Which Of The Following Statements About Tax Expenditures Are Accurate

The federal budget is a complex tapestry woven with trillions of dollars, and woven into that tapestry are often unseen threads: tax expenditures. These seemingly innocuous provisions, designed to incentivize specific behaviors or alleviate financial burdens, are under increased scrutiny as policymakers grapple with rising national debt and persistent social inequalities.

At the heart of this scrutiny lies a fundamental question: are tax expenditures truly serving their intended purpose, and are they doing so efficiently and equitably? Getting the answers right is crucial for responsible fiscal policy.

This article dissects the often-murky world of tax expenditures, separating fact from fiction and exploring the profound implications of these budgetary tools.

Understanding Tax Expenditures: A Deep Dive

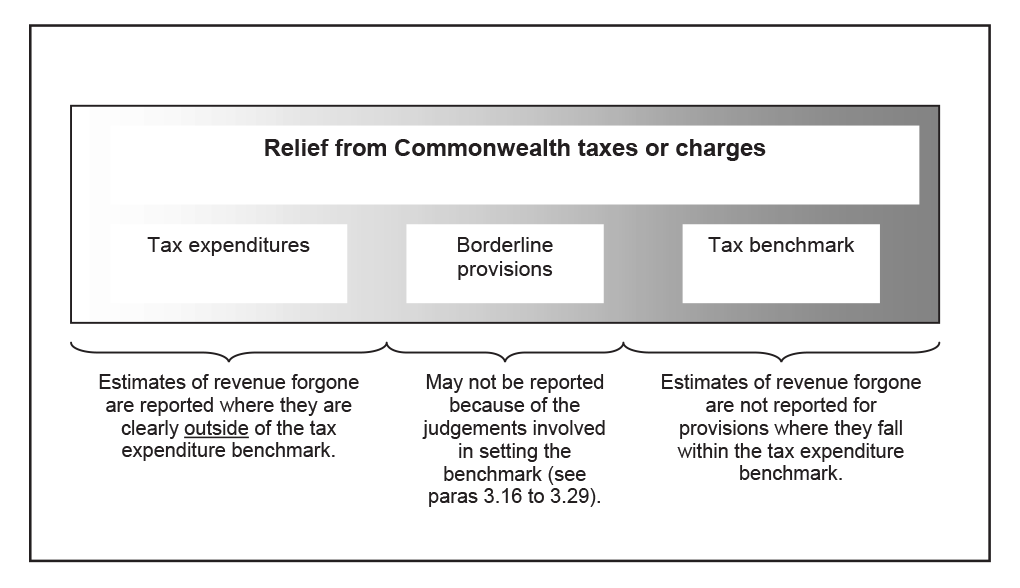

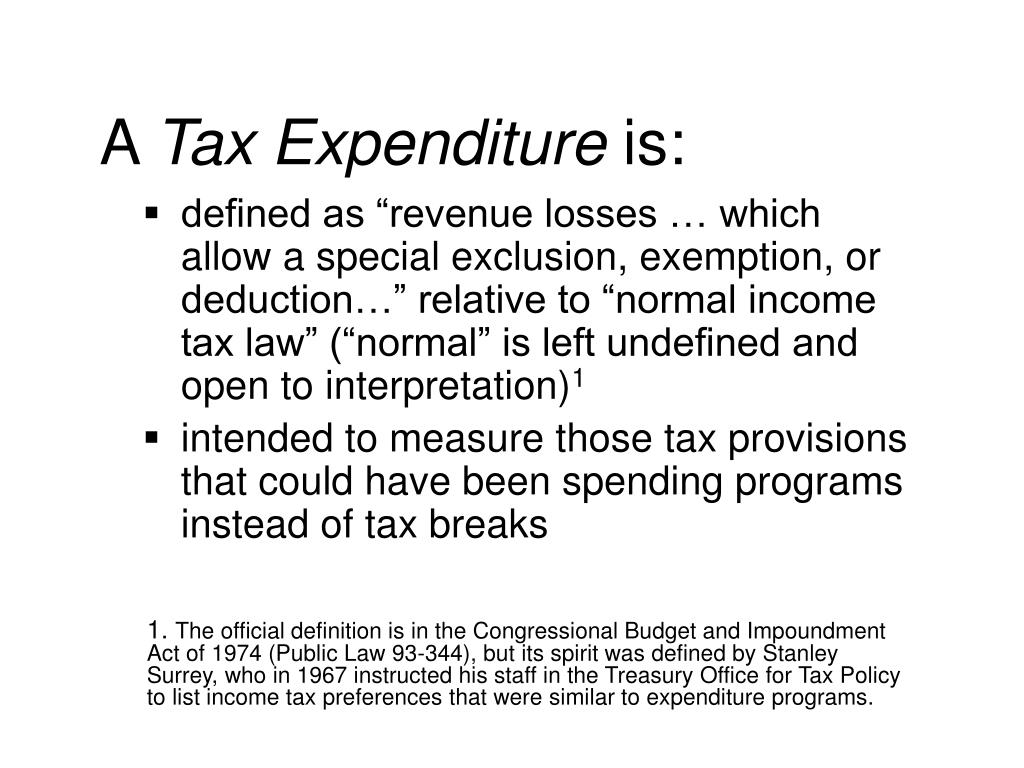

Tax expenditures, in essence, are deviations from the standard tax code. They act like subsidies, offering special deductions, credits, exclusions, or exemptions that reduce an individual's or corporation's tax liability.

The Congressional Budget Office (CBO) and the Joint Committee on Taxation (JCT) meticulously track these expenditures, providing crucial data for understanding their impact on the federal budget. Their reports are often cited when debating the merits of certain tax provisions.

These provisions range from popular deductions like the mortgage interest deduction, which encourages homeownership, to more targeted credits such as the Earned Income Tax Credit (EITC), aimed at supporting low-to-moderate income workers.

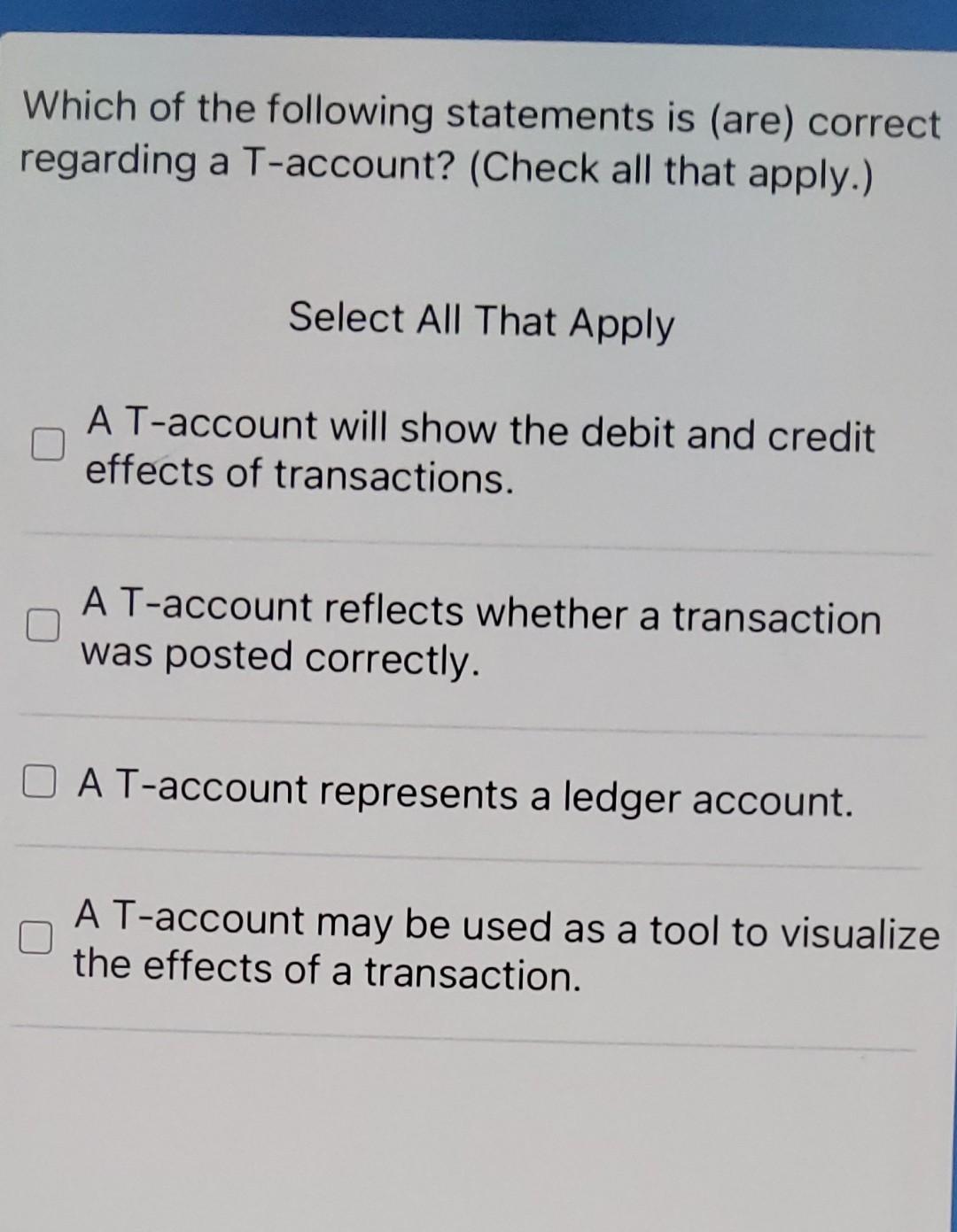

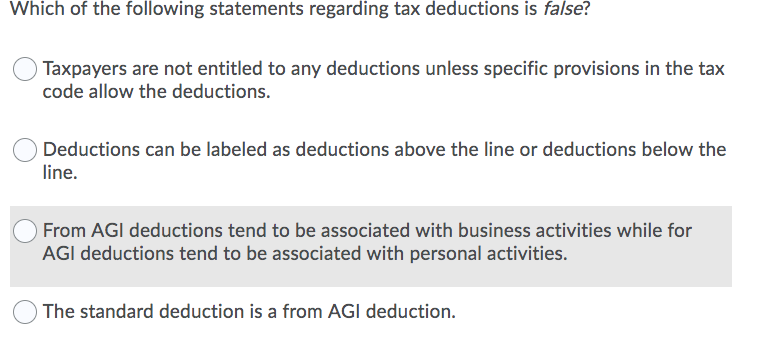

Accurate Statements About Tax Expenditures: Debunking Myths

Tax Expenditures Are a Significant Part of the Federal Budget

It's undeniably true that tax expenditures represent a considerable portion of the federal budget. The total cost of these provisions often rivals or even exceeds discretionary spending, the portion of the budget allocated by Congress annually through the appropriations process.

According to the CBO, the aggregate value of major tax expenditures amounts to over a trillion dollars annually. This figure underscores their significant impact on the government's fiscal position.

Ignoring the impact of tax expenditures creates an incomplete picture of the budget and any attempt at fiscal reform.

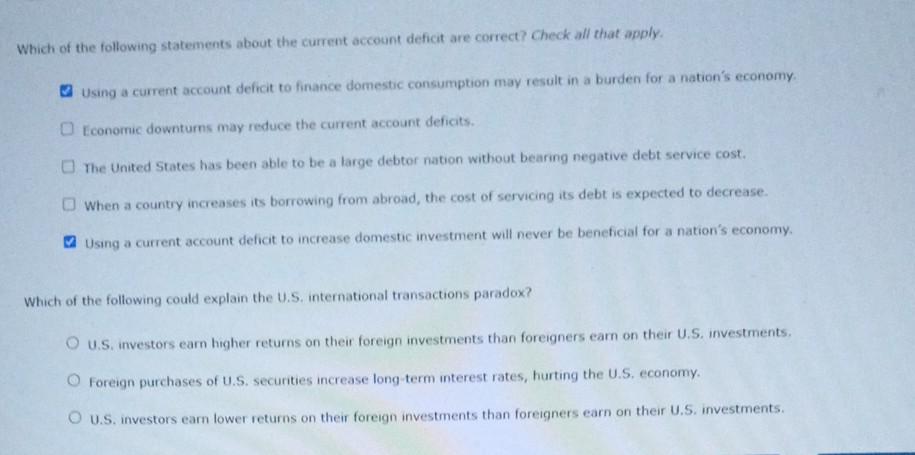

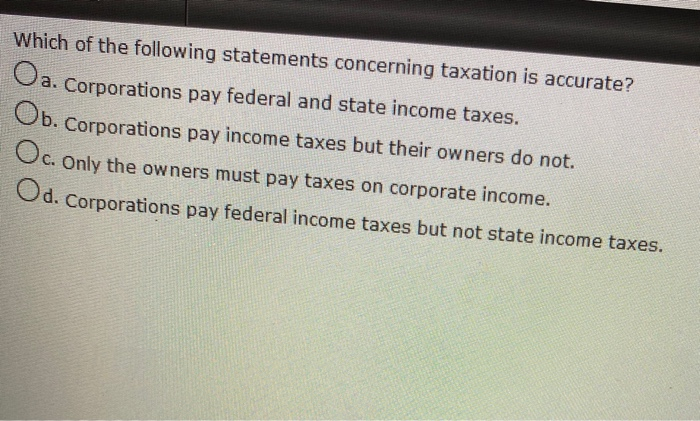

Tax Expenditures Can Be Regressive

The claim that some tax expenditures disproportionately benefit higher-income individuals is also accurate. Many provisions, like the deduction for state and local taxes (SALT), offer the greatest benefit to those with higher incomes and larger tax liabilities.

The Tax Policy Center has consistently demonstrated how the distribution of tax benefits from certain expenditures skews towards the wealthy. This distributional effect can exacerbate existing income inequalities.

While some tax expenditures, such as the EITC, are explicitly designed to aid low-income individuals, others unintentionally widen the income gap.

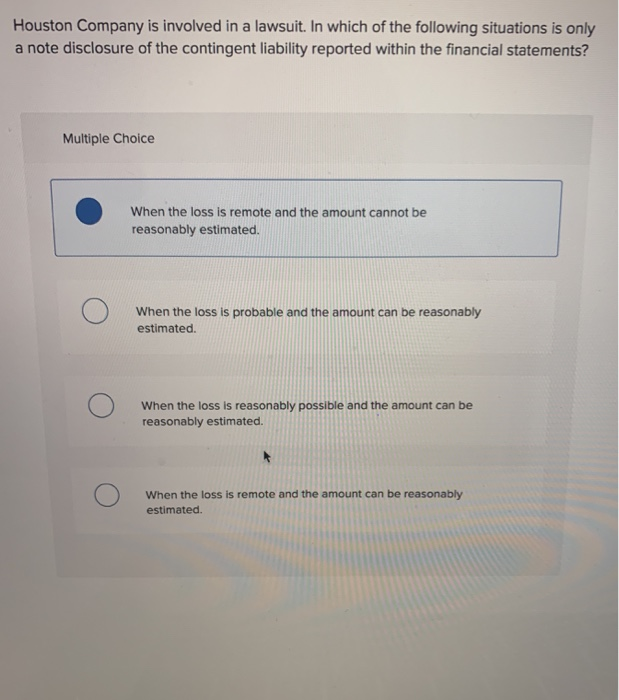

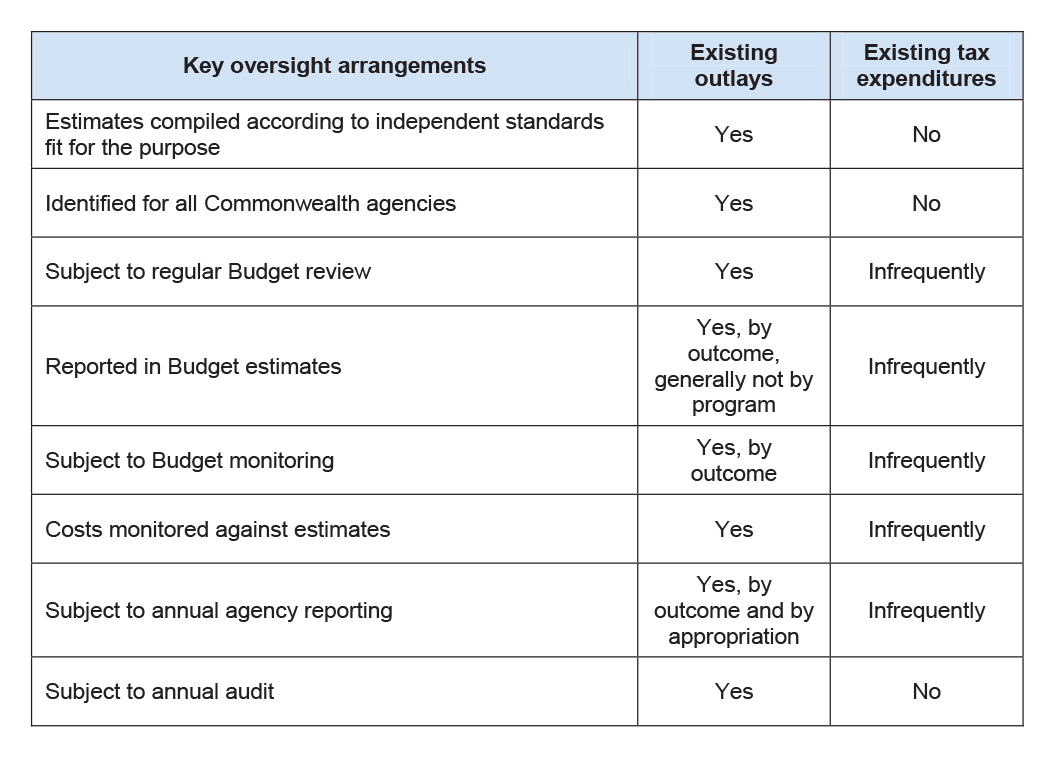

Tax Expenditures Lack Transparency

A common criticism of tax expenditures is that they often lack the same level of scrutiny and transparency as direct spending programs. Unlike direct spending, tax expenditures are not subject to annual appropriations debates.

The Government Accountability Office (GAO) has highlighted the need for improved evaluation and oversight of tax expenditures. This lack of transparency makes it difficult to assess their effectiveness and efficiency.

Because of this, reforming these provisions becomes more difficult since their costs are not immediately obvious.

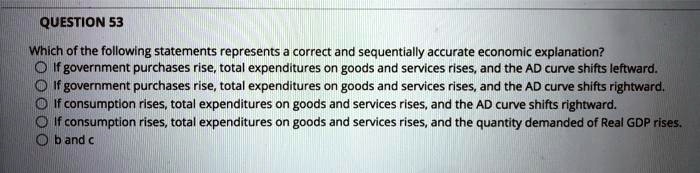

Tax Expenditures Can Distort Economic Decisions

Another valid point is that tax expenditures can distort economic decision-making. By incentivizing certain behaviors, they can lead to inefficient resource allocation.

For example, the mortgage interest deduction can encourage excessive borrowing and contribute to inflated housing prices. These kinds of distortions interfere with the natural allocation of capital within the economy.

Economists often argue that a broader tax base with lower rates would be more efficient than a system riddled with targeted tax breaks.

Common Misconceptions About Tax Expenditures

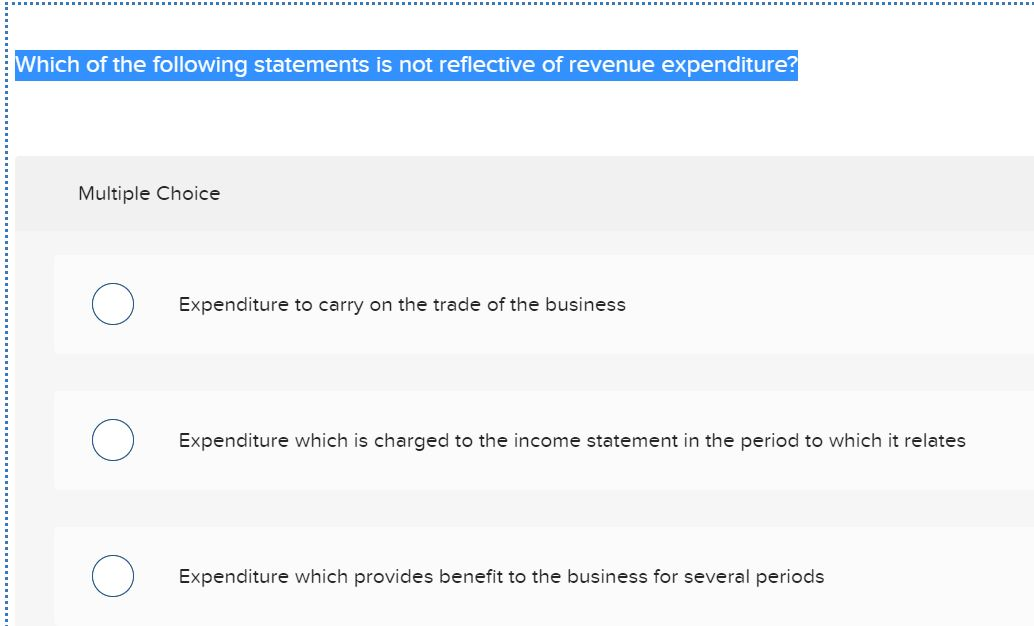

All Tax Expenditures Are Inefficient and Ineffective

It's incorrect to assume that all tax expenditures are inherently inefficient or ineffective. Some, like the EITC, have been shown to be effective in reducing poverty and encouraging work.

Evaluating each tax expenditure individually, based on its specific goals and outcomes, is crucial to determine its overall value.

Blanket condemnation of all tax expenditures overlooks the potential benefits that some provisions may provide to targeted populations.

Tax Expenditures Have No Impact on Economic Growth

Some might argue that tax expenditures have no impact on economic growth, but that statement is misleading. While the impact of each individual expenditure varies, some provisions are designed to stimulate specific sectors of the economy.

Research and development (R&D) tax credits, for example, are intended to encourage innovation and technological advancement, which can ultimately boost economic growth.

The effectiveness of these measures is often debated, but it's inaccurate to claim that they have no impact whatsoever.

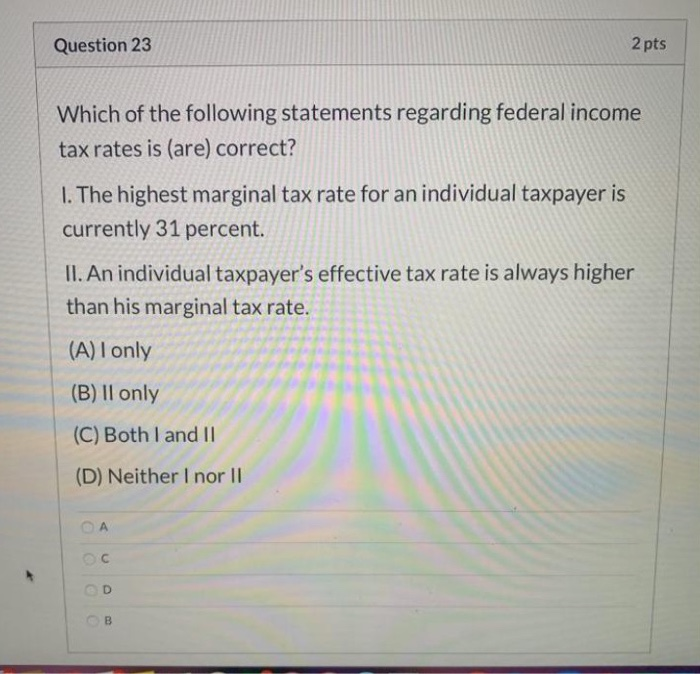

The Future of Tax Expenditures: Reform Possibilities

As the national debt continues to grow, the need for comprehensive tax reform, including a re-evaluation of tax expenditures, becomes increasingly urgent.

Options for reform range from eliminating or scaling back certain deductions and credits to consolidating multiple provisions into simpler, more efficient programs. The ultimate goal is to achieve a fairer, more efficient, and more sustainable tax system.

The debate over tax expenditures is likely to intensify in the years to come, as policymakers seek to address pressing fiscal challenges and promote a more equitable society.

A bipartisan approach to tax reform is essential to achieve lasting change and ensure that the benefits of economic growth are shared more broadly.

![Which Of The Following Statements About Tax Expenditures Are Accurate [FREE] Consider the following simplified financial statements for the](https://media.brainly.com/image/rs:fill/w:1080/q:75/plain/https://us-static.z-dn.net/files/d33/0943f0cd3dce2381438a4f0ccbf21ed7.jpg)

![Which Of The Following Statements About Tax Expenditures Are Accurate [FREE] which of the following statements is most accurate - brainly.com](https://media.brainly.com/image/rs:fill/w:750/q:75/plain/https://us-static.z-dn.net/files/d07/bc50374e70061724dba6eb507508775e.png)