Tax Yields Profit System Reviews Consumer Reports

Imagine a sunny Saturday morning. You're sipping coffee, the scent of freshly cut grass drifts in from the open window, and a sense of calm washes over you. But wait, a nagging thought interrupts the peace: taxes. This year, though, instead of dread, there’s a glimmer of optimism, fueled by whispers of higher tax yields potentially lining the pockets of savvy consumers through innovative profit systems.

This article dives into the complex world of tax yields and profit systems, exploring how they are reviewed by consumer reports and examining their potential impact on your financial well-being. We'll unpack the key concepts, dissect the reviews, and equip you with the knowledge to navigate this evolving landscape confidently.

Understanding Tax Yields and Profit Systems

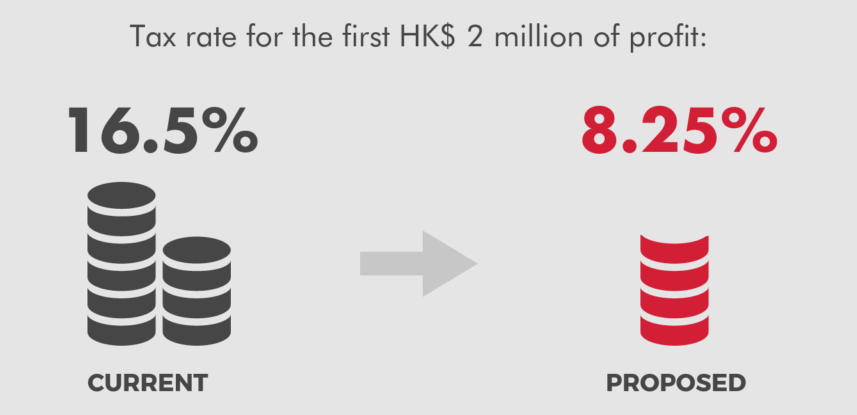

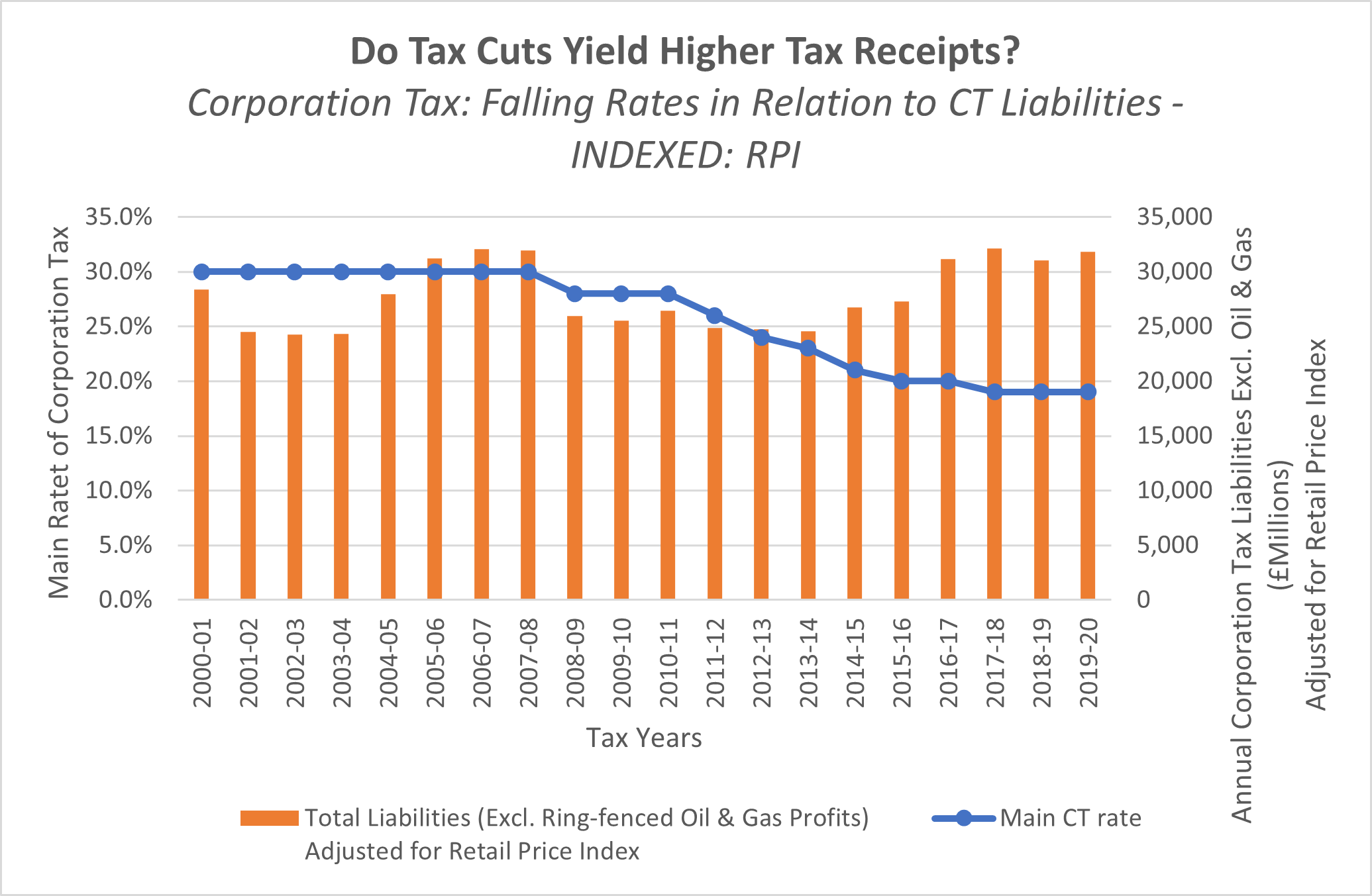

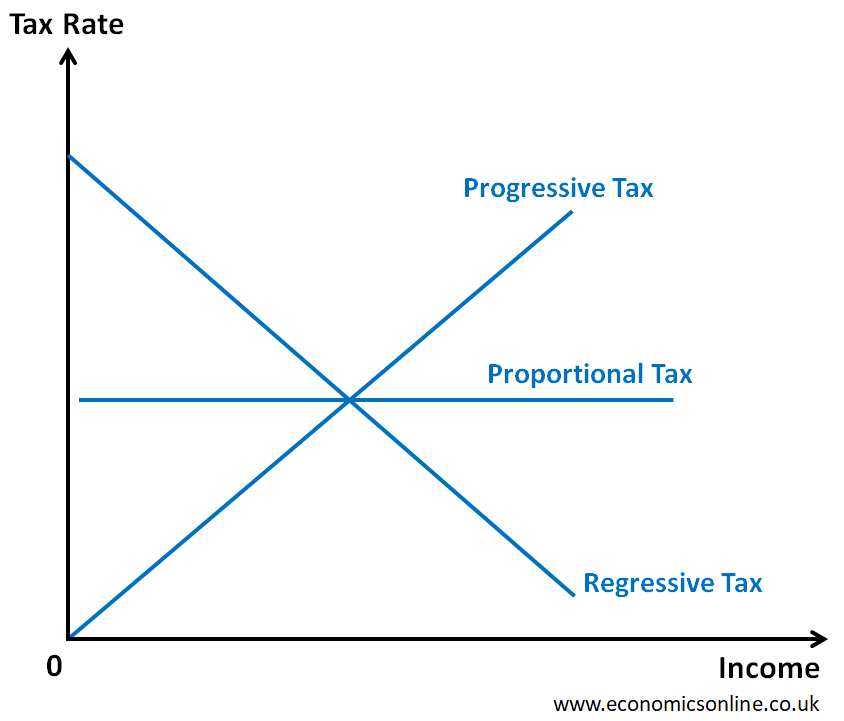

Tax yield, at its core, is the revenue generated from taxes as a percentage of a particular base, such as GDP or personal income. A higher tax yield can signal a more efficient tax system, increased economic activity, or, conversely, higher tax burdens.

Profit systems, in this context, refer to strategies and investment vehicles designed to leverage tax benefits and increase overall returns. These can range from traditional investments like municipal bonds, which offer tax-exempt interest, to more complex strategies involving real estate, small business ownership, and specialized trusts.

The rise of these systems is driven by a desire for individuals and businesses to minimize their tax liabilities while maximizing their wealth. The complexity of tax laws, coupled with the ever-changing economic climate, has created a fertile ground for these sophisticated strategies.

The Role of Consumer Reports

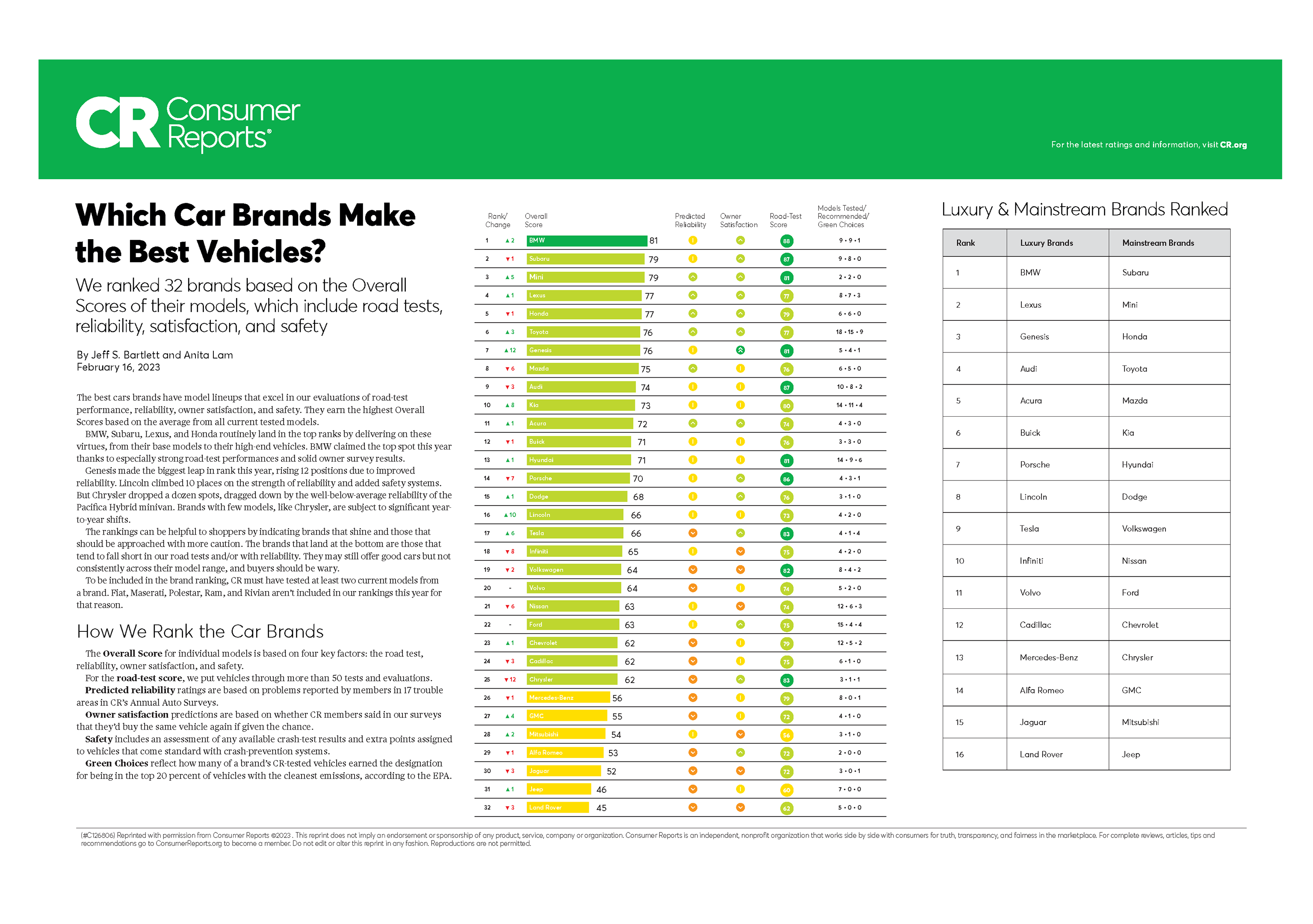

Enter Consumer Reports. Known for its independent and unbiased assessments, this organization plays a vital role in evaluating the effectiveness and safety of various products and services, including those related to finance.

When it comes to tax yields and profit systems, Consumer Reports scrutinizes several key aspects. They assess the transparency of the system, the associated risks, the potential returns, and the overall suitability for different consumer profiles.

Their methodology typically involves a combination of expert analysis, data analysis, and real-world testing. They might compare the performance of different profit systems over time, evaluate the impact of various tax policies, and solicit feedback from consumers who have used these systems.

Digging Deeper: Key Areas of Review

Transparency and Disclosure: Consumer Reports places a high premium on transparency. They investigate whether the profit system clearly discloses all associated fees, risks, and potential conflicts of interest. A system that obscures important details or uses overly complex language raises red flags.

Risk Assessment: Every investment carries risk, and profit systems are no exception. Consumer Reports analyzes the potential downside of each system, considering factors like market volatility, regulatory changes, and the possibility of unexpected tax liabilities. They aim to help consumers understand the trade-off between potential returns and potential losses.

Return on Investment (ROI): Obviously, the ultimate goal of any profit system is to generate a positive return. Consumer Reports examines the historical performance of different systems, taking into account factors like inflation, taxes, and opportunity cost. They also assess the system's potential for future growth, considering the current economic climate and any anticipated changes in tax policy.

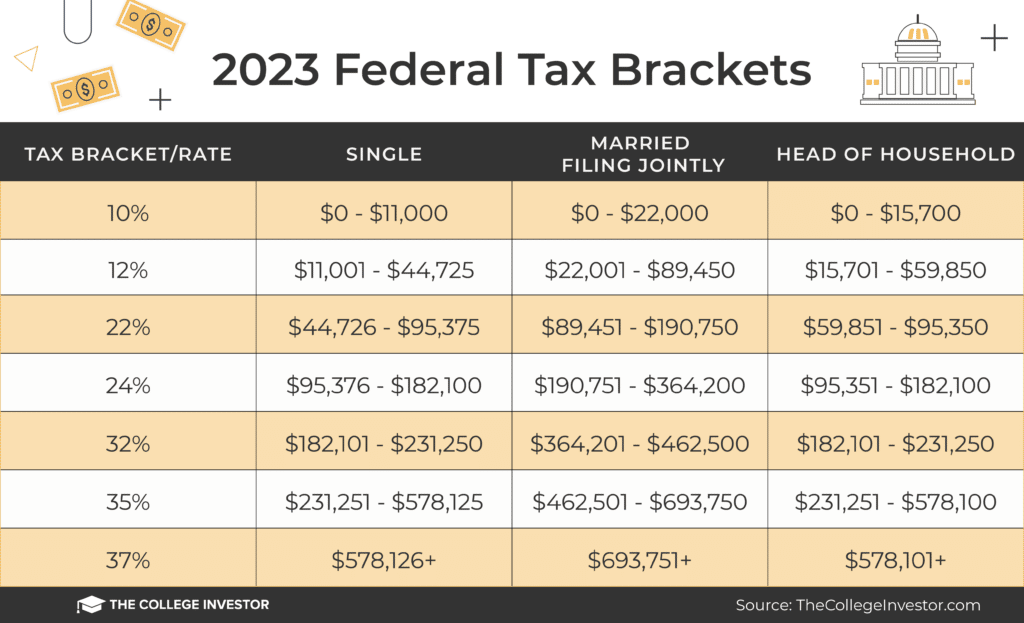

Suitability: Not all profit systems are created equal, and what works for one person may not work for another. Consumer Reports considers the suitability of different systems for various consumer profiles, taking into account factors like age, income, risk tolerance, and financial goals. They might recommend certain systems for retirees seeking stable income, while suggesting others for younger investors with a higher risk appetite.

For example, a high-yield municipal bond fund might be well-suited for a retiree in a high tax bracket, offering tax-exempt income and relatively low risk. On the other hand, a more aggressive real estate investment trust (REIT) might be more appealing to a younger investor willing to take on more risk in exchange for potentially higher returns.

Real-World Examples and Case Studies

Let's consider a hypothetical example. A small business owner invests in a qualified retirement plan, such as a 401(k) or SEP IRA, to reduce their taxable income and save for retirement. Consumer Reports might analyze the different types of plans available, compare their fees and investment options, and assess their overall suitability for small business owners with varying income levels and risk tolerances.

Another example could involve a family considering purchasing a rental property as an investment. Consumer Reports might evaluate the potential rental income, property taxes, maintenance costs, and depreciation benefits associated with owning a rental property. They might also analyze the local real estate market and assess the potential for appreciation.

These case studies illustrate the importance of conducting thorough research and seeking professional advice before investing in any profit system. Consumer Reports can serve as a valuable resource in this process, providing unbiased information and helping consumers make informed decisions.

Navigating the Landscape: Tips for Consumers

Do Your Research: Don't rely solely on marketing materials or testimonials. Read independent reviews, consult with financial advisors, and thoroughly understand the risks and potential rewards of any profit system before investing.

Understand Your Risk Tolerance: Are you comfortable with the possibility of losing money? Or do you prefer a more conservative approach? Choose a profit system that aligns with your risk tolerance and financial goals.

Seek Professional Advice: A qualified financial advisor can help you assess your financial situation, understand your tax liabilities, and choose a profit system that is appropriate for your needs. They can also provide ongoing guidance and support as your financial circumstances change.

Be Wary of Guarantees: No investment is guaranteed to generate a profit. Be skeptical of any system that promises unrealistic returns or guarantees against losses. These are often signs of fraud or high-risk investments.

Diversify Your Investments: Don't put all your eggs in one basket. Diversifying your investments across different asset classes can help reduce your overall risk and improve your long-term returns.

The Future of Tax Yields and Profit Systems

The landscape of tax yields and profit systems is constantly evolving. New tax laws, technological advancements, and changing economic conditions are all shaping the future of this industry. As such, constant vigilance and education are needed.

The rise of fintech and automated investment platforms is making it easier for consumers to access sophisticated profit systems. However, it's important to remember that these platforms are not a substitute for professional advice. Consumers should still conduct thorough research and understand the risks involved before investing.

It is likely that Consumer Reports and similar organizations will continue to play a crucial role in evaluating these systems and providing consumers with the information they need to make informed decisions. Their independent and unbiased assessments will be essential in navigating the complexities of the modern financial landscape.

In conclusion, navigating the world of tax yields and profit systems requires a combination of knowledge, diligence, and sound judgment. By understanding the key concepts, reading independent reviews, and seeking professional advice, you can increase your chances of making informed decisions and achieving your financial goals. The promise of higher tax yields and innovative profit systems is enticing. With proper insight and careful planning, you may indeed transform those fleeting moments of financial peace into a long-lasting reality.