Small Business Booking Keeping Software

For small business owners juggling multiple roles, managing finances often becomes a daunting task. Efficient bookkeeping is crucial for survival, and a growing market of software solutions promises to simplify this process. This article explores the evolving landscape of small business bookkeeping software, highlighting key features, trends, and potential impacts on business operations.

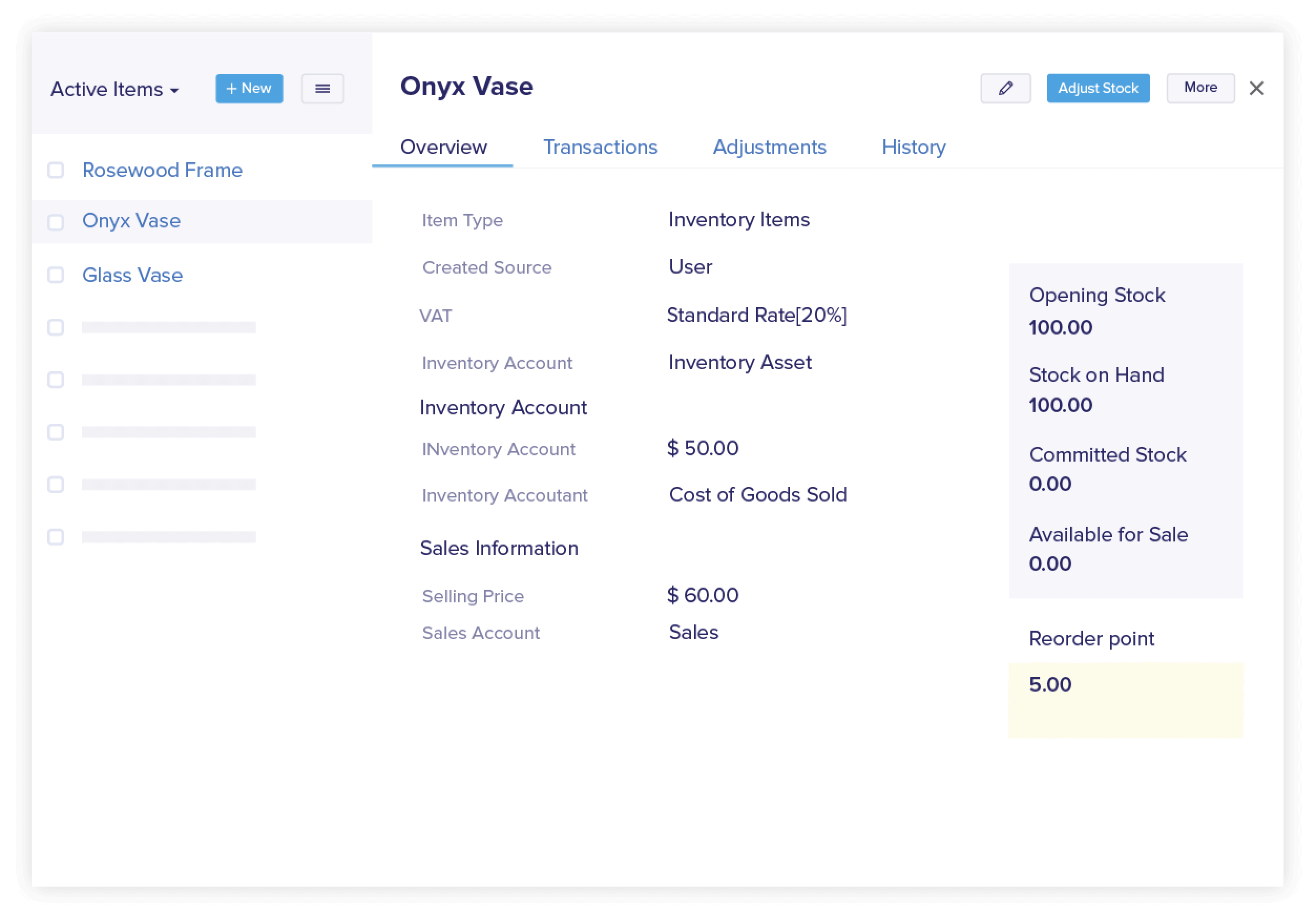

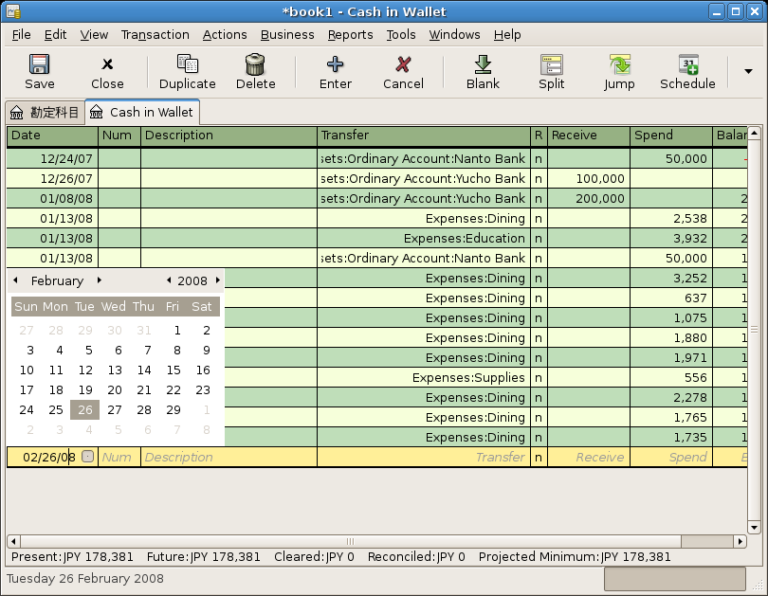

Small business bookkeeping software is experiencing significant growth, driven by the increasing need for efficient financial management and compliance. These platforms offer features like invoice generation, expense tracking, bank reconciliation, and financial reporting. They aim to provide small business owners with real-time insights into their financial health.

Key Features and Trends

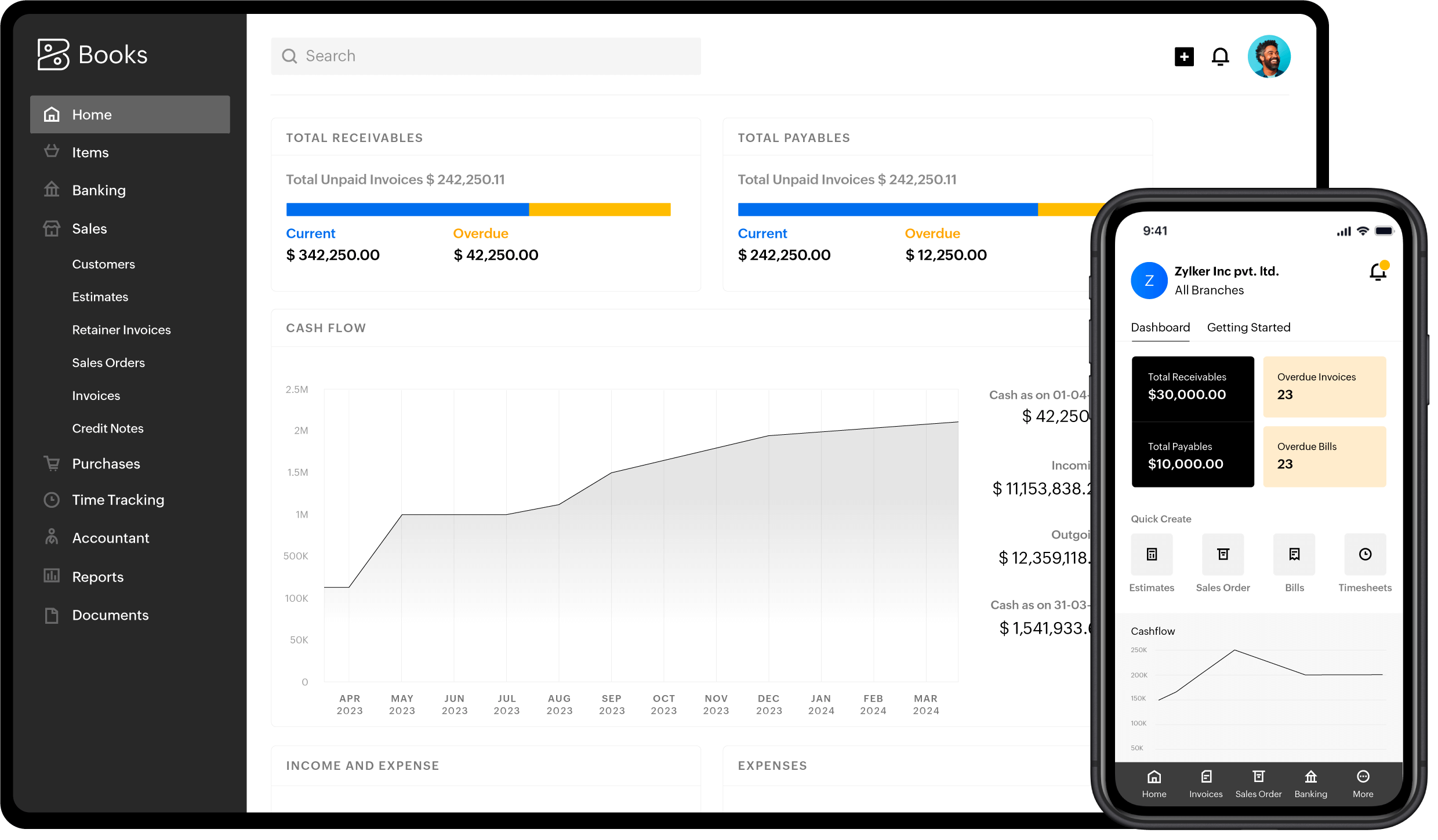

Cloud-based solutions are becoming increasingly popular, allowing businesses to access their financial data from anywhere with an internet connection. This offers greater flexibility and collaboration among team members. Integration with other business tools, such as payment processors and CRM systems, is another key trend.

Many platforms now offer mobile apps, enabling users to manage their finances on the go. Artificial intelligence (AI) and machine learning (ML) are also being integrated to automate tasks like categorizing transactions and identifying potential fraud.

Popular Software Options

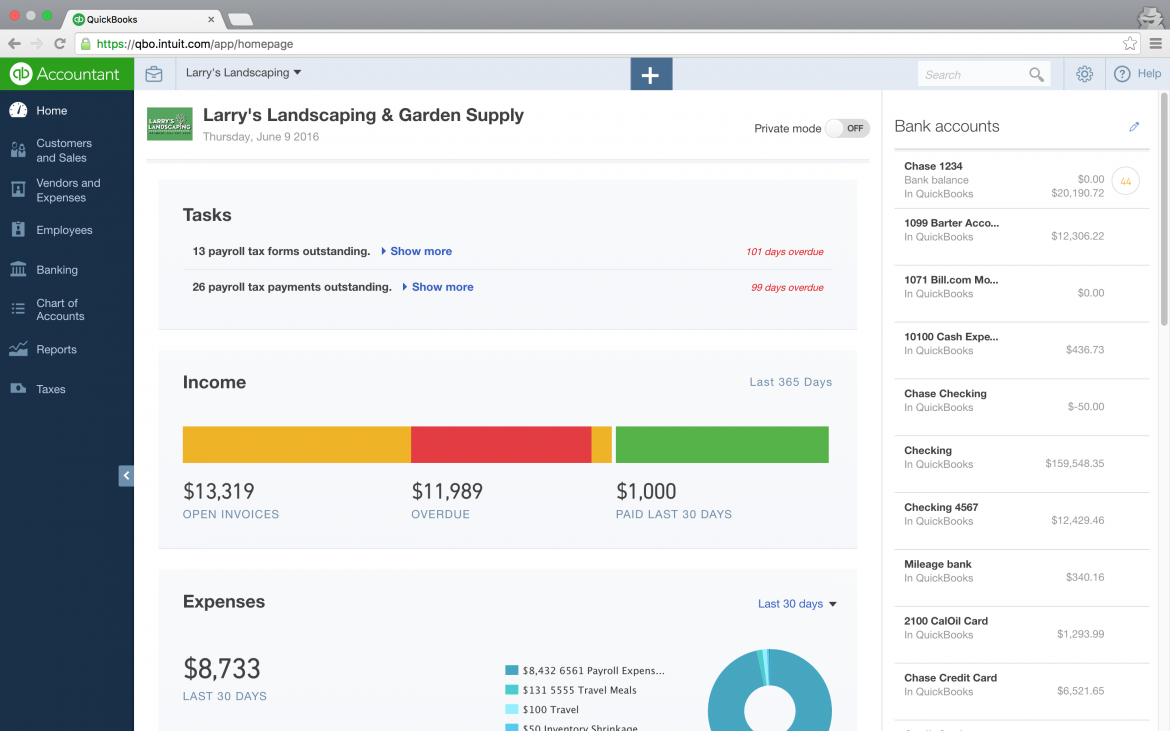

Several players dominate the market, each offering different features and pricing plans. QuickBooks Online remains a popular choice, known for its comprehensive features and extensive ecosystem of add-ons. Xero is another leading platform, praised for its user-friendly interface and strong integration capabilities.

Other notable options include Zoho Books, FreshBooks (particularly suited for freelancers), and Wave Accounting, which offers a free version with limited features. Choosing the right software depends on the specific needs and budget of the business.

Impact on Small Businesses

The adoption of bookkeeping software can significantly improve efficiency and accuracy in financial management. Automation reduces the risk of human error and saves valuable time. This allows business owners to focus on other critical aspects of their operations, such as marketing and customer service.

Improved financial visibility enables better decision-making. Real-time reports provide insights into cash flow, profitability, and other key metrics. According to a recent study by Gartner, businesses that utilize cloud-based accounting software experience a 20% increase in efficiency.

Challenges and Considerations

While bookkeeping software offers numerous benefits, there are also challenges to consider. Data security is a primary concern, and businesses must choose platforms with robust security measures. Implementation can also be time-consuming, requiring training and data migration.

Cost is another factor, as subscription fees can add up over time. It is crucial to carefully evaluate different pricing plans and features to find the most cost-effective solution. Some businesses may also require the assistance of a professional accountant or bookkeeper to set up and manage their software effectively.

The Small Business Administration (SBA) offers resources and guidance to help small businesses navigate the world of bookkeeping software. They emphasize the importance of choosing a solution that aligns with the business's specific needs and industry regulations.

Human-Interest Angle

Sarah Miller, owner of a local bakery, shares her experience with bookkeeping software. "Before, I spent hours each week manually tracking expenses and invoices," she says. "Since switching to a cloud-based solution, I've been able to automate many of those tasks.

I now have more time to focus on creating new recipes and engaging with my customers,"Miller adds.

The software has not only saved her time but has also provided valuable insights into her business's profitability. This allows her to make informed decisions about pricing and inventory management.

In conclusion, small business bookkeeping software is transforming the way businesses manage their finances. By automating tasks, improving accuracy, and providing real-time insights, these platforms empower business owners to make better decisions and achieve greater success. While challenges exist, the benefits of adopting bookkeeping software are undeniable, making it an essential tool for modern small businesses.