Selling Accounts Receivable To Obtain Short Term Funds Is Called

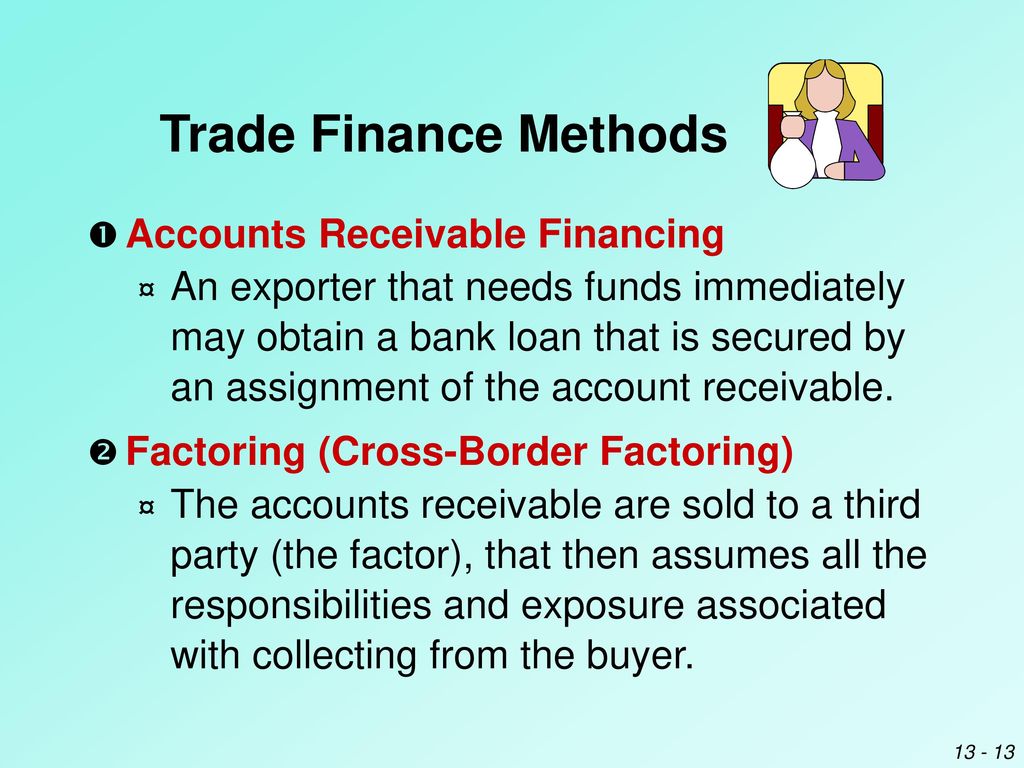

For businesses navigating the complexities of cash flow management, understanding the nuances of accounts receivable financing is crucial. Often referred to as factoring, this strategy involves selling accounts receivable to a third party to secure immediate funds. We’ll explore a critical trend shaping its present and future.

The Rise of Embedded Finance in Factoring

A significant trend is the increasing integration of embedded finance within the factoring industry. This means factoring services are becoming seamlessly integrated into existing business software platforms. Expect to see more of this by mid 2025.

Think of platforms like accounting software or e-commerce marketplaces directly offering factoring options. This eliminates the need to seek out and onboard with a separate factoring company. It creates a faster, more efficient process for businesses seeking immediate liquidity.

This shift reduces friction and makes factoring accessible to a wider range of businesses. Smaller businesses, which were previously hesitant to explore factoring due to its perceived complexity, now have easy access.

Challenges and Opportunities

While embedded finance presents significant advantages, it also introduces new challenges. Maintaining data security and privacy is paramount when integrating financial services into existing platforms. Businesses must be vigilant about choosing providers with robust security protocols.

Another challenge lies in ensuring transparency regarding fees and terms. Embedded finance solutions must clearly outline the costs associated with factoring to avoid misleading businesses. Hidden fees can quickly erode the benefits of this financing method.

On the other hand, this trend presents enormous opportunities for innovation. Platforms can leverage data analytics to offer personalized factoring solutions tailored to specific business needs. Faster, more efficient funding decisions can then be made.

Impact on Risk Assessment and Pricing

The availability of real-time data through embedded finance is revolutionizing risk assessment. Factors can now access comprehensive business data to evaluate the creditworthiness of debtors. This leads to more accurate and efficient risk management.

With better risk assessment comes more competitive pricing. Factors can offer more favorable rates to businesses with a strong financial track record. This makes factoring a more attractive option for a wider range of companies.

However, reliance on data also creates a potential pitfall: algorithmic bias. Factors must ensure their algorithms are fair and do not discriminate against certain types of businesses or industries. Regular audits and oversight are essential.

Strategies for Leveraging Factoring Effectively

To maximize the benefits of factoring, businesses should adopt a strategic approach. First, carefully evaluate different factoring providers. Don't just focus on the interest rate.

Consider factors such as the factor's reputation, experience in your industry, and the quality of their customer service. Understand the terms and conditions of the factoring agreement, including any fees or charges.

Second, use factoring as part of a broader cash flow management strategy. It should be a tool to address short-term funding needs, not a permanent solution to underlying financial problems. Analyze your cash flow to see if it’s right for your company.

Finally, maintain open communication with your factoring provider. Regularly update them on your business performance and any changes in your customer base. Strong communication fosters a collaborative relationship and helps ensure the factoring arrangement remains effective.

The Future of Accounts Receivable Financing

The future of accounts receivable financing will be characterized by greater automation and personalization. Expect to see even more sophisticated algorithms and machine learning tools being used to assess risk and optimize pricing.

Blockchain technology may also play a role, enhancing the security and transparency of factoring transactions. The technology can streamline the process and reduce the risk of fraud.

As embedded finance continues to evolve, factoring will become an increasingly accessible and integral part of the business landscape. Businesses that understand and embrace these trends will be better positioned to thrive in an ever-changing marketplace.