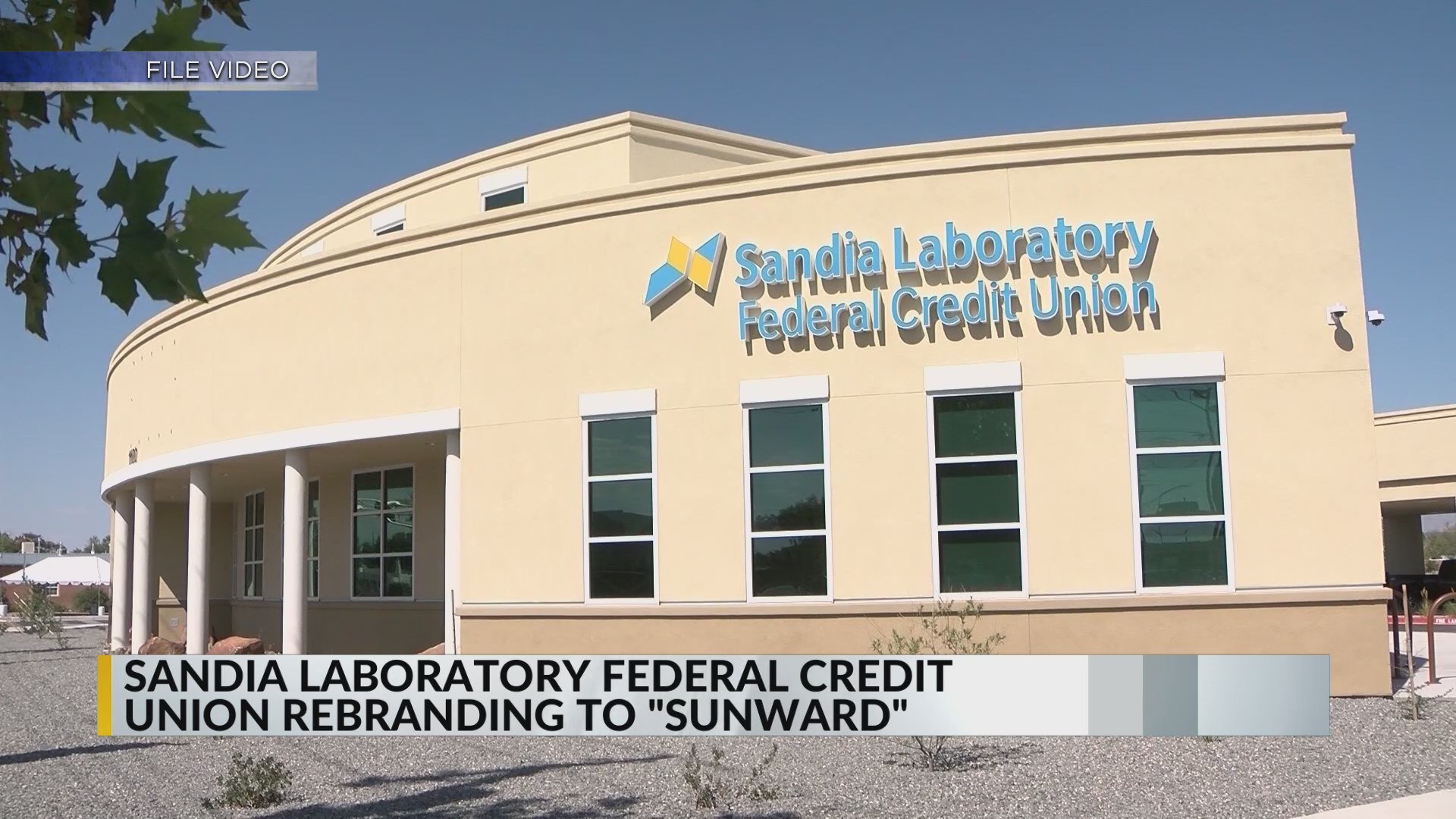

Sandia National Laboratories Federal Credit Union

Sandia National Laboratories Federal Credit Union (SNLFCU), a financial institution deeply rooted in New Mexico's scientific community, continues to expand its services and community outreach, reflecting a broader trend of credit unions adapting to a rapidly evolving financial landscape.

SNLFCU, chartered in 1948 to serve employees of Sandia National Laboratories, has grown to serve a diverse membership base across New Mexico.

This article examines the credit union's recent initiatives, financial performance, and its role in the local economy.

A History of Serving the Scientific Community

Founded in the post-World War II era, SNLFCU was initially conceived to provide affordable financial services to the employees of Sandia National Laboratories, a facility instrumental in the nation's defense and scientific research.

Over the decades, its eligibility requirements have broadened to include not only employees of Sandia but also individuals and families residing or working in specific communities in New Mexico.

This expansion reflects a strategic effort to diversify its membership base and strengthen its financial stability.

Recent Initiatives and Growth

SNLFCU has recently invested heavily in enhancing its digital banking platform, a move aimed at attracting younger members and improving convenience for existing customers.

These upgrades include a redesigned mobile app with enhanced security features and expanded online services such as remote check deposit and online loan applications.

Furthermore, the credit union has emphasized financial literacy programs, offering workshops and online resources to help members manage their finances effectively.

This initiative underscores SNLFCU's commitment to not just providing financial services but also empowering its members to make informed decisions.

Financial Performance

SNLFCU's financial performance remains strong, demonstrating consistent growth in assets and membership.

According to recent reports, the credit union has maintained a healthy capital ratio, indicating its ability to withstand economic fluctuations and continue lending to its members.

This stability is crucial in ensuring the long-term viability of the institution and its ability to serve its members' financial needs.

"Our focus remains on providing value to our members through competitive rates, personalized service, and innovative financial solutions," stated a representative from SNLFCU in a recent press release.

Community Involvement

Beyond its core financial services, SNLFCU actively engages in community outreach programs, supporting local charities and sponsoring events that benefit the residents of New Mexico.

The credit union has partnered with several non-profit organizations to provide financial assistance to families in need and to promote educational opportunities for underprivileged youth.

This commitment to social responsibility underscores SNLFCU's role as a community-focused institution rather than simply a financial service provider.

Impact on the Local Economy

SNLFCU's lending practices have a significant impact on the local economy, providing crucial capital for small businesses and individuals seeking to purchase homes or finance education.

By offering competitive interest rates and flexible repayment options, the credit union facilitates economic growth and supports the financial well-being of its members.

Moreover, SNLFCU's presence creates jobs within the local community, further contributing to its economic vitality.

Challenges and Opportunities

Like all financial institutions, SNLFCU faces challenges in navigating a complex regulatory environment and adapting to rapidly changing technological advancements.

Maintaining data security and protecting members' privacy are paramount concerns, requiring ongoing investments in cybersecurity infrastructure and employee training.

However, these challenges also present opportunities for SNLFCU to innovate and differentiate itself from larger, more impersonal financial institutions.

By leveraging technology to enhance the member experience and providing personalized financial advice, SNLFCU can strengthen its relationships with its members and attract new customers.

Looking Ahead

SNLFCU is poised to continue its growth and expansion in the coming years, building upon its strong foundation of member service and community involvement.

The credit union's strategic focus on digital innovation and financial literacy will be crucial in attracting and retaining members in an increasingly competitive market.

By staying true to its core values and adapting to the evolving needs of its members, Sandia National Laboratories Federal Credit Union is well-positioned to remain a vital financial resource for the people of New Mexico.