Is It Hard To Get An American Express Platinum Card

The American Express Platinum card remains a coveted status symbol, but securing approval isn't guaranteed. High credit scores and substantial income are crucial, leading many to wonder just how difficult it really is to get approved.

Acquiring the Amex Platinum hinges on meeting stringent eligibility criteria. A strong credit history and a proven ability to manage substantial credit lines are paramount for approval. Let's examine the key factors influencing your chances.

Credit Score Requirements

A credit score of 700 or higher is generally recommended. Data suggests applicants with scores in the "good" to "excellent" range (700-850) have the best odds.

Experian data reveals that the average credit score for approved Amex Platinum cardholders falls within this range. While not an absolute guarantee, a higher score significantly improves your chances.

Income Verification

American Express requires applicants to demonstrate a strong ability to repay. This often involves verifying income through bank statements or tax returns.

There is no explicitly stated minimum income requirement. However, anecdotal evidence indicates that applicants with annual incomes above $60,000 are more likely to be approved, especially if they have other significant debt obligations.

Spending Habits and Credit History

Beyond your score, Amex scrutinizes your overall credit profile. They will look at your debt-to-income ratio and payment history.

A history of responsible credit card use, including consistent on-time payments, is vital. Recent bankruptcies or significant delinquencies will likely result in denial.

The Application Process

The application is primarily online and takes about 10-15 minutes to complete. You'll need to provide personal and financial information.

American Express typically provides a decision within minutes for online applications. If more information is needed, expect a delay of a few days.

Alternatives and Strategies

If you don't meet the requirements initially, consider building your credit. A secured credit card can be a good first step.

Also, explore co-branded cards with American Express, which might have less stringent requirements. Improving your credit score and demonstrating responsible financial behavior over time can increase your chances of future approval.

Tips For Increasing Your Approval Odds:

- Check Your Credit Report: Ensure there are no errors before applying.

- Pay Down Debt: Lowering your debt-to-income ratio improves your profile.

- Show Responsible Credit Usage: Avoid maxing out your existing credit cards.

Approval Isn't Guaranteed

Even with a high credit score and solid income, approval isn't automatic. American Express considers a range of factors.

Denials can occur for reasons like too many recent credit inquiries or insufficient credit history. Understanding the specific reasons for denial is key to improving your future application.

Next Steps

Review your credit report and address any issues before applying. Consider pre-qualification options if available on the American Express website.

Monitor your credit score regularly. A proactive approach to credit management is your best bet for securing the Amex Platinum and other premium credit cards in the future.

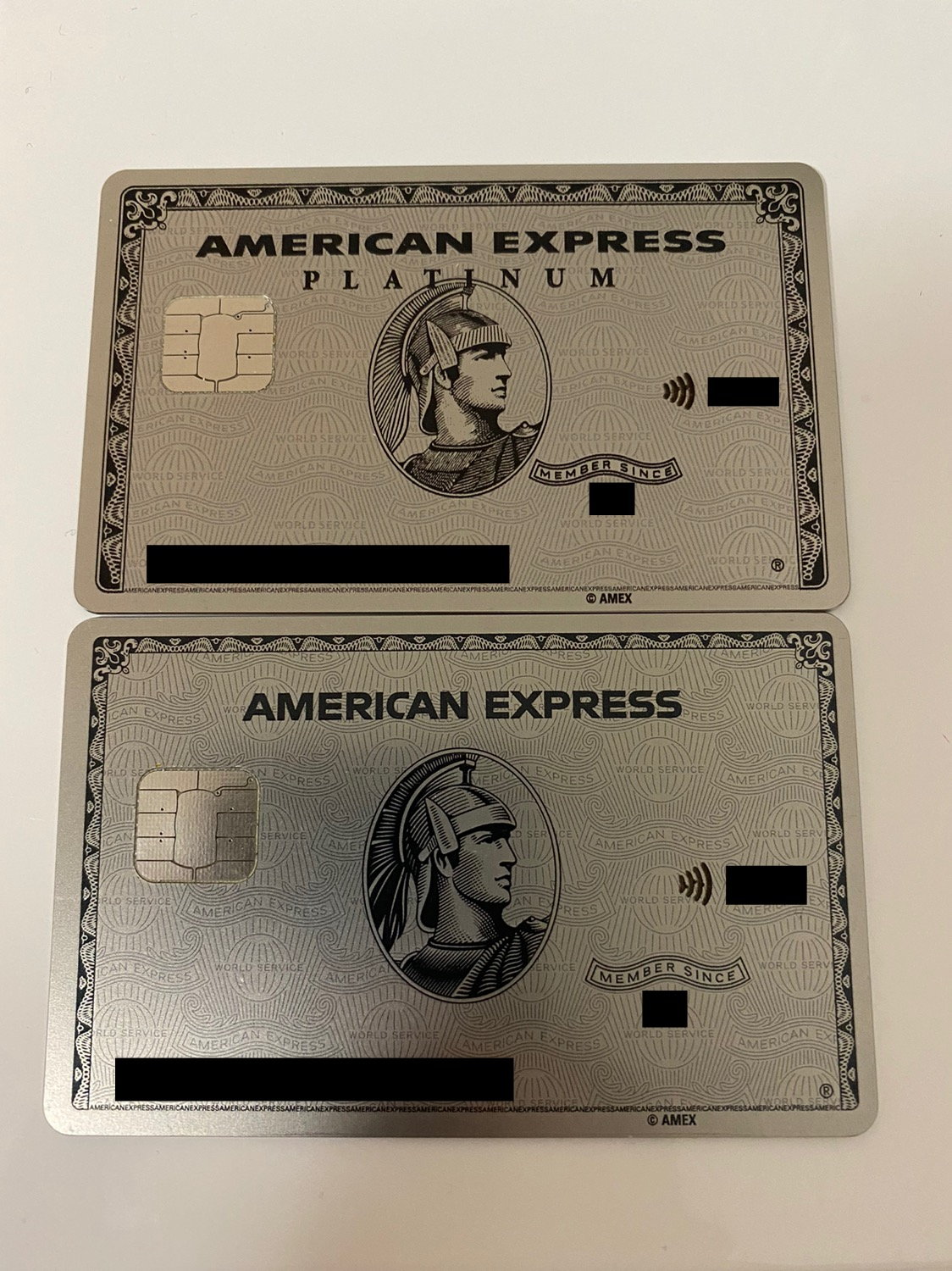

:max_bytes(150000):strip_icc()/-black-centurion-vs-platinum-american-express.asp-ADD-V2-5fa94f4221f74a6180dc5ee96a1b5f3b.jpg)