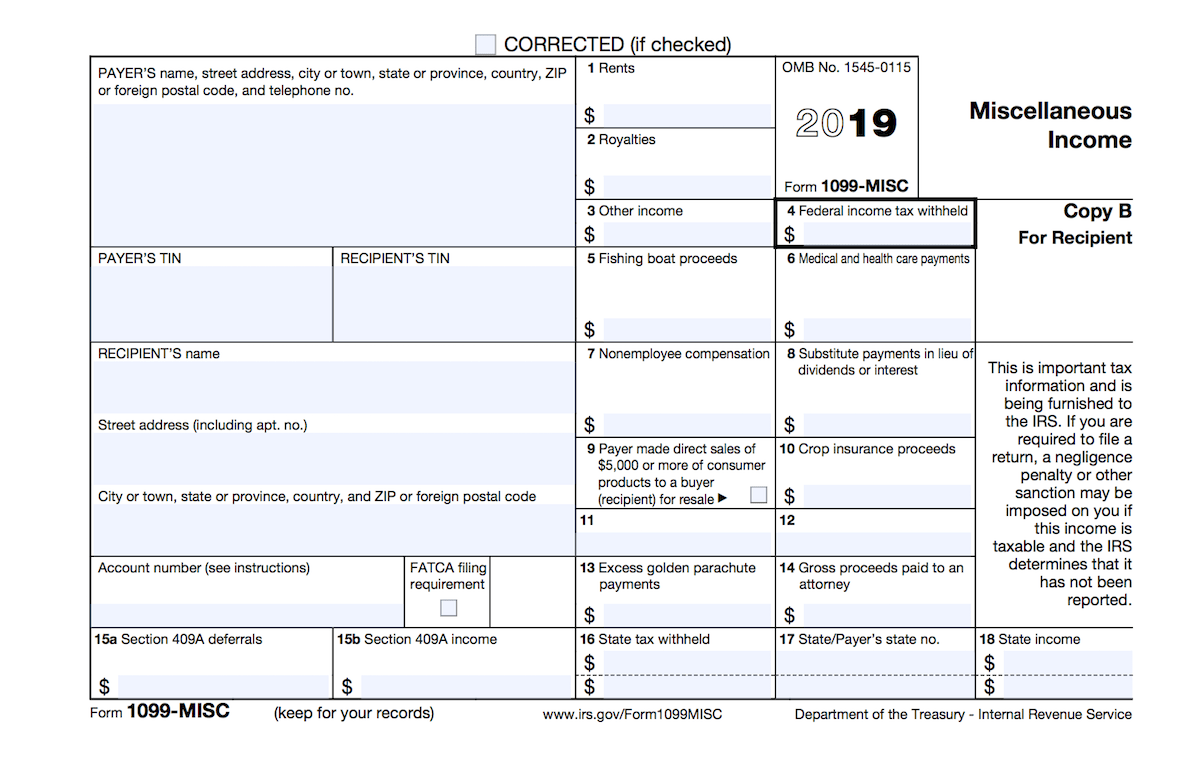

- Rents

- Royalties

- Other income payments

- Fishing boat proceeds

Specifically, you're likely required to file if you paid someone who is not your employee at least $600 in rent, services, prizes, awards, or other income payments.

There are exceptions, such as payments to corporations in many cases. Always check the IRS guidelines for specific requirements.

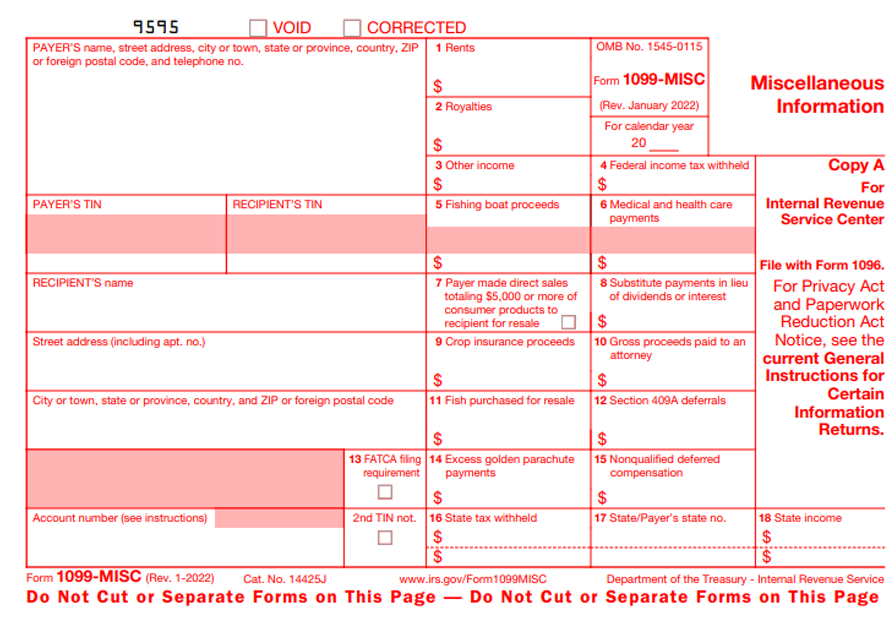

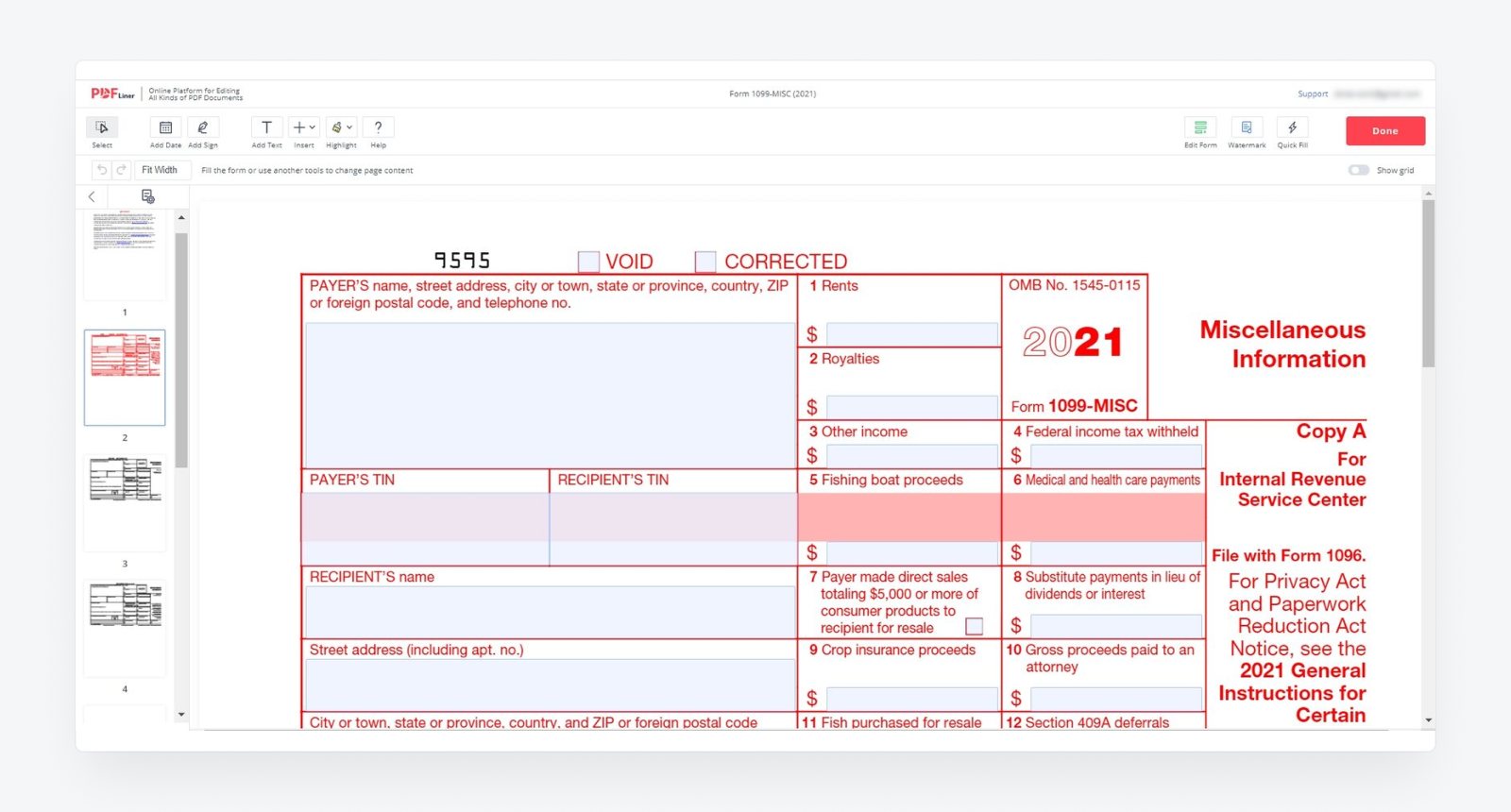

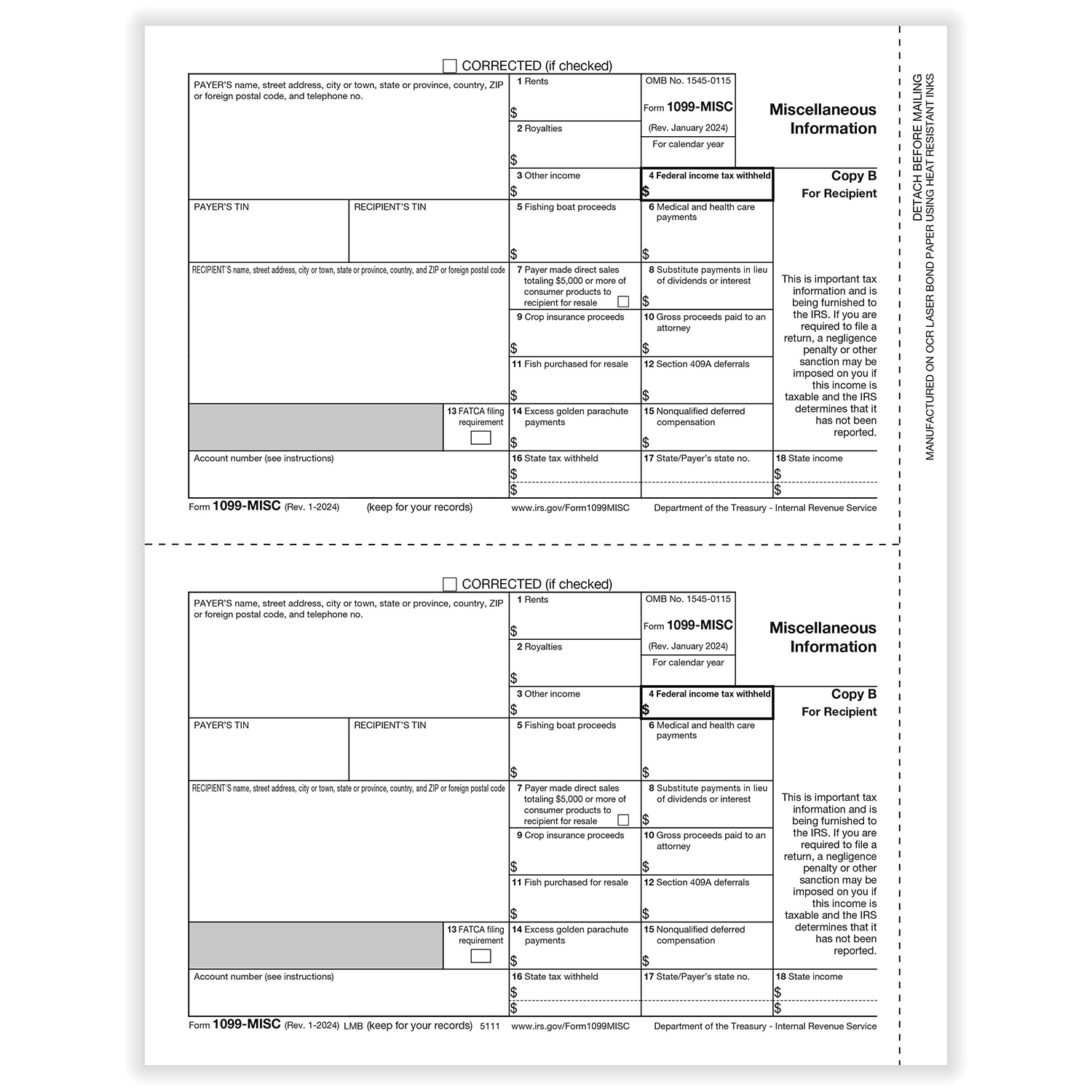

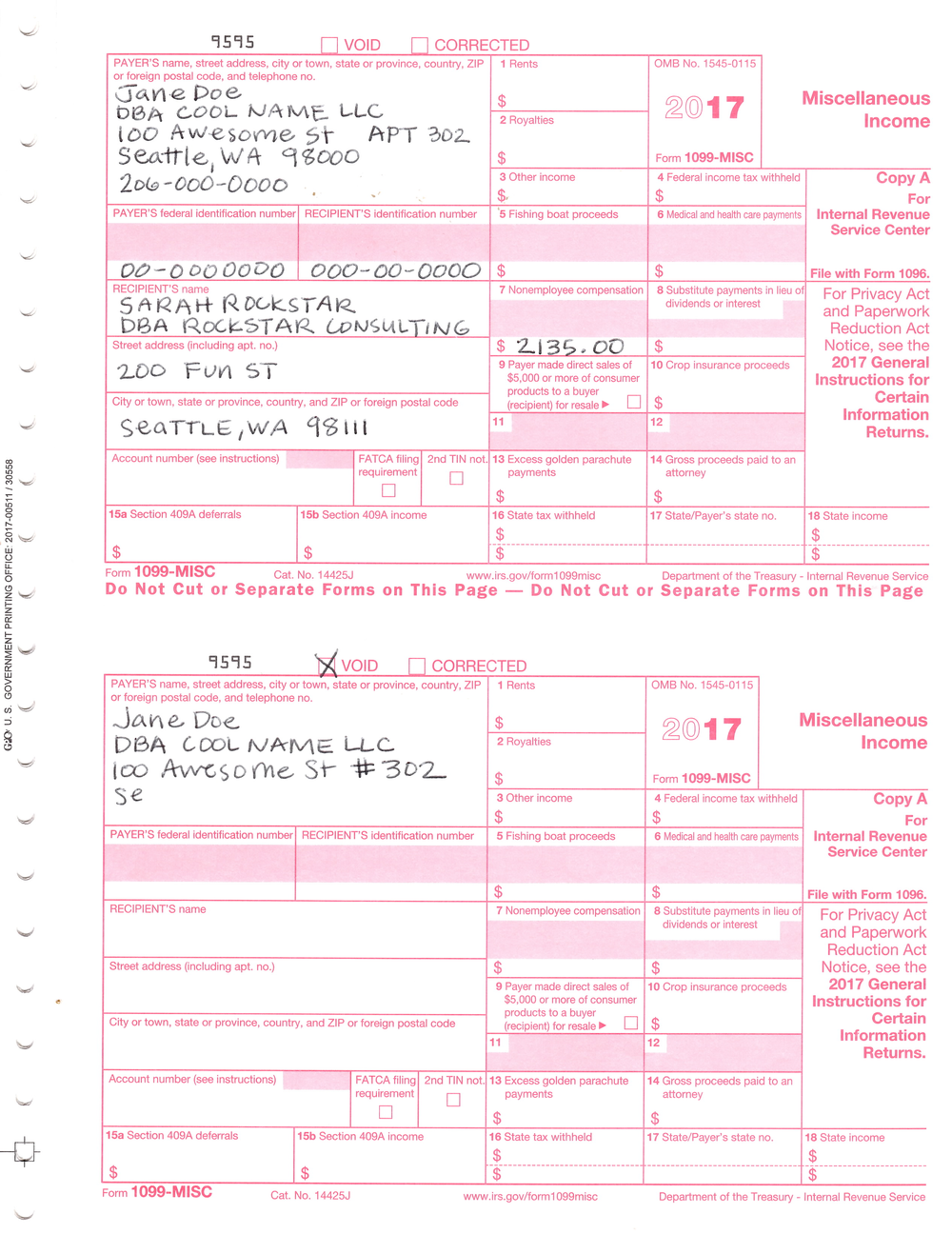

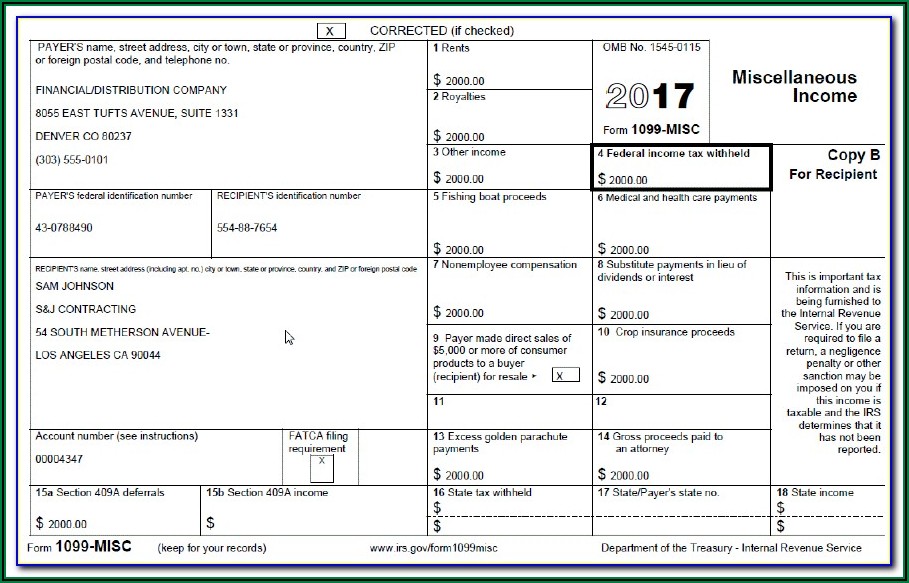

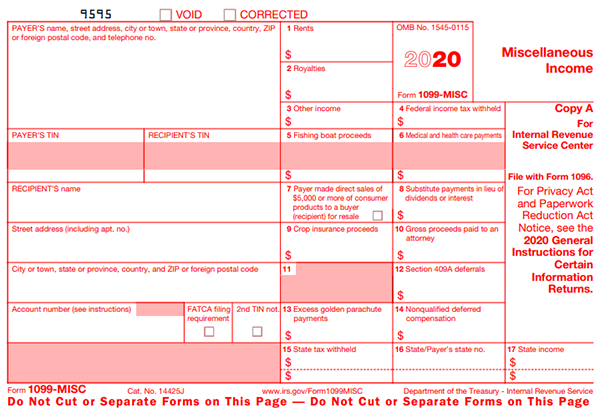

What Information is Required?

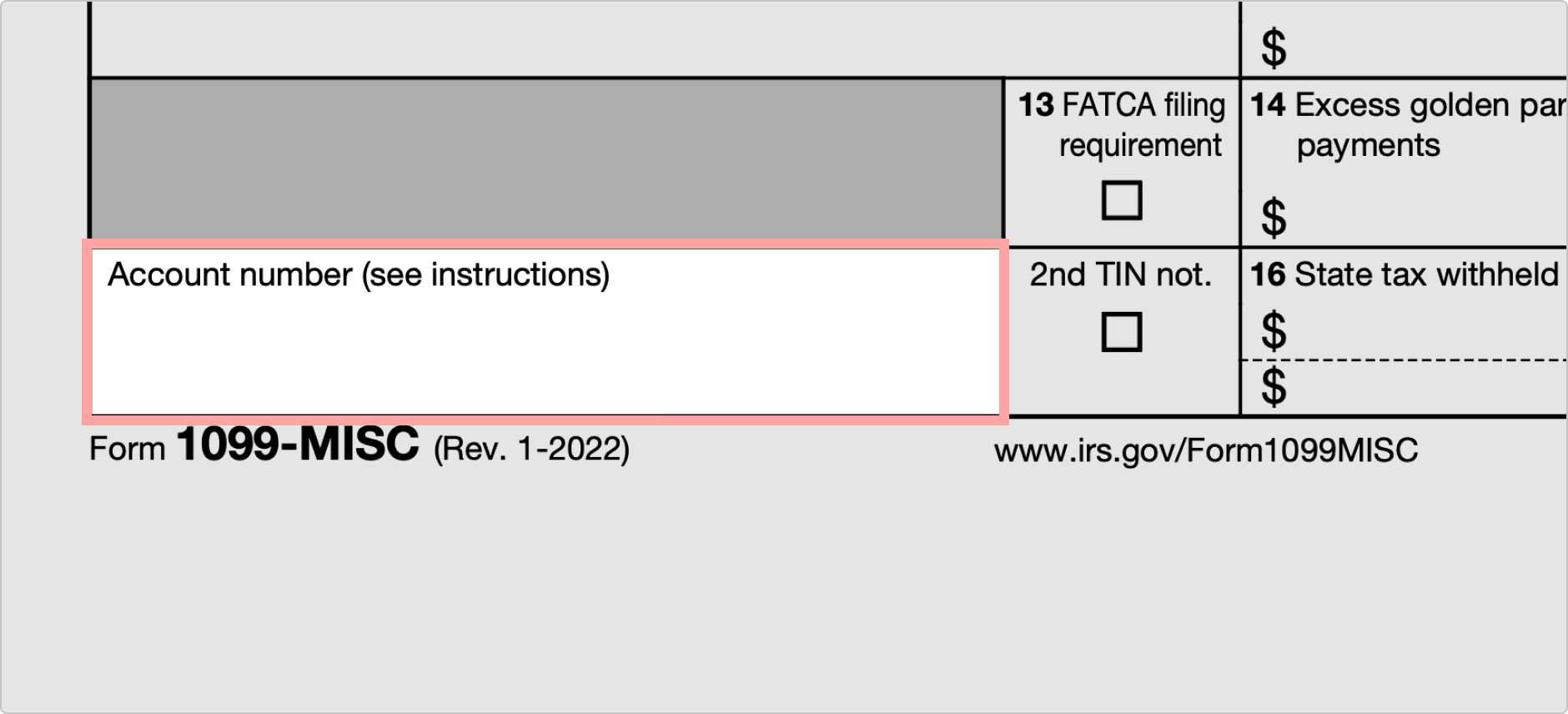

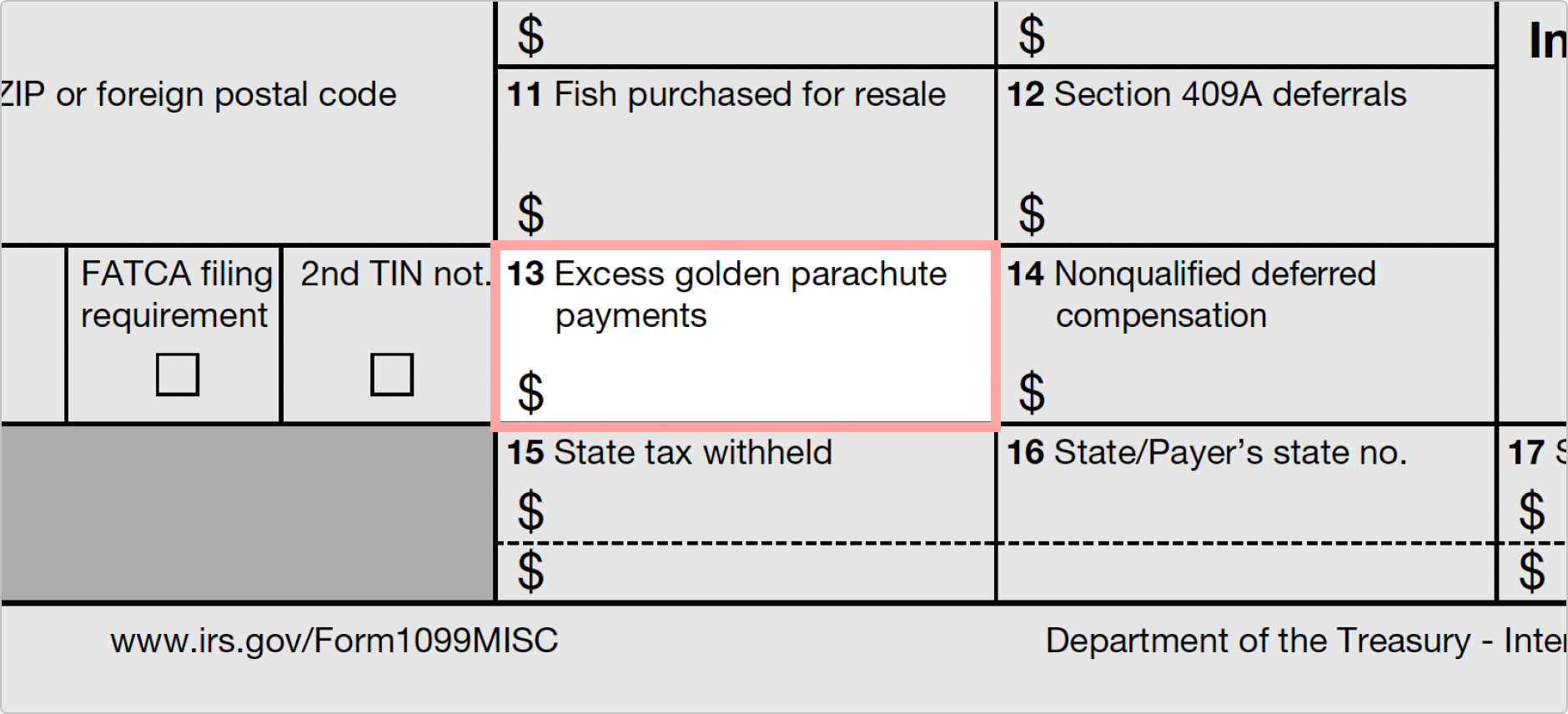

Accurate and complete information is essential when preparing Form 1099-MISC. This includes:

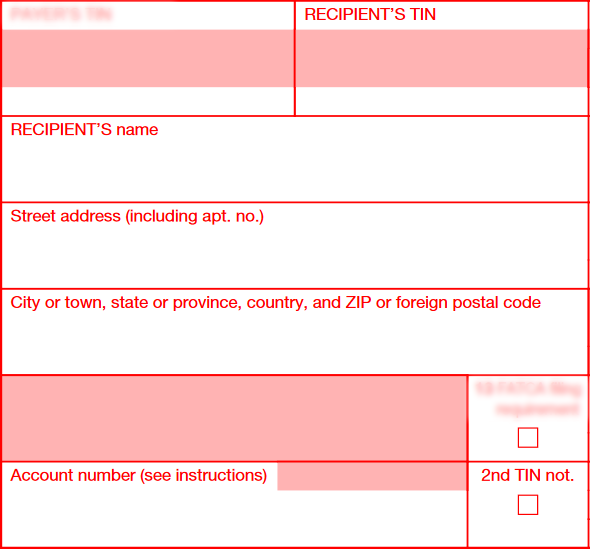

- Payer's name, address, and Taxpayer Identification Number (TIN)

- Recipient's name, address, and TIN

- Amount of payments made

Ensure all details are correct to avoid errors and potential issues with the IRS.

How to Furnish the Form?

Form 1099-MISC can be furnished to recipients either electronically or via mail. Electronic delivery requires the recipient's consent.

If mailing, ensure the form is sent to the recipient's last known address by the deadline.

Penalties for Non-Compliance

Failure to furnish Form 1099-MISC to recipients by the deadline can result in penalties from the IRS. Penalties vary based on the timing and extent of the non-compliance.

The penalty for failure to furnish correct payee statements is $50 to $290 per statement, depending on when you file the correct statement. The penalty increases if you intentionally disregard the requirement to file.

These penalties are designed to encourage compliance with tax regulations.

Where to Find More Information?

The IRS website (IRS.gov) is the primary resource for detailed information on Form 1099-MISC requirements. Seek instructions from the IRS.

The IRS provides detailed instructions, forms, and publications to guide businesses and individuals through the filing process.

Consult with a qualified tax professional for personalized guidance.

What to Do Now?

Review your records immediately to identify any payments made in 2023 that require filing Form 1099-MISC.

Gather all necessary information and prepare the forms for distribution to recipients by January 31st. Ensure electronic filing is done well in advance, considering potential processing times.

Address any outstanding questions or concerns with a tax advisor promptly.