Sbi Personal Loan Eligibility Calculator

Imagine you're perched on the edge of a new adventure, perhaps renovating your cozy kitchen or finally pursuing that long-held dream of further education. The path seems clear, the vision vivid, but a crucial question lingers: How do I finance this exciting journey? The answer, for many, lies in the accessibility of a personal loan, and SBI (State Bank of India) offers a tool to ease your financial planning: the Personal Loan Eligibility Calculator.

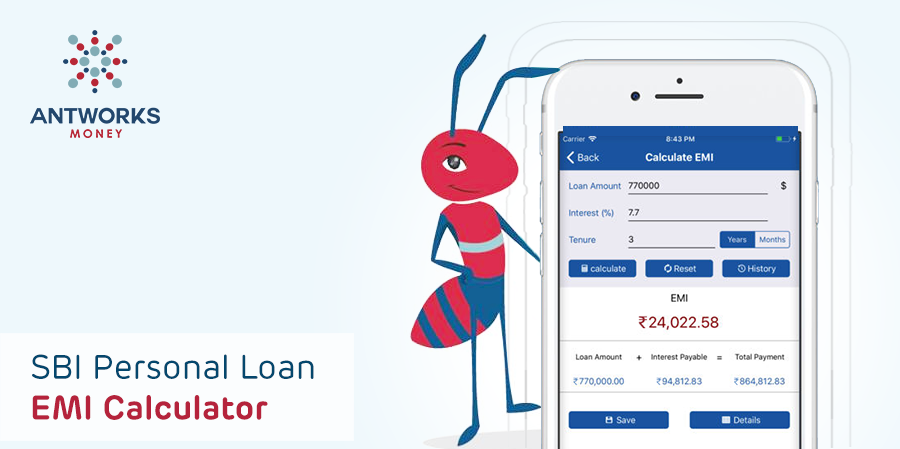

This online calculator serves as a preliminary guide, helping prospective borrowers quickly assess their chances of loan approval and estimate the potential loan amount they could receive. It doesn’t guarantee loan approval, but it provides a realistic snapshot based on key financial indicators.

Understanding the SBI Personal Loan Eligibility Calculator

The SBI Personal Loan Eligibility Calculator is a free, user-friendly online tool designed to provide an instant estimate of your personal loan eligibility. It works by analyzing several key factors that SBI considers when evaluating loan applications.

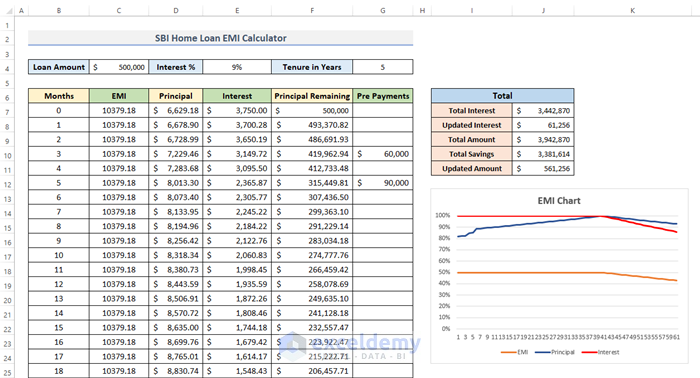

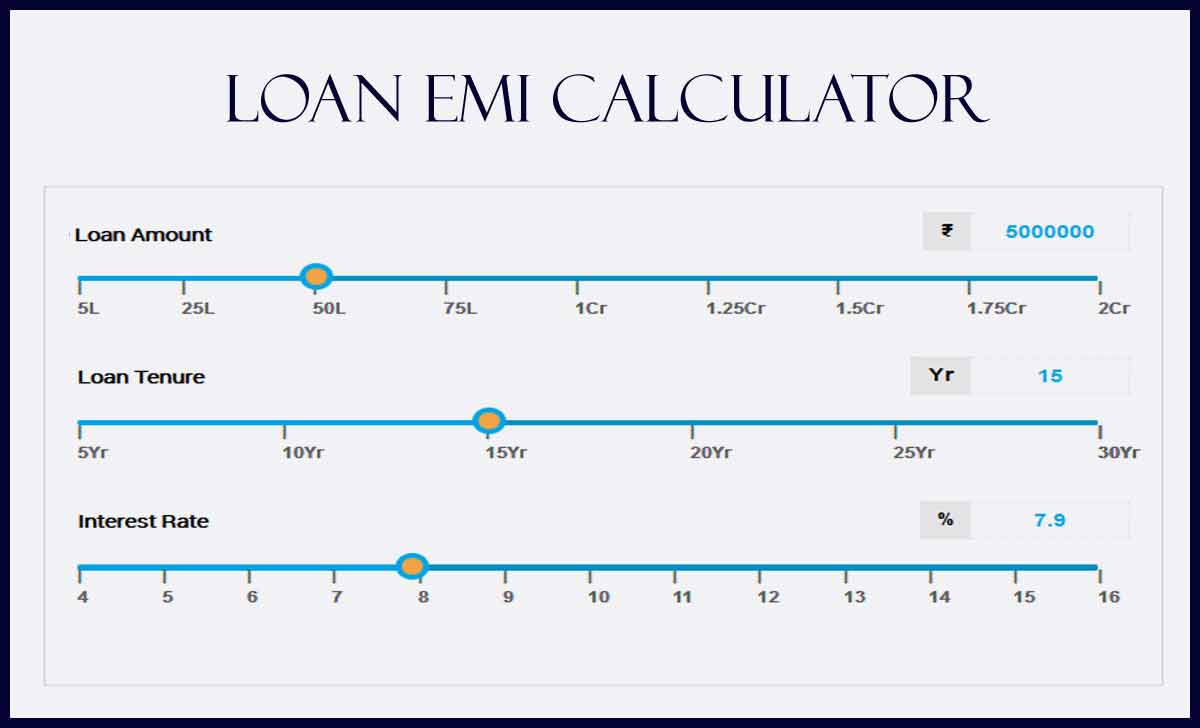

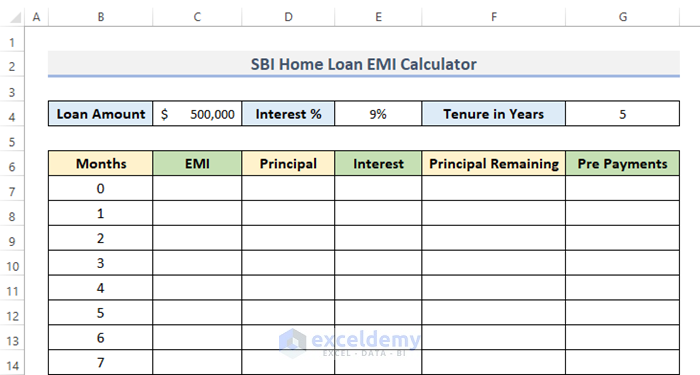

These factors typically include your monthly income, existing EMIs (Equated Monthly Installments), age, and employment status. The calculator then uses this information to determine your potential loan eligibility and the estimated loan amount you might qualify for.

The Importance of Assessing Eligibility

Before diving headfirst into the loan application process, understanding your eligibility is crucial. Applying for a loan you are unlikely to get not only wastes time but can also negatively impact your credit score. Each loan application triggers a credit inquiry, and too many inquiries in a short period can signal potential risk to lenders.

The SBI Personal Loan Eligibility Calculator allows you to gauge your chances and refine your application strategy. It can help you determine if you need to adjust your loan amount request or improve your creditworthiness before formally applying.

Key Factors Influencing Eligibility

Several factors play a significant role in determining your eligibility for an SBI personal loan. A stable and sufficient monthly income is paramount, as it demonstrates your ability to repay the loan.

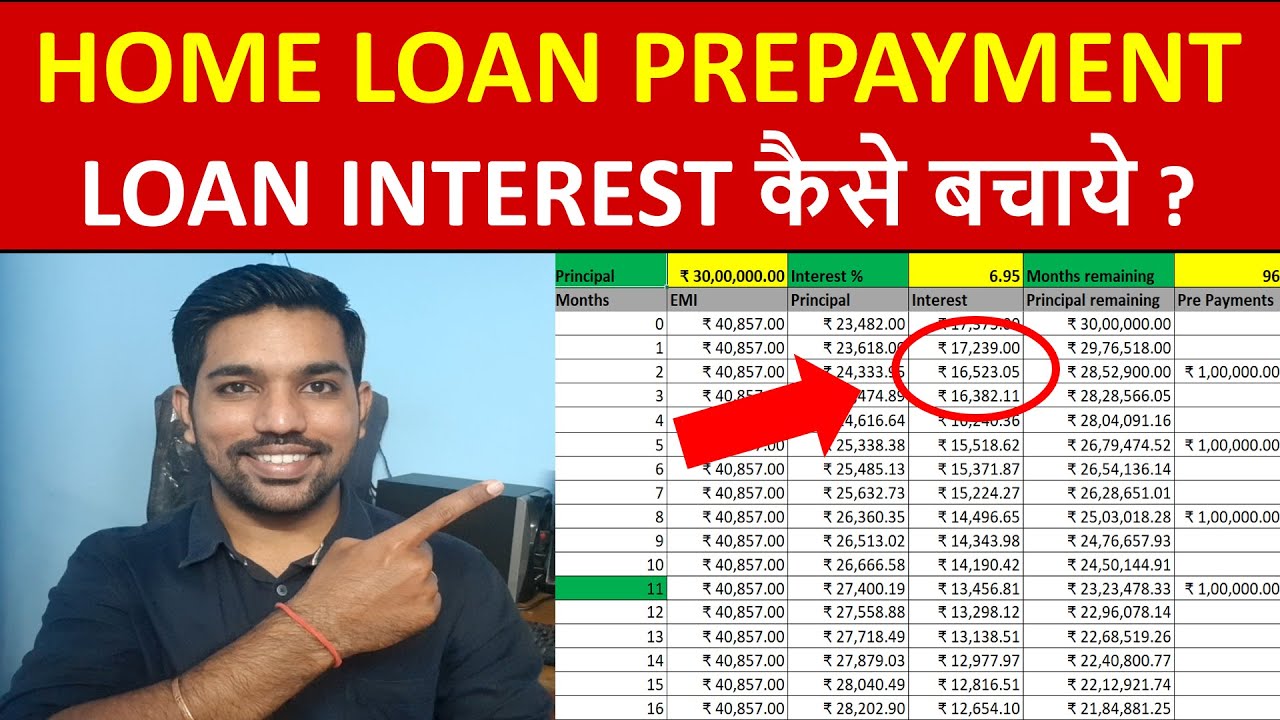

Your existing EMIs also significantly impact your eligibility. SBI will assess your debt-to-income ratio, ensuring that your existing debt obligations don't overextend your financial capacity. A lower debt-to-income ratio improves your chances of approval.

Age and employment status are also considered. Generally, SBI prefers applicants within a specific age range (typically 21 to 60 years) and those with stable employment, whether salaried or self-employed.

Your credit score is a critical determinant of eligibility. SBI, like most lenders, prefers applicants with a good credit history, reflecting responsible financial behavior. Regularly checking your CIBIL score and addressing any discrepancies can significantly improve your chances.

Beyond the Calculator: The Application Process

While the SBI Personal Loan Eligibility Calculator provides a valuable initial assessment, it is essential to remember that it’s an estimate. The actual loan approval process involves a more thorough evaluation.

Once you're satisfied with the estimated eligibility, you can proceed with the formal application, which typically requires submitting supporting documents such as proof of identity, address, income, and bank statements. SBI's official website offers detailed information on required documents and the application procedure.

The SBI team will verify the information provided and conduct a more in-depth assessment of your creditworthiness. They may also consider other factors specific to your situation.

Empowering Financial Decisions

In conclusion, the SBI Personal Loan Eligibility Calculator is more than just a tool; it's a gateway to informed financial decision-making. By providing an accessible and user-friendly way to assess your borrowing potential, it empowers you to approach your financial goals with confidence.

By understanding your eligibility beforehand, you can streamline the loan application process, improve your chances of approval, and ultimately, turn your dreams into reality. It is a step towards responsible borrowing and a future where financial planning is accessible to all.