Small Business Accounting Softwares

The lifeline of countless local economies, small businesses often operate on tight margins, juggling multiple roles and responsibilities. Effective financial management, therefore, is not just an advantage but a necessity for survival and growth. In today’s digital age, small business accounting software has emerged as a powerful tool, promising to simplify bookkeeping, automate tasks, and provide critical financial insights.

At its core, accounting software for small businesses aims to streamline financial processes, ensuring accurate record-keeping and enabling informed decision-making. This technology, ranging from basic bookkeeping solutions to comprehensive enterprise resource planning (ERP) systems, is increasingly vital. The challenge for small business owners lies in navigating the diverse landscape of available options, identifying the software that best suits their specific needs and budget.

The Rise of Cloud-Based Solutions

One of the most significant trends in small business accounting is the shift towards cloud-based software. According to a recent report by Grand View Research, the global cloud accounting market is projected to reach $6.1 billion by 2028, driven by factors such as cost-effectiveness, accessibility, and enhanced security. These platforms allow business owners to access their financial data from anywhere with an internet connection, fostering collaboration with accountants and advisors in real-time.

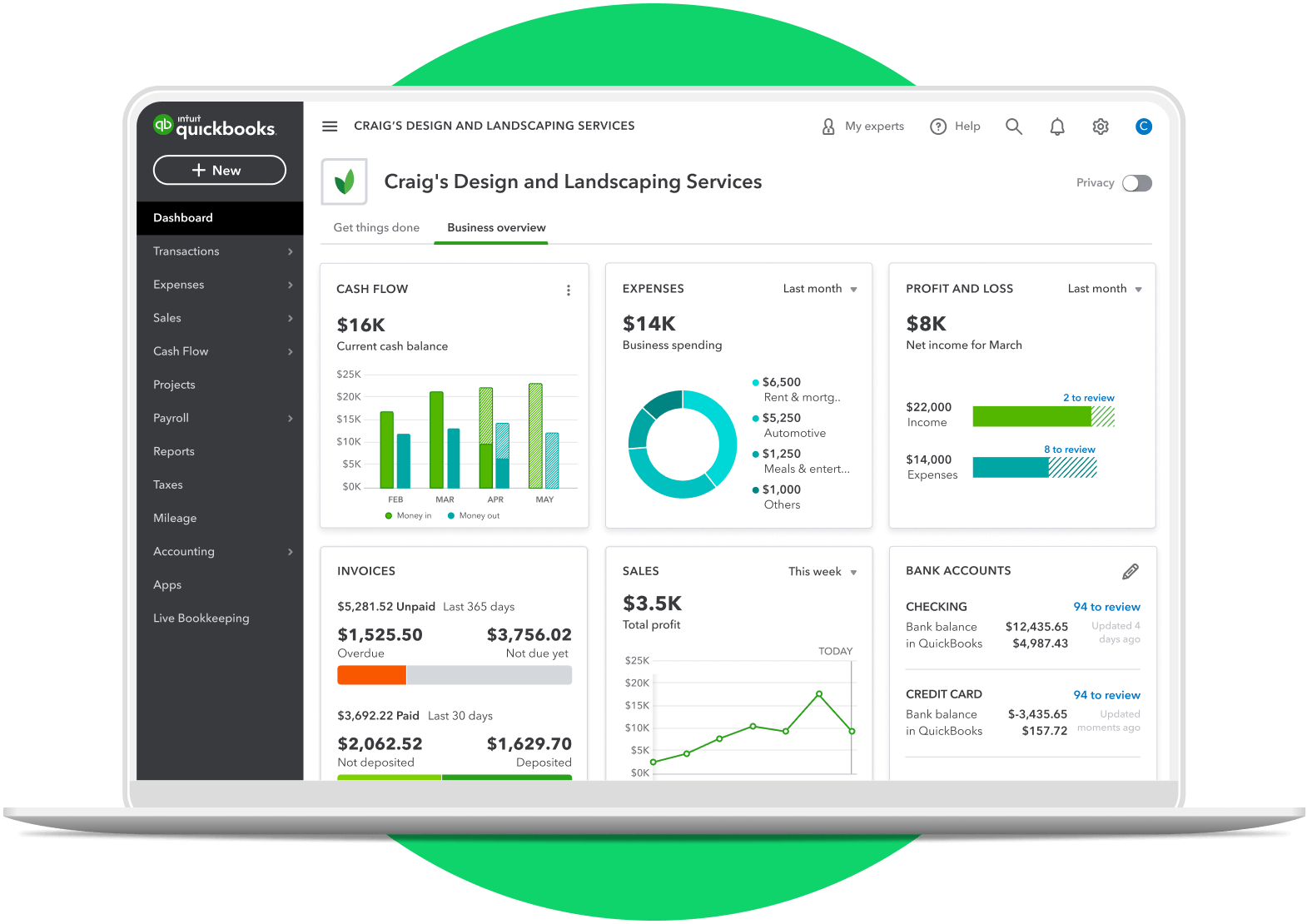

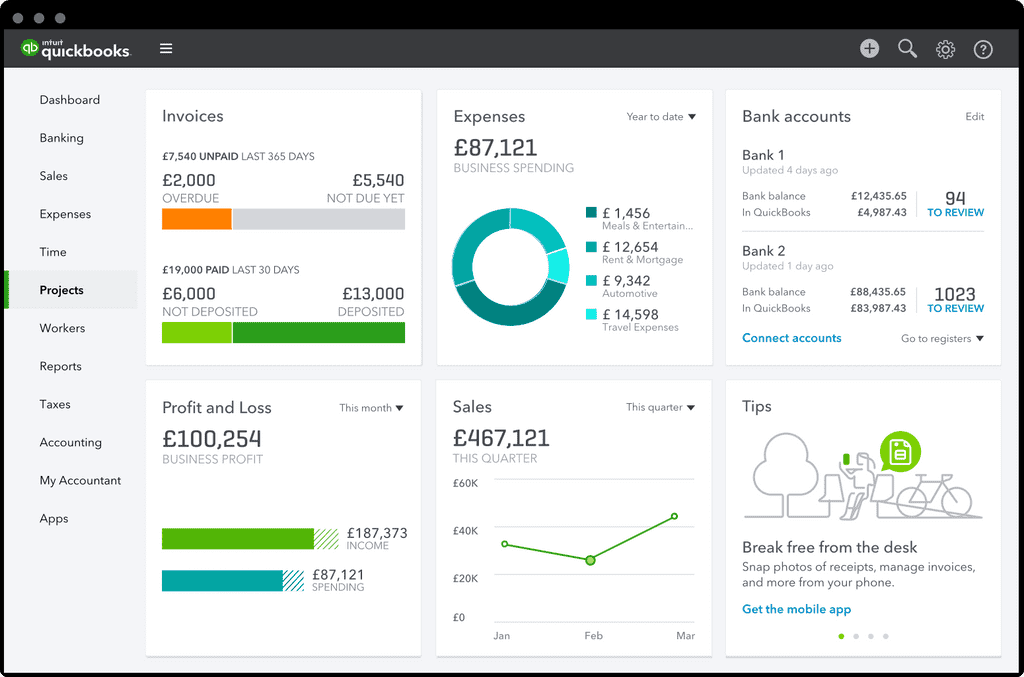

Furthermore, cloud solutions often offer automatic backups and updates, reducing the risk of data loss and eliminating the need for manual software maintenance. Xero and QuickBooks Online are two leading examples of cloud-based accounting software widely adopted by small businesses. These platforms provide features such as invoicing, expense tracking, bank reconciliation, and financial reporting.

Key Features and Functionality

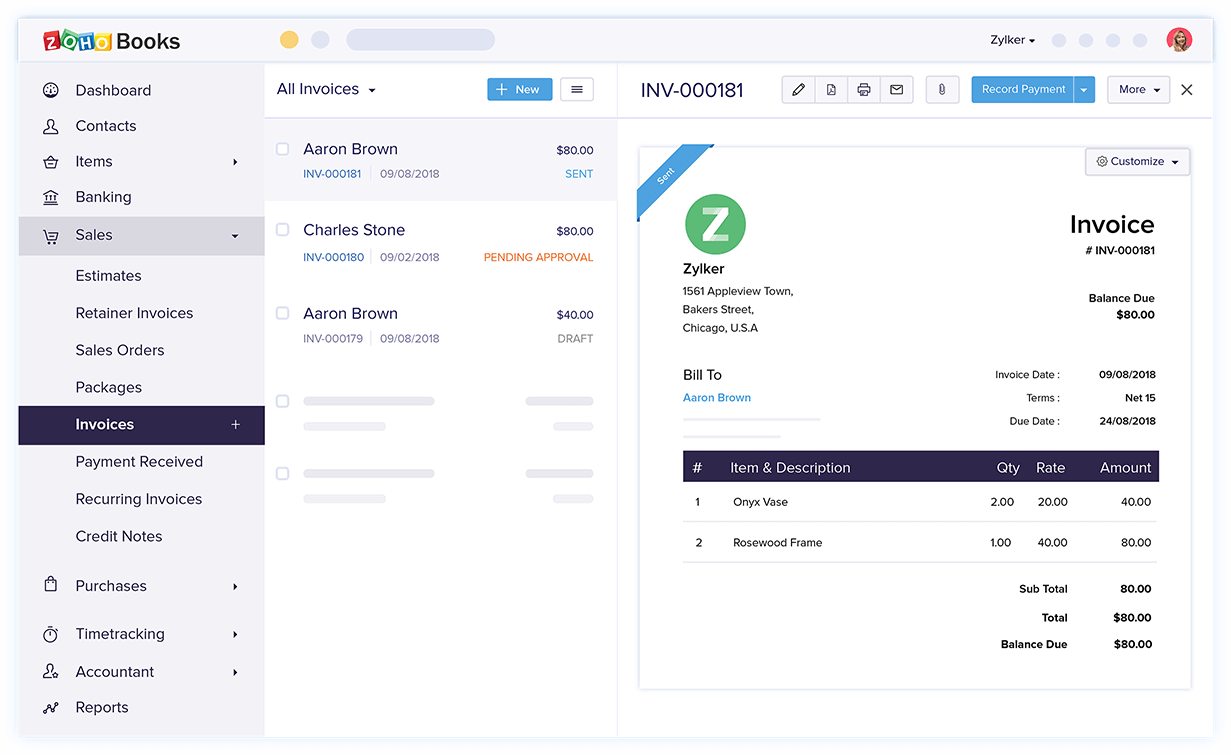

The functionality offered by small business accounting software varies depending on the specific product and pricing tier. However, several key features are essential for most businesses. Invoicing is a cornerstone, allowing businesses to create and send professional invoices, track payments, and manage overdue accounts.

Expense tracking enables businesses to monitor their spending, categorize expenses, and prepare for tax season. Bank reconciliation automates the process of matching bank statements with internal records, ensuring accuracy and identifying discrepancies. Financial reporting capabilities provide insights into a business's financial performance, enabling owners to make informed decisions about pricing, budgeting, and investment.

The Impact of Automation

Automation is a major benefit of using accounting software. Repetitive tasks, such as data entry and invoice generation, can be automated, freeing up time for business owners to focus on core operations and strategic planning. Artificial intelligence (AI) and machine learning (ML) are increasingly being integrated into these platforms, further enhancing automation capabilities.

AI-powered features can automatically categorize transactions, detect fraudulent activity, and provide personalized financial insights. This reduces the risk of human error and improves efficiency, leading to cost savings and better financial management. A survey by Intuit found that small businesses using accounting software reported a significant reduction in time spent on bookkeeping tasks.

Challenges and Considerations

While accounting software offers numerous advantages, small businesses may face certain challenges when adopting these solutions. The initial setup and implementation can be time-consuming, requiring data migration and employee training. Cost is another consideration, as subscription fees can vary depending on the features and number of users required.

Data security is also a concern, particularly with cloud-based solutions. Businesses must ensure that their chosen software provider has robust security measures in place to protect sensitive financial data. Integration with other business systems, such as CRM and e-commerce platforms, is crucial for streamlining workflows and avoiding data silos.

Future Trends and Innovations

The future of small business accounting software is likely to be shaped by several key trends. Increased integration with other business applications will create seamless workflows and enhanced data visibility. Blockchain technology may be used to improve the security and transparency of financial transactions.

Mobile accounting apps will become even more sophisticated, allowing business owners to manage their finances on the go. Ultimately, the goal is to empower small businesses with the tools and insights they need to thrive in an increasingly competitive marketplace. By embracing these technological advancements, small businesses can unlock new levels of efficiency, profitability, and growth.