Tata Housing Finance Home Loan Interest Rate

The dream of owning a home just became a little more attainable for some, and potentially more expensive for others, as Tata Housing Finance recently announced adjustments to its home loan interest rates. These changes reflect the dynamic interplay of market forces, regulatory policies, and the company's own strategic goals. Understanding the nuances of these rate revisions is crucial for prospective homebuyers and existing borrowers alike.

This article delves into the specifics of the new interest rate regime implemented by Tata Housing Finance. It analyzes the factors influencing these changes and explores the potential impact on borrowers, the housing market, and the broader economy. We'll examine whether this move signals a wider trend within the housing finance industry and what homeowners should consider in this evolving landscape.

Understanding the New Interest Rates

Tata Housing Finance has implemented a tiered interest rate structure, primarily based on the borrower's credit score, loan amount, and loan-to-value (LTV) ratio. The changes, effective from [Date], see a general increase in interest rates across most loan brackets. However, select categories, particularly those with high credit scores, may see marginally lower rates.

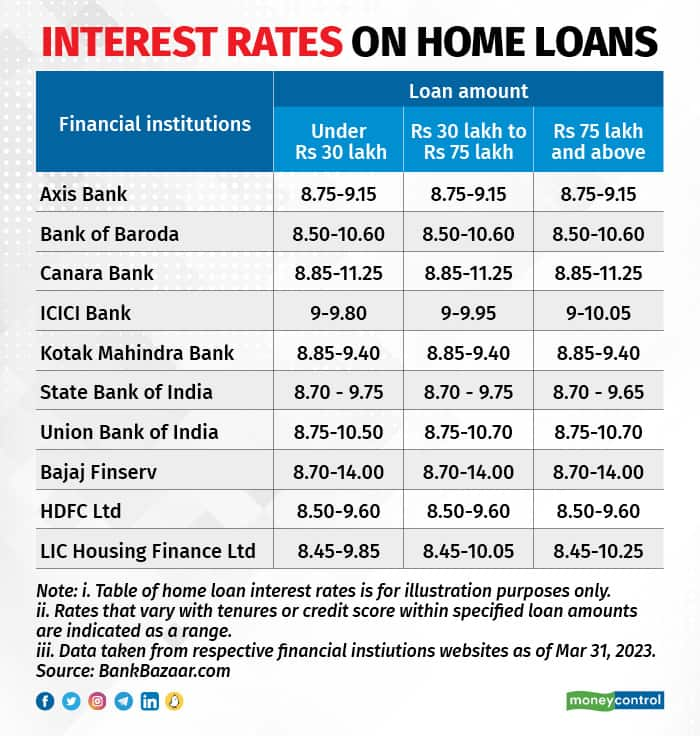

Specifically, interest rates now range from 8.50% to 9.75% for eligible applicants. The exact rate offered is tailored to the individual's risk profile, reflecting the lender's strategy to mitigate risk and optimize profitability. These rates are subject to change based on market conditions and internal policy revisions.

Factors Influencing the Rate Hike

Several factors have contributed to the recent rate adjustments. The Reserve Bank of India's (RBI) monetary policy stance plays a significant role, with recent repo rate hikes putting upward pressure on lending rates. Inflationary pressures and global economic uncertainties also contribute to the increased cost of funds for housing finance companies.

Moreover, Tata Housing Finance aims to maintain a healthy net interest margin (NIM) in a competitive market. Risk assessment and management are also key considerations, with the lender carefully evaluating the creditworthiness of borrowers to minimize potential defaults. Consequently, interest rates reflect this calculated risk.

Impact on Borrowers and the Housing Market

The immediate impact of these rate hikes is an increase in the overall cost of borrowing for new homebuyers. This could potentially dampen demand in the housing market, particularly in price-sensitive segments. Existing borrowers with floating-rate loans will also see an increase in their equated monthly installments (EMIs).

According to real estate analysts, a sustained increase in interest rates could lead to a slowdown in housing sales. This is especially true if other lenders follow suit. The affordability factor for potential homebuyers is directly impacted.

"Interest rate fluctuations are a key determinant of housing demand. A significant increase can deter potential buyers and affect the overall market sentiment,"notes Dr. Anika Sharma, a leading housing market economist at the National Institute of Housing Studies.

Expert Opinions and Borrower Strategies

Financial advisors recommend that prospective homebuyers carefully evaluate their financial situation before taking out a loan. Comparing loan offers from different lenders and understanding the terms and conditions is crucial. Exploring options for increasing one's credit score can also help secure a lower interest rate.

For existing borrowers, refinancing options may be worth considering if they can secure a lower rate from another lender. Making prepayments to reduce the principal amount can also help lower the overall interest burden. Careful budgeting and financial planning are essential to navigate this evolving landscape.

Looking Ahead: Market Trends and Future Outlook

The future trajectory of home loan interest rates will depend on a combination of factors, including RBI policy decisions, inflation trends, and global economic developments. If inflationary pressures persist, further rate hikes may be on the horizon. However, a stabilization or reduction in inflation could lead to a more favorable interest rate environment.

Tata Housing Finance will likely continue to monitor these factors and adjust its lending rates accordingly. The company remains committed to providing competitive financing options to support homeownership while maintaining financial prudence. The real estate market will adjust based on these changes.

In conclusion, the recent adjustments to Tata Housing Finance's home loan interest rates underscore the dynamic nature of the housing finance market. Borrowers should stay informed, seek expert advice, and carefully evaluate their options to make informed decisions. The dream of owning a home remains achievable, but requires careful planning and a thorough understanding of the prevailing market conditions.