Stockholders Equity Consists Of Which Of The Following

The financial health of any corporation hinges on a critical metric: Stockholders' Equity. This figure, representing the owners' stake in the company, is a vital sign for investors, creditors, and management alike.

Understanding its composition is not merely academic; it's essential for making informed decisions about investments, loans, and strategic planning.

Unpacking Stockholders' Equity: The Core Components

At its core, stockholders’ equity, also often referred to as shareholders' equity, represents the residual interest in the assets of an entity after deducting its liabilities.

This article breaks down the primary elements that comprise this crucial financial measure, offering insights into its significance and implications.

Contributed Capital: The Initial Investment

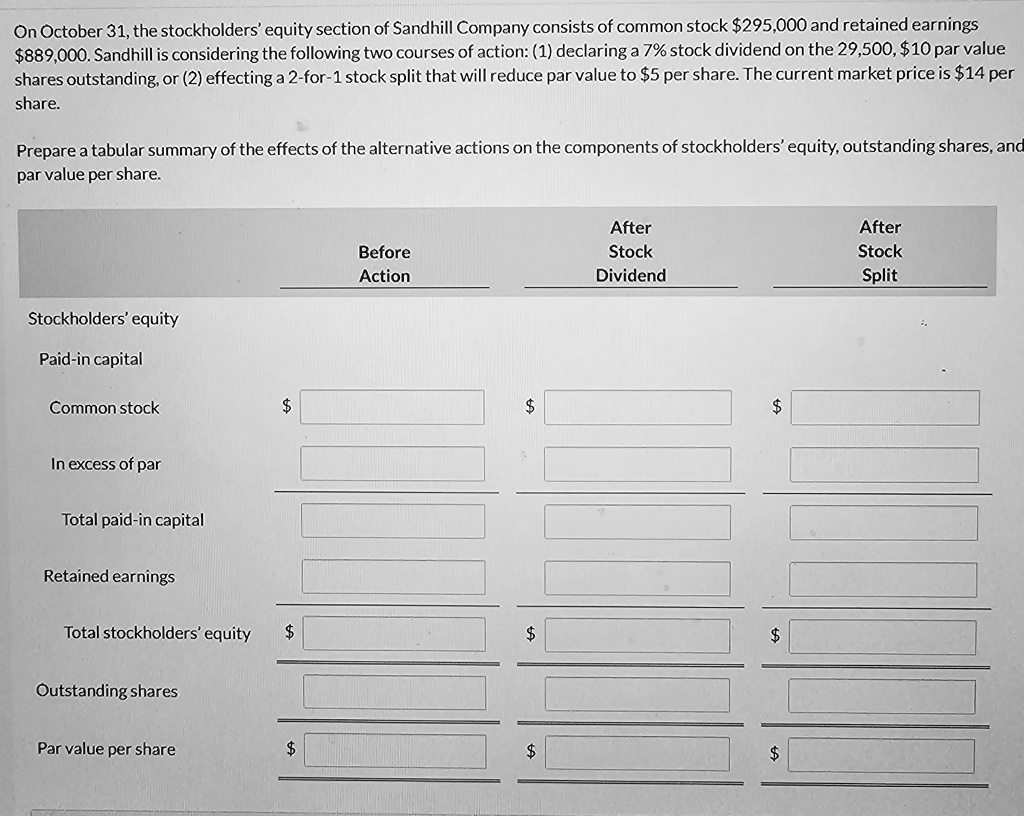

Contributed capital, sometimes called paid-in capital, forms the foundation of stockholders' equity.

This represents the total value of cash and other assets received by the corporation from shareholders in exchange for stock.

It is further divided into components such as: common stock and preferred stock.

Common Stock

Common stock is the most prevalent type of stock and represents basic ownership in a corporation.

Holders of common stock typically have voting rights, allowing them to participate in the election of directors and other important corporate decisions.

The par value, if any, of the common stock is recorded separately from any amount paid in excess of par, which is categorized as additional paid-in capital.

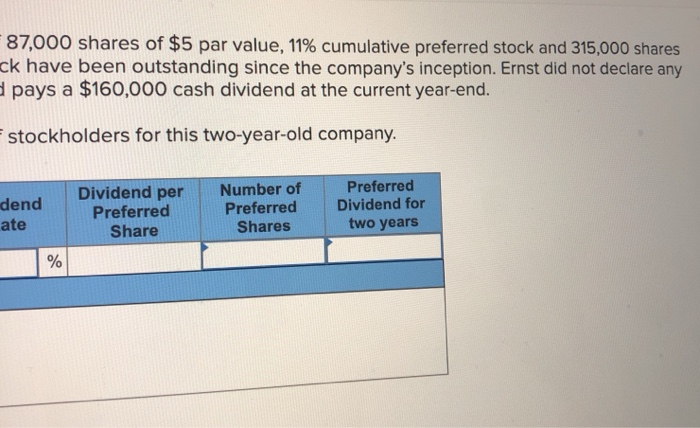

Preferred Stock

Preferred stock offers certain privileges over common stock, such as priority in dividend payments and asset distribution during liquidation.

Preferred stockholders generally do not have voting rights.

Similar to common stock, the par value and any excess paid over par are recorded separately.

Additional Paid-In Capital (APIC)

Additional Paid-In Capital (APIC) represents the amount by which the proceeds from the sale of stock exceed the stock's par value.

This component reflects the premium investors are willing to pay for the company's stock, signaling confidence in its future prospects.

APIC can arise from the sale of both common and preferred stock.

Retained Earnings: Accumulating Profits

Retained earnings represents the cumulative net income of the corporation that has not been distributed to shareholders as dividends.

It is essentially the accumulated profits reinvested back into the business, fueling growth and expansion.

A positive retained earnings balance indicates a history of profitability, while a negative balance, often called accumulated deficit, suggests accumulated losses.

Treasury Stock: Repurchased Shares

Treasury stock refers to shares of a company's own stock that have been repurchased from the market.

Treasury stock is not an asset and is presented as a reduction of stockholders' equity.

Companies repurchase stock for various reasons, including increasing earnings per share, providing shares for employee stock options, or preventing hostile takeovers.

Accumulated Other Comprehensive Income (AOCI)

Accumulated Other Comprehensive Income (AOCI) encompasses gains and losses that are not included in net income but are recognized in comprehensive income.

These items bypass the income statement and are directly recorded in equity.

Examples include unrealized gains and losses on available-for-sale securities, foreign currency translation adjustments, and certain pension adjustments.

Minority Interest (Non-Controlling Interest)

Minority interest, also known as non-controlling interest, arises when a company owns a majority stake in another company but less than 100%.

The portion of the subsidiary's equity that is not owned by the parent company is reported as minority interest in the consolidated balance sheet.

This ensures that the financial statements accurately reflect the ownership structure of the consolidated entity.

The Significance of Stockholders' Equity

Stockholders' equity is a critical indicator of a company's financial strength and stability.

A healthy stockholders' equity balance provides a buffer against losses and demonstrates the company's ability to meet its obligations.

Investors use stockholders' equity to assess the value of their investment and the potential for future growth.

Looking Ahead

The composition of stockholders' equity is constantly evolving, reflecting changes in a company's performance, financing activities, and accounting standards.

Staying informed about these components and their implications is essential for making sound financial decisions.

As businesses navigate an increasingly complex economic landscape, a thorough understanding of stockholders' equity will remain a cornerstone of financial analysis and strategic planning.