Software To Manage Small Business Finances

Small businesses are facing a critical need for efficient financial management tools. New software solutions are emerging to address these challenges head-on, promising to streamline operations and improve profitability.

This surge in financial technology aims to empower small business owners by providing user-friendly platforms for accounting, budgeting, and forecasting, offering a significant advantage in today's competitive market.

The Growing Need for Financial Management Software

According to a recent report by Intuit, nearly 60% of small businesses struggle with cash flow management. These challenges often stem from outdated accounting practices or a lack of understanding of financial data.

Financial management software addresses this need by automating tasks such as invoicing, expense tracking, and bank reconciliation.

This automation frees up valuable time for business owners to focus on strategic growth initiatives, ultimately leading to improved efficiency and profitability.

Key Features and Benefits

Modern software solutions offer a range of features tailored to the specific needs of small businesses.

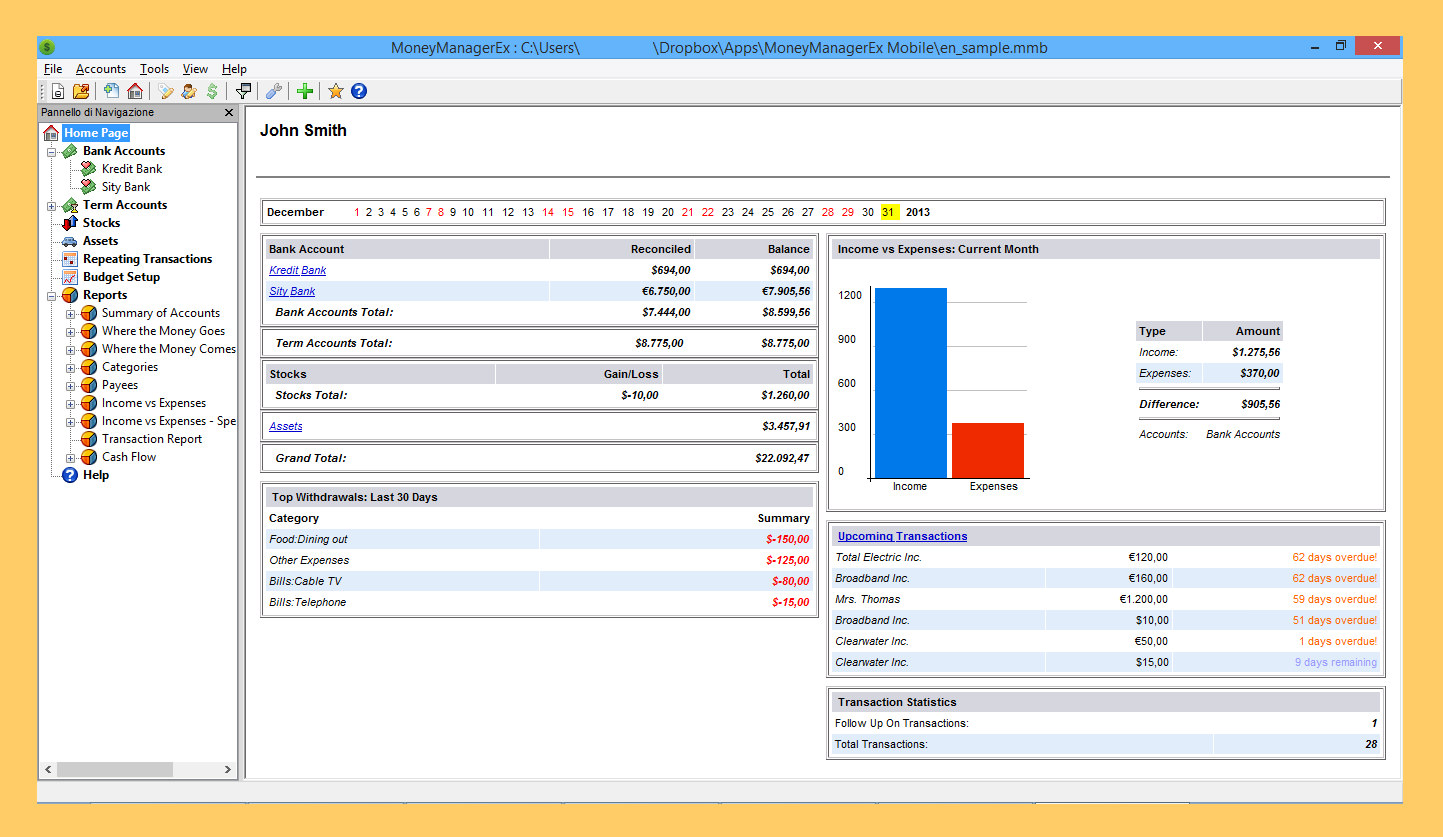

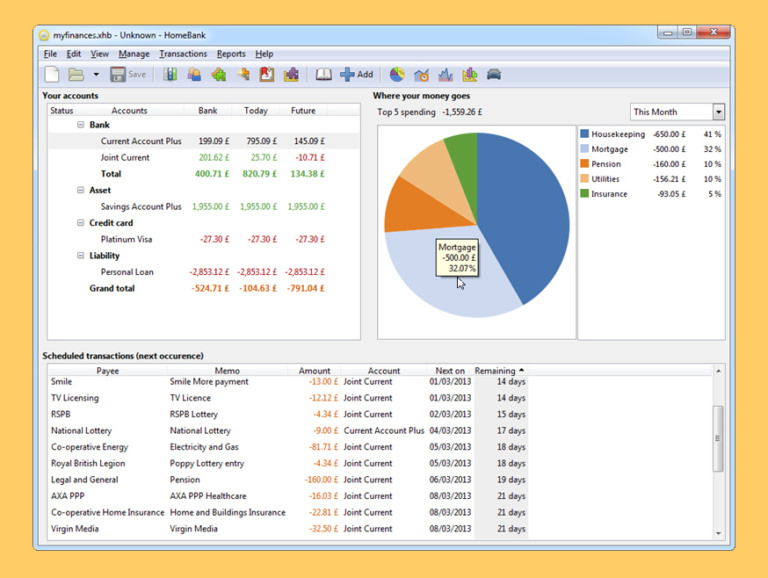

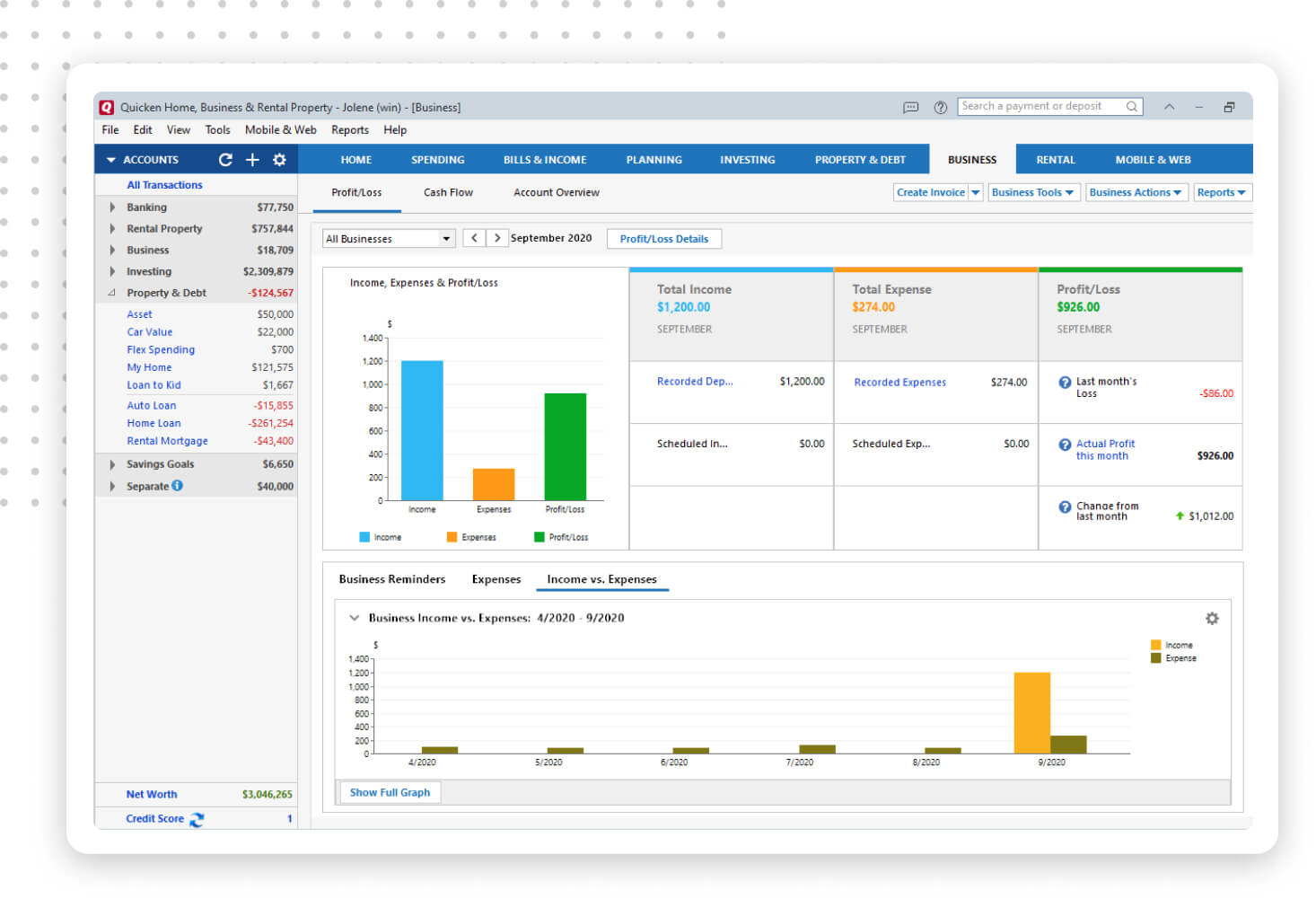

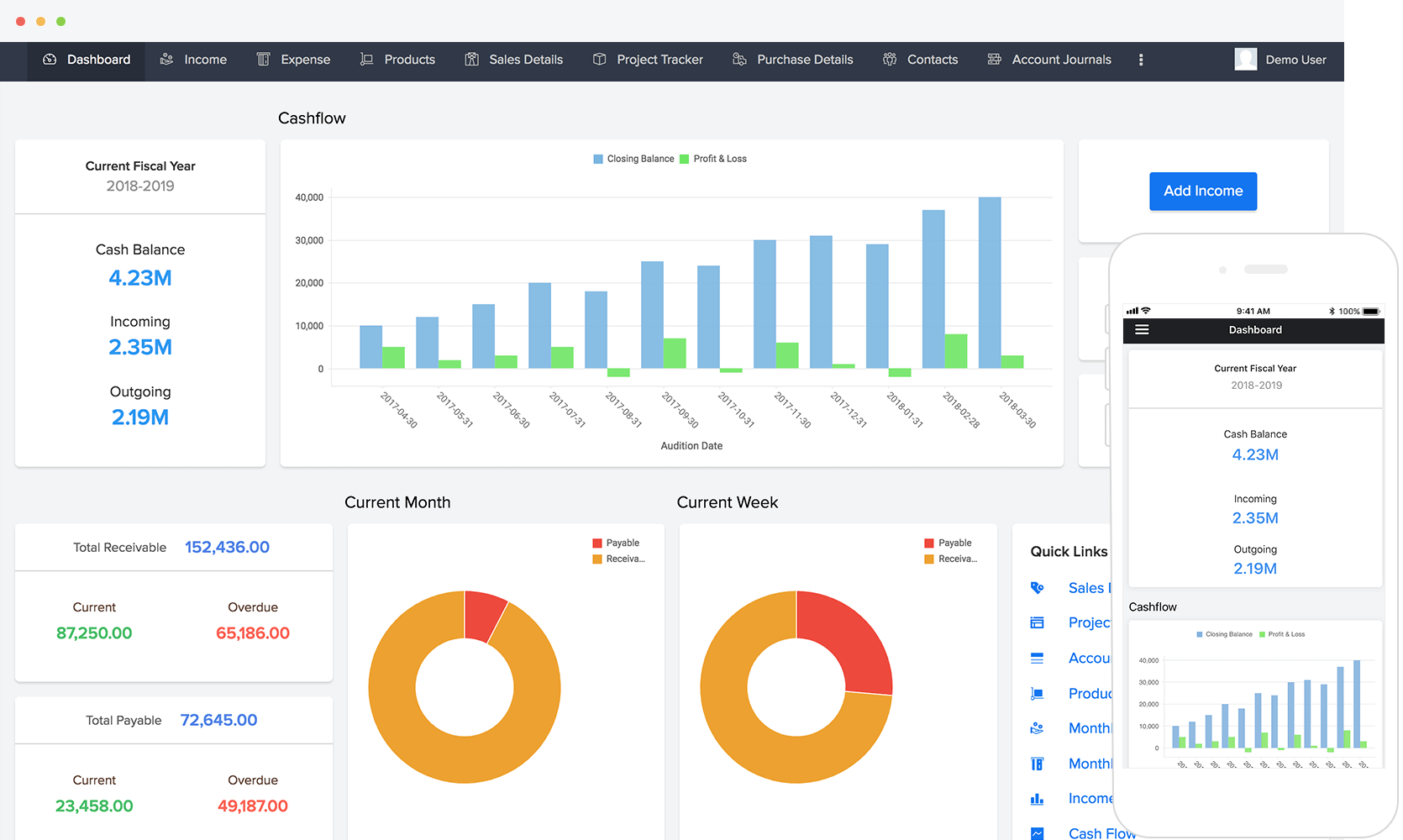

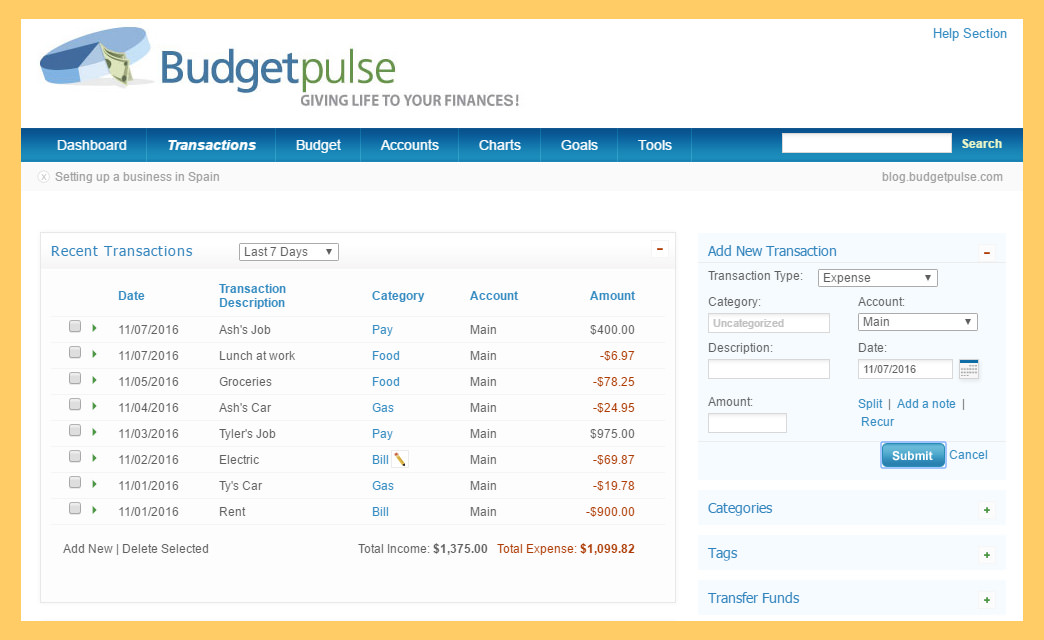

These features include: Real-time financial reporting, automated invoicing and payment reminders, budgeting and forecasting tools, and seamless integration with existing banking and payment systems. Cloud-based accessibility is also a major benefit, allowing business owners to manage their finances from anywhere, at any time.

Furthermore, many platforms offer scalable pricing models, ensuring that businesses only pay for the features they need.

Popular Software Options

Several software providers are leading the charge in this rapidly evolving market. Some of the popular choices are:

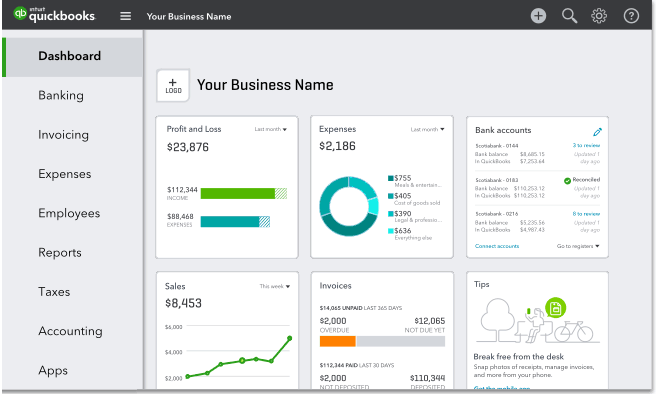

QuickBooks Online

QuickBooks Online remains a dominant player, known for its comprehensive features and user-friendly interface.

It caters to a wide range of industries and offers various subscription tiers to accommodate different business sizes and needs.

Xero

Xero is another strong contender, praised for its intuitive design and strong integration capabilities.

It emphasizes collaboration and offers features such as multi-currency support, making it a suitable option for businesses with international operations.

Zoho Books

Zoho Books provides a cost-effective solution with a focus on simplicity and ease of use.

It's well-integrated within the Zoho ecosystem, making it a seamless choice for businesses already using other Zoho applications.

Implementation and Training

While the benefits of financial management software are clear, successful implementation requires careful planning and training. Businesses should invest time in selecting the right software based on their specific needs and budget. Many software providers offer training resources and support to help users get up to speed quickly.

Consider attending webinars, reading tutorials, and utilizing customer support channels to maximize the value of the software.

Looking Ahead

The adoption of financial management software is expected to continue its upward trajectory as more small businesses recognize the need for improved efficiency and financial control. Ongoing developments include: Increased use of artificial intelligence (AI) to automate tasks and provide predictive insights, Enhanced cybersecurity measures to protect sensitive financial data, and Improved integration with other business applications, such as CRM and e-commerce platforms.

Small businesses should carefully evaluate their options and implement a solution that aligns with their unique needs to unlock greater financial stability and growth.