Target Credit Card Pre Approval Bad Credit

For millions of Americans grappling with less-than-perfect credit, the promise of store credit cards, like the Target RedCard, can seem like a lifeline. The allure of discounts and rewards, particularly at popular retailers, is strong. However, navigating the complexities of pre-approval and understanding the actual likelihood of acceptance with bad credit requires careful consideration.

This article delves into the reality of Target Credit Card pre-approval for individuals with bad credit. We'll explore the factors Target and its banking partner, TD Bank, consider. We'll also examine alternative options and provide guidance for rebuilding credit.

Understanding Target RedCard Options

The Target RedCard comes in two main forms: a credit card and a debit card. The credit card version, issued by TD Bank, requires a credit check. The debit card links directly to your checking account and bypasses the need for credit approval.

A pre-approval offer suggests a higher likelihood of approval for the credit card. However, it's not a guarantee. Several factors, including income, debt-to-income ratio, and overall credit history, will ultimately determine the final decision.

The Reality of Pre-Approval with Bad Credit

While a pre-approval offer might be extended to individuals with "fair" credit scores, securing the Target RedCard with a truly "bad" credit score (typically below 580) is highly unlikely. According to credit scoring models like FICO and VantageScore, "bad" credit indicates a significant history of late payments or defaults.

TD Bank, like most credit card issuers, aims to minimize risk. Therefore, applicants with demonstrably poor credit are often denied. The pre-approval process relies on a soft credit inquiry. This does not affect your credit score, it provides an initial assessment of your creditworthiness.

"Pre-approval offers are based on a limited snapshot of your credit history," explains John Ulzheimer, a credit expert. "The actual approval process involves a more comprehensive review."

Factors Influencing Approval

Beyond your credit score, several factors play a crucial role in TD Bank's approval process. These include your income, employment history, and the amount of debt you already carry.

A low debt-to-income (DTI) ratio is generally favored. This shows you have enough income to manage your existing debt and any new credit obligations. Recent bankruptcies or collections accounts are major red flags.

Even with a pre-approval, a recent negative mark on your credit report could lead to denial. Be sure to review your credit report before applying.

Alternative Options for Building Credit

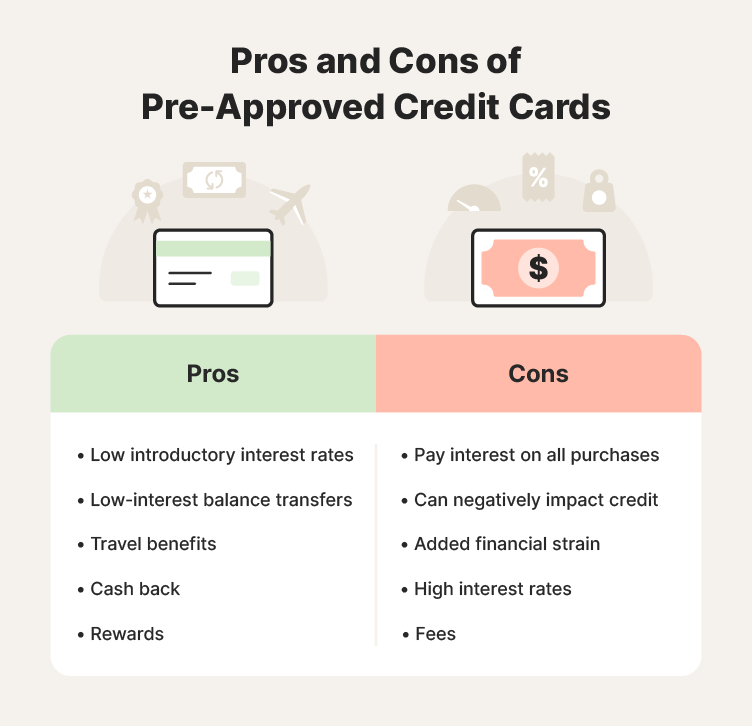

If you've been denied the Target RedCard due to bad credit, several alternative options can help you rebuild your credit profile. These include secured credit cards and credit-builder loans.

Secured credit cards require a cash deposit as collateral. This reduces the risk for the issuer and makes them more accessible to individuals with bad credit. Responsible use of a secured card can positively impact your credit score over time.

Credit-builder loans are designed specifically to help you establish or improve your credit. The lender holds the loan funds in a secured account, and you make regular payments. Once the loan is repaid, you receive the funds and a positive credit history.

The Debit Card Alternative

The Target RedCard debit card offers the same 5% discount as the credit card. However, it doesn't require a credit check. This makes it a viable option for those with bad credit who want to save money at Target.

The debit card links directly to your checking account. Transactions are immediately deducted from your balance. It's important to manage your account carefully to avoid overdraft fees.

Using the debit card won't directly improve your credit score. However, it can help you save money and avoid accumulating debt.

Checking Your Credit Report

Regardless of your interest in the Target RedCard, checking your credit report is a crucial step toward financial health. You are entitled to a free credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) annually through AnnualCreditReport.com.

Review your credit reports carefully for errors or inaccuracies. Disputing any incorrect information can help improve your credit score. Addressing outstanding debts and making timely payments are essential for rebuilding your credit.

"The first step to improving your credit is knowing where you stand," advises Beverly Harzog, a credit card expert. "Regularly monitoring your credit report is essential."

The Future of Credit Access

The landscape of credit access is constantly evolving. Fintech companies are developing new scoring models and lending products that may offer opportunities for individuals with limited or damaged credit.

However, traditional credit cards like the Target RedCard will likely continue to prioritize creditworthiness based on established credit scores. Responsible financial habits and a commitment to credit repair remain the most effective strategies for long-term financial success.

In conclusion, while a Target RedCard pre-approval offer may be tempting, individuals with bad credit should carefully assess their chances of approval. Exploring alternative options for building credit and considering the debit card version can be more prudent strategies. Focus on improving your credit profile for future opportunities.