Simple Path Financial Credit Score Requirements

Imagine a sun-drenched kitchen, the aroma of freshly brewed coffee filling the air. A young couple, Sarah and David, huddle over a laptop, their faces illuminated by the screen. They're navigating the complex world of homeownership, and one daunting phrase keeps popping up: credit score requirements.

Simple Path Financial, known for its approachable and transparent lending practices, aims to demystify this process. This article explores Simple Path Financial's credit score requirements, offering insights into what borrowers need to know to achieve their financial goals.

The Simple Path Philosophy

Simple Path Financial emerged from a desire to provide straightforward and accessible financial solutions.

The company's mission is to empower individuals and families to achieve their dreams, whether it’s buying a home, starting a business, or securing their financial future.

Central to this mission is a commitment to transparency and education, particularly regarding credit score requirements.

Understanding Credit Scores

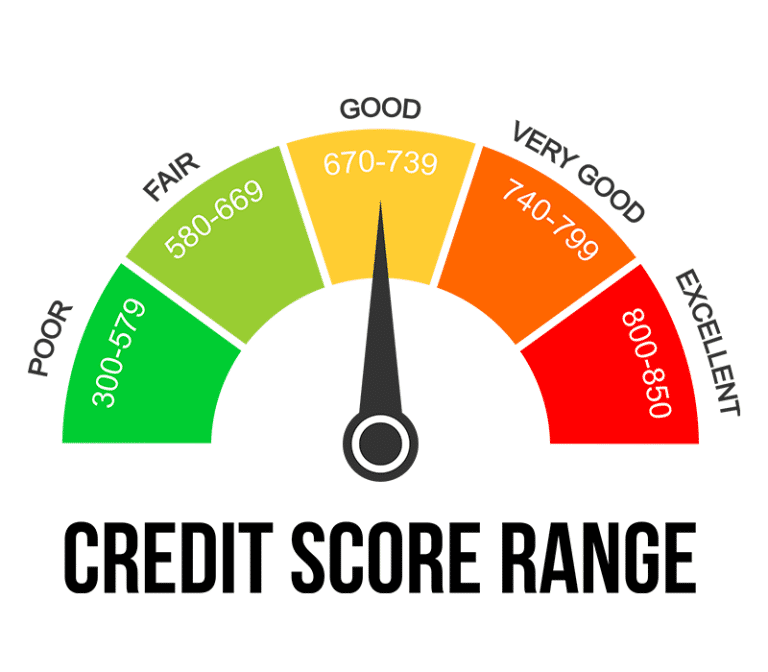

Before diving into Simple Path's specific requirements, it’s crucial to grasp the basics of credit scores.

A credit score is a numerical representation of your creditworthiness, reflecting your history of repaying debts.

These scores, typically ranging from 300 to 850, are calculated by credit bureaus like Equifax, Experian, and TransUnion, using algorithms that consider factors like payment history, amounts owed, length of credit history, credit mix, and new credit.

The Importance of a Good Credit Score

A good credit score unlocks a multitude of financial opportunities.

It can lead to lower interest rates on loans, better terms on credit cards, and even influence insurance premiums.

For Simple Path Financial, a healthy credit score signifies a borrower's reliability and commitment to financial responsibility.

Simple Path Financial's Credit Score Requirements: A Detailed Look

Simple Path Financial adopts a nuanced approach to credit score requirements, acknowledging that a single number doesn't tell the whole story.

While they do have minimum credit score thresholds for different products, they also consider other factors like debt-to-income ratio, employment history, and overall financial stability.

According to a representative from Simple Path Financial, "We believe in looking at the whole picture. A credit score is just one piece of the puzzle. We strive to understand each applicant's unique circumstances."

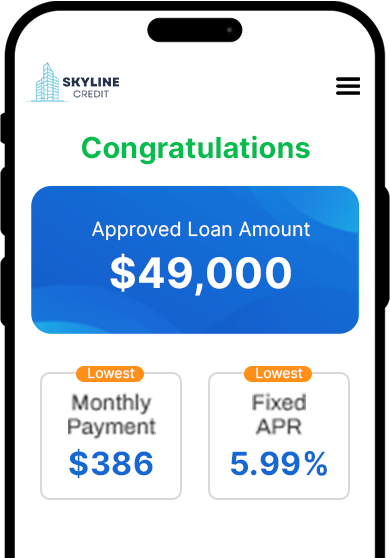

Minimum Credit Score Thresholds

While subject to change based on market conditions and product offerings, Simple Path Financial generally adheres to the following guidelines:

Mortgages: A minimum credit score of 620 is typically required for conventional mortgages. However, borrowers with scores in the 620-680 range may face higher interest rates or require a larger down payment.

Personal Loans: Personal loans often have a slightly higher threshold, with a minimum score of 640 generally needed. The interest rates and loan terms are influenced by the applicant's creditworthiness.

Business Loans: Business loans, which often involve higher risk, may require a credit score of 680 or higher. In addition, businesses will undergo a thorough assessment of their financial health and business plan.

Beyond the Score: Holistic Evaluation

Simple Path Financial emphasizes a holistic evaluation process.

This means that even if an applicant's credit score falls slightly below the minimum threshold, they may still be approved if other factors are strong.

For example, a stable employment history, a low debt-to-income ratio, and a substantial down payment can positively influence the decision.

Case Studies: Real-Life Examples

Consider the case of Maria, a single mother who dreamed of owning a home.

Her credit score was 610, slightly below Simple Path Financial's minimum requirement for a conventional mortgage.

However, Maria had a stable job, a solid savings account, and a low debt-to-income ratio. Simple Path Financial, recognizing her potential, worked with her to secure an FHA loan, enabling her to achieve her dream of homeownership.

Another example is David, a young entrepreneur seeking a small business loan.

His credit score was 660, which was acceptable but not exceptional.

Simple Path Financial was impressed by David's detailed business plan and his proven track record of success in his industry. They approved his loan application, giving him the capital he needed to expand his business.

Tips for Improving Your Credit Score

Whether you're planning to apply for a mortgage, a personal loan, or a business loan, improving your credit score is a worthwhile endeavor.

Here are some practical tips to consider:

Pay Bills on Time

Payment history is the most significant factor in determining your credit score.

Make sure to pay all your bills on time, every time, to avoid negative marks on your credit report.

Setting up automatic payments can help ensure you never miss a due date.

Keep Credit Utilization Low

Credit utilization refers to the amount of credit you're using compared to your total available credit.

Experts recommend keeping your credit utilization below 30%. For example, if you have a credit card with a $1,000 limit, try to keep your balance below $300.

Lowering your credit utilization can significantly improve your credit score.

Monitor Your Credit Report Regularly

Regularly reviewing your credit report is crucial for identifying errors and potential fraud.

You can obtain a free copy of your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) once a year at AnnualCreditReport.com.

Dispute any inaccuracies you find to ensure your credit report is accurate.

Avoid Opening Too Many New Accounts

Opening too many new credit accounts in a short period can lower your average account age and potentially impact your credit score.

Be mindful of how frequently you apply for new credit.

The Future of Lending at Simple Path Financial

Simple Path Financial is continuously evolving to meet the changing needs of its customers.

They are exploring new technologies and strategies to further personalize the lending experience and make financial products more accessible.

This includes leveraging alternative data sources to assess creditworthiness and offering customized financial education resources.

Conclusion: Navigating the Path to Financial Success

Understanding credit score requirements is a crucial step toward achieving your financial goals. Simple Path Financial's transparent and holistic approach to lending provides a supportive pathway for individuals and businesses to realize their dreams.

By focusing on improving your credit score and understanding the factors that lenders consider, you can increase your chances of securing the financing you need to build a brighter future.

Remember Sarah and David in their sun-drenched kitchen? With a little knowledge and careful planning, they, and you, can navigate the path to homeownership and beyond.