Send Money To Usa From Dominican Republic

Urgent concerns are mounting for Dominicans sending money to the United States due to fluctuating exchange rates and rising transaction fees. These financial pressures significantly impact families reliant on remittances for essential needs.

This article breaks down the challenges and available options for sending money from the Dominican Republic to the United States, highlighting the real-world impact on individuals and families.

Challenges and Impacts

The Dominican Republic is a major source of remittances to the United States. Many families depend on these funds to cover expenses like housing, healthcare, and education.

Fluctuating exchange rates between the Dominican Peso (DOP) and the US Dollar (USD) directly impact the amount recipients receive. When the Peso weakens, more DOP is needed to send the same amount in USD, increasing the sender's burden.

Transaction fees levied by money transfer services further erode the value of remittances. These fees vary widely depending on the provider and transfer method, making it crucial to compare options carefully.

Available Transfer Options

Several avenues exist for sending money from the Dominican Republic to the US, each with its own advantages and disadvantages.

Traditional money transfer services like Western Union and MoneyGram remain popular despite higher fees. Their extensive network of agents provides accessibility, especially in rural areas.

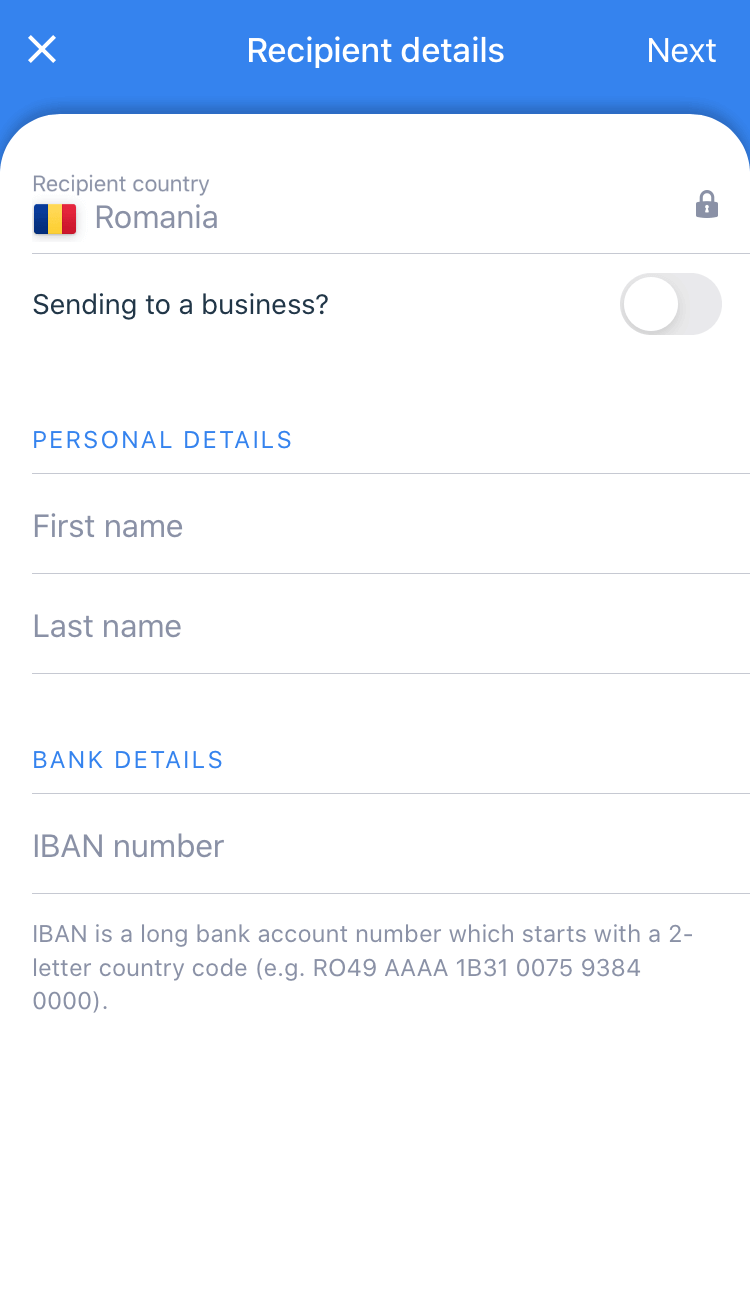

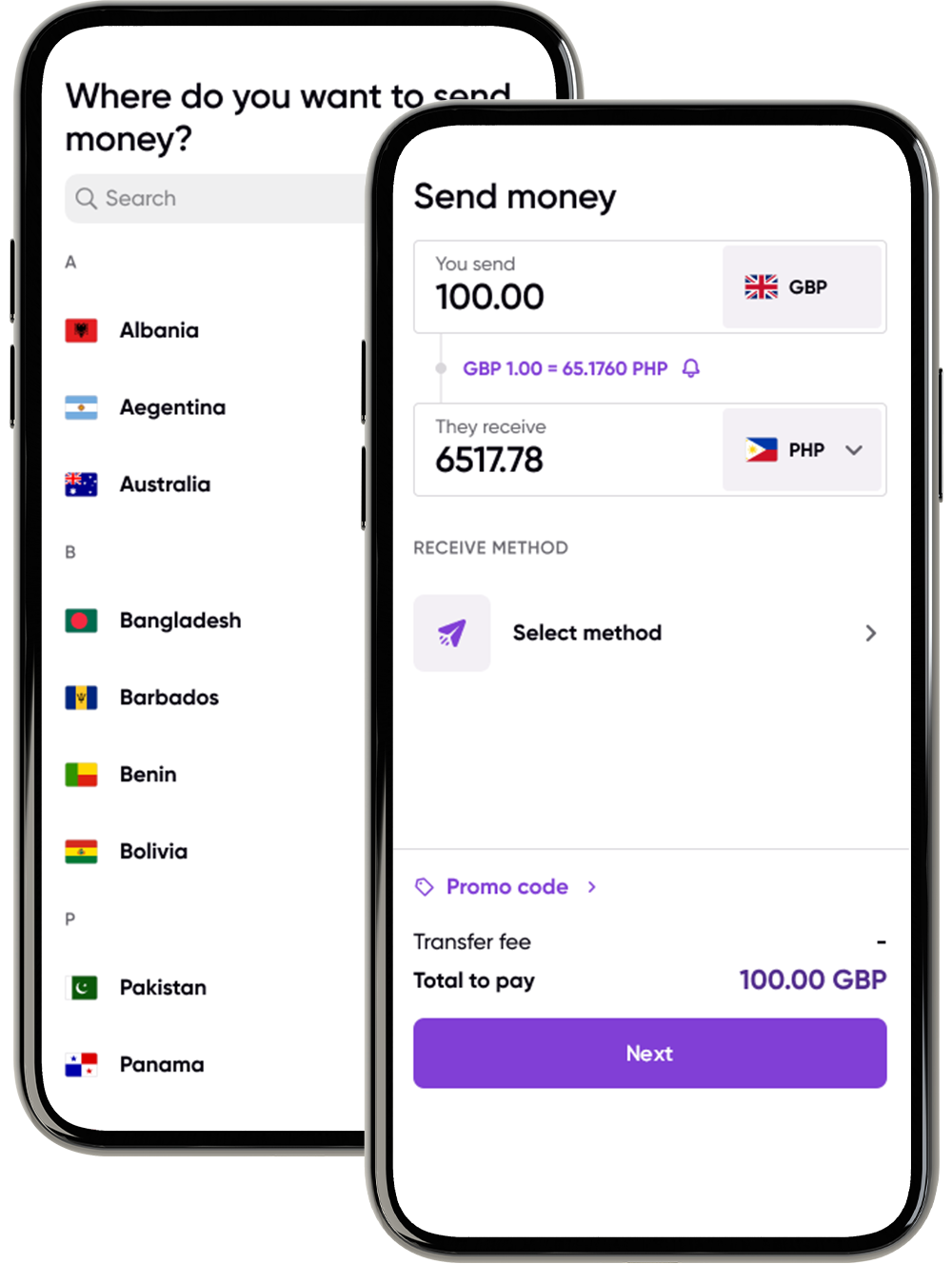

Online platforms such as Remitly, Xoom (a PayPal service), and WorldRemit offer competitive exchange rates and lower fees. These services require internet access and a bank account or debit/credit card.

Bank transfers are another option, but they often involve higher fees and longer processing times. It's essential to check with both the sending and receiving banks for specific charges.

Comparing Costs

A recent study by Investigaciones Economicas found that average transaction fees range from 3% to 7% of the sent amount. This represents a significant cost for families sending smaller amounts regularly.

Online platforms tend to offer better exchange rates than traditional services. However, promotional rates may only apply to first-time users.

It is always important to compare costs using real-time calculators on each platform's website to get the most accurate information for a specific transfer amount.

Real-World Impact

For many Dominican families in the US, remittances are a lifeline. Even small decreases in the received amount can have significant consequences.

"Every dollar counts," says Maria Rodriguez, a Dominican immigrant in New York. "When the exchange rate is bad, I have to work extra hours to send the same amount of money home to my mother."

The economic impact extends beyond individual families. Reduced remittance flows can negatively affect the Dominican Republic's overall economy.

Next Steps and Ongoing Developments

Consumers are encouraged to carefully compare fees and exchange rates before choosing a money transfer service.

Government and financial institutions are exploring ways to reduce the cost of remittances through policy changes and technological innovation.

Ongoing monitoring of exchange rate fluctuations and transaction fee trends is essential to protect the interests of both senders and receivers of remittances.