Small Home Business Accounting Software

Small home businesses face accounting hurdles, but affordable software solutions are changing the game. Streamlined bookkeeping is now within reach, levelling the playing field.

This article provides a concise overview of the top accounting software options tailored for small home businesses, helping entrepreneurs make informed decisions and simplify their finances.

Essential Features to Look For

When choosing accounting software, consider features like invoicing, expense tracking, and bank reconciliation.

Reporting capabilities, such as profit and loss statements and balance sheets, are also crucial.

Integration with other business tools, like payment processors (e.g., PayPal, Stripe) and e-commerce platforms (e.g., Shopify), is a major plus.

Top Software Options for Home Businesses

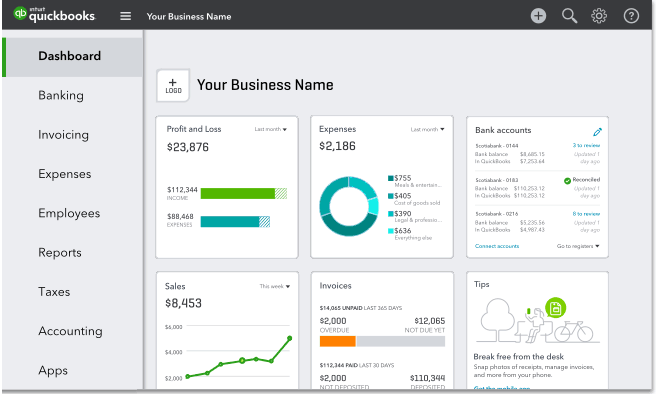

QuickBooks Self-Employed

Designed specifically for freelancers and independent contractors, QuickBooks Self-Employed simplifies tax preparation.

It automatically tracks income and expenses, estimates quarterly taxes, and helps identify deductible business expenses.

Its integration with TurboTax streamlines the tax filing process.

Xero

Xero is a cloud-based accounting platform ideal for small businesses with more complex accounting needs.

It offers features like inventory management, project tracking, and multi-currency support.

Its robust reporting capabilities provide valuable insights into business performance. According to 2023 data, businesses using cloud-based accounting solutions reported a 15% increase in financial efficiency.

FreshBooks

Known for its user-friendly interface and strong invoicing features, FreshBooks is popular among service-based businesses.

It allows users to create professional-looking invoices, track time, and manage projects.

Automated payment reminders help ensure timely payments from clients.

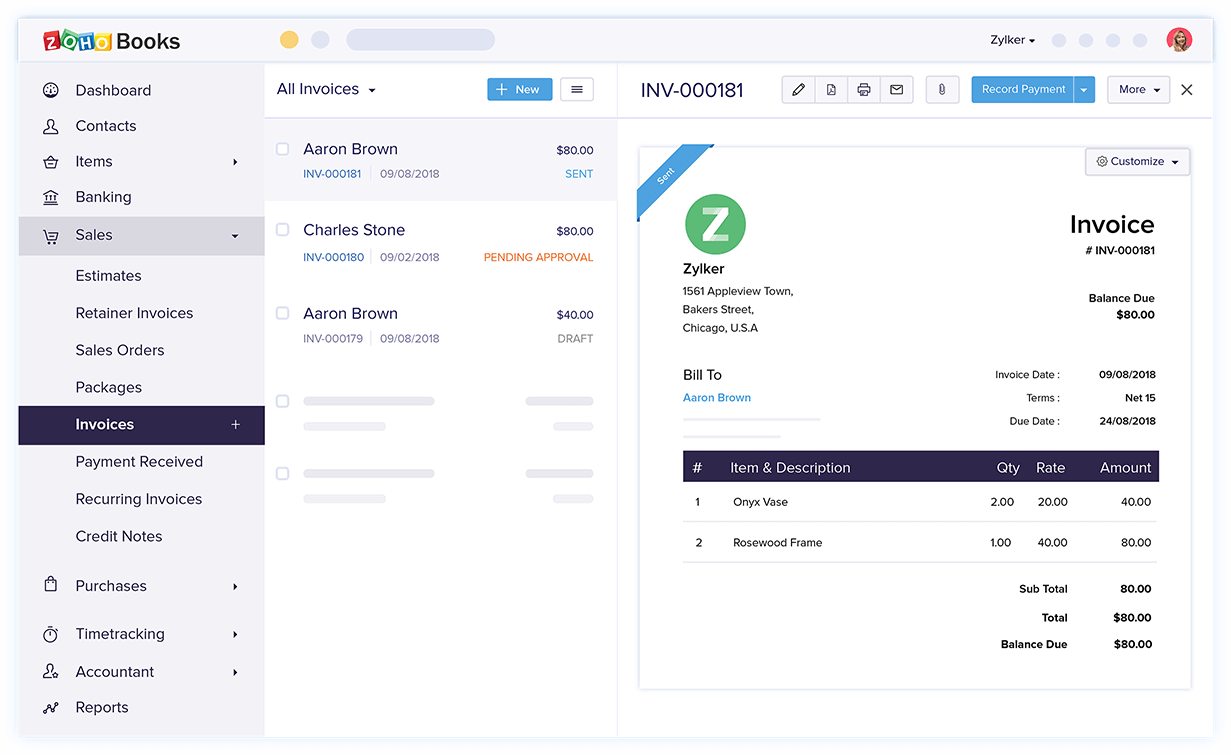

Zoho Books

Part of the Zoho suite of business applications, Zoho Books offers comprehensive accounting features at a competitive price.

It includes features like invoicing, expense tracking, inventory management, and reporting.

Its integration with other Zoho apps, such as Zoho CRM, provides a seamless business management solution.

Wave Accounting

Wave Accounting offers free accounting software for small businesses, making it an attractive option for startups on a tight budget.

Its free version includes invoicing, expense tracking, and basic reporting.

However, payroll and payment processing features require paid add-ons.

Choosing the Right Software

The best software depends on the specific needs and budget of the home business.

Consider the features that are most important and compare pricing plans.

Many software providers offer free trials, allowing users to test the software before committing to a subscription.

Security Considerations

With the rise of cyber threats, security is more critical than ever.

Ensure the chosen software offers robust security measures, including data encryption and multi-factor authentication.

Regularly back up your accounting data to prevent data loss.

Next Steps for Small Business Owners

Entrepreneurs should research and compare different software options to find the best fit for their business.

Take advantage of free trials to test the software's features and usability.

Implementing a robust accounting system is a vital step toward financial success. Consult with a CPA, certified personal accountant, if needed.