Stoxx Europe Total Market Aerospace & Defense Etf

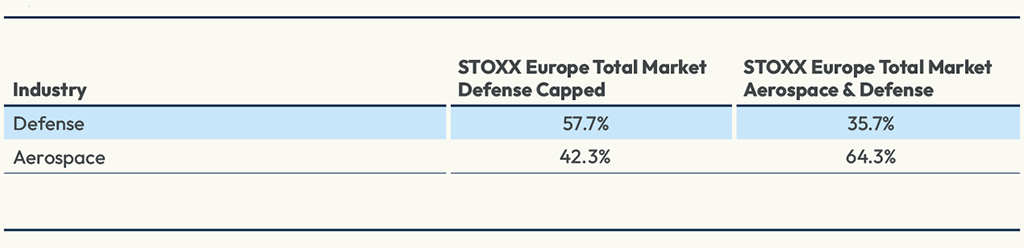

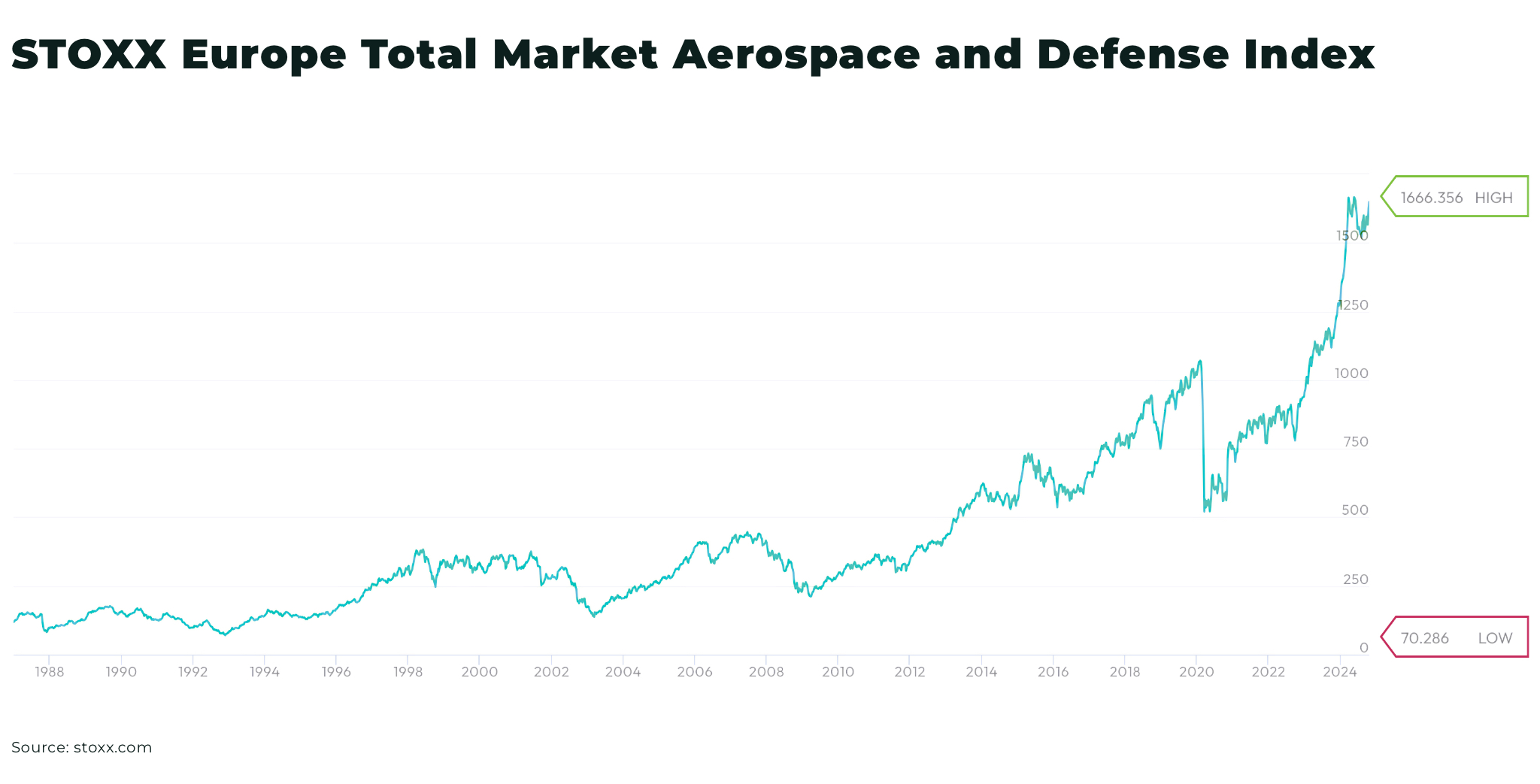

Geopolitical tensions and increased defense spending across Europe have fueled significant interest in the Stoxx Europe Total Market Aerospace & Defense ETF, offering investors a focused avenue to participate in the growth of the aerospace and defense sector. This ETF has experienced notable fluctuations and overall growth, reflecting the shifting global landscape and evolving investment strategies.

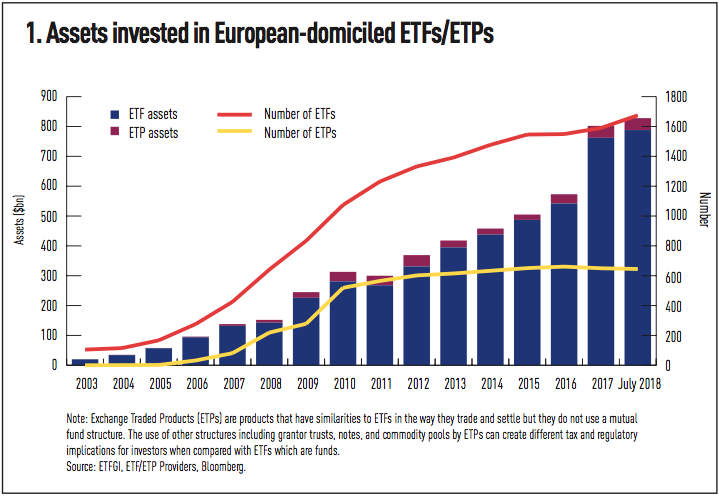

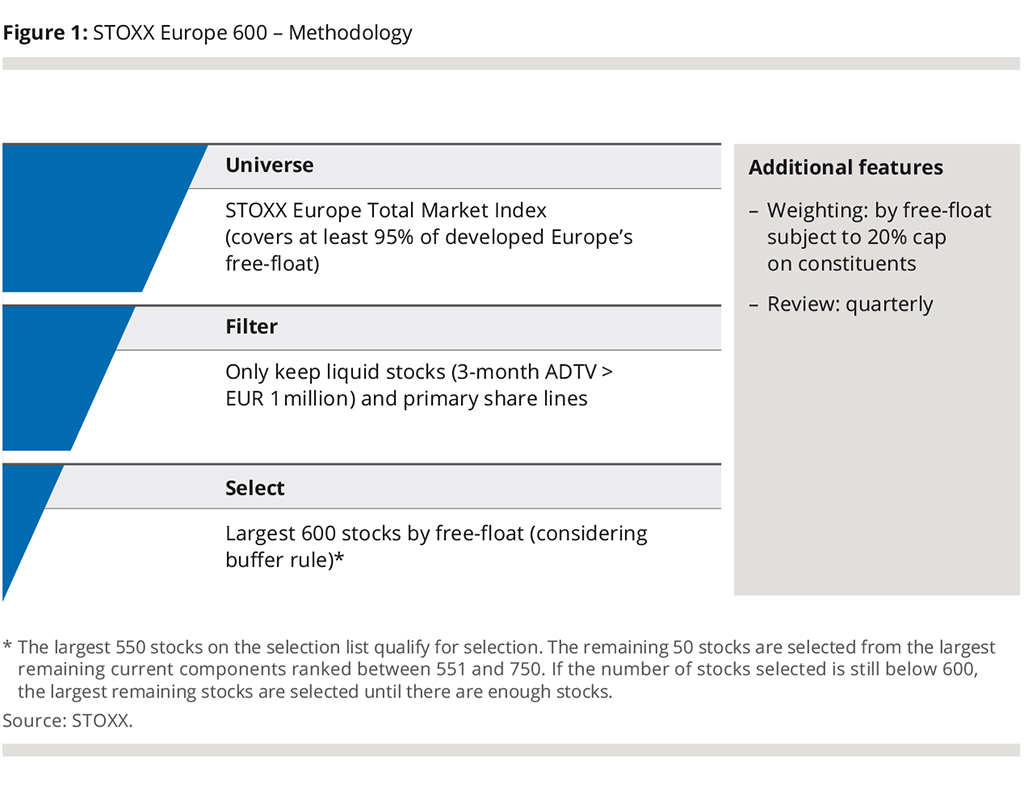

The Stoxx Europe Total Market Aerospace & Defense ETF tracks the performance of companies operating in the aerospace and defense industries within the European market. It provides a diversified investment vehicle, allowing investors to gain exposure to a basket of companies without directly purchasing individual stocks. The ETF's performance is closely tied to factors such as government defense budgets, technological advancements, and geopolitical events.

What is the Stoxx Europe Total Market Aerospace & Defense ETF?

The Stoxx Europe Total Market Aerospace & Defense ETF is an exchange-traded fund designed to mirror the performance of the Stoxx Europe Total Market Aerospace & Defense Index. This index comprises companies from various European countries that are involved in the production, development, and maintenance of aerospace and defense equipment, systems, and services. The ETF offers a convenient and liquid way for investors to gain exposure to this specialized sector.

The fund’s holdings typically include major players in the European defense industry. These companies often manufacture military aircraft, naval vessels, missile systems, and communication technologies.

Recent Performance and Market Drivers

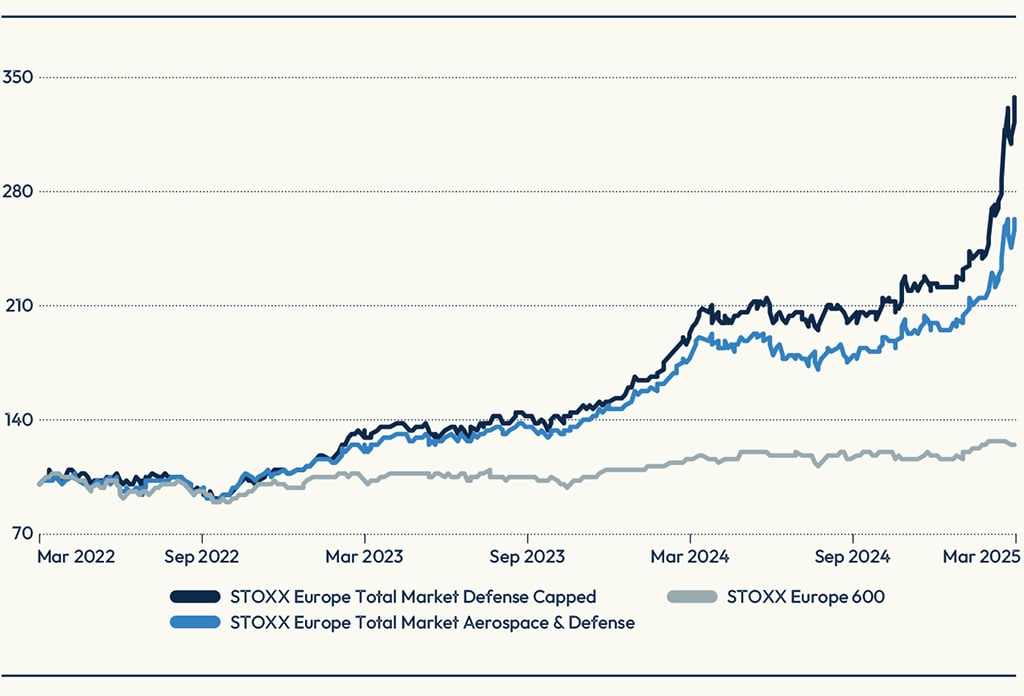

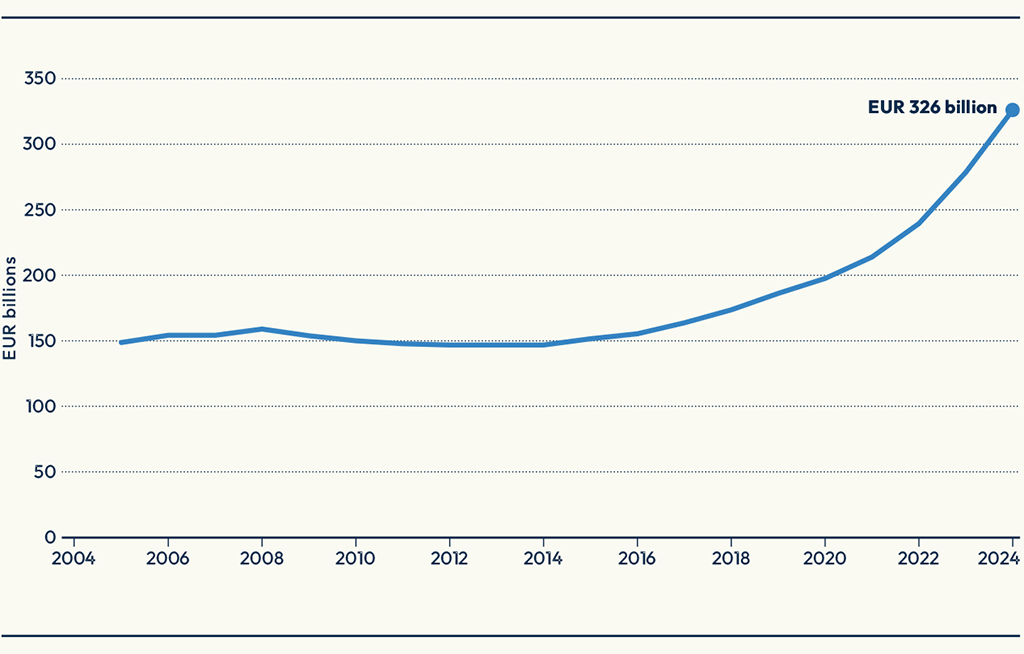

Over the past year, the Stoxx Europe Total Market Aerospace & Defense ETF has experienced significant growth, driven largely by increased geopolitical instability. The ongoing conflict in Ukraine, coupled with rising tensions in other regions, has prompted many European nations to increase their defense spending. This has led to increased demand for the products and services offered by companies held within the ETF.

This increased spending has positively impacted the financial performance of companies within the aerospace and defense sector, which consequently boosted the ETF's overall performance. Several major events, such as announcements of new defense contracts and technological breakthroughs, have influenced the ETF’s price.

Key Holdings and Company Highlights

The ETF’s top holdings often include companies like Safran, BAE Systems, and Thales. Safran, a French multinational, is a major supplier of aircraft engines and aerospace equipment. BAE Systems, a British multinational, specializes in defense, security, and aerospace. Thales, another French multinational, designs and builds electrical systems and provides services for the aerospace, defense, transportation, and security markets.

These companies have benefited from increased defense budgets and rising demand for advanced military technologies. Their contributions to the ETF’s performance are significant, and their individual performance often reflects broader trends within the sector.

Impact of Geopolitical Events

Geopolitical events have a profound impact on the Stoxx Europe Total Market Aerospace & Defense ETF. Increased global instability typically leads to higher defense spending and a greater demand for military equipment and services. This, in turn, boosts the performance of companies operating in the aerospace and defense sector, leading to increased investor interest in the ETF.

Conversely, periods of relative peace and stability may lead to reduced defense budgets and lower demand, potentially impacting the ETF's performance. The ETF's sensitivity to geopolitical events makes it a unique investment option that requires careful consideration of global affairs.

Investment Considerations and Risks

Investing in the Stoxx Europe Total Market Aerospace & Defense ETF involves certain risks and considerations. The ETF is highly sensitive to geopolitical events and changes in government defense policies. Unforeseen global conflicts or shifts in political priorities could significantly impact the ETF’s performance.

The ETF is also subject to market volatility and general economic conditions. Investors should carefully consider their risk tolerance and investment objectives before investing in the ETF.

Looking Ahead

The future performance of the Stoxx Europe Total Market Aerospace & Defense ETF will likely depend on several factors, including continued geopolitical instability, government defense spending, and technological advancements in the aerospace and defense sectors. The ETF is poised to remain an area of interest for investors seeking exposure to the evolving European defense landscape.

As European nations continue to prioritize defense spending in response to global uncertainties, the ETF could continue to see growth. The long-term prospects for the ETF will depend on a complex interplay of geopolitical, economic, and technological factors.