Take Picture Of Check To Deposit Chime

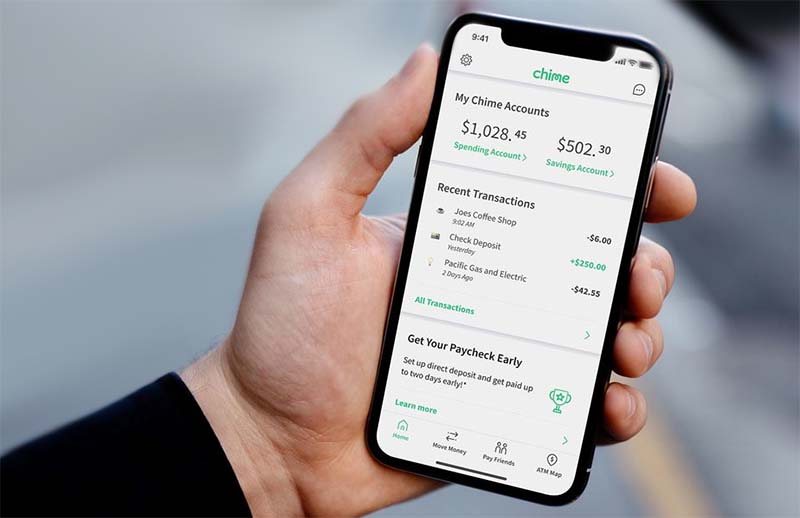

Chime, a popular financial technology company, continues to offer mobile check deposit as a convenient feature for its users. The ability to deposit checks remotely through a smartphone remains a core functionality. This method allows users to access their funds without physically visiting a bank branch.

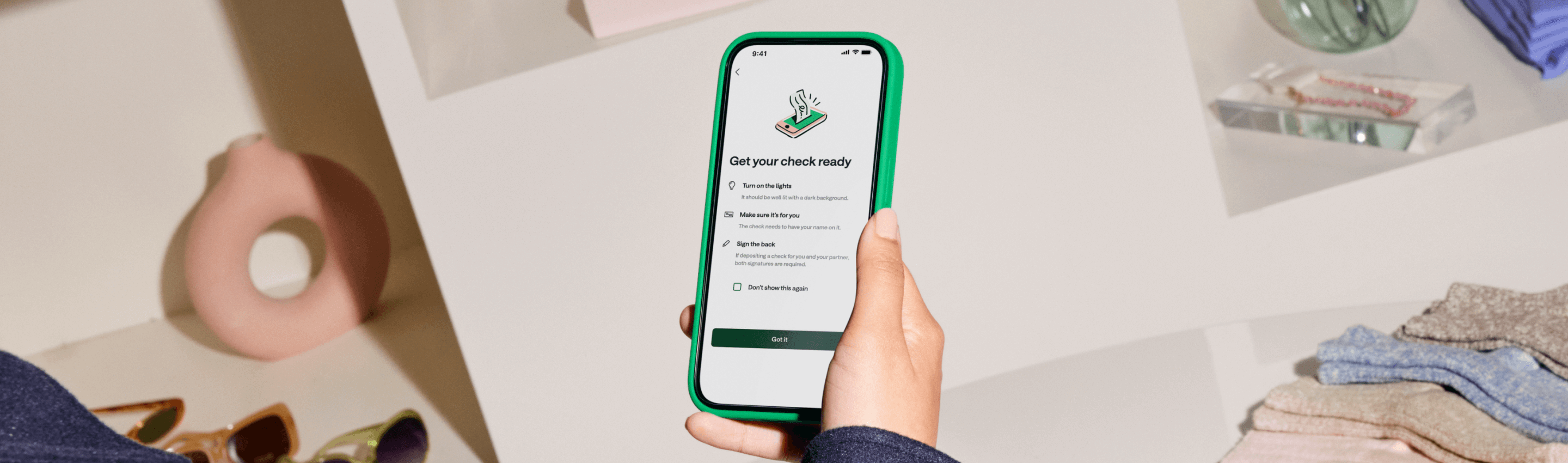

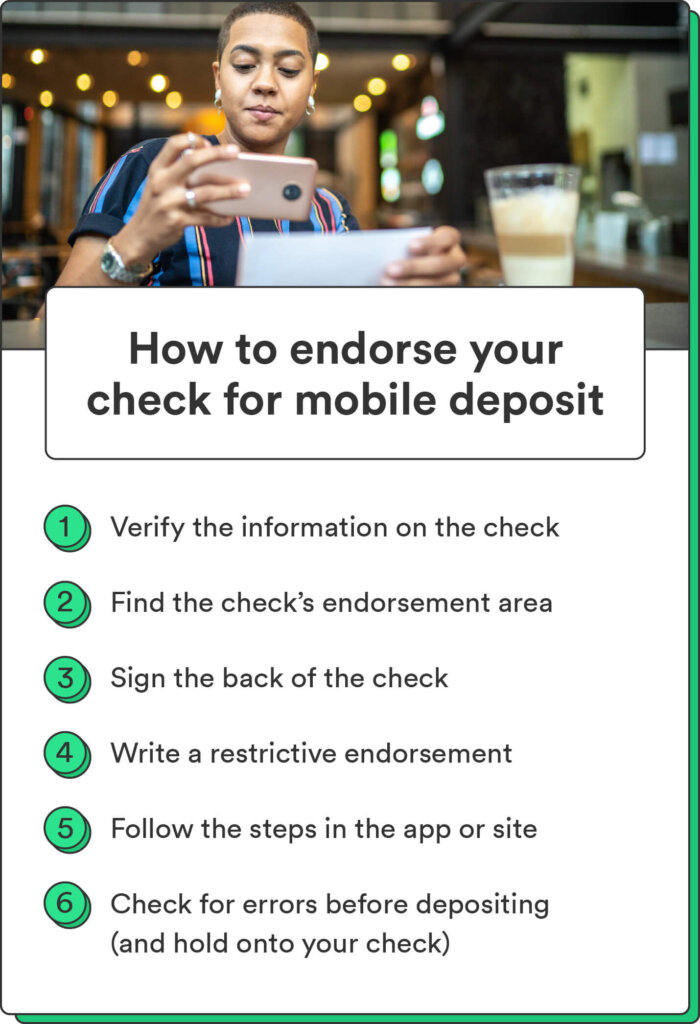

The check deposit feature is embedded within the Chime mobile app. Users can deposit checks by taking a photo of both the front and back of the endorsed check.

How Chime's Mobile Check Deposit Works

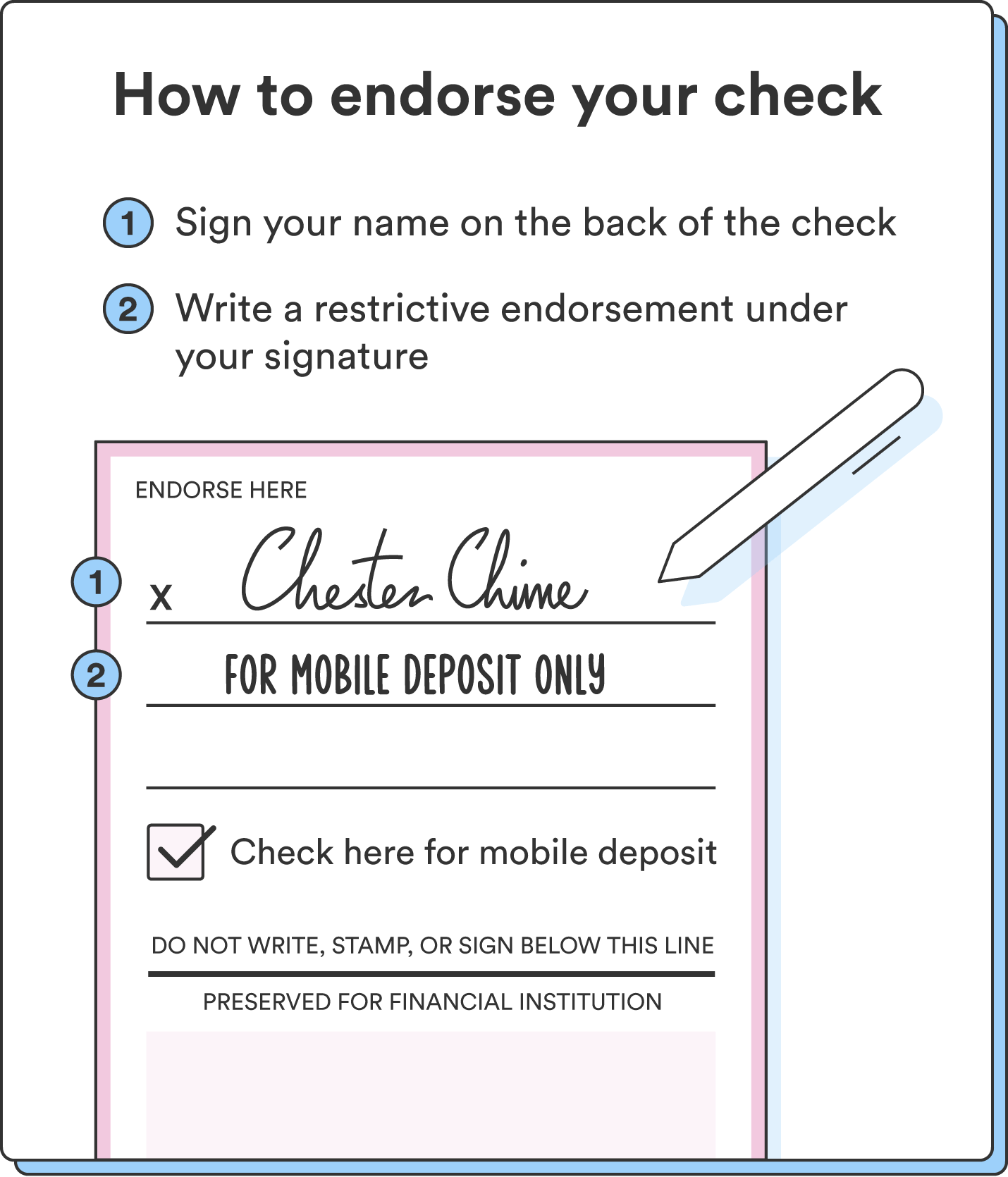

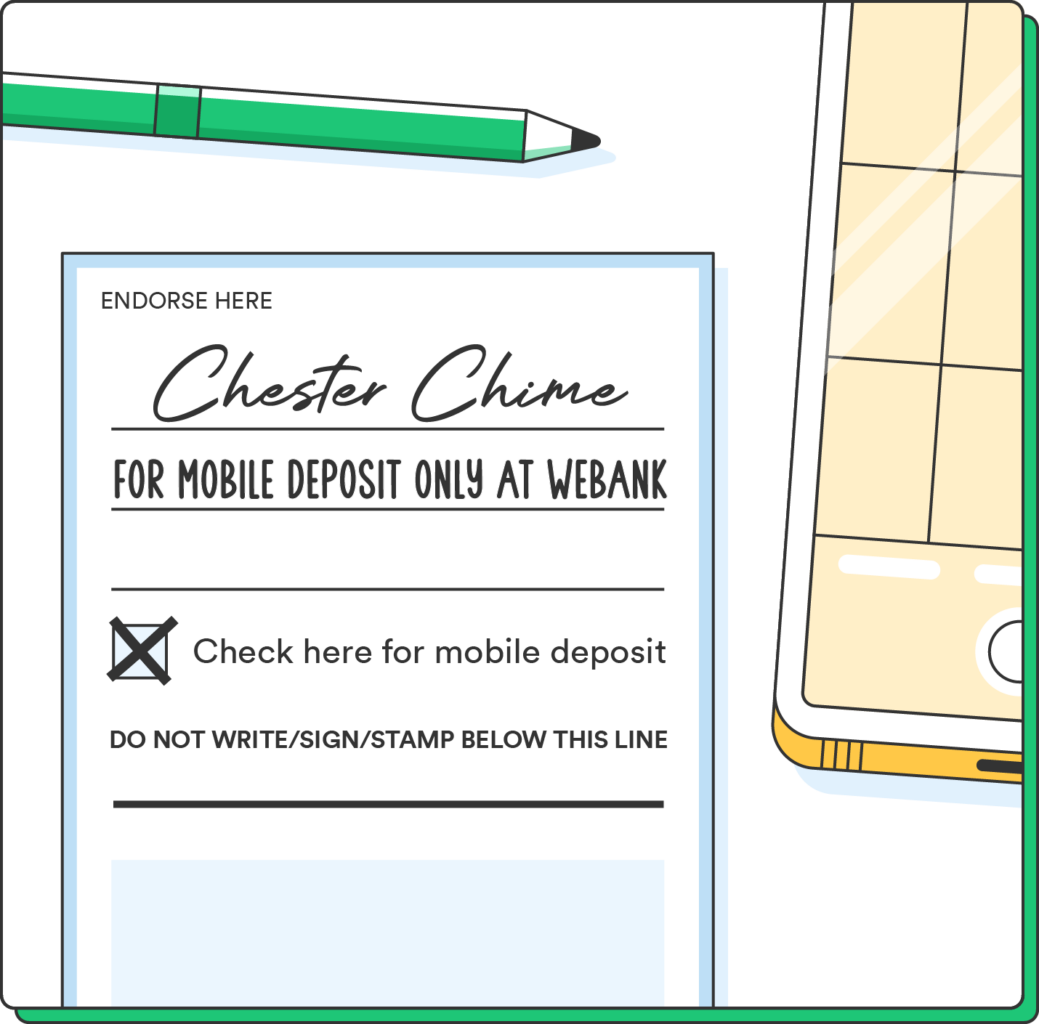

The process starts by endorsing the check. The user then opens the Chime app, navigates to the deposit section, and follows the prompts to photograph the check.

The app's software scans and captures the check image. After submitting the images, Chime reviews the deposit.

Typically, funds become available within a few business days. Processing times can vary depending on several factors.

Key Details and Considerations

There are deposit limits. These limits are set to manage risk and comply with regulatory requirements.

Specific limits vary by user. These depend on individual account history and other criteria.

According to Chime's website, processing times can be affected by the check amount. Weekend or holiday submissions may also experience delays.

Check eligibility is also a crucial factor. Certain checks may not be eligible for mobile deposit, such as those with alterations or those that are poorly imaged.

Chime advises users to securely store the original check. Keep the check until the deposit clears to avoid any complications.

Impact and User Experience

Mobile check deposit offers notable convenience. It eliminates the need for physical bank visits.

This is especially valuable for users in remote areas. It is also helpful for those with mobility issues or busy schedules.

However, reliance on technology presents challenges. Issues can arise from poor image quality or app malfunctions.

"The convenience of mobile check deposit is undeniable, but users should be aware of potential limitations and ensure they meet all requirements," says financial analyst, Sarah Miller.

Security Measures

Chime employs security measures. These measures help protect against fraud and unauthorized access.

These measures include encryption of data transmissions. They also include identity verification procedures during the deposit process.

Users should also take precautions. They should only use trusted devices and secure networks when making deposits.

Reporting suspicious activity is also important. Chime provides resources for users to report any concerns.

Conclusion

The ability to deposit checks via photo on Chime remains a significant benefit. It offers ease of use and accessibility for many users.

However, understanding the limitations, processing times, and security measures is vital. It ensures a smooth and secure experience.

By adhering to guidelines and staying informed, users can effectively leverage this feature. They can manage their finances efficiently.

![Take Picture Of Check To Deposit Chime How to Deposit Check on Chime Mobile [2023-Updated]](https://handlewife.com/wp-content/uploads/2021/08/How-to-Deposit-Check-on-Chime.webp)