State Of Delaware Certificate Of Amendment

Delaware businesses face a critical deadline as changes to company charters require immediate action. Failure to comply with new amendment procedures could jeopardize corporate standing.

This article provides a concise guide to navigating the State of Delaware Certificate of Amendment process, ensuring businesses maintain compliance and avoid potential penalties.

Understanding the Urgency

The State of Delaware, a popular jurisdiction for incorporation, demands strict adherence to its corporate laws. Amendments to a company's certificate of incorporation are a routine, yet vital, aspect of corporate governance.

Recent changes have streamlined the amendment process, but also introduced a tighter framework for compliance. Missing deadlines or incomplete filings can result in significant repercussions.

What is a Certificate of Amendment?

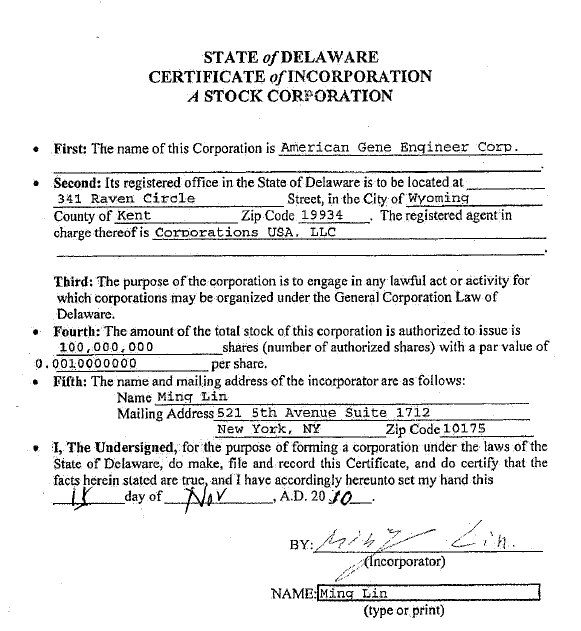

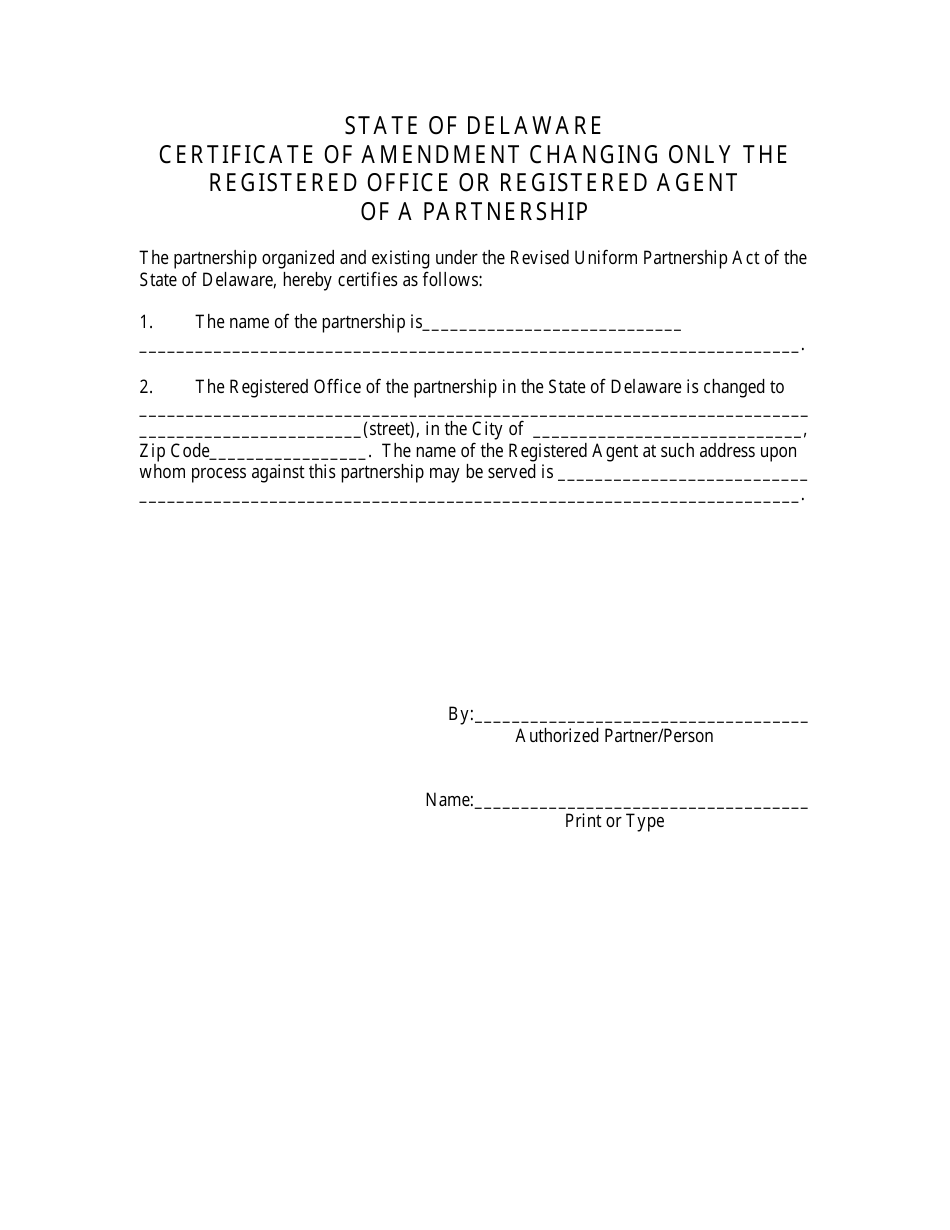

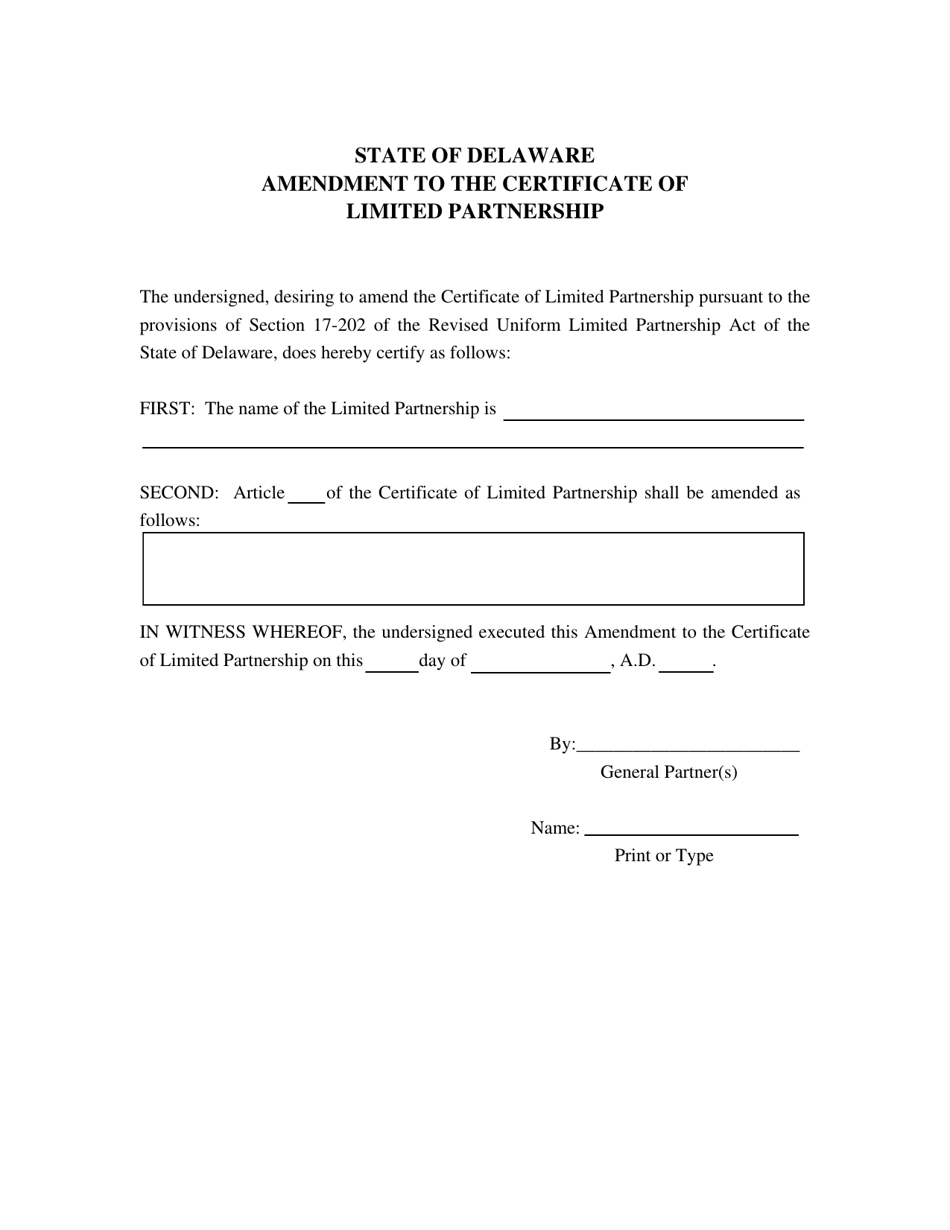

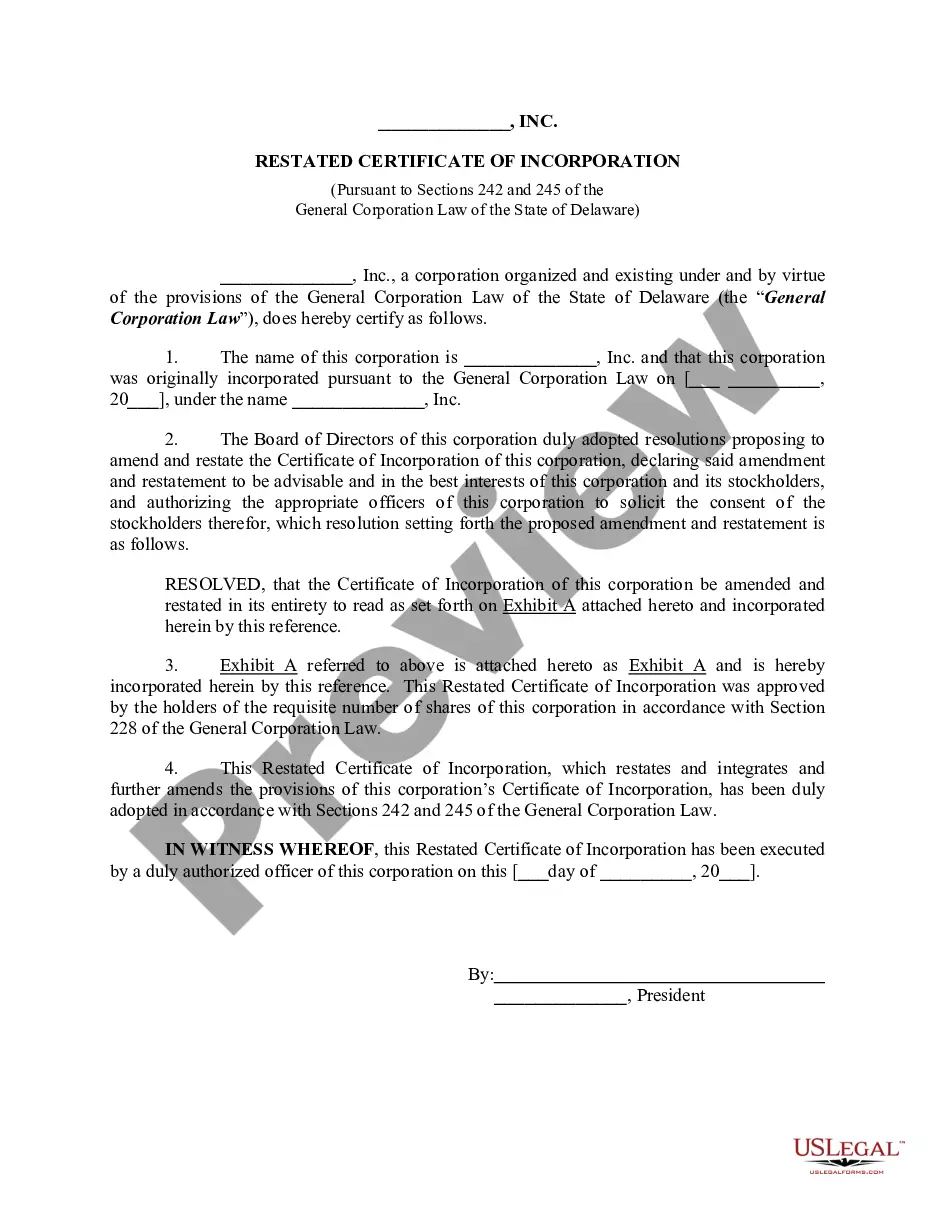

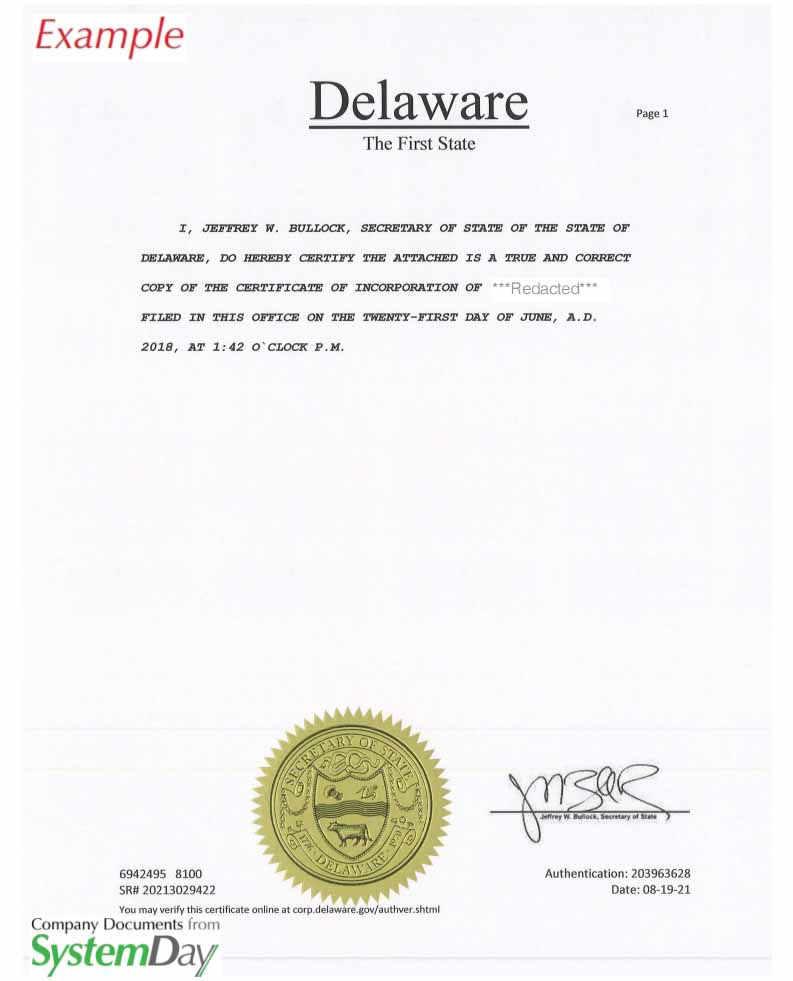

A Certificate of Amendment is a legal document filed with the Delaware Secretary of State. It formally alters a Delaware corporation's original certificate of incorporation.

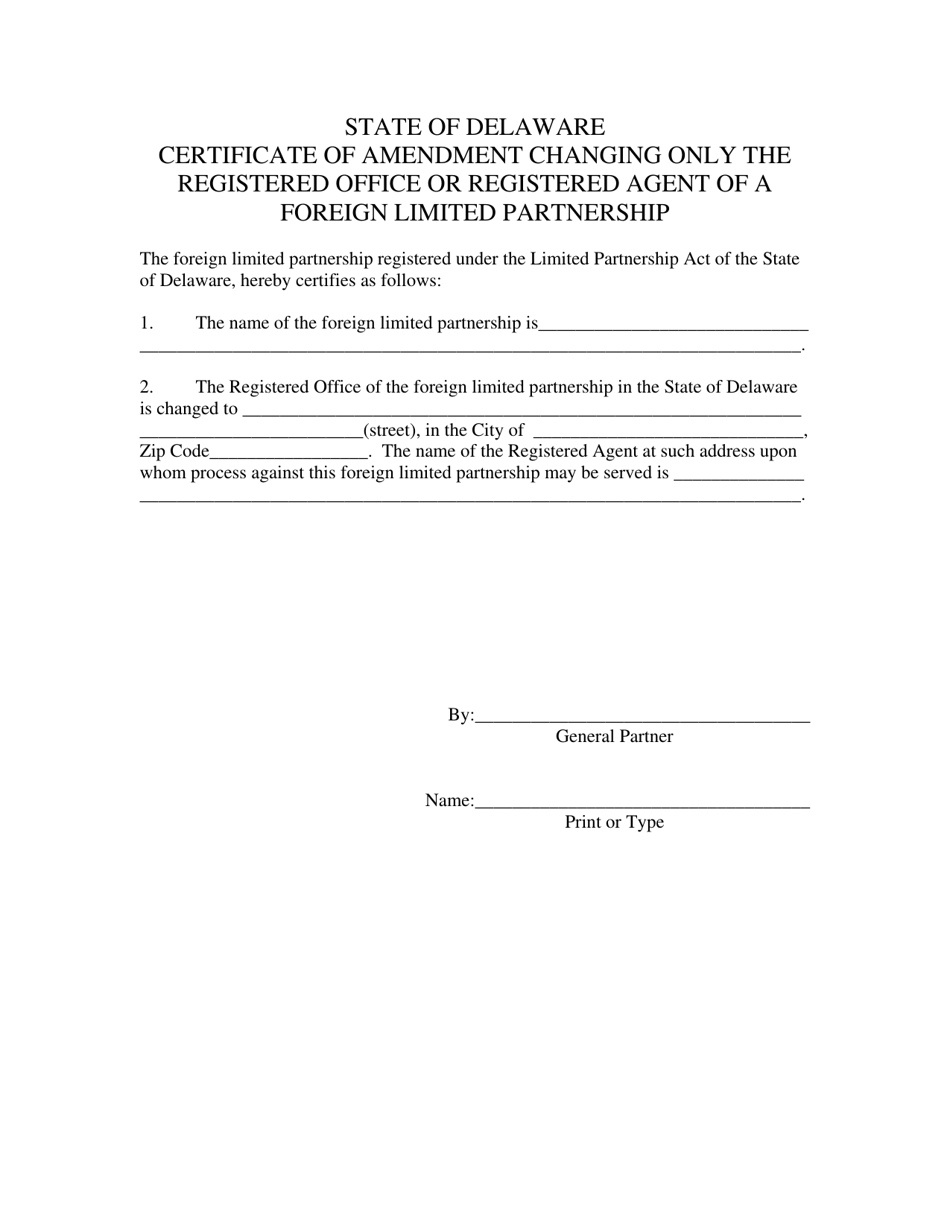

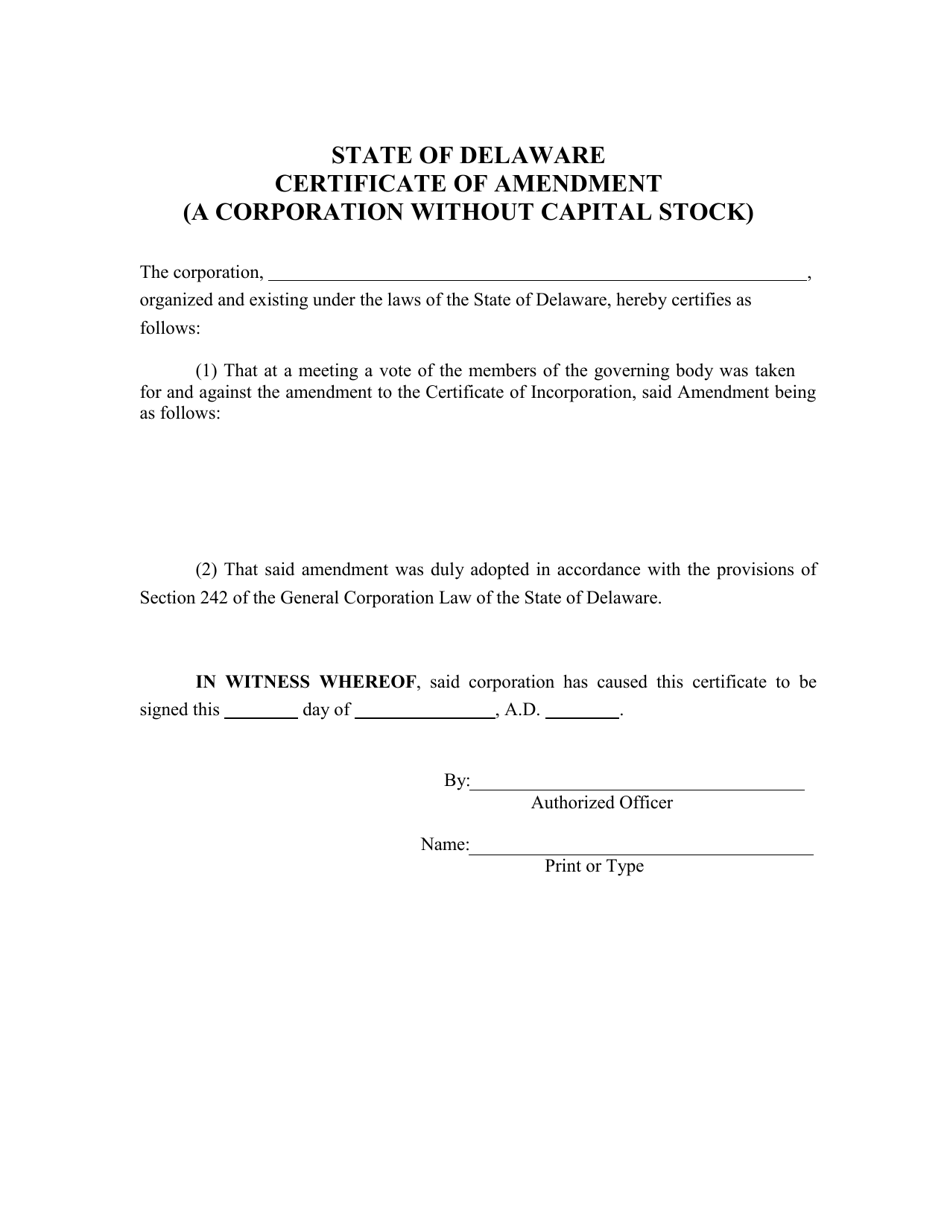

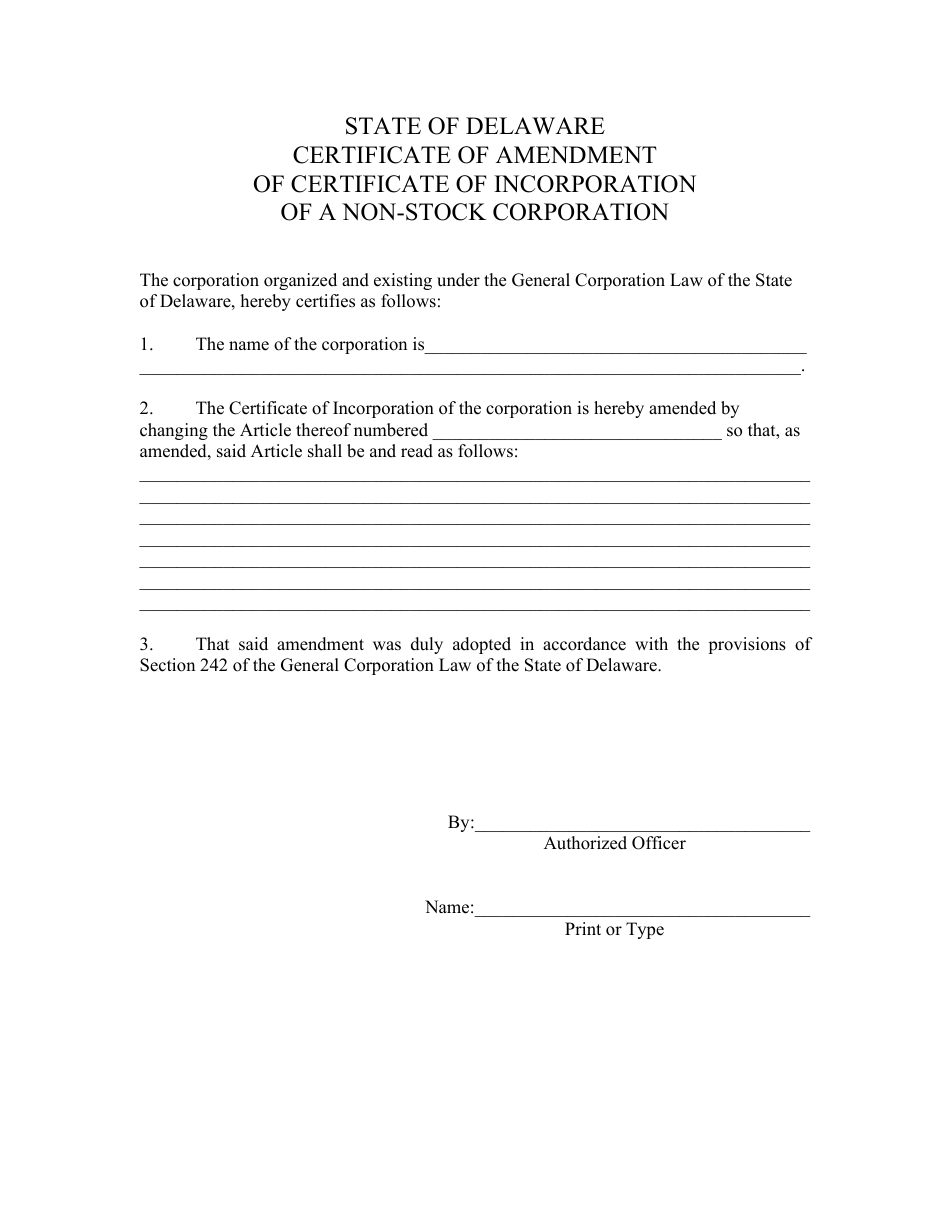

Common amendments include changes to the company name, authorized shares, registered agent, or business purpose. These changes must reflect the evolving needs and strategies of the corporation.

Who Needs to File?

Any Delaware corporation seeking to modify its existing certificate of incorporation must file a Certificate of Amendment. This responsibility falls squarely on the corporation's officers and directors.

It's crucial to consult with legal counsel to determine the precise requirements for your specific amendment. Different types of amendments may necessitate different procedures.

Navigating the Amendment Process

The process of filing a Certificate of Amendment involves several key steps. Diligence and accuracy are paramount throughout each stage.

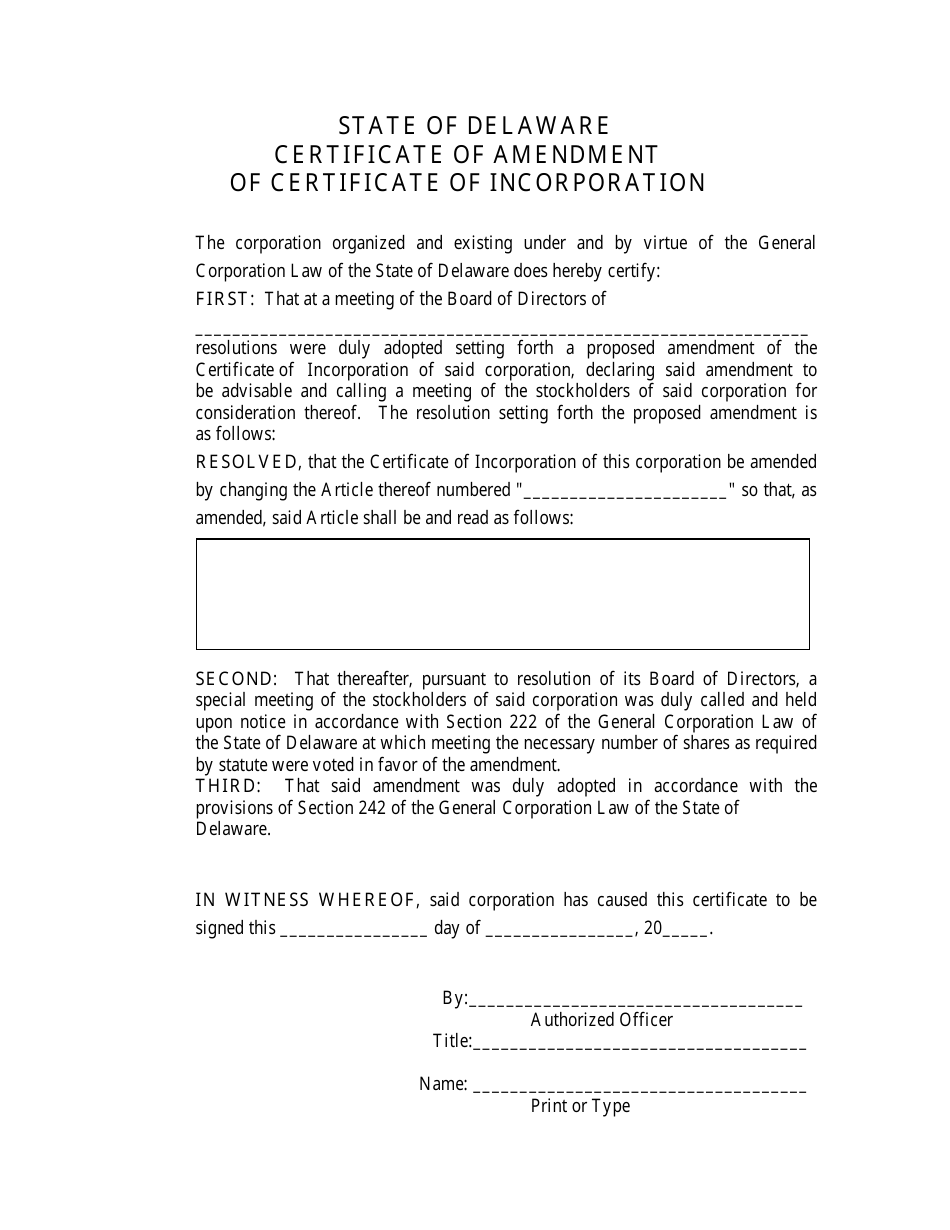

First, the proposed amendment must be approved by the corporation's board of directors. Then, shareholder approval is usually required, although exceptions exist depending on the nature of the amendment.

Step-by-Step Guide:

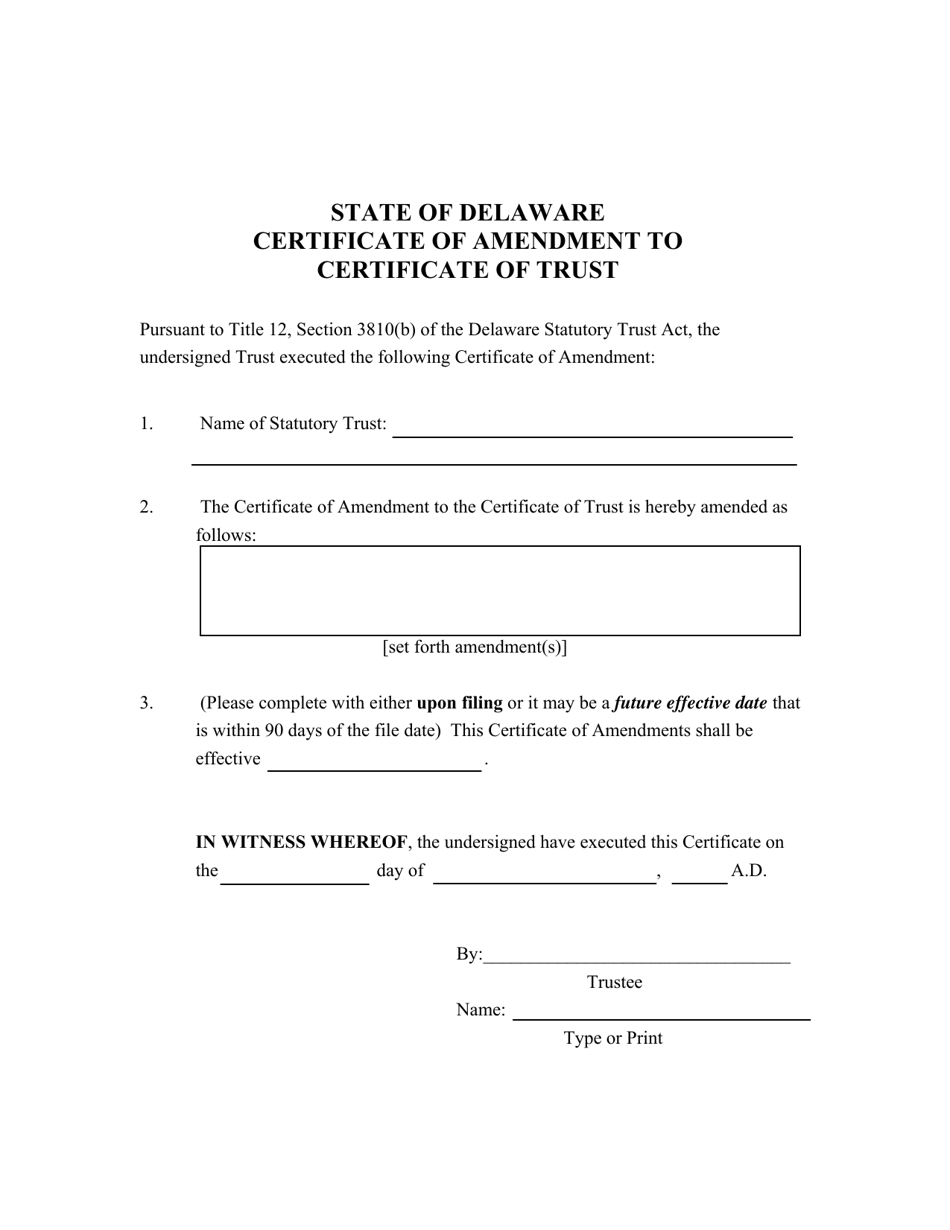

1. Drafting the Amendment: Carefully draft the amendment language, ensuring it aligns with the desired changes. Ambiguity can lead to future legal disputes.

2. Board Approval: Hold a formal board meeting to approve the proposed amendment. Document the approval in the board meeting minutes.

3. Shareholder Approval: Obtain the necessary shareholder vote, in accordance with Delaware law and the company's bylaws. Certain amendments require a supermajority vote.

4. Filing the Certificate: Prepare and file the Certificate of Amendment with the Delaware Secretary of State's office. Pay the required filing fees.

5. Post-Filing Requirements: Update internal corporate records to reflect the amendment. Notify relevant stakeholders of the changes.

Key Considerations:

Delaware law requires specific information to be included in the Certificate of Amendment. This includes the name of the corporation, the date of original incorporation, and the text of the amendment itself.

The filing fee varies depending on the nature and complexity of the amendment. Consult the Delaware Secretary of State's website for the current fee schedule.

Timing is critical. Amendments must be filed promptly after shareholder approval to avoid potential legal challenges.

Consequences of Non-Compliance

Failure to properly file a Certificate of Amendment can have serious consequences. The corporation may face penalties, fines, or even legal challenges to the validity of the amendment.

Furthermore, inaccurate or incomplete filings can create confusion and uncertainty among stakeholders. This can damage the company's reputation and hinder its ability to conduct business effectively.

Important Note: If changes are made to the registered agent, ensure that the new registered agent has consented to serve in that capacity. Failing to obtain this consent can invalidate the amendment.

Where to File and Find Information

All Certificates of Amendment must be filed with the Delaware Secretary of State's office. Filings can be submitted electronically or by mail.

The Secretary of State's website provides detailed information on the amendment process, including filing fees and required forms. The website is a crucial resource for Delaware corporations.

For online filing: Visit the Delaware Division of Corporations website.

For mailing: Send the completed form to the address provided on the Delaware Division of Corporations website.

Staying Ahead of Changes

Delaware corporate law is subject to change. It is essential for businesses to stay informed about updates and revisions to the law.

Subscribing to legal newsletters and consulting with legal professionals are effective ways to stay abreast of these changes. Proactive compliance is always the best approach.

Ongoing vigilance is key to maintaining good standing in Delaware. Don't wait until the last minute to address amendment needs.

Next Steps

Review your company's certificate of incorporation to determine if any amendments are necessary. Consult with legal counsel to ensure compliance with Delaware law.

If an amendment is required, initiate the process immediately to avoid potential delays or penalties. Act now to protect your company's legal standing.

Failure to address these changes promptly could jeopardize future operations. Don't delay – take action today.