Stock Screener Candlestick Patterns

The intersection of stock screeners and candlestick patterns is gaining traction among investors looking to refine their trading strategies. By combining the power of automated screening with the visual cues provided by candlestick charts, traders aim to identify potentially profitable opportunities with greater precision.

This article explores the rising popularity of this technique, its underlying principles, and potential benefits and drawbacks for both novice and experienced investors.

Understanding the Basics

Stock screeners are tools that filter stocks based on user-defined criteria, such as market capitalization, price-to-earnings ratio, or trading volume. They allow investors to quickly narrow down a vast universe of stocks to a smaller, more manageable list that meets their specific investment objectives.

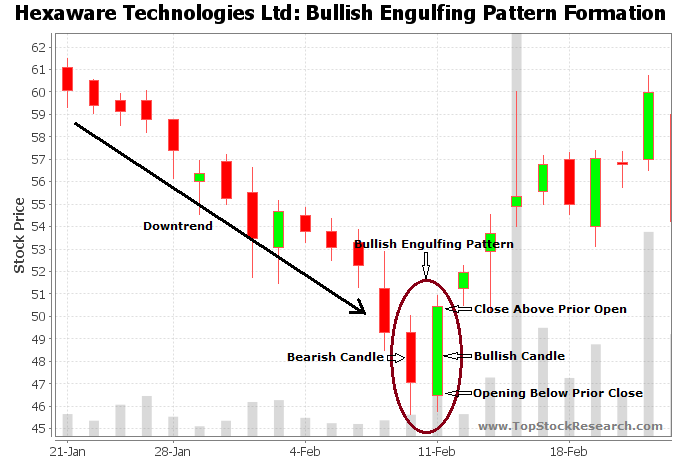

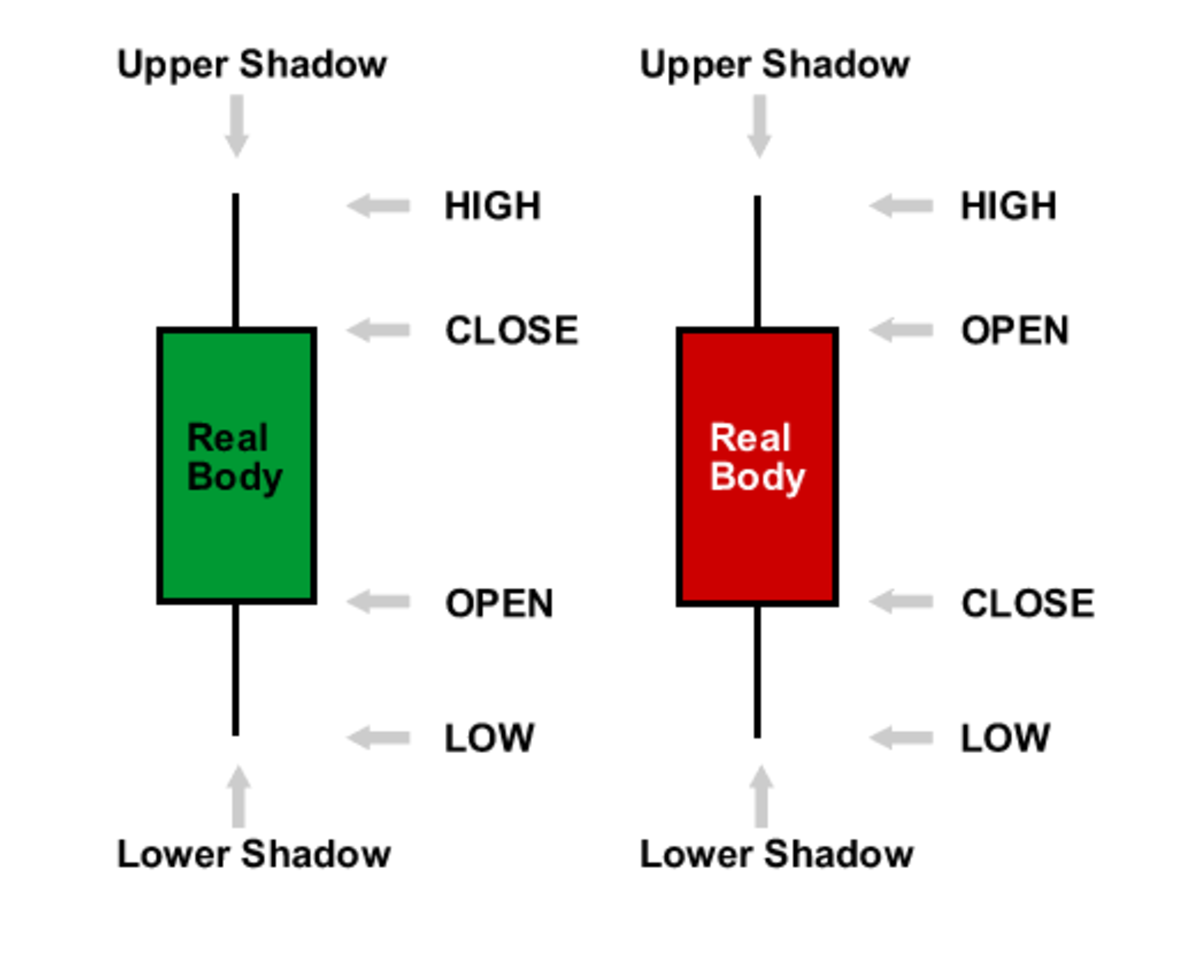

Candlestick patterns, on the other hand, are visual representations of price movements over a given period. Each candlestick displays the open, high, low, and close prices, forming patterns that traders interpret to predict future price direction.

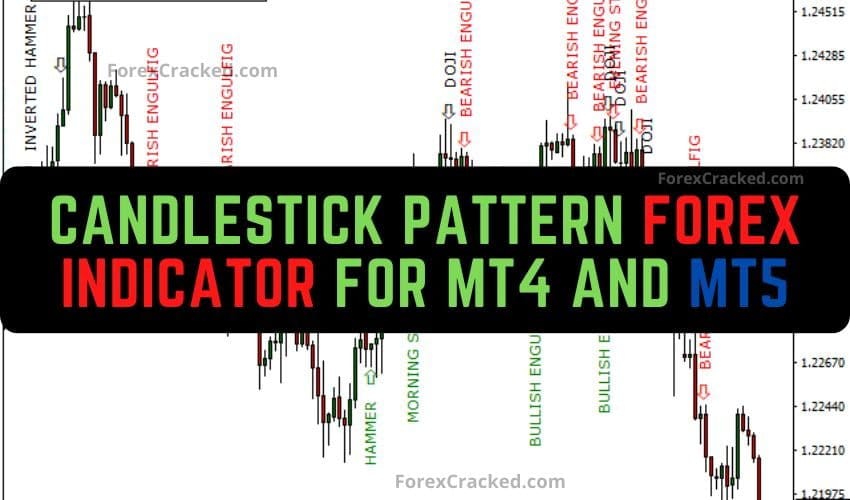

Examples of popular candlestick patterns include the "Hammer," the "Engulfing Pattern," and the "Morning Star," each suggesting different potential market sentiments and trend reversals.

The Synergistic Approach

The appeal of combining stock screeners and candlestick patterns lies in their complementary nature. A stock screener can first identify stocks that meet certain fundamental or technical criteria.

Then, investors can analyze the candlestick charts of those selected stocks to pinpoint specific entry and exit points based on pattern recognition. This two-pronged approach aims to increase the probability of successful trades.

For instance, a trader might use a stock screener to find companies with strong earnings growth and then analyze their candlestick charts for bullish reversal patterns, indicating a potential buying opportunity.

Benefits and Drawbacks

One of the key benefits of this approach is efficiency. It saves time by automating the initial stock selection process.

It also potentially improves decision-making by providing visual confirmation of price trends and potential reversals, based on established candlestick pattern interpretations.

However, there are also drawbacks to consider. Over-reliance on technical analysis, including candlestick patterns, can lead to missed opportunities or false signals, especially in volatile markets.

Furthermore, it is crucial to remember that candlestick patterns are not foolproof predictors of future price movements. They are merely indicators that should be used in conjunction with other forms of analysis, such as fundamental analysis and market sentiment analysis.

Expert Opinions and Industry Trends

According to a recent report by Bloomberg, the usage of technical analysis tools, including candlestick pattern recognition software, has seen a significant increase among retail investors in recent years. This trend is driven by the increasing accessibility of trading platforms and the availability of educational resources on technical analysis.

Financial analysts at JP Morgan Chase suggest that while combining stock screeners and candlestick patterns can be a valuable tool, it is essential to have a solid understanding of both techniques and to practice risk management. They emphasize that no trading strategy guarantees profits, and investors should always be prepared for potential losses.

The Human Element

Sarah Chen, a day trader based in Chicago, shared her experience using this combined approach. "I used to spend hours manually searching for stocks. Now, I use a screener to find potential candidates and then quickly analyze their candlestick charts for patterns. It has definitely streamlined my process and improved my win rate, but it's not a magic bullet."

Conclusion

The integration of stock screeners and candlestick patterns offers a potentially powerful tool for investors seeking to refine their trading strategies. It provides a structured approach to identifying and analyzing potential trading opportunities.

However, it's crucial to approach this method with a balanced perspective, understanding both its benefits and limitations. Successful implementation requires a solid understanding of both stock screening and candlestick analysis, combined with disciplined risk management.

As with any investment strategy, thorough research, continuous learning, and a cautious approach are essential for maximizing returns and minimizing risk.

![Stock Screener Candlestick Patterns Candlestick Patterns Screener [By MUQWISHI] — Indicator by MUQWISHI](https://s3.tradingview.com/x/xiWQuGOq_big.png)

.png)