Student Loan Repayment Calculator Bankrate

The weight of student loan debt continues to burden millions of Americans, impacting their financial futures and overall economic well-being. Navigating the complexities of repayment options can be daunting, leaving many borrowers feeling lost and overwhelmed. Fortunately, tools like the Bankrate Student Loan Repayment Calculator offer a beacon of clarity, providing a personalized roadmap to manage and potentially alleviate this significant financial stress.

This article delves into the functionality and impact of the Bankrate Student Loan Repayment Calculator, examining its features, benefits, and limitations in helping borrowers strategize their repayment plans. We will also explore the broader context of student loan debt and the various resources available to borrowers beyond a single calculator, ensuring a comprehensive understanding of this critical issue. By providing a balanced perspective, we aim to empower readers to make informed decisions about their student loan repayment journey.

Understanding the Bankrate Student Loan Repayment Calculator

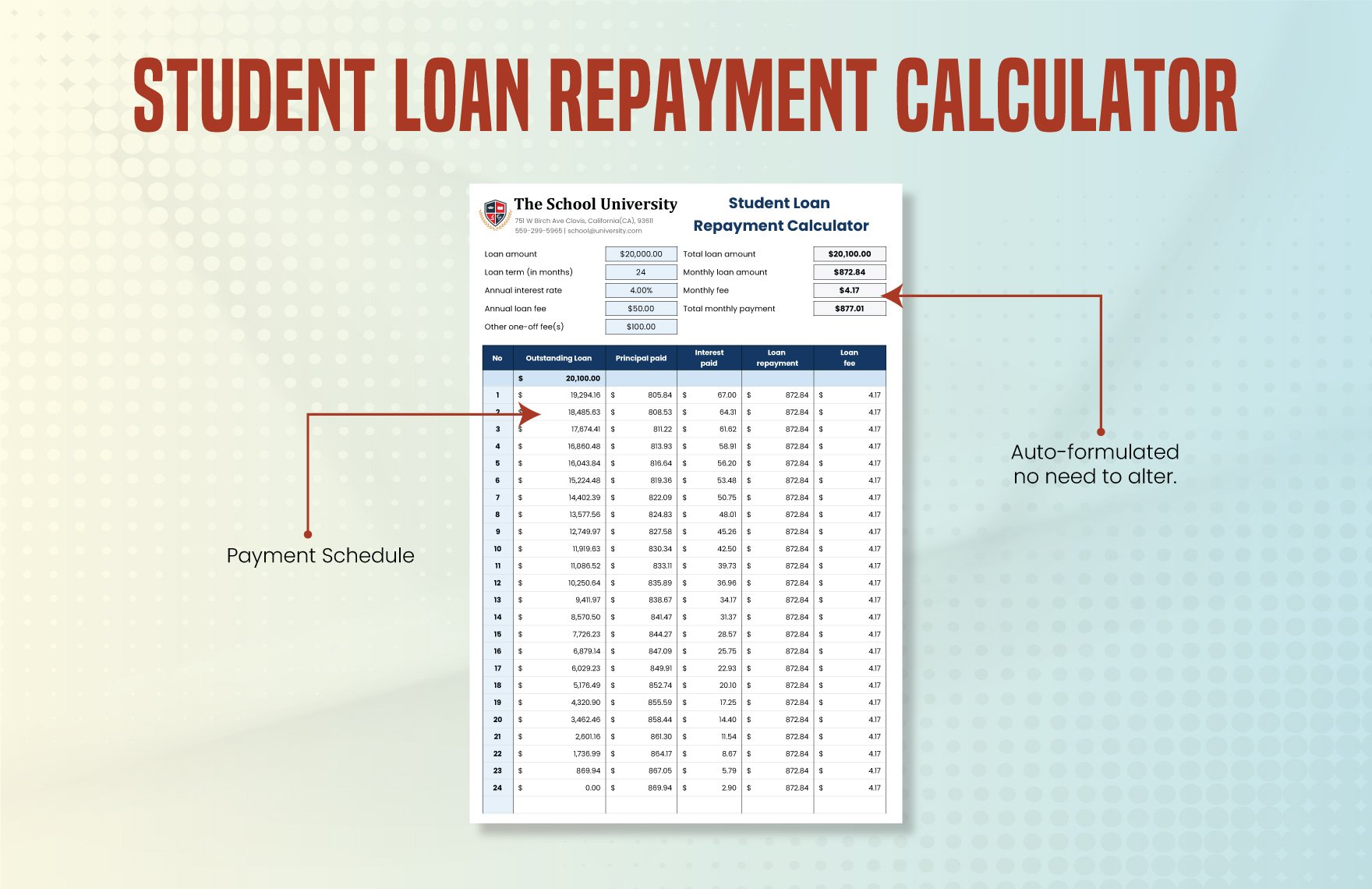

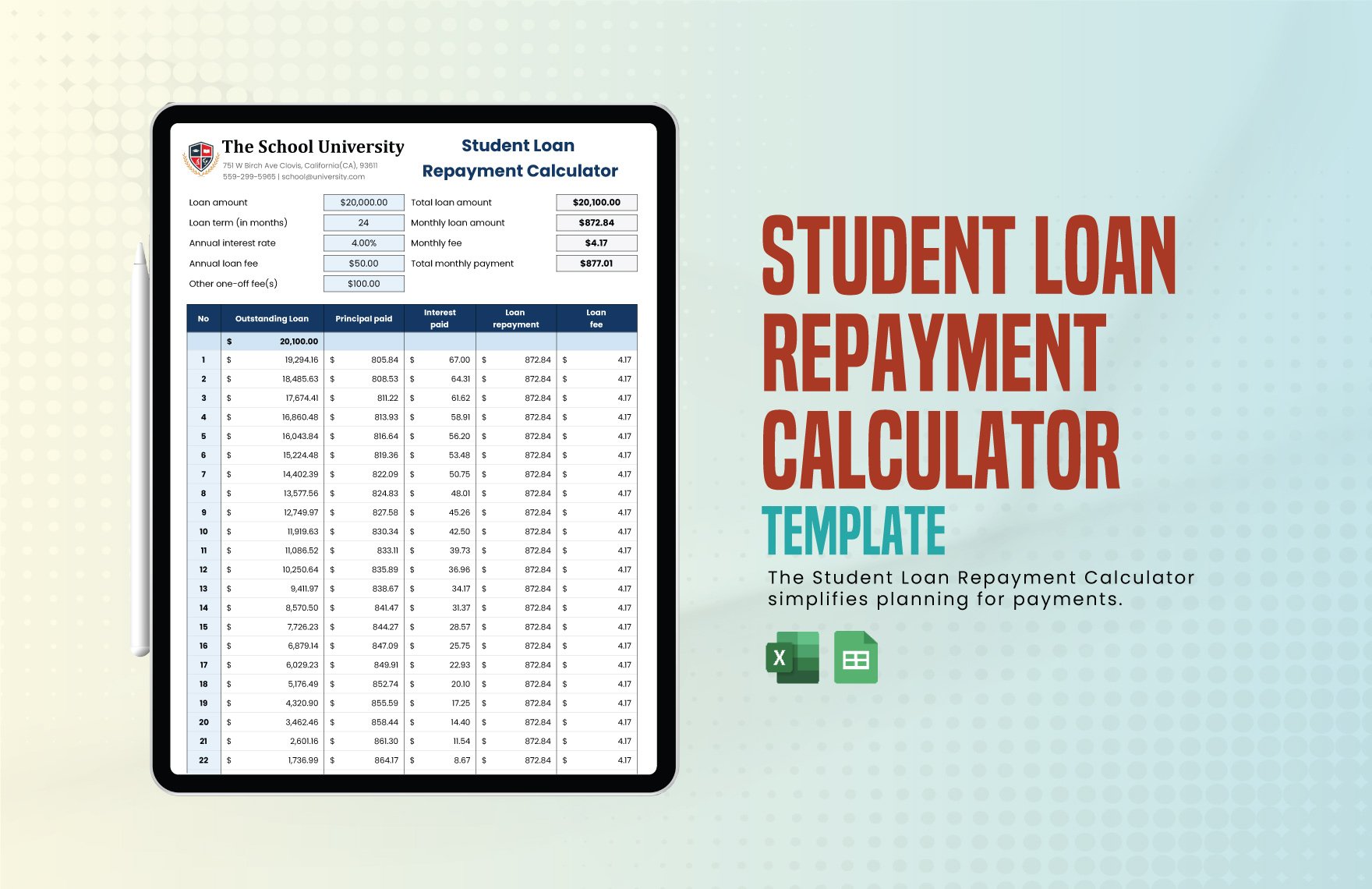

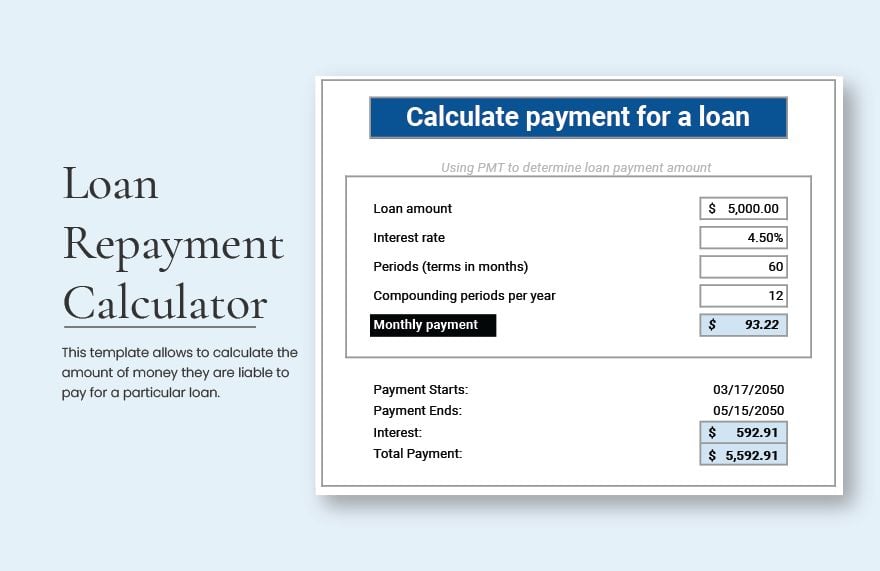

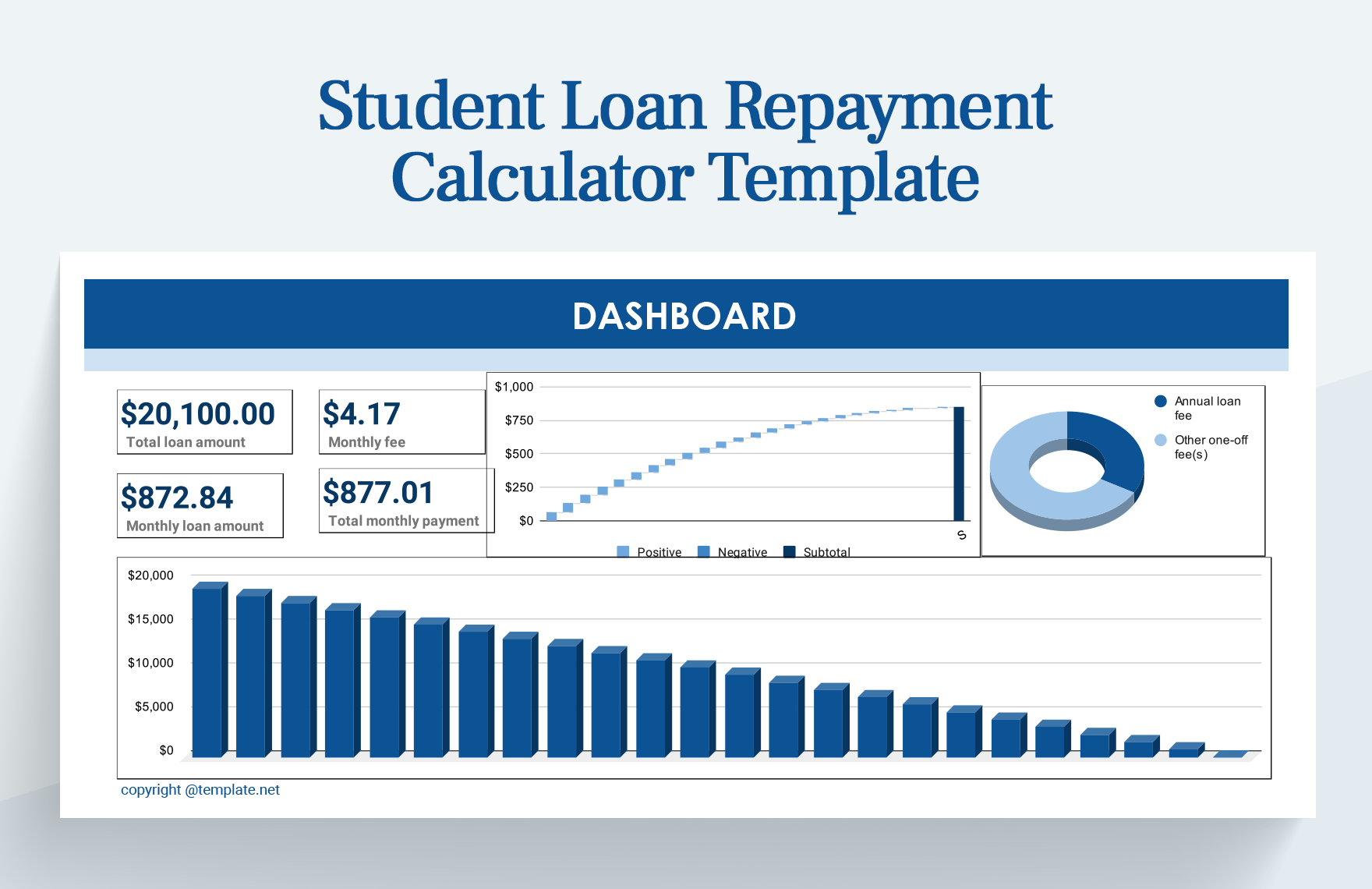

The Bankrate Student Loan Repayment Calculator is a free, online tool designed to help borrowers estimate their monthly payments and the total cost of repaying their student loans. Users input their loan amounts, interest rates, and loan terms to generate personalized repayment scenarios.

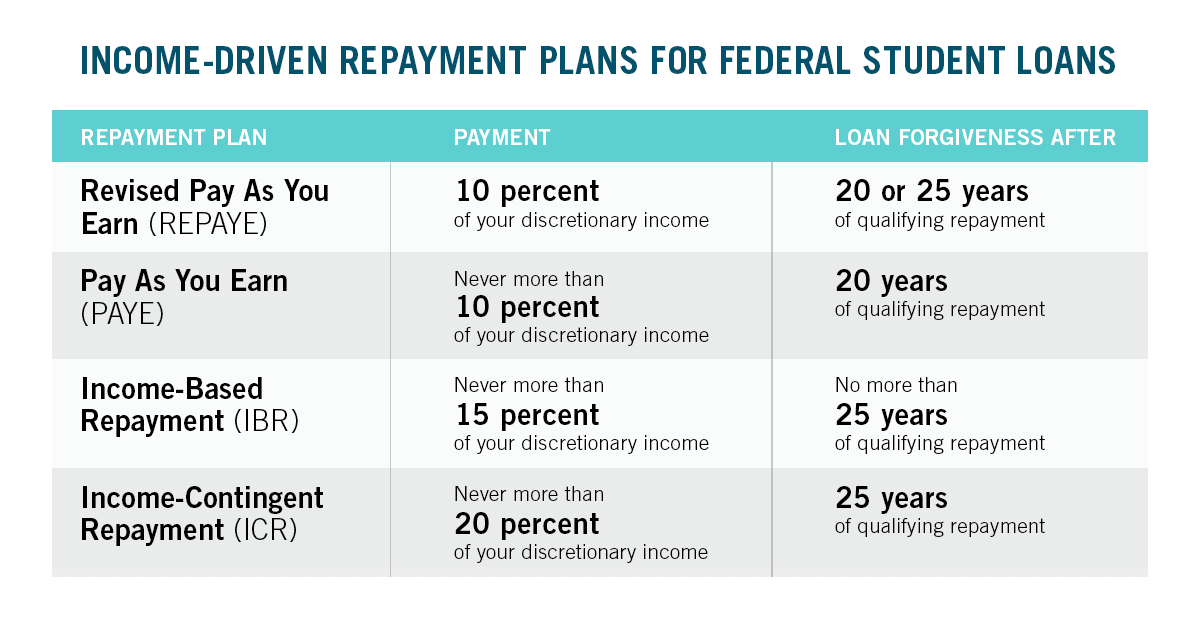

The calculator also allows users to explore different repayment options, such as standard, graduated, and income-driven repayment plans. This feature is particularly valuable as it enables borrowers to compare the long-term costs and benefits of each option.

Key Features and Functionality

The calculator's interface is user-friendly, guiding borrowers through a step-by-step process. Input fields are clearly labeled, and explanations are provided to clarify potentially confusing terms like "loan term" and "interest rate."

Beyond calculating basic repayment schedules, the tool incorporates advanced features. It can estimate the impact of making extra payments, which can significantly reduce the total interest paid and shorten the repayment period.

The calculator also provides insights into potential savings from refinancing options, allowing users to assess whether refinancing is a viable strategy for their situation. This includes showing potential new interest rates and monthly payments after refinancing.

The Impact of Student Loan Debt on Borrowers

Student loan debt has far-reaching consequences for individuals and the economy. According to the Education Data Initiative, the average federal student loan debt is over $37,000. This burden often delays major life decisions such as buying a home, starting a family, or saving for retirement.

High debt-to-income ratios can also limit access to other forms of credit, impacting financial stability. The psychological toll of student loan debt, including stress and anxiety, is also a significant concern.

Furthermore, defaults on student loans can have severe repercussions, including damage to credit scores and wage garnishment. This can create a cycle of financial hardship that is difficult to break.

Beyond the Calculator: Additional Resources for Borrowers

While the Bankrate Student Loan Repayment Calculator is a valuable tool, it is essential to recognize its limitations and explore other available resources. Borrowers should consult with financial advisors or student loan experts for personalized guidance.

The U.S. Department of Education offers various repayment plans, including income-driven options, which can significantly lower monthly payments based on income and family size. These plans, such as Income-Based Repayment (IBR) and Pay As You Earn (PAYE), can provide much-needed relief to struggling borrowers.

Nonprofit organizations like the National Foundation for Credit Counseling (NFCC) also offer free or low-cost counseling services to help borrowers develop personalized repayment strategies and navigate the complexities of student loan debt. These services can be invaluable for those who feel overwhelmed or uncertain about their options.

A Balanced Perspective

It's crucial to acknowledge that while tools like the Bankrate calculator offer estimations, individual circumstances can vary. The calculator's accuracy depends on the accuracy of the information inputted by the user.

External factors, such as changes in interest rates or income, can also impact repayment plans. Therefore, it's important to regularly update the calculator with the most current information and seek professional advice for personalized guidance.

Some critics argue that these calculators, while helpful, don't fully address the systemic issues surrounding student loan debt, such as rising tuition costs and the accessibility of higher education. Addressing these broader issues requires policy changes and systemic reforms.

Looking Ahead

As the debate surrounding student loan debt continues, tools like the Bankrate Student Loan Repayment Calculator will remain valuable resources for borrowers seeking clarity and control over their financial futures. However, it's important to view these tools as just one piece of a larger puzzle.

Borrowers should actively explore all available resources, including repayment plans offered by the Department of Education, and seek professional advice to develop a personalized repayment strategy that aligns with their individual circumstances. Furthermore, advocating for policies that address the root causes of student loan debt is crucial for creating a more equitable and sustainable system of higher education financing.

Ultimately, informed decision-making and proactive engagement are key to navigating the complexities of student loan debt and achieving long-term financial well-being. The Bankrate calculator serves as a starting point, empowering borrowers to take control of their financial future.