Schools First Credit Union Savings Account

Schools First Federal Credit Union, a financial institution dedicated to serving educational communities in California, continues to offer a suite of savings accounts tailored to various needs. These accounts are designed to foster financial literacy and provide members with accessible options for saving and growing their money. Understanding the specifics of these accounts, including interest rates, fees, and eligibility requirements, is crucial for educators and their families seeking optimal financial solutions.

At the core of Schools First's offerings is a commitment to supporting the financial well-being of its members. Schools First achieves this by providing user-friendly savings accounts. Understanding the features of these accounts helps members make informed decisions about their financial futures.

Savings Account Options at Schools First

Schools First offers a variety of savings accounts, including traditional savings accounts, high-yield savings accounts, and certificates of deposit (CDs). Each account type is designed to meet different saving goals and risk tolerances. These accounts cater to everyone from those just starting to save to those looking to maximize their returns.

The traditional savings account is a basic account that provides a safe place to store money while earning modest interest. High-yield savings accounts generally offer higher interest rates in exchange for maintaining a higher minimum balance. CDs are time-based deposits that offer a fixed interest rate for a specified term, typically ranging from a few months to several years.

Key Features and Benefits

Several key features distinguish Schools First savings accounts. These include competitive interest rates, online and mobile banking access, and low or no monthly fees for certain accounts. Members also benefit from the credit union's commitment to personalized service and financial education resources.

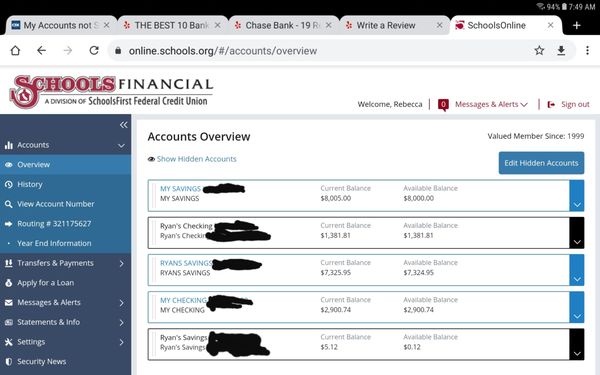

Online and mobile banking provide convenient access to account information and transaction capabilities. Schools First also has a network of branches and ATMs throughout California. This network allows members to manage their accounts in person.

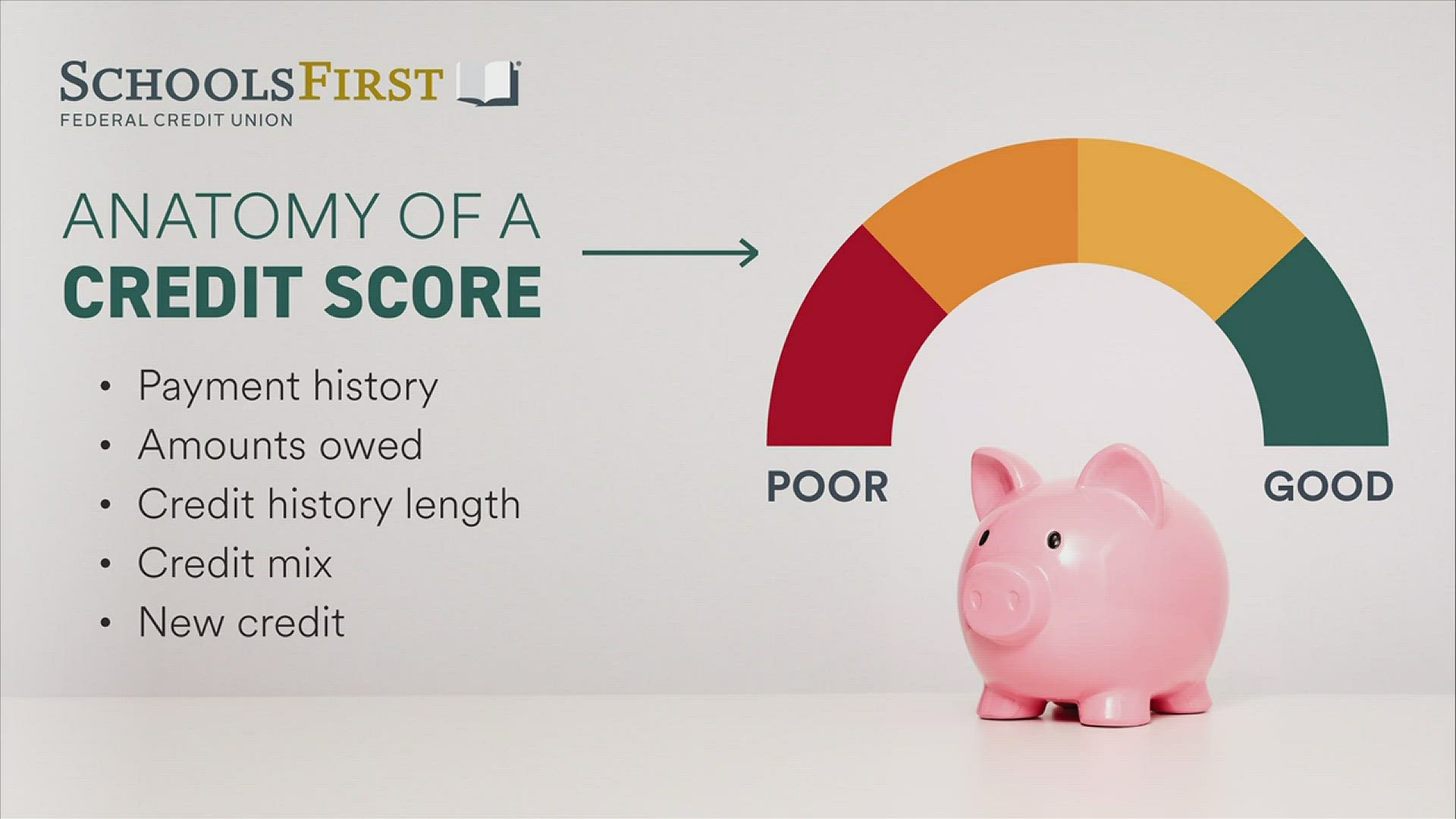

Many Schools First savings accounts come with features that promote financial literacy. These include tools for tracking savings goals and educational resources on personal finance management.

Interest Rates and Fees

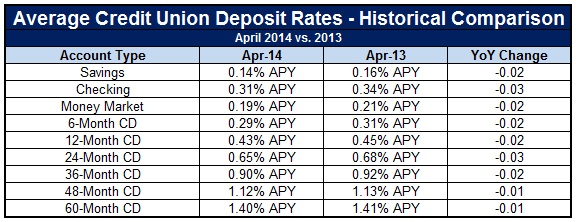

Interest rates on savings accounts at Schools First vary depending on the account type and the current economic climate. It's essential to check the credit union's website or contact a representative for the most up-to-date rates. Transparency around fees is another important aspect.

Schools First typically charges minimal fees for its savings accounts. However, it is wise to carefully review the fee schedule to understand any potential charges for things like excessive withdrawals or account inactivity. Understanding these fees ensures that members can manage their accounts effectively.

Eligibility and How to Open an Account

Membership at Schools First is generally open to individuals who work in education or have family members who do. Specific eligibility requirements can be found on the credit union's website or by contacting a branch representative. Opening an account is a straightforward process.

Individuals can typically open an account online or in person at a branch. The process generally involves completing an application. Also, it requires providing identification and making an initial deposit.

Impact on the Educational Community

Schools First's focus on serving the educational community provides unique advantages to its members. The credit union understands the specific financial needs and challenges faced by educators. This understanding allows them to tailor their services accordingly.

For example, Schools First offers specialized loan programs for teachers. Also, they conduct financial literacy workshops for students. These initiatives reflect their commitment to supporting the financial well-being of the entire educational ecosystem.

Financial stability among educators can lead to greater job satisfaction and retention. Schools First aims to contribute positively to the educational community. It does so by providing access to affordable financial services and resources.

Comparative Analysis

When choosing a savings account, it's important to compare Schools First's offerings with those of other financial institutions. Factors to consider include interest rates, fees, account features, and customer service. Comparing these factors allows individuals to make informed decisions.

Banks, credit unions, and online savings platforms all offer various savings account options. Comparing the benefits and drawbacks of each type of institution is a crucial step in the decision-making process. The specific needs and preferences of the individual saver should guide this decision.

For example, some individuals may prioritize higher interest rates offered by online banks. Others may value the personal service and community focus of a credit union like Schools First. Understanding these preferences can help individuals find the best option for their financial goals.

Conclusion

Schools First Federal Credit Union's savings accounts provide educators and their families with valuable tools for achieving their financial goals. With a range of account options, competitive interest rates, and a commitment to financial literacy, Schools First plays a vital role in supporting the financial well-being of the educational community. By carefully considering the features and benefits of these accounts, members can make informed decisions about how to save and grow their money effectively.