Should I Get The Chase Sapphire Preferred

Considering the Chase Sapphire Preferred card? Time is of the essence: a strategic decision now can unlock significant travel rewards and benefits. But is it right for *you*?

The Chase Sapphire Preferred consistently ranks among the top travel credit cards due to its lucrative rewards program and reasonable annual fee. This guide cuts through the noise to help you decide if adding it to your wallet is a smart move.

Who is the Chase Sapphire Preferred for?

This card primarily targets individuals who enjoy travel and dining. Ideal applicants spend at least $4,000 within the first three months to earn the lucrative sign-up bonus.

If you already hold other Chase cards and are well-versed in optimizing rewards points, the Chase Sapphire Preferred could be a perfect fit. Consider your travel patterns; frequent flyers and hotel guests will extract the most value.

What are the Key Benefits?

Earning Points

Cardholders earn 5x points on travel purchased through Chase Ultimate Rewards. You also get 3x points on dining, select streaming services and online groceries. All other purchases earn 1x point.

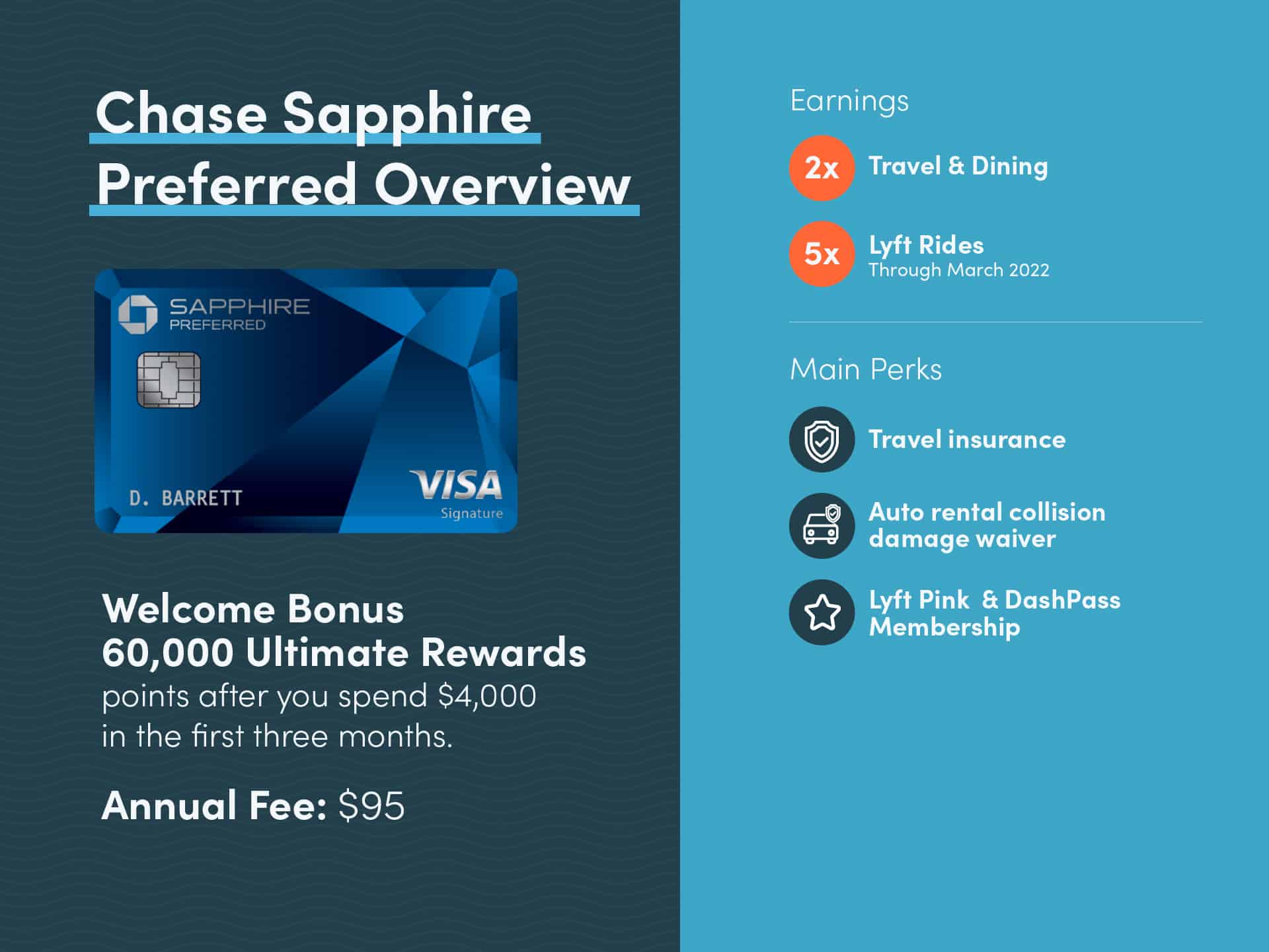

The current sign-up bonus is typically around 60,000 bonus points after spending $4,000 on purchases in the first 3 months from account opening. Points are redeemable for travel, cash back, gift cards, or transferred to partner airlines and hotels.

Travel Perks

The Chase Sapphire Preferred provides travel insurance benefits. These include trip cancellation/interruption insurance, auto rental collision damage waiver, and baggage delay insurance.

There are no foreign transaction fees. This makes it ideal for international travel.

Redemption Options

Points are worth 1.25 cents each when redeemed for travel through Chase Ultimate Rewards. Transferring points to partner airlines and hotels is often the best way to maximize their value.

Partner programs include United Airlines, Hyatt, and Southwest Airlines. Strategic transfers can result in significantly greater value than cash back redemption.

Where can you use the card?

The Chase Sapphire Preferred, a Visa card, is accepted virtually anywhere credit cards are taken. Maximize the rewards by using it for all dining and travel expenses.

Consider booking travel through the Chase Ultimate Rewards portal to leverage the 5x points earning rate. This applies to flights, hotels, and rental cars.

When should you apply?

Timing is crucial. Apply when you anticipate a large upcoming purchase or travel expense to meet the minimum spending requirement.

Check your credit score before applying. A good to excellent credit score (670 or higher) significantly increases your approval odds.

How to Maximize Value

Combine the Chase Sapphire Preferred with other Chase cards like the Chase Freedom Unlimited or Chase Freedom Flex. This combination creates a powerful points-earning ecosystem.

Use the Chase Freedom Flex for its rotating quarterly bonus categories. Then transfer earned points to your Chase Sapphire Preferred account for higher redemption value.

Annual Fee & Ongoing Considerations

The Chase Sapphire Preferred has a $95 annual fee. Evaluate if the rewards and benefits outweigh this cost.

Carefully track your spending and point earnings to assess the card's long-term value. Redeeming strategically is critical.

Consider if you can consistently meet spending requirements. This is how to unlock and maximize the benefits over time.

Next Steps

Visit the Chase website to review the full terms and conditions before applying. Compare the Chase Sapphire Preferred to other travel credit cards to find the best fit for your needs.

Monitor your credit score regularly. Responsible credit card use builds a positive credit history for future financial opportunities.