Small Business Accounting Software Online

The landscape of small business finance is undergoing a rapid transformation, largely fueled by the increasing accessibility and sophistication of online accounting software.

These digital tools are no longer a luxury, but rather a necessity for entrepreneurs seeking to streamline operations, improve financial visibility, and ultimately, enhance profitability.

The Rise of Cloud-Based Accounting

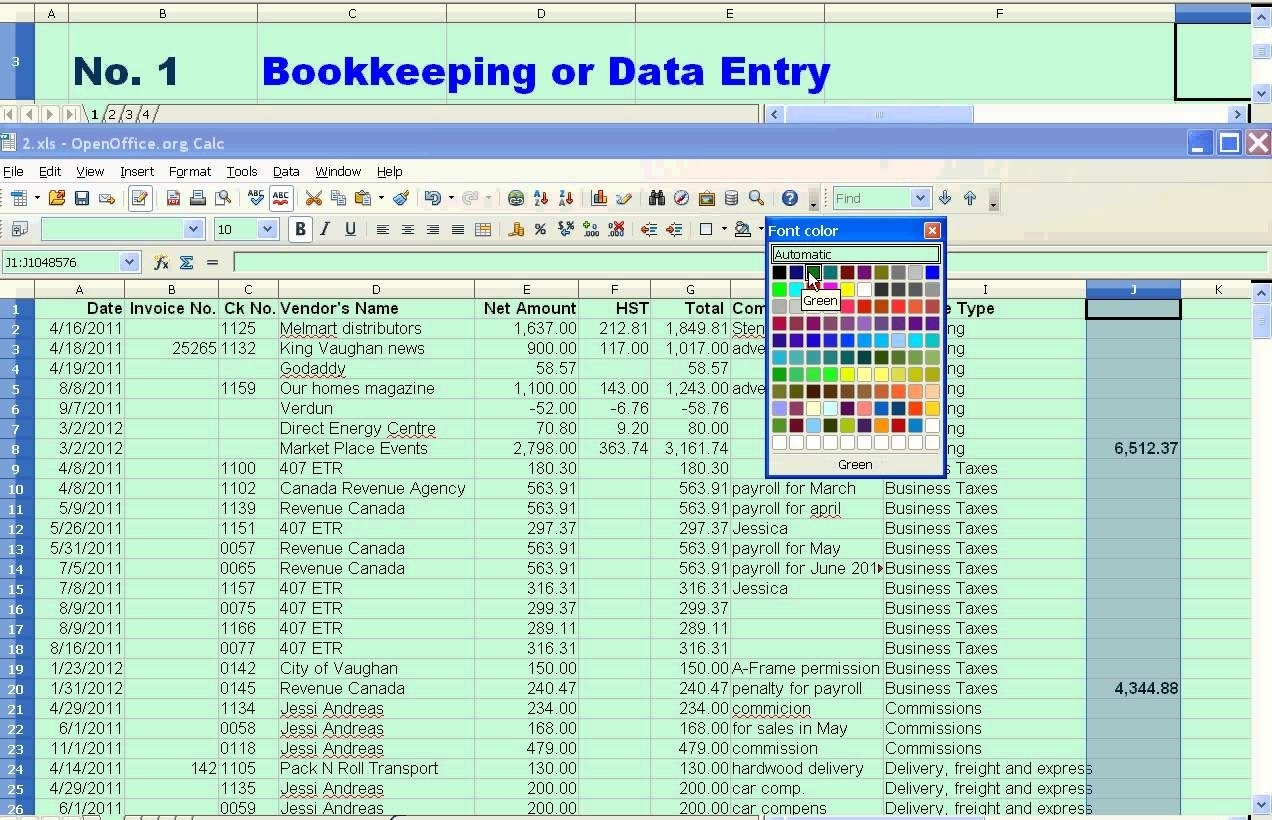

The shift towards online accounting software represents a significant departure from traditional desktop-based solutions and manual bookkeeping practices.

Cloud-based platforms offer numerous advantages, including real-time data access, automated data entry, enhanced security, and seamless integration with other business applications. This accessibility is particularly impactful for small businesses with limited resources.

According to a recent report by Research and Markets, the global cloud accounting market is projected to reach $12.3 billion by 2027, growing at a CAGR of 11.2% from 2020. The growth shows a global trend toward increased adoption.

Key Features and Benefits

Online accounting software typically includes a range of features designed to simplify financial management. These features are helpful for any small business owner.

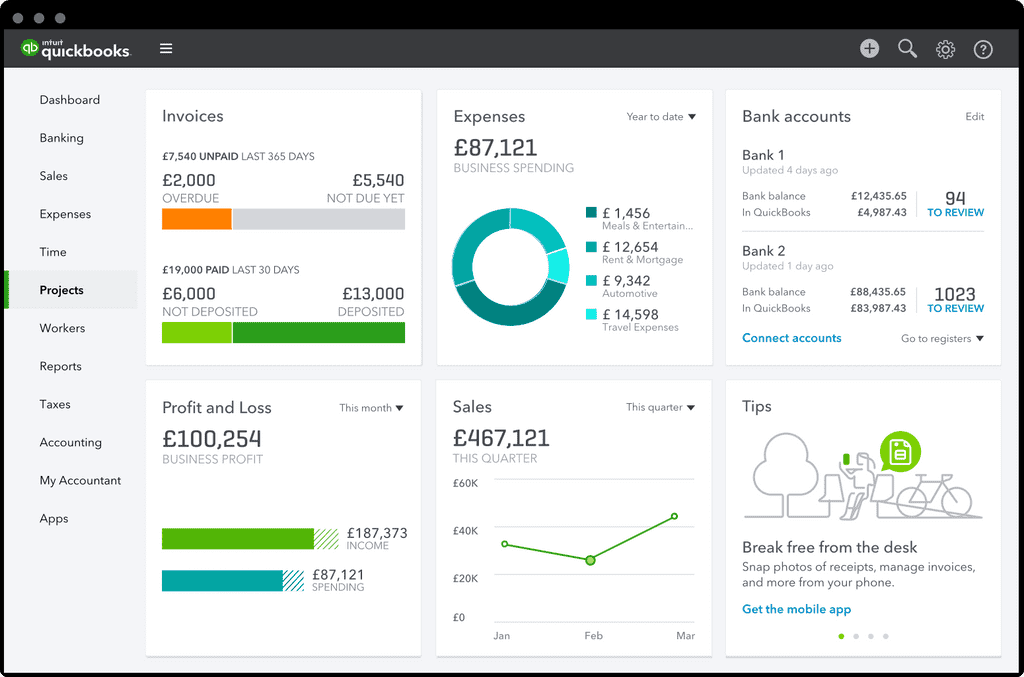

These functionalities often encompass invoice creation, expense tracking, bank reconciliation, financial reporting, payroll management, and inventory control. Automation is also a crucial component.

By automating routine tasks, such as invoice generation and bank reconciliation, small business owners can free up valuable time to focus on strategic decision-making and core business activities. This is essential for growth.

Furthermore, the ability to generate real-time financial reports provides valuable insights into a company's performance, allowing for proactive adjustments and informed business strategies.

Integration with other business tools, such as CRM systems and e-commerce platforms, further streamlines operations and eliminates data silos. This allows for a more holistic view of the business.

Choosing the Right Software

With a plethora of online accounting software options available, selecting the right solution can be a daunting task for small business owners.

Factors to consider include the size and complexity of the business, the specific features required, the budget available, and the level of technical support offered.

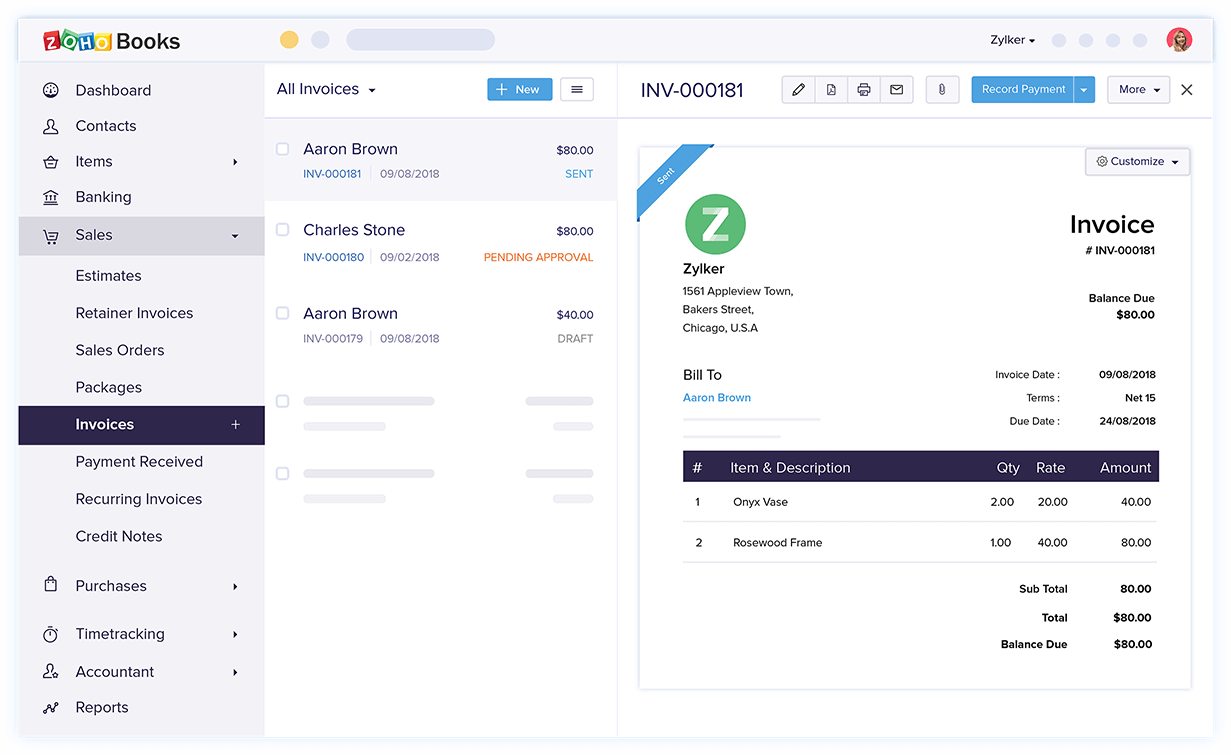

Popular options include QuickBooks Online, Xero, FreshBooks, and Zoho Books, each offering a unique set of features and pricing plans. There are various plans to consider.

It is crucial to conduct thorough research, read reviews, and take advantage of free trials before committing to a particular software package. Proper research can save money in the long run.

Impact on Small Businesses

The widespread adoption of online accounting software is having a profound impact on the small business sector.

By improving financial visibility, streamlining operations, and automating routine tasks, these tools are empowering small business owners to make better decisions, improve profitability, and ultimately, achieve sustainable growth.

Moreover, the accessibility of these platforms is leveling the playing field, allowing smaller businesses to compete more effectively with larger enterprises. Technology can empower businesses of all sizes.

Sarah Miller, owner of a local bakery, shared her experience: "Switching to an online accounting system was a game-changer for my business. I can now track my expenses, send invoices, and manage my cash flow from anywhere, at any time."

This improved efficiency has allowed her to focus on baking and expanding her product line, leading to a significant increase in revenue. Success story is a great example of how it can help a business.

Security Considerations

While online accounting software offers numerous benefits, it is essential to address the security concerns associated with storing sensitive financial data in the cloud.

Reputable software providers employ robust security measures, including encryption, multi-factor authentication, and regular security audits, to protect user data from unauthorized access.

However, it is also crucial for small business owners to implement their own security best practices, such as using strong passwords, keeping software up to date, and educating employees about phishing scams. This can help keep data safe.

The Future of Small Business Accounting

The future of small business accounting is undoubtedly digital. Expect to see more innovation in this space.

As technology continues to evolve, we can expect to see further advancements in online accounting software, including the integration of artificial intelligence and machine learning, that will help small business owners automate even more tasks and gain deeper insights into their financial data.

This trend will likely lead to greater efficiency, improved profitability, and increased competitiveness for small businesses in the years to come. Small businesses will need to adapt.