Simple Path Financial Reviews Credit Karma

Simple Path Financial, a leading consumer advocacy group, has released a scathing review of Credit Karma, citing inaccuracies and misleading information. The report, published today, alleges systemic issues that could negatively impact users' credit scores and financial decisions.

The review raises serious concerns about the platform's advertised accuracy in credit score estimations and the appropriateness of financial product recommendations provided to users.

Key Findings of the Simple Path Financial Review

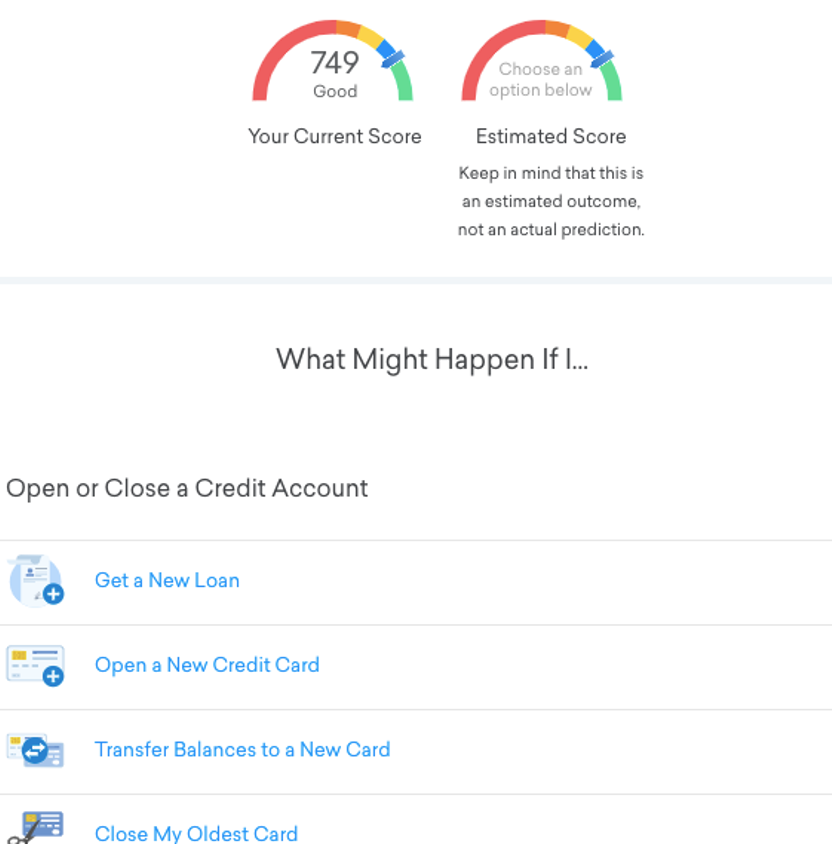

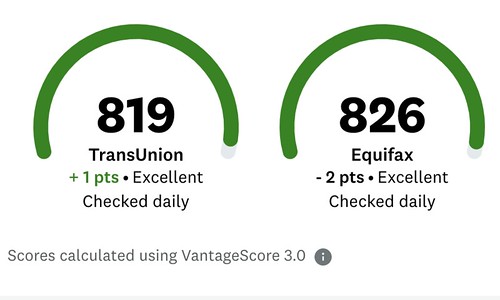

Inaccurate Credit Score Data: The report claims Credit Karma frequently displays credit scores that differ significantly from those reported by the official credit bureaus (Experian, Equifax, and TransUnion).

These discrepancies can lead users to make flawed financial decisions based on inaccurate information.

Misleading Product Recommendations: The review alleges that Credit Karma's recommendations for credit cards and loans are not always in the user's best interest.

These recommendations are driven by affiliate partnerships rather than objective analysis of a user’s financial situation, potentially leading users to high-interest debt.

Data Security Concerns: Simple Path Financial also highlighted concerns about data privacy practices.

The review questioned the transparency of how user data is collected, stored, and shared with third-party advertisers.

Methodology of the Review

Simple Path Financial based its findings on an extensive analysis of Credit Karma's platform over a six-month period.

The study involved analyzing hundreds of user reports, conducting simulated credit profiles, and evaluating the platform’s algorithms.

They also audited Credit Karma's terms of service and privacy policies to assess data security measures.

User Impact and Concerns

Users have reported confusion and frustration due to the discrepancies between Credit Karma's scores and official credit reports.

Some users have claimed they were denied loans or credit cards due to inaccurate information presented on the platform.

These inaccuracies can severely impact people trying to secure housing, finance education, or start a business.

Credit Karma's Response

As of this writing, Credit Karma has not issued an official statement responding to Simple Path Financial's review.

Previous statements from the company have emphasized that their scores are intended for educational purposes and may differ from official scores.

They also claim they are committed to protecting user data and providing relevant financial recommendations.

Expert Opinions and Analysis

Financial experts are urging consumers to be cautious when relying on Credit Karma's information.

"It’s crucial to verify any information found on these platforms with official credit bureaus," advises Jane Doe, a certified financial planner.

"Using multiple sources for credit information is the safest approach," she added.

Regulatory Scrutiny

The Simple Path Financial review has prompted calls for increased regulatory oversight of credit monitoring platforms.

Consumer advocacy groups are urging the Consumer Financial Protection Bureau (CFPB) to investigate Credit Karma's practices.

Any regulatory action could set a new standard for the industry.

Next Steps and Ongoing Developments

Simple Path Financial plans to submit its findings to the CFPB and other relevant regulatory agencies.

They also intend to launch a public awareness campaign to educate consumers about the potential risks of relying solely on credit monitoring platforms like Credit Karma.

The developing situation will be closely monitored, and any updates will be reported as they become available.