Surge Credit Card Pre Approval No Credit Check

The allure of instant gratification, especially when paired with the promise of financial assistance, can be powerful. Recent marketing pushes surrounding "Surge" credit card pre-approval offers, explicitly stating "no credit check," have ignited both interest and concern among consumers. This raises critical questions about the true cost of such readily available credit and the potential impact on vulnerable individuals.

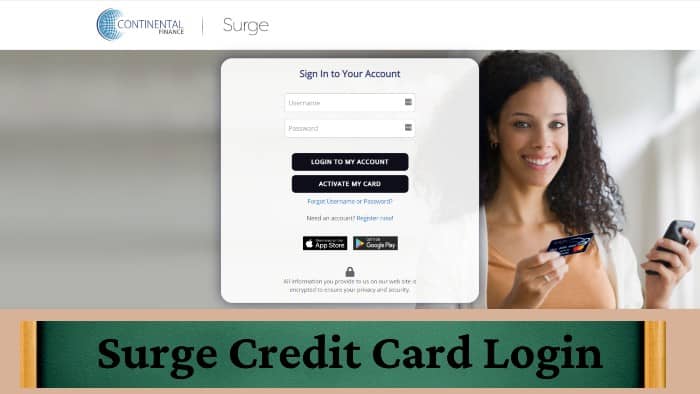

At the heart of the matter is the Surge credit card, issued by Continental Finance. It’s marketed towards individuals with less-than-perfect credit. These pre-approval campaigns, emphasizing the lack of an initial credit check, present a seemingly easy path to obtaining credit. However, experts warn that these offers often come with high interest rates, fees, and potentially limited credit lines, potentially trapping users in a cycle of debt.

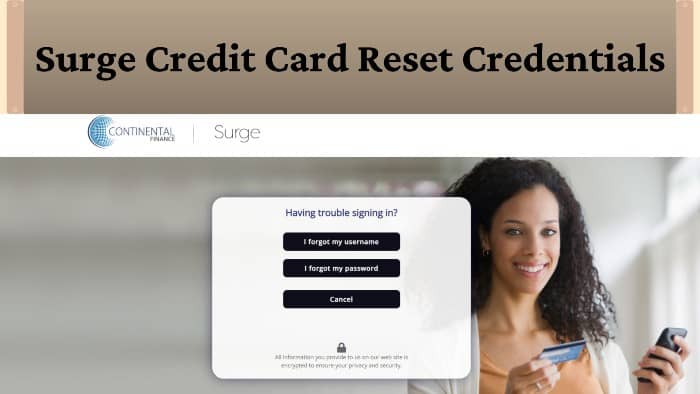

Understanding the "No Credit Check" Claim

The term "no credit check" requires careful examination. While a hard credit inquiry, which can slightly lower a credit score, might be avoided during the pre-approval stage, a soft credit pull likely still occurs. This allows the issuer to assess a consumer's basic financial profile without impacting their credit score directly.

According to a statement from the Federal Trade Commission (FTC), consumers should be wary of any offer that seems too good to be true, particularly when it comes to credit. "Predatory lending practices often target individuals with limited credit options," the statement warns.

Fees and Interest Rates: The Real Cost

The primary concern surrounding the Surge credit card lies in its associated fees and interest rates. These cards typically carry annual fees, monthly maintenance fees, and potentially even fees for exceeding the credit limit. The Annual Percentage Rate (APR) on the Surge card can be significantly higher than those offered by traditional credit cards.

Data from Creditcards.com indicates that subprime credit cards, similar to the Surge card, often have APRs exceeding 25%. This makes it exceedingly difficult to pay down balances and avoid accumulating substantial interest charges.

Building Credit vs. Debt Trap

While proponents argue that the Surge card can help individuals build or rebuild their credit, critics contend that it's a risky proposition. Responsible credit card usage, which includes paying balances on time and keeping credit utilization low, is crucial for credit improvement.

However, the high interest rates and fees associated with the Surge card can make responsible usage challenging, especially for those already struggling with finances. "Consumers need to carefully weigh the potential benefits against the significant costs," advises the Consumer Financial Protection Bureau (CFPB) in a recent advisory.

Continental Finance's Perspective

Continental Finance maintains that the Surge card provides a valuable service to individuals who may not qualify for traditional credit cards. The company emphasizes that all fees and interest rates are clearly disclosed to applicants.

In a prepared statement, a spokesperson for Continental Finance stated, "We are committed to providing access to credit responsibly and transparently. Our goal is to help consumers manage their finances and improve their credit profiles."

Alternatives to Consider

Before applying for a Surge credit card, consumers should explore alternative options for building or rebuilding credit. Secured credit cards, which require a cash deposit as collateral, often offer lower interest rates and fees.

Credit builder loans, offered by some credit unions and community banks, can also be a viable alternative. These loans are specifically designed to help individuals establish a positive credit history.

Additionally, consumers should review their credit reports regularly to identify and correct any errors that may be negatively impacting their credit score. This can be done for free through AnnualCreditReport.com.

The Regulatory Landscape

The marketing and lending practices of companies like Continental Finance are subject to regulatory oversight by the FTC and the CFPB. These agencies have the authority to investigate and prosecute companies engaged in deceptive or unfair business practices.

In recent years, the CFPB has increased its scrutiny of subprime lending practices, focusing on transparency and responsible lending. This heightened regulatory focus underscores the importance of consumer awareness and vigilance.

Consumers who believe they have been harmed by predatory lending practices should file a complaint with the FTC or the CFPB. These complaints can help inform regulatory action and protect other consumers from similar harm.

Looking Ahead: Consumer Education and Responsible Lending

The proliferation of "no credit check" credit card offers highlights the ongoing need for consumer education and responsible lending practices. Consumers must be equipped with the knowledge and tools to make informed financial decisions.

Lenders have a responsibility to ensure that their marketing materials are clear and transparent and that their lending practices are fair and equitable. A balanced approach that prioritizes both access to credit and consumer protection is essential for fostering a healthy and sustainable financial marketplace.

Ultimately, the key to navigating the complex world of credit lies in understanding the terms and conditions of any financial product and making informed decisions that align with individual financial goals and circumstances. Due diligence remains the best defense against predatory lending practices.