Setting Up A Roth Ira With Vanguard

Imagine waking up years from now, the sun streaming through your window, a gentle breeze rustling the leaves outside. You're retired, finally free to pursue those passions you've always dreamed of. But what makes this vision truly golden isn't just the freedom, it's the security of knowing your financial future is bright, thanks to the wise decisions you made today. One of the most empowering of those decisions? Setting up a Roth IRA.

Investing in a Roth IRA, particularly with a reputable institution like Vanguard, can seem daunting. Yet, the process is surprisingly accessible, especially when broken down into manageable steps.

Founded in 1975 by John C. Bogle, Vanguard was built on the principle of providing low-cost, client-owned investment options. This philosophy makes it a popular choice for individuals seeking to secure their retirement.

Why Choose a Roth IRA?

The beauty of a Roth IRA lies in its tax advantages. Contributions are made with after-tax dollars, but qualified withdrawals in retirement are completely tax-free.

According to the IRS, a qualified withdrawal generally means you are at least 59 1/2 years old and the account has been open for at least five years.

This can be a significant advantage, especially if you anticipate being in a higher tax bracket during retirement. You will not owe federal income tax on any earnings generated within the account.

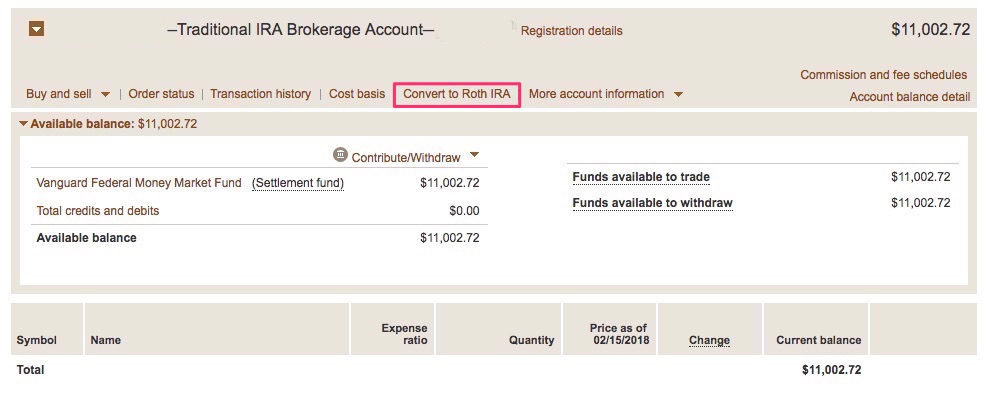

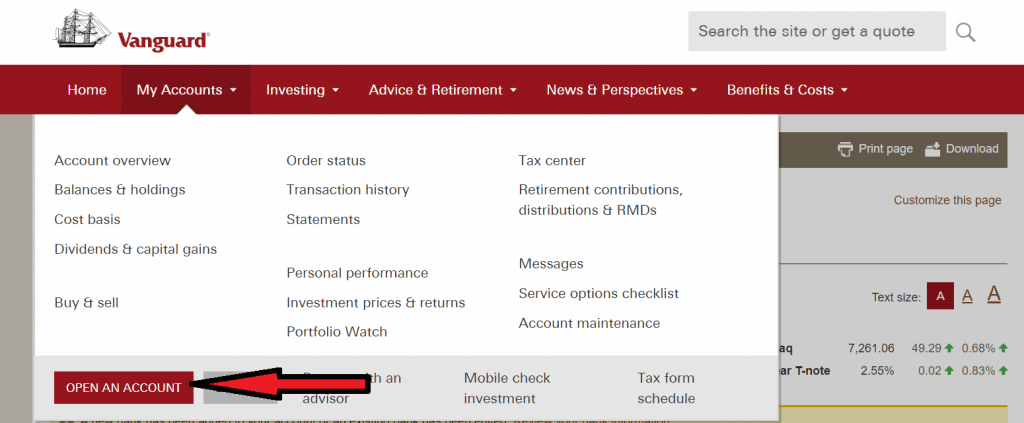

Setting Up Your Roth IRA with Vanguard: A Step-by-Step Guide

First, you'll need to open an account online at Vanguard's website. The process begins by navigating to the "Open an Account" section and selecting "Roth IRA".

You will then be guided through a series of questions to verify your identity and ensure you meet the eligibility requirements. You will need to provide your social security number, date of birth, and contact information.

Next, you will need to choose your investments.

Vanguard offers a wide variety of options, including index funds, mutual funds, and exchange-traded funds (ETFs). Popular choices for Roth IRAs include target retirement funds, which automatically adjust their asset allocation over time as you approach retirement.

Target retirement funds offer built-in diversification, simplifying the investment process. Consider investing in a low-cost, broadly diversified index fund such as the Vanguard Total Stock Market Index Fund (VTSAX) or the Vanguard S&P 500 ETF (VOO).

After selecting your investments, you'll need to fund your account. Vanguard allows you to transfer funds electronically from a bank account or contribute via check.

Remember, there are annual contribution limits. As of 2024, the contribution limit is $7,000, with an additional $1,000 catch-up contribution allowed for those age 50 or older, according to the IRS.

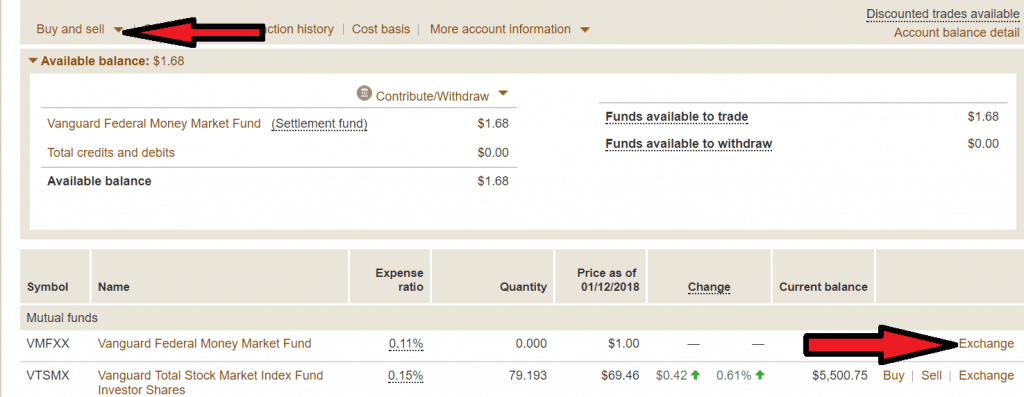

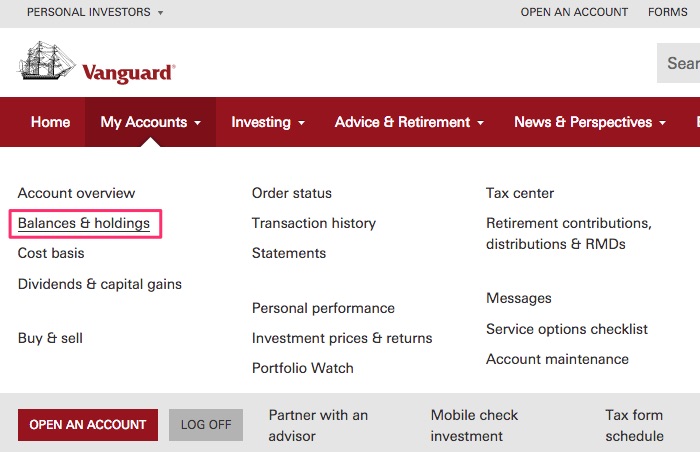

Navigating the Vanguard Platform

Vanguard's online platform is designed to be user-friendly, providing tools and resources to help you manage your account.

You can track your portfolio's performance, make adjustments to your asset allocation, and access educational materials to enhance your financial literacy.

Vanguard also offers phone support and financial advisors who can provide personalized guidance, although keep in mind that advisor services may come with associated fees.

"The key to successful investing is to start early, invest regularly, and keep your costs low." - John C. Bogle

Setting up a Roth IRA with Vanguard is not merely about paperwork and transactions. It's about taking control of your financial future and building a foundation for a comfortable retirement. The journey may seem long, but the peace of mind that comes with knowing you're prepared for the future is invaluable. Embrace the process, make informed decisions, and watch your retirement savings grow.

![Setting Up A Roth Ira With Vanguard How to Open a Roth IRA at Vanguard [with Screenshots] | White Coat Investor](https://www.whitecoatinvestor.com/wp-content/uploads/2022/07/open-roth-ira-vanguard-img1-768x720.jpg)