Wells Fargo Bank High Yield Savings Account

Imagine a sun-drenched morning, the aroma of freshly brewed coffee filling the air. You check your bank account, and instead of the usual incremental growth, you see a noticeably larger balance. That little spark of financial optimism, fueled by a high-yield savings account, can brighten anyone's day.

For those seeking a safe haven for their savings that also offers competitive returns, the Wells Fargo High Yield Savings Account presents a compelling option. While not always leading the pack in interest rates, it provides the backing of a major financial institution and a suite of features that cater to a broad range of savers.

A Look at Wells Fargo's High Yield Offering

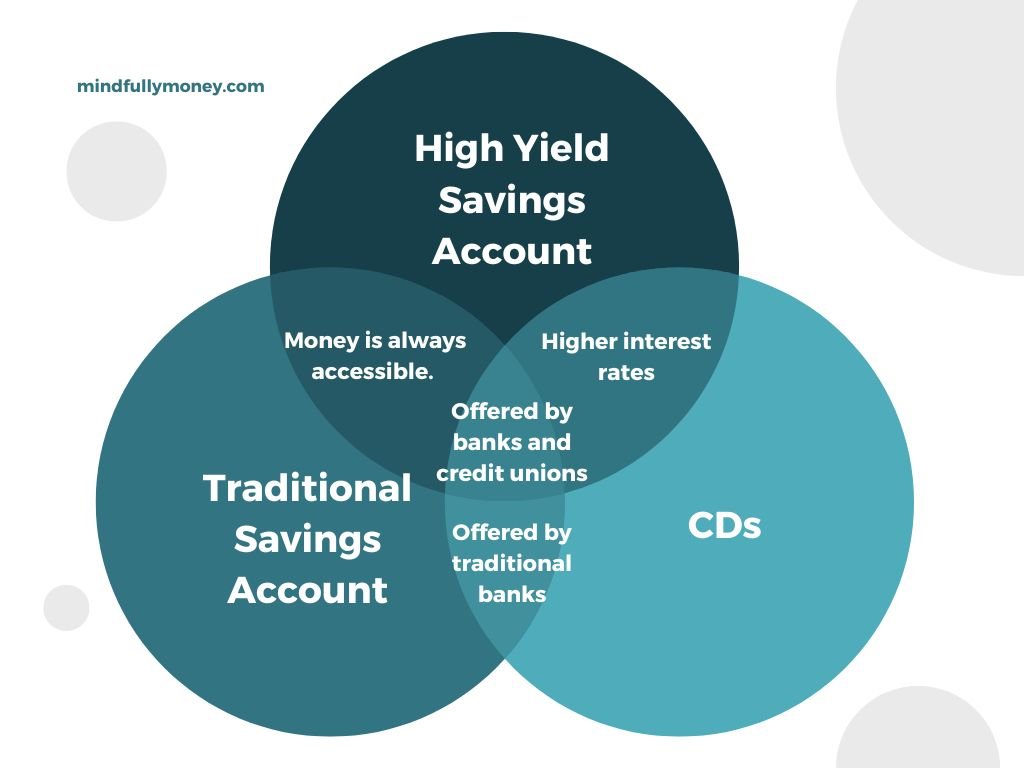

Wells Fargo, a name synonymous with American banking, offers its High Yield Savings Account as a way for customers to maximize their savings potential. This account distinguishes itself from traditional savings accounts by offering a significantly higher annual percentage yield (APY).

The specific APY offered on the Wells Fargo High Yield Savings Account fluctuates based on market conditions. Potential customers should check the latest rates on the Wells Fargo website or by visiting a local branch to ensure they have the most up-to-date information before making any decisions.

Benefits Beyond the Rate

While the APY is a primary draw, the Wells Fargo High Yield Savings Account also offers several other benefits. As a customer of Wells Fargo, you gain access to their extensive network of branches and ATMs, providing convenient access to your funds.

This accessibility is a crucial advantage for those who prefer in-person banking or require occasional cash withdrawals. Additionally, the account integrates seamlessly with Wells Fargo's online and mobile banking platforms, allowing you to manage your finances from anywhere, at any time.

Furthermore, the Wells Fargo High Yield Savings Account is FDIC-insured, up to the standard maximum deposit insurance amount. This provides peace of mind, knowing that your deposits are protected by the full faith and credit of the United States government.

Weighing the Considerations

Before opening a Wells Fargo High Yield Savings Account, it's essential to consider a few factors. While the higher APY is attractive, it's crucial to compare it against other high-yield savings accounts offered by different banks and credit unions.

Some institutions may offer slightly higher rates, particularly online-only banks with lower overhead costs. It's also wise to evaluate any potential fees associated with the account. Wells Fargo does charge monthly fees, however there is a way to avoid it.

For example, to avoid the monthly service fee of $5, the account must maintain a $500 minimum daily balance. It's important to ensure that you can consistently meet these requirements to avoid incurring unnecessary charges.

The Significance of High-Yield Savings

High-yield savings accounts play a crucial role in personal finance by allowing individuals to grow their savings faster than traditional accounts. Over time, the power of compound interest can significantly increase your savings balance, helping you reach your financial goals sooner.

Whether it's saving for a down payment on a house, building an emergency fund, or simply planning for the future, a high-yield savings account can be a valuable tool. The Wells Fargo High Yield Savings Account offers a reliable option from a well-established institution.

Moreover, the account can act as a strong foundation for other savings objectives, such as 529 plans or retirement funds. The benefits of this are significant, as the larger one's financial foundation is, the higher one can climb.

As we navigate an ever-changing economic landscape, the need for smart financial planning has never been greater. The Wells Fargo High Yield Savings Account, with its blend of competitive rates, accessibility, and security, provides a solid starting point for those looking to make their money work harder.

![Wells Fargo Bank High Yield Savings Account [Expired] [Targeted] Wells Fargo $500 Savings Account Bonus - Doctor Of](https://www.doctorofcredit.com/wp-content/uploads/2019/07/wells-fargo-500-1.jpg)